Predict, Prescribe, Prosper: Unlocking the power of data and AI in public sector banks - The Economic Times

In this scenario, traditional analytics models—centered on retrospective dashboards and regulatory reporting—are no longer sufficient. To remain competitive and future-ready, PSBs must adopt analytics at scale - not just for efficiency, but to unlock new growth areas such as SMB lending models, risk adjusted cross-sell models, personalisation, etc. They must harness advanced analytics and artificial intelligence (AI) to predict, prescribe, and prosper.

Traditional data analytics has largely been backward-looking—offering summaries of what happened and why. While useful for compliance and strategic reporting, it fails to deliver the predictive foresight or real-time intelligence needed in today's hyper-digital banking environment.

For Public sector banks, traditional analytics has largely centered around analysing historical data to generate regulatory reports, MIS summaries, and support strategic planning. These approaches, while valuable, often focus on retrospective insights — what happened, when, and why — without offering foresight or actionable intelligence.

However, banking today is no longer willing to wait. This is particularly relevant in areas like SMB and retail lending, where expectations around turnaround time, credit personalization, and digital servicing continue to rise.

Three forces are accelerating the shift toward advanced analytics in PSBs:

Advanced analytics models—be it predictive credit scoring, risk monitoring or generative AI —are only as powerful as the data they ingest. For PSBs to enable smarter lending they must invest in a modern, cloud-ready data platform that offers

- Centralized data ingestion from core banking, GST systems, Bureau reports, CRM, digital channels, and other relevant ecosystem partners

- In-built data governance, lineage tracking, and quality assurance

- Scalable, real-time processing for analytics and AI workloads

- Secure, compliant architecture aligned with RBI and sectoral mandates

This platform is not just infrastructure—it is the strategic enabler for unlocking value across the banking value chain.

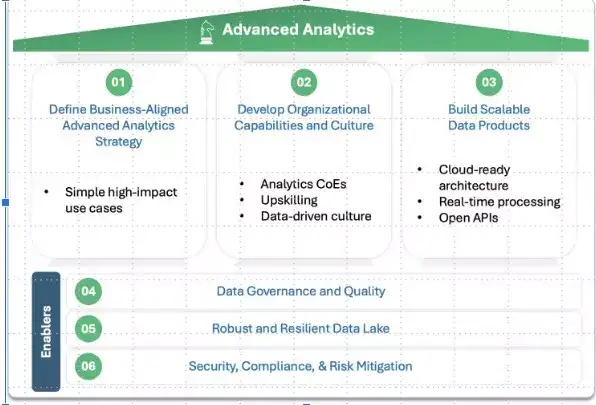

Successfully adopting advanced analytics in public sector banks (PSBs) requires more than just selecting the right technology. It demands strategic alignment, modernized architecture, and organizational readiness across multiple dimensions. Based on common implementation challenges and proven remediation strategies, a practical readiness framework can be anchored around the following pillars:Start with high-impact use cases like fraud detection, credit scoring, and churn prediction to demonstrate early value and secure stakeholder buy-in.

Establish analytics Centers of Excellence (CoEs) to institutionalize best practices, drive talent development, and foster a data-driven culture where decisions are guided by insight rather than intuition.

Avoid suboptimal tech stacks and quick-fix solutions that create long-term technical debt. Also ensure interoperability by choosing platforms that support open APIs and middleware, allowing seamless integration across systems.

Ensure trusted, consistent data through centralized dictionaries, role-based access, and robust metadata management frameworks.

Modernize legacy systems by adopting cloud-native platforms with real-time processing and strong data governance. Build scalable, high-performing data lakes to enable reliable, large-scale analytics

Integrate privacy, consent, and localization controls early. Ensure full alignment with RBI and sectoral regulations when working with cloud or external vendors.

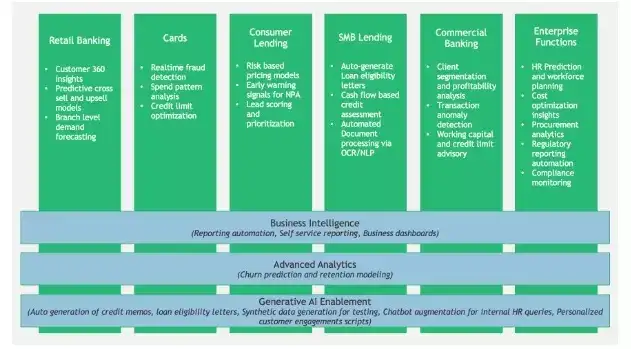

This layered view illustrates how core banking functions across retail, consumer and SMB lending, cards, commercial, and enterprise operations can be elevated through Business Intelligence, Advanced Analytics, and Generative AI. Each horizontal enabler brings progressively deeper insights — from automated reporting to predictive decision-making and AI-driven personalization. Together, they form a unified intelligence fabric to accelerate data-driven transformation across the bank.

30–40% reduction in compliance costs via automation

Real-time anomaly detection reduces risk

Streamlined documentation and automated credit memo generation in a smarter lending context specially for retail and SMB loans

Lower processing costs for small-ticket loans through digital workflows

Smarter underwriting improves credit quality

Early warning systems mitigate NPA risks

Personalized offers boost conversions

Cash flow–based scoring improves credit reach to thin-file SMBs

Faster loan decisions

Intelligent product recommendations

24/7 self-service analytics

Digital-first onboarding journeys for SMB borrowers

AI-powered chat support for loan status, eligibility, and documentation assistance

Conclusion

In the digital age, data is the new core capital. For public sector banks, embracing advanced analytics at scale is not just a technology upgrade—it is a strategic imperative. By investing in scalable data infrastructure, aligning analytics with business priorities, and fostering a data-driven culture, PSBs can unlock a virtuous cycle of innovation and impact.

The authors are Dibyanshu Lahiri, Director, BCG; Shray Jain, Director, BCG; Vipul Singh, Lead IT Architect, BCG and Nishchal Pawar, Senior IT Architect, BCG.

Read More News on

Read More News on

Stories you might be interested in