Senegal Leads Africa's $345.9M June Funding Surge as Nigeria Falls to Just 4% Share

Startups across Africa raised a total of $345.9 million in funding this June, marking the highest single-month total in 2025 so far, according to data tracked by Launch Base Africa. This represents a strong rebound from several months of fluctuating investor confidence. While the continent’s venture capital scene demonstrated resilience, driven by a surge of clean energy and fintech deals, Nigeria—once the leading tech hub of the continent—experienced one of its worst performances in recent memory.

The $345.9 million secured in June brings Africa’s year-to-date total to approximately $1.45 billion, a modest recovery from the capital drought that plagued the continent throughout much of 2023 and early 2024. The surge this month was driven not only by international interest but also by the growing presence of local capital.

In June, African investors accounted for the largest share of participation, contributing to 42% of the total deals. North American investors followed with 25%, while European and Asian investors represented 21% and 19%, respectively.

This shift marks a pivotal moment in Africa’s venture capital landscape. After years of reliance on Silicon Valley and European venture firms, local capital is increasingly stepping in to fill the gap. Analysts attribute this trend to the rise of regional fund managers, development finance institutions, and corporate-backed innovation arms across key markets like Kenya, South Africa, and Egypt.

“As seen in many deals this year, the first check is increasingly coming from African investors,” stated an analyst at Launch Base Africa. “This sends a crucial signal to global investors. It helps unlock external capital and shows that the ecosystem is maturing.”

In a surprising development, Senegal led the continent in total capital raised, accounting for 43% of the funding volume in June, largely driven by Wave’s last-minute $137.2 million fundraising announcement. Kenya followed with 23%, while South Africa secured 16%. The remaining 18% of funding was distributed across other parts of the continent.

Despite this, South Africa continued to dominate deal activity, registering the highest number of transactions with 20% of the total deals for the month. Egypt and Ghana also saw strong funding flows, particularly in fintech and agritech startups.

Fintech maintained its position as Africa’s top-funded sector, attracting 46% of the capital in June. However, clean energy and climate tech made notable progress, securing 33% of the total funding. This increase reflects growing investor interest in sustainable infrastructure and carbon-neutral technologies.

Large funding rounds for Kenyan company Burn Manufacturing and South African players like Wetility, Open Access Energy, and Zero Carbon Charge highlight the region’s shift toward energy security and renewable solutions.

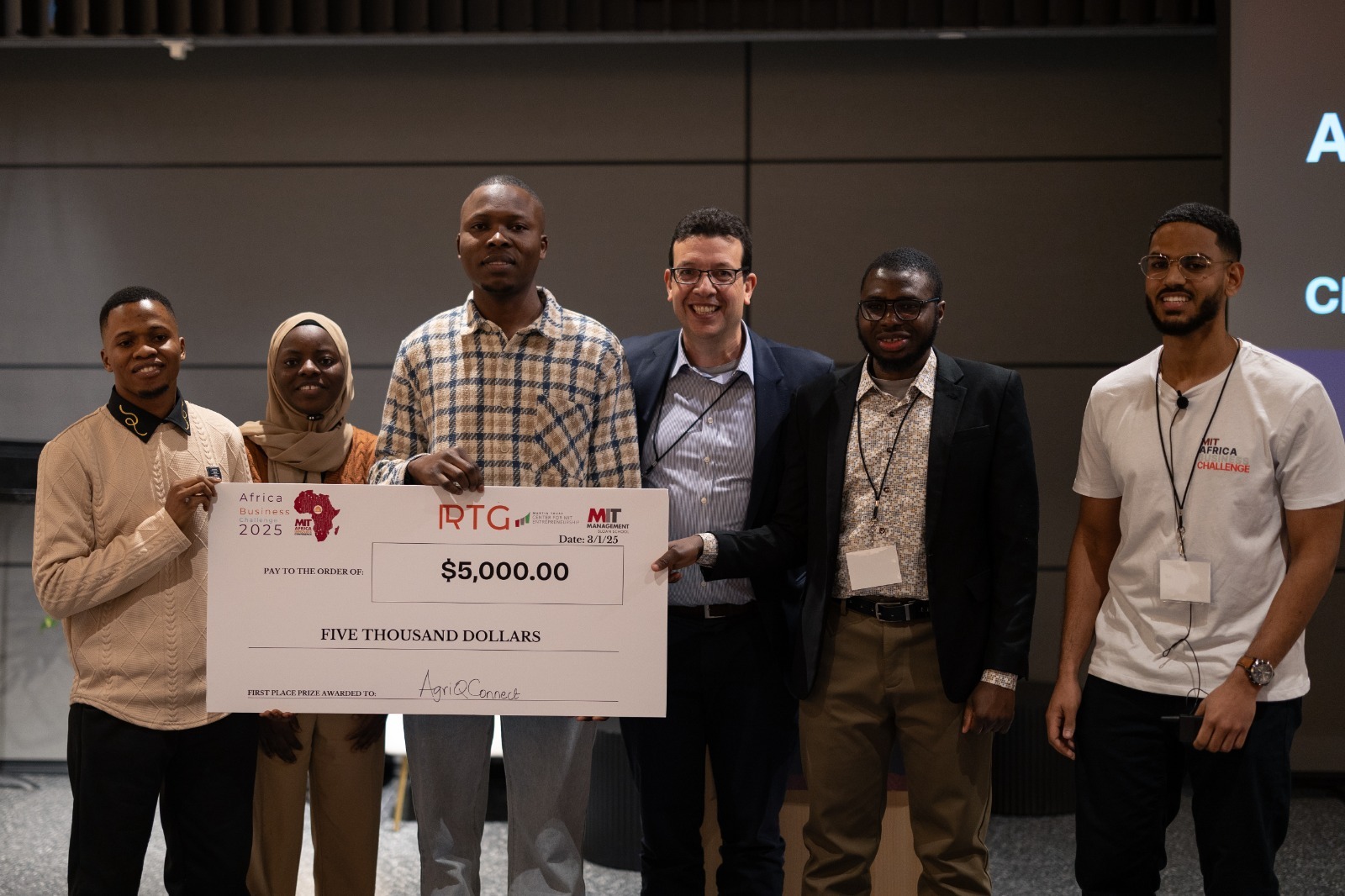

On the other hand, sectors like mobility, software, agritech, and healthtech captured the remaining 21% of funding. While agritech demonstrated strong deal volume, it only accounted for 4.3% of the capital, indicating a landscape dominated by early-stage investments rather than late-stage scale-ups.

While Nigerian investors remained active in deals across the continent, Nigerian startups raised just over $15 million, making up a mere 4.35% of the total disclosed funding.

This figure is particularly striking given Nigeria’s historical prominence in African tech funding. Just three years ago, Lagos alone attracted more capital than entire regions. The current downturn, experts suggest, stems from a combination of harsh macroeconomic conditions, foreign exchange instability, and a funding cycle correction that has made investors more cautious.

A Lagos-based founder, whose startup has postponed its fundraising twice in 2025, describes the atmosphere as “dry and disillusioned.”

“Nigerian founders are still building,” he said, “but securing funding at any stage now feels like a miracle.”

June’s surge in funding, particularly from local investors, signals that Africa’s startup ecosystem may be entering a new phase—one characterized by infrastructure investments, climate solutions, and capital resilience, rather than chasing unicorns.

However, the uneven distribution of funding—ranging from Senegal’s dominance to Nigeria’s near-exclusion—suggests a broader recalibration of investor focus across the continent.