PayPal Holdings (NasdaqGS:PYPL) Expands Insurance Payment Solutions With Input 1 Partnership

PayPal Holdings (NasdaqGS:PYPL) recently announced a collaboration with Input 1 to integrate its Digital Wallet for insurance premium payments, enhancing user payment convenience and security. During the last quarter, the company's stock price increased by 9%. This rise was likely influenced by several strategic partnerships, including Selfbook for hotel bookings and a Mastercard collaboration, enhancing PayPal's service integration and brand reach. Despite market volatility due to geopolitical tensions and fluctuating oil prices impacting broader indices, these developments in PayPal's business activities supported the company's positive stock performance alongside market trends.

The recent developments at PayPal Holdings, including the collaboration with Input 1, could further facilitate the company's progression towards becoming a comprehensive commerce platform. As PayPal integrates its Digital Wallet for insurance premium payments, user convenience and security are enhanced, potentially driving transaction volumes and strengthening merchant relationships. This move complements PayPal’s ongoing transformation initiatives, which focus on expanding its branded experiences, Venmo benefits, and other value-added services, potentially improving both revenue and earnings in upcoming quarters.

Over the last year, which ended on 13th June 2025, PayPal’s total return, combining share price and dividends, reached 21.56%. This performance contrasts with a 1-year underperformance relative to the US Diversified Financial industry, which returned 24.5%. Despite the stock overshadowing the broader US market's one-year return, this discrepancy highlights a complex competitive landscape.

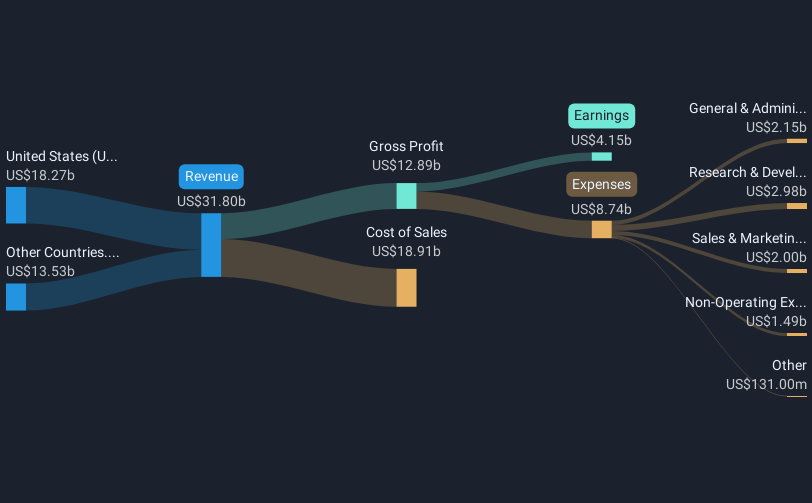

The boost in PayPal’s stock price in the recent quarter, driven by collaborations with Selfbook and Mastercard, aligns with analysts forecasting revenue growth at a compound annual rate of 5.7% over the next three years. Analysts foresee earnings growth to US$5.5 billion by 2028, slightly above the current revenue of 31.89 billion and earnings of 4.55 billion. However, these projections are sensitive to macroeconomic challenges and regulatory changes that could impact PayPal’s financial trajectory.

The company's current share price of US$68.05, which represents a discount of around 9% to the consensus price target of US$81.74, suggests potential upside, provided that PayPal continues to leverage its commerce platform to enhance earnings and revenue growth effectively. This target reflects expectations of a price-to-earnings ratio alignment with the industry average, offering a potentially compelling case for investors if forecast assumptions materialize as expected.

Click to explore a detailed breakdown of our findings in PayPal Holdings' financial health report.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

We've created the for stock investors,

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]