United States Power Tool Accessories Market Outlook Report

Dublin, July 07, 2025 (GLOBE NEWSWIRE) -- The "U.S. Power Tool Accessories Market Research Report 2025-2030" report has been added to offering.

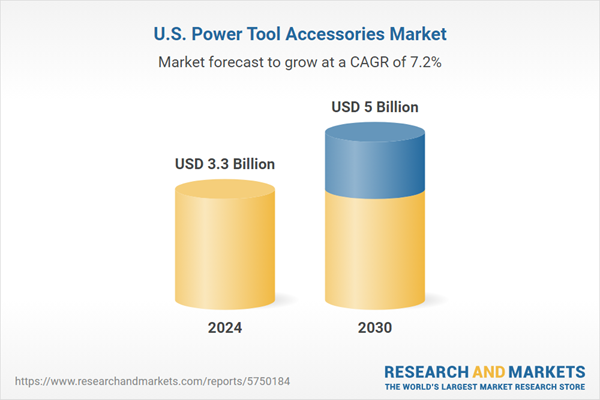

The U.S. Power Tool Accessories Market was valued at USD 3.30 Billion in 2024, and is projected to reach USD 5 Billion by 2030, rising at a CAGR of 7.17%.

The surge in the U.S. power tool accessories market in 2024 and the projected growth in 2025 can be attributed to a combination of large-scale infrastructure projects, particularly in the western region, and regulatory changes facilitating faster project approvals. These factors collectively contribute to increased construction activities, thereby driving the demand for power tools and accessories.

Through decades of technological leadership, access to critical resources, and early industrial maturity, the U.S. built a substantial advantage in precision manufacturing and industrial tooling. However, changing global economic dynamics, competitive manufacturing environments in Asia, and evolving domestic market demands have begun reshaping the U.S. power tool accessories market landscape. In response to tariff volatility on imports from China and Southeast Asia, especially during the U.S.-China trade war; several U.S.-based power tool accessory manufacturers have begun relocating production back to the United States or nearby countries in North America.

Midwest and Southern U.S. states have emerged as preferred destinations due to available industrial infrastructure, government incentives, and proximity to core construction and automotive markets. Production relocation to Mexico and Canada is also gaining traction to mitigate tariff exposure and logistics bottlenecks while preserving North American supply chain integrity. Moreover, US firms are increasingly investing in Industry 4.0 technologies, including IoT-enabled machine tools, additive manufacturing, and AI-driven predictive maintenance systems, to enhance operational efficiency and precision in accessory manufacturing.

The South (Texas, Florida), Midwest (Ohio, Illinois), and West (California) continue to lead the demand for power tool accessories due to large-scale residential and commercial construction activity fueled by population growth, real estate development, and federal infrastructure investments. The Infrastructure Investment and Jobs Act (IIJA) has provided a significant boost to accessory demand, especially for industrial and commercial-grade power tool accessories needed in public works and energy projects.

Leading manufacturers like Bosch, Makita, and DeWalt are expanding professional training and certification programs in key states such as California, Texas, and Florida, where demand for skilled tradespeople and DIYers is strong. Programs like Bosch's Power Tools Academy focus on educating users about proper accessory use, safety, and efficiency, boosting user skills, brand loyalty, and accessory sales.

States including Illinois, Ohio, and New York are seeing increased adoption of digital platforms by manufacturers like Stanley Black & Decker and Bosch. Heavy investment in e-commerce portals and online marketing improves accessibility to power tool accessories, with smart tools, tutorials, and promotions driving consumer engagement and sales, especially in densely populated areas. Moreover, in southern states like Georgia, North Carolina, and Alabama, manufacturers are introducing financial initiatives such as leasing, zero-percent financing, and trade-in programs to help contractors and dealers access premium accessories with less upfront cost. Companies like Husqvarna and Hilti support dealers with equipment loans, enabling contractors to upgrade regularly and boosting sales through ongoing accessory purchases.

Urban centers in states like California, New York, and Illinois have embraced manufacturer-led referral and loyalty programs to expand their customer base for power tool accessories. Brands such as Husqvarna have launched loyalty clubs that reward customers for referring friends and making repeat purchases, building a strong community of trusted users. These programs leverage word-of-mouth marketing and social proof to attract new customers while retaining existing ones. Coupled with heavy discount offers and promotional events, these incentives play a crucial role in urban areas where competition is high, and customer engagement through personalized rewards fosters brand loyalty and increases accessory sales.

The U.S. power tool accessories market exhibits a moderately consolidated structure, with intensifying competition among global tool manufacturers, specialized accessory producers, and value-focused private-label brands. Market growth is being driven by expanding DIY culture, increasing residential remodeling activities, and heightened demand for high-performance, precision accessories across both professional contractors and consumer segments.

Furthermore, leading brands including Stanley Black & Decker, Robert Bosch, Milwaukee Tool, and Makita U.S.A. continue to strengthen their positions in the U.S. power tool accessories market through product line expansions, battery platform integrations, and smart-enabled accessory innovations. These companies are actively leveraging multi-brand strategies, exclusive retail partnerships, and omnichannel distribution networks to widen their consumer reach.

However, the relatively low product differentiation in certain accessory categories - such as drill bits, saw blades, and sanding pads - has intensified pricing pressures and led to commoditization risks. Additionally, the growing influx of imported, lower-cost accessories from Asian manufacturers is contributing to price erosion and quality perception challenges in the mid-tier segment. Also, the commoditization risk is particularly pronounced in accessory types with minimal differentiation or brand loyalty, which has forced premium players such as Milwaukee, Bosch, and DeWalt to consistently innovate with features like impact-rated accessories, carbide-tipped blades, and precision-ground bits to justify premium pricing and preserve their professional customer base.

Leading brands in the U.S. power tool accessories market are increasingly integrating their accessory products within broader battery platforms and smart-enabled tool systems. For instance, DeWalt's ToughSystem 2.0 and Milwaukee's PACKOUT modular storage systems now feature custom insert trays and accessory bundles, enhancing convenience and cross-selling opportunities at both retail outlets and online stores. Furthermore, retail dynamics in the U.S. power tool accessories market are heavily influenced by exclusive retail partnerships and omnichannel sales strategies. Milwaukee Tool's exclusivity with Home Depot, Diablo's exclusivity with Home Depot, and Kobalt's exclusivity with Lowe's enable these brands to secure dedicated shelf space, promotional support, and consistent consumer exposure in targeted retail environments.

| No. of Pages | 139 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value (USD) in 2024 | $3.3 Billion |

| Forecasted Market Value (USD) by 2030 | $5 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | United States |

13. Geography (Market Size & Forecast: 2021-2030)

14. Competitive Landscape

15. Key Company Profiles

16. Other Prominent Company Profiles

17. Report Summary

- Strategic Recommendations

For more information about this report visit https://www.researchandmarkets.com/r/rucpjm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

_1751880097.jpeg)