Theta capital raises $175M to back early-stage blockchain startups

Amsterdam-based Theta Capital Management raised over $175 million for its latest fund-of-funds, aimed at supporting early-stage blockchain startups through specialized venture capital (VC) firms.

The new vehicle, Theta Blockchain Ventures IV, will channel capital into crypto-native VC firms with a track record of backing blockchain innovation, Theta’s managing partner and chief investment officer Ruud Smets told Bloomberg.

Smets said the strategy focuses on specialist managers who can outperform generalist investors in the earliest funding rounds.

“We’ve always been looking for areas where specialization and active management provide a sustainable edge,” Smets noted. He said that the experience and positioning of dedicated crypto VCs “has compounded over time,” creating barriers for less focused investors trying to enter the space.

Founded in 2001, Theta shifted its focus to digital assets in 2018 and now manages about $1.2 billion. The firm has backed leading crypto investment names such as Polychain Capital, CoinFund and Castle Island Ventures.

The fund’s close comes as crypto venture capital begins to rebound. According to Galaxy Digital, VC investment in digital assets rose 54% in the first quarter of 2025 to $4.8 billion, signaling renewed confidence in the sector after a prolonged downturn.

A report from PitchBook also showed that crypto venture capital funding surged in early 2025, even as deal activity declined.

The report showed that 405 VC deals were completed in Q1 2025, a 39.5% drop from the 670 recorded in the same period last year. However, that’s a modest uptick from the 372 deals seen in Q4 2024.

Despite fewer deals, total funding more than doubled year-over-year, reaching $6 billion in Q1 compared to $2.6 billion in Q1 2024, also doubling from the previous quarter’s $3 billion.

PitchBook’s senior crypto analyst Robert Le noted that even amid macroeconomic uncertainty, “capital continued to seek crypto’s core utility rails.”

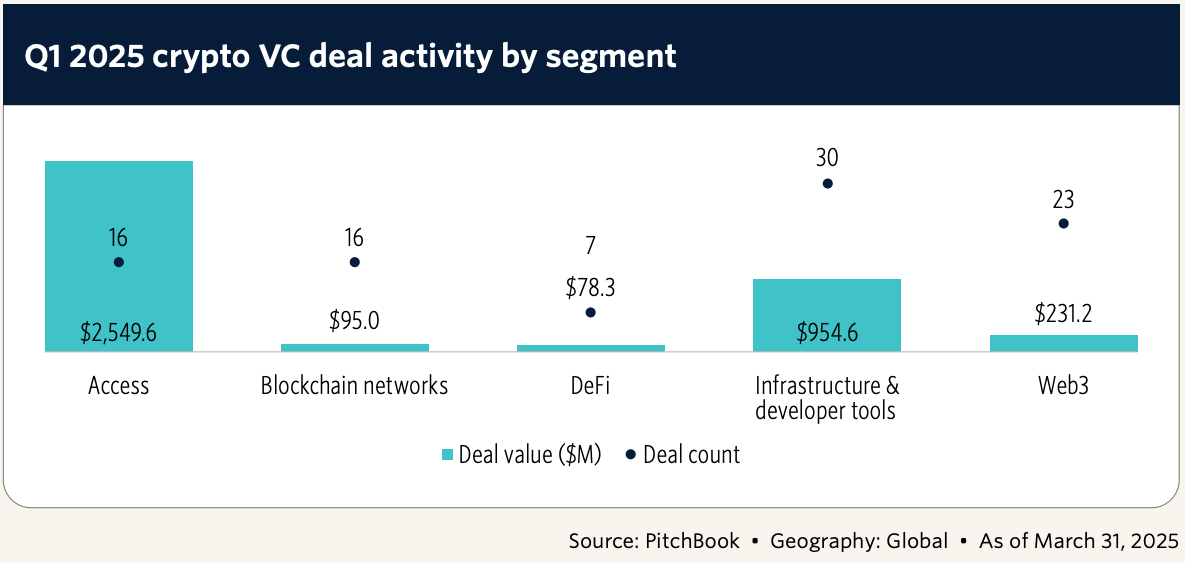

The bulk of the investment — around $2.55 billion across just 16 deals — went to companies in asset management, trading platforms and crypto financial services. Infrastructure and development firms followed, raising nearly $955 million across 30 deals.

Web3-focused companies saw the third-most deals and funding, at 23 and $231.2 million, respectively. Source: PitchBook.

PitchBook also said that Circle’s anticipated IPO may be the most significant crypto equity pricing event since Coinbase’s 2021 debut.

If Circle secures a valuation above the rumored $4 billion to $5 billion range, it “could therefore crowd in new late-stage capital and reset valuation expectations upward across the payments and infrastructure stack,” Le said.

With $1.18 billion in VC funding raised so far, PitchBook estimates a 64% chance that Circle will ultimately go public.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.