Shareholders Will Most Likely Find Universal Display Corporation's (NASDAQ:OLED) CEO Compensation Acceptable - Simply Wall St News

Under the guidance of CEO Steve Abramson, (NASDAQ:OLED) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 18th of June. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for Universal Display

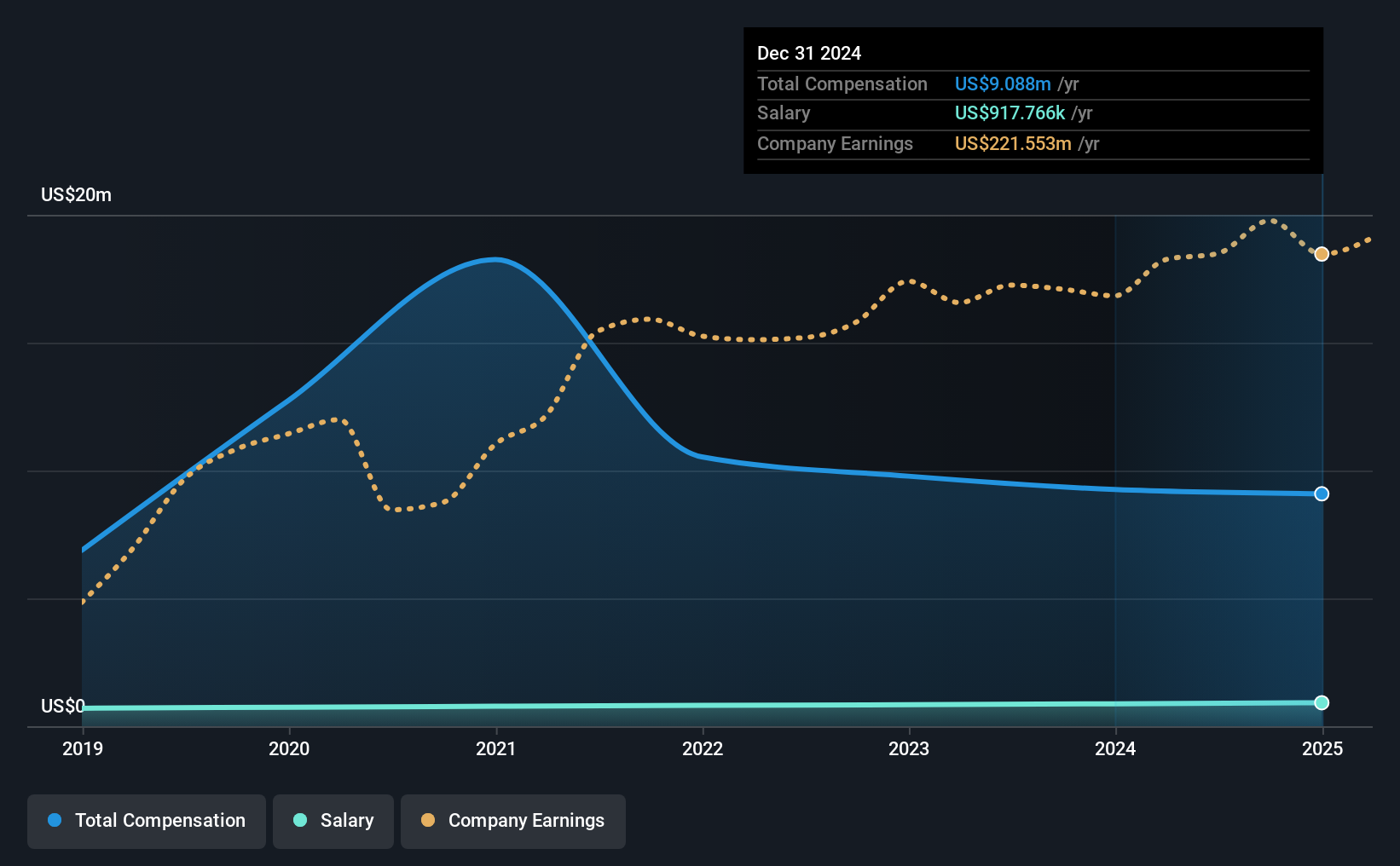

According to our data, Universal Display Corporation has a market capitalization of US$7.4b, and paid its CEO total annual compensation worth US$9.1m over the year to December 2024. That's mostly flat as compared to the prior year's compensation. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$918k.

On examining similar-sized companies in the American Semiconductor industry with market capitalizations between US$4.0b and US$12b, we discovered that the median CEO total compensation of that group was US$9.5m. This suggests that Universal Display remunerates its CEO largely in line with the industry average. Furthermore, Steve Abramson directly owns US$41m worth of shares in the company, implying that they are deeply invested in the company's success.

| US$918k | US$878k | 10% | |

| US$8.2m | US$8.4m | 90% | |

| US$9.1m | US$9.3m | 100% |

On an industry level, roughly 13% of total compensation represents salary and 87% is other remuneration. Universal Display sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Universal Display Corporation's earnings per share (EPS) grew 8.0% per year over the last three years. Its revenue is up 6.1% over the last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Moving away from current form for a second, it could be important to check this free visual depiction of for the future.

Most shareholders would probably be pleased with Universal Display Corporation for providing a total return of 49% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

Whatever your view on compensation, you might want to check if insiders are buying or selling Universal Display shares (free trial).

Of course, So take a peek at this list of interesting companies.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.