Mark Zuckerberg didn’t just hire a few engineers—he vacuumed up [...]

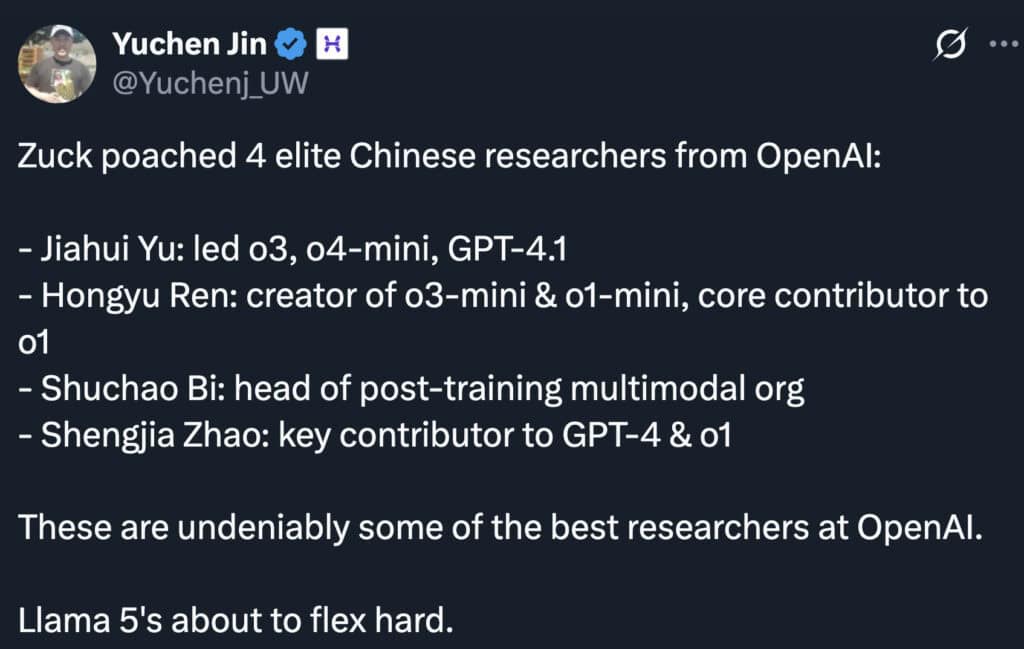

Mark Zuckerberg didn’t just hire a few engineers—he vacuumed up an entire brain-trust. Names like Shengjia Zhao, Jiahui Yu, Shuchao Bi, and Hongyu Ren vanished from OpenAI Slack and re-appeared on Meta’s org chart overnight. MSL is co-led by Alexandr Wang (ex-Scale AI) and Nat Friedman (ex-GitHub), turning Meta’s AI org from a research campus into a special-forces unit.

“Developing superintelligence is coming into sight… I’m committed to doing what it takes for Meta to lead the way.” —Mark Zuckerberg, in an internal memo.

Translation: If OpenAI is building ChatGPT 5, Meta’s building ChatGPT Ω—and they want it first.

Meta didn’t just hire big-name execs; it vacuumed up rank-and-file talent in bulk. Over eight senior OpenAI researchers and a cluster of DeepMind and Anthropic veterans have defected in the past fortnight entrepreneur.com. OpenAI’s Chief Research Officer Mark Chen called the raid “a home invasion” in a leaked Slack memo—because nothing says you’re winning like invoking felony metaphors. He told staff the company is “recalibrating compensation” and running 24/7 retention triage

OpenAI insiders say Meta dangled “exploding” offers worth nine figures—accept in 48 hours or the bonus self-destructs. Altman told the Uncapped podcast his “best people” haven’t bitten yet, but losing eight senior scientists suggests otherwise.

OpenAI’s response?

Zuck poached 4 elite Chinese researchers from OpenAI, Source: X

Meta is already spending $68 billion in cap-ex this year, nearly double last year’s bill. It’s elbowing Nvidia customers aside, buying entire foundries of H100s, and—apparently—super-charging recruitment budgets. Investors shrugged and sent Meta stock to $736.83, up 0.47% on the hiring news

If you’re OpenAI, the only play is to pay up or pray. Chen warned employees about “exploding offers”—bonuses that vanish if you hesitate. So OpenAI gave everyone a “recharge week” to clear their heads, a Netflix-and-nap solution to nine-figure FOMO.

Meta is projected to spend $68 billion on cap-ex this year, most of it on Nvidia H100 clusters. That’s unsustainable if model sizes double every six months. Enter decentralized compute:

Why Meta cares: Off-loading inference to a token-incentivized swarm could slash opex and sidestep data-center choke points—exactly what Facebook’s global scale demands.

Meta’s failed Diem/Libra stablecoin still haunts regulators, but an in-app AI compute credit isn’t quite a currency. Imagine earning “LlamaPoints” for donating phone idle time, then spending them on AI-generated content in Instagram or Horizon Worlds. Not money—digital utility assets. Plausible deniability, regulatory gray zone, huge network effect.

Judge Vince Chhabria dismissed a suit by Sarah Silverman & friends, ruling Meta’s book-scraping “fair use.” That doesn’t end copyright wars, but it lowers the risk premium on massive data grabs—crucial when you’re about to train a 100-trillion-parameter model.

SEO nugget: “AI fair-use ruling” is trending. Link this story to your evergreen piece on “How Copyright Law Shapes Generative AI” for extra Google juice.

Meta is up 23% TYD, Source: Google

| Timeline | Catalyst | SEO-Friendly Angle |

| Q3 2025 | Meta unveils first MSL-built model (rumored “Llama-Ultra”). | “Llama Ultra vs GPT-5 performance benchmark.” |

| Q4 2025 | Gradient Network main-net launch. | “How to earn crypto by renting your GPU to AI.” |

| Q1 2026 | EU Digital Markets Act enforcement on AI dataset transparency. | “AI compliance checklist for Web3 founders.” |

Bottom Line

AI supremacy won’t be won on GitHub alone—it’ll be settled in HR Slack channels, GPU clusters, and yes, crypto incentive layers. Meta’s talent raid is the opening salvo in a larger contest where whoever aligns money, math, and mission first will write humanity’s next operating system.

So whether you’re a quant in Zurich or a Solidity dev on Solana, keep your LinkedIn DMs open. The next nine-figure offer might ping any minute.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.