Money Lenders - Govt Acts!

GUEST ARTICLE: Money Lenders – Govt Acts!

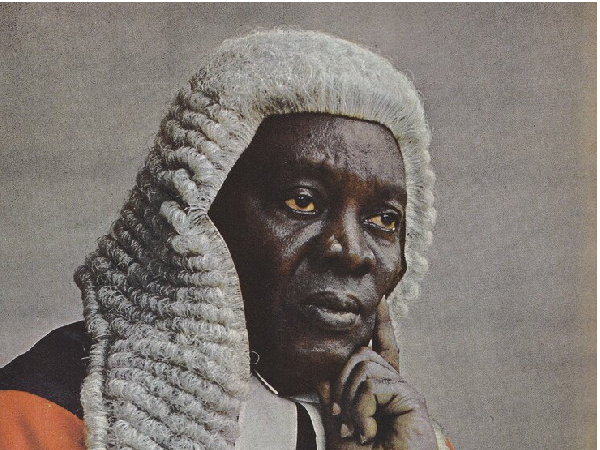

By Dickson Jere

Finally, the government has taken steps to deal with the issue of money lenders. Cabinet has approved in principle the introduction of The Pawn and Money Lenders Bill, 2025, which will replace the current and outdated Money Lenders Act, Chapter 398 of the Laws of Zambia. This has been my rallying call for while that the Money Lenders Act was obsolete in our environment especially that it was enacted in 1938.

For instance, the current law has a fixed interest rate for loans (48% per centum) which was not in line with the current economic situation. So, money lenders opted to avoid the normal route of lending to drafting Contracts of Sale with “buy back” clauses. That is how people lost houses in such schemes promoting massive court cases.

I am also happy that money lenders will now be supervised by the Bank of Zambia (BOZ) under the new law. Most of them – especially foreign owned – have grown so big that their capital and asset base is bigger than most micro lending institutions.

“The new law will also provide for, the licensing and management of moneylenders and pawn brokers; improved registration process…” government has said.

This is a very progressive move by government and should be supported given the current problems facing money lenders and borrowers.

“Cabinet has realized that this law, which is over eighty-six years, is outdated and non-responsive with some operating illegally,” government announced after the Cabinet meeting held on Tuesday.

I hope, under the new law, a balance will be struck between the lenders and the borrowers so that those who borrow should also be made to pay (collateral) within the law just like banks do.