The Market Lifts Globus Maritime Limited (NASDAQ:GLBS) Shares 29% But It Can Do More

(NASDAQ:GLBS) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

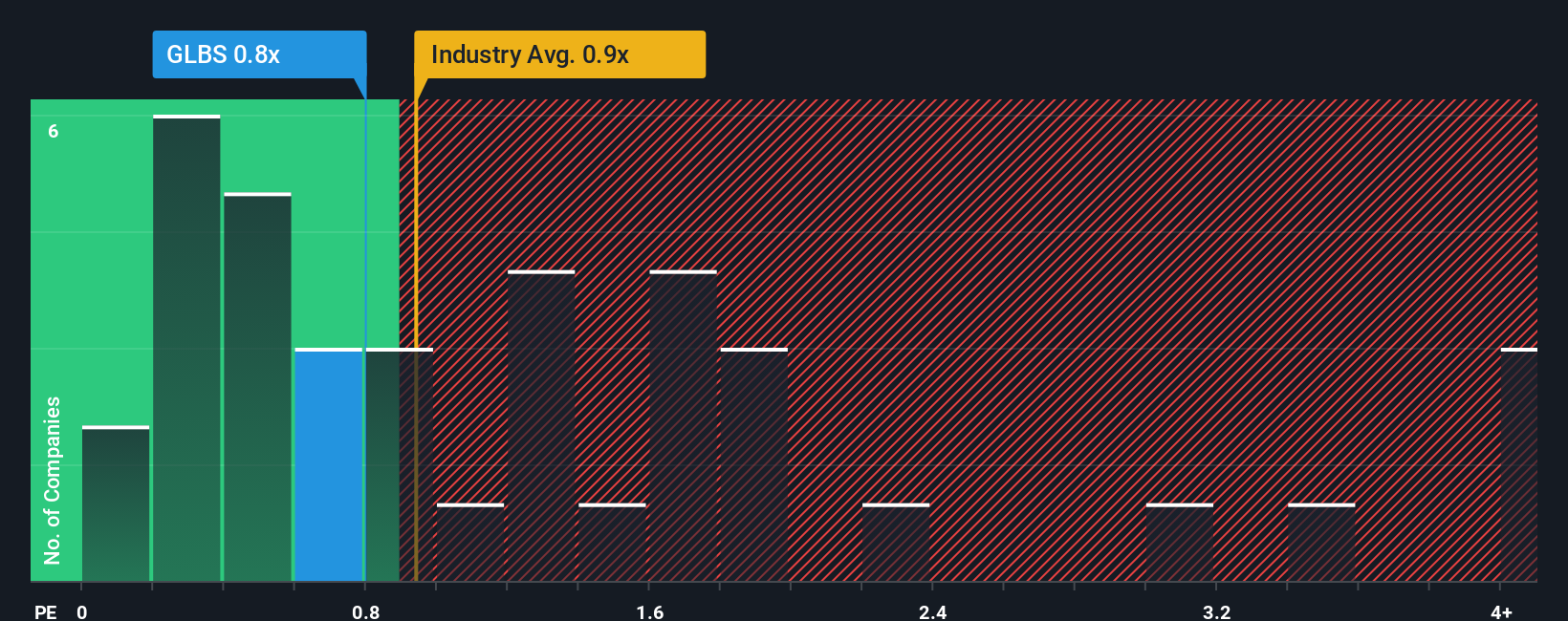

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Globus Maritime's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in the United States is also close to 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Globus Maritime

Recent times haven't been great for Globus Maritime as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Globus Maritime's future stacks up against the industry? In that case, our report is a great place to start.

The only time you'd be comfortable seeing a P/S like Globus Maritime's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 20% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 31% during the coming year according to the lone analyst following the company. That would be an excellent outcome when the industry is expected to decline by 5.9%.

With this in mind, we find it intriguing that Globus Maritime's P/S trades in-line with its industry peers. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

Globus Maritime appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Globus Maritime's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted you should be aware of, and 2 of them are significant.

If these , explore our interactive list of high quality stocks to get an idea of what else is out there.

We've created the for stock investors,

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.