Hey all, Jason here.

Spring seems to have finally sprung in the Netherlands, and it’s good to see the sun again.

If you missed my podcast with Matthew Goldman, of Totavi and CardsFTW, it’s definitely worth a listen (and, if you tried previously, but there was an issue with the audio, I’ve corrected that — my apologies!)

If you enjoy reading this newsletter each Sunday and find value in it, please consider supporting me (and finhealth non-profits!) by signing up for a paid subscription. It wouldn’t be possible to do what I do without the support of readers like you!Last week saw Trump’s much-anticipated “Liberation Day” tariff announcements, and, I suspect, investors and employees of a number of IPO-ready fintechs are less than pleased that their capital won’t be liberated.

With venture-backed companies remaining private longer, for a variety of reasons, the stars had seemingly finally aligned for a spate of public offerings, including multiple fintech companies: Klarna, Chime, eToro, and Circle were all progressing towards IPOs.

But as quickly as the so-called IPO window opened, it has slammed shut, at least for the time being.

AI cloud computing firm CoreWeave’s less-than-impressive IPO a bit over a week ago could be read as a potential sign of softness in the market, even before the tariff-driven sell off.

The company lowered its price target from a range of $47 to $55 to ultimately price at $40 per share; it also reduced the size of its offering from 49 million shares to 37.5 million.

While CoreWeave dipped below its IPO price, it has since rebounded and closed Friday at $47.61 (and, for what it’s worth, I generally don’t find too much value in analyzing share price movements in the days immediately following an IPO; Facebook memorably had a “disaster” of an IPO, but has seen its market capitalization grow from about $82 billion when it went public in May 2012 to about $1.28 trillion as of Friday’s close.)

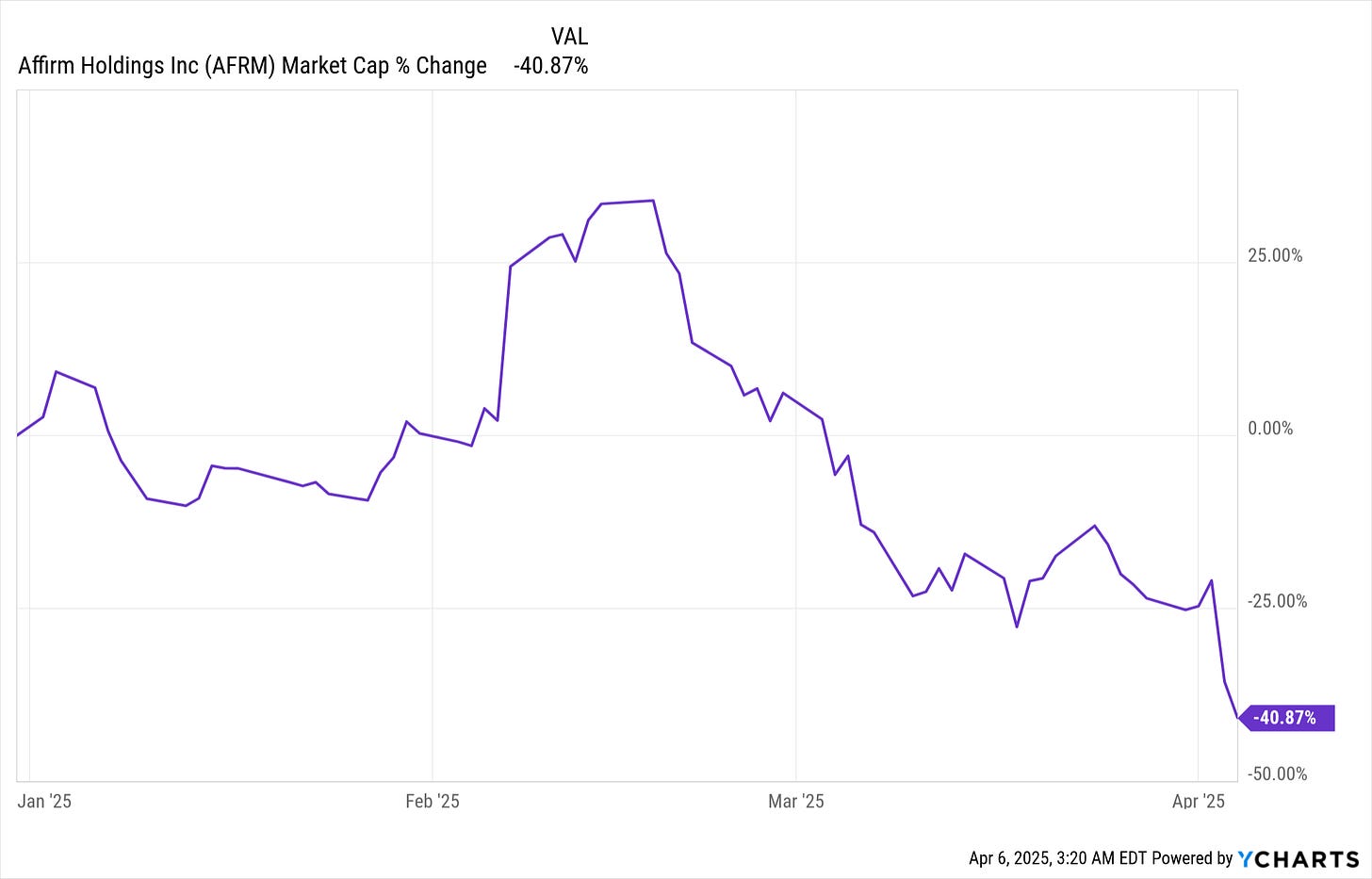

Trump’s tariff announcements on Tuesday, April 2nd, and responses from other countries drove a broad sell off in markets, with public fintechs seeing their shares drop more than market indices.

Buy now, pay later provider Klarna, which has been busy building a (somewhat misleading) narrative around embracing AI and crypto and landing marquee partnerships with household names like DoorDash and Walmart (sort of), was surely disheartened to see Affirm, arguably its closest public market comp in the U.S., shed about $4 billion in market cap since the announcement of Trump’s tariffs.

Including last week’s bloodbath, Affirm has seen its market cap decline by more than 40% since the start of the year.

So it shouldn’t be too surprising that, according to reports, Klarna has decided to postpone its IPO roadshow.

Steve McLaughlin, of well-known fintech-focused investment banking firm FT Partners, said of the current climate,

McLaughlin added that fintechs that had sought to IPO this year may opt to sell themselves instead.

Chime, which had submitted a confidential filing in late 2024 to go public, was widely understood to be ready to file its S-1 in weeks or even days; but it has now delayed those plans, according to reports.

eToro, a stock and crypto trading app that filed its F-1 registration statement on March 24th, said it would “evaluate market conditions,” but it is also understood to be pressing pause on its IPO roadshow to see the tariff situation plays out.

And, last but not least, Circle, issuer of the USDC stablecoin, which filed its S-1 registration just five days ago, is also considering whether or not to progress with the offering, given the current climate.

On Christmas Eve of 2021, Immad Akhund, the founder and CEO of Mercury, at the time, a fourth-party service provider to Evolve Bank & Trust via middleware platform Synapse, signed a settlement agreement with California’s financial regulator, the Department of Financial Protection and Innovation (DFPI).

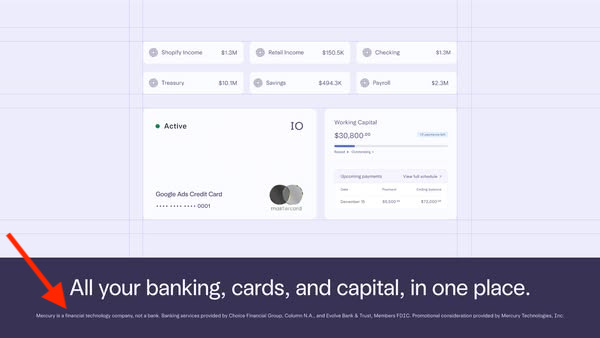

The settlement stemmed from Mercury’s violation of California Fin. Code §§ 561 and 562 and 12 U.S.C § 1828(a)(4) in California by falsely describing itself as a bank, use of phrases like “Mercury makes bank accounts” and “building a bank for startups,” which could be deceptive, and misusing the FDIC logo.

As part of the settlement, Mercury agreed to “cease and desist from 1) using the word bank or banking in its name or twitter handle and 2) using the FDIC logo on its webpage and advertising in a manner likely to mislead.”

The settlement required Mercury to review its website and all marketing and advertising materials and remediate them, as needed, to “avoid representing that it operates as a bank or itself provides banking products.”

The agreement also required Mercury to:

In legal terminology, proximate is generally understood to mean “sufficiently close or directly linked to the relevant content or action, ensuring clarity and accessibility for the user.”

While Mercury has increased the use and prevalence of disclosures on its site that clarify it is not a bank, but partners with regulated banks, numerous pages on its site, advertisements, and affiliates appear to directly flout the settlement’s requirements.

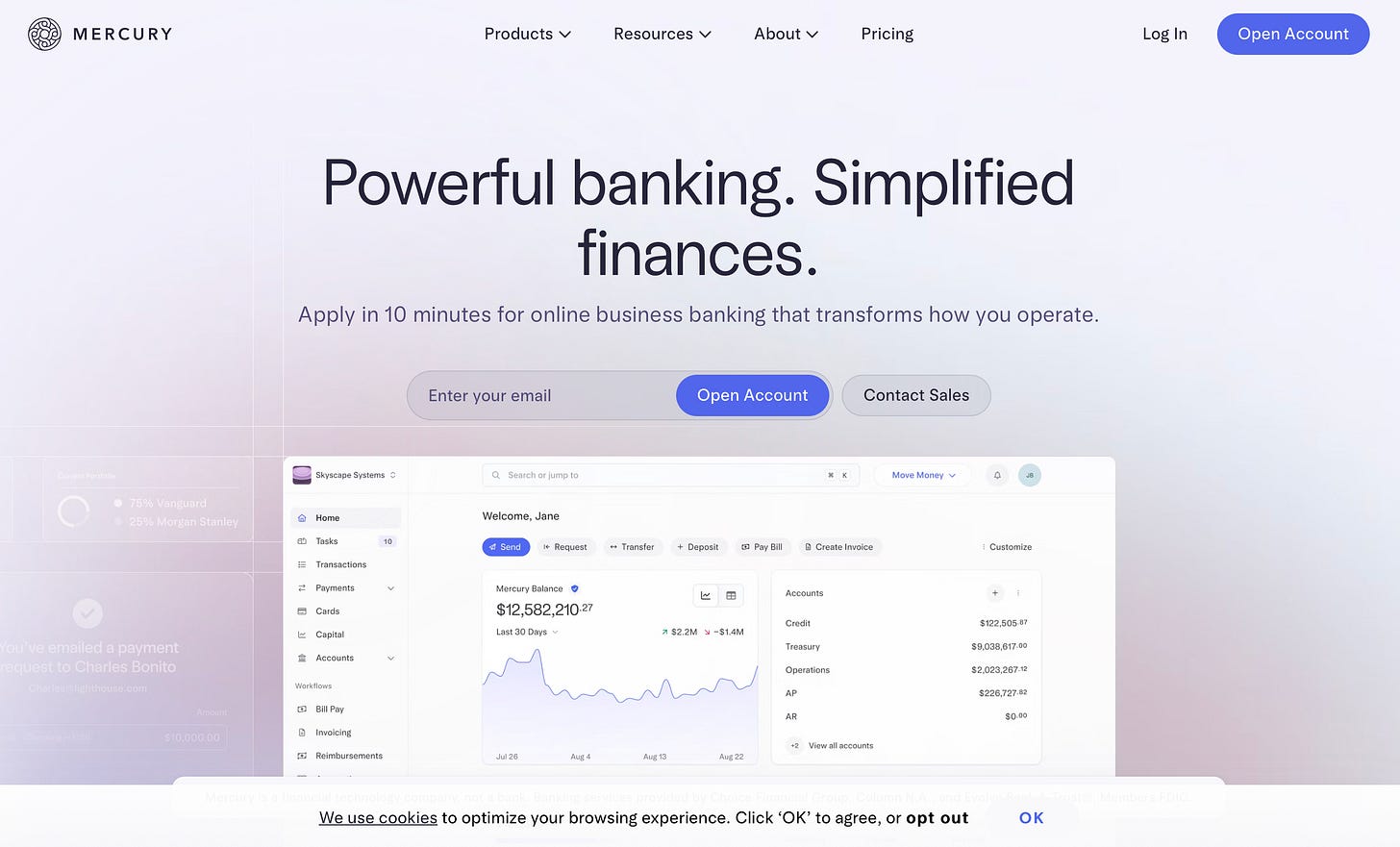

Here’s what a first-time visitor to Mercury’s homepage would see today; the disclosure that makes clear Mercury isn’t in fact a bank is hidden beneath a cookie disclosure.

The disclosure beneath the cookie banner is white, on top of a white image, and disappears as a user scrolls down the screen — which would not seem to meet the requirements of being clear, conspicuous, and proximate to the “banking” claims above it.

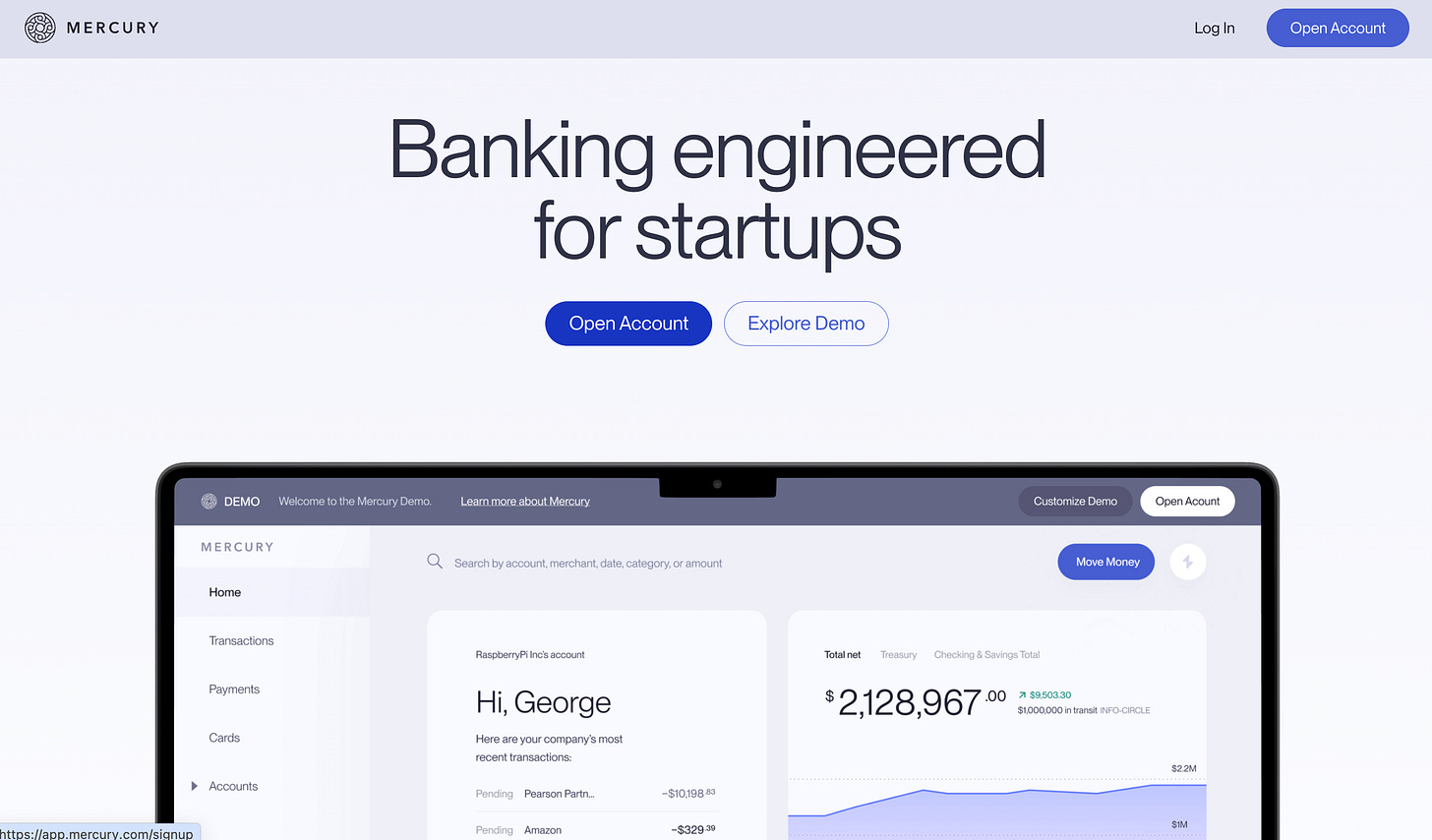

Despite being specifically prohibited from using the phrase “banking built for startups” or similar phrases, on a page about how Mercury works, the company describes its product as “Banking engineered for startups,” which is strikingly similar to the prohibited phrases cited in the California settlement.

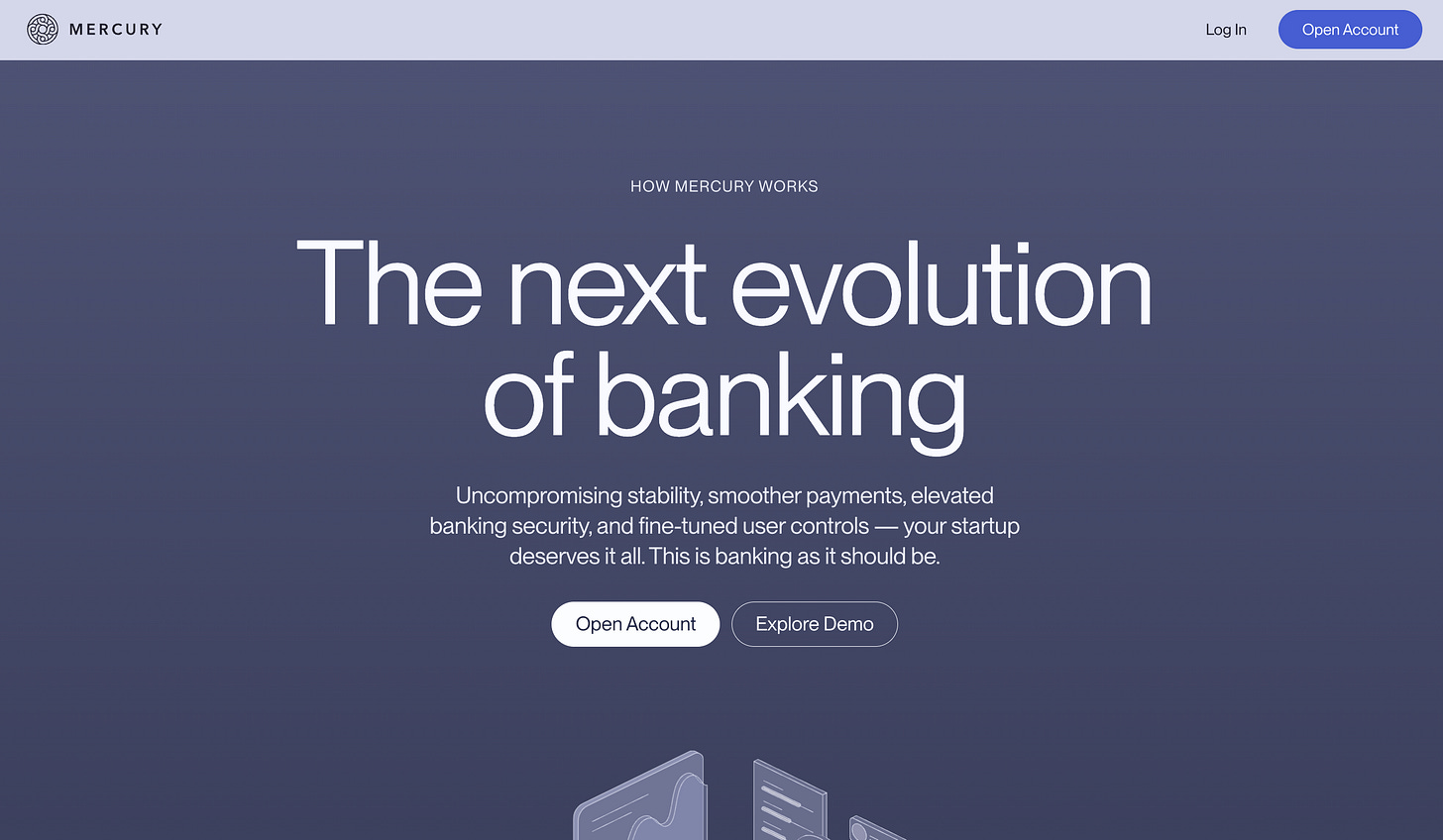

The same page also refers to Mercury as “the next evolution of banking” and “banking as it should be,” with no visible disclosure accompanying the use of “banking” language.

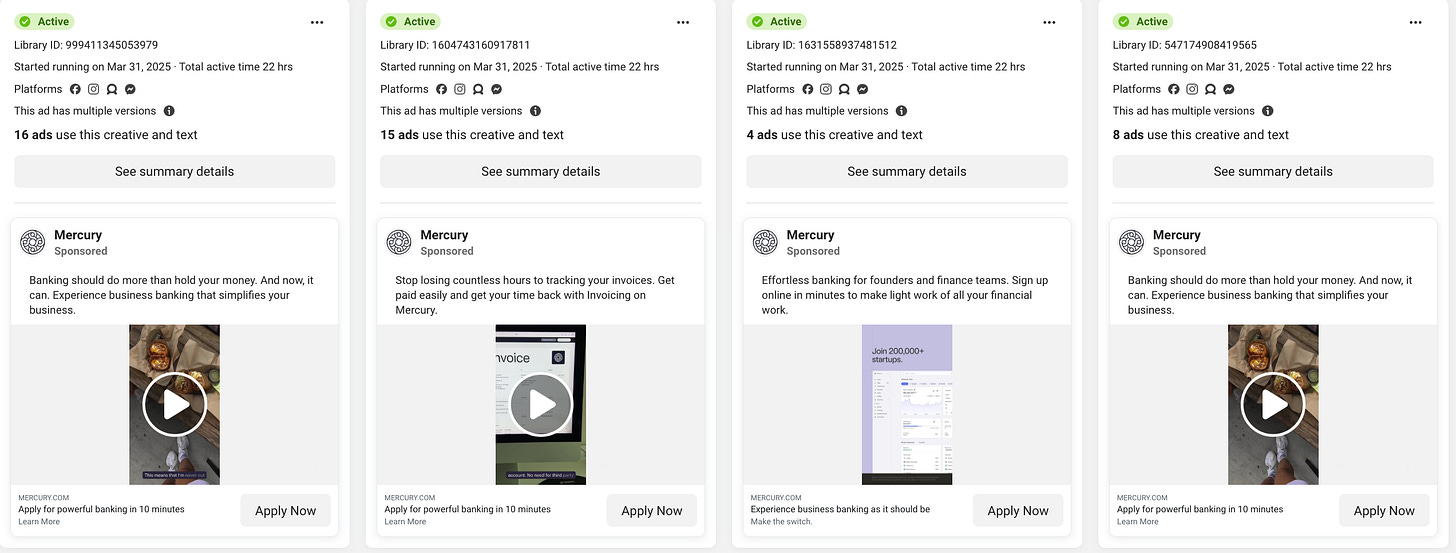

Many of Mercury’s advertisements also appear to flout the California settlement, including ads launched as recently as last week:

Nearly all of the ad units Mercury is running on Facebook and Instagram make use of “banking” language, yet, for ads with videos, the disclosure clarifying that Mercury isn’t a bank appears for approximately 1 second — at the very end of the video.

For ad units that use a static image, there is a disclosure, though in a substantially smaller and difficult to read typeface.

In addition to Mercury’s site and advertisements it has direct control over, Mercury also appears to leverage third-party affiliates to market its product — including some still referring to the company as “Mercury Bank.”

A common strategy for affiliates in the financial services space is to generate content purporting to review a product or service; if users click through and sign up for the product, the affiliate earns a commission.

While this is common across many verticals, with huge players like CreditKarma and LendingTree essentially using this approach, there is a long tail of tens of thousands of sites and individual influencers who use this business model.

This poses a challenge for companies in highly regulated spaces, like financial services, as they typically have an obligation to have policies and procedures governing how they monitor and ensure the accuracy of marketing affiliates undertake on their behalf.

Mercury appears to be struggling to police sites that look to be marketing affiliates of the company. For example, here is a review of “Mercury Bank” on popular comparison site NerdWallet:

And here is an example of one of many YouTube reviews of Mercury, which appears to contain an affiliate link to Mercury’s site.

The video purports to review “Mercury Bank,” including stating that “deposits in checking & savings accounts are FDIC insured up to $5 million,” without specifying the underlying insured depository institution(s), as required by FDIC regulations.

The persistent issues with “banking” language and inadequate disclosures are

An analysis of data released in the Russia-linked hack of Mercury partner Evolve showed that, at one point, just five registered agent addresses had more than 13,000 Mercury accounts associated with them, accounting for nearly 20% of Mercury accounts on Evolve at the time.

Despite listing U.S. addresses, a material number of the accounts had indicators, such as phone numbers and IP addresses, that indicated they were associated with higher-risk jurisdictions, such as Russia, the United Arab Emirates, and Pakistan.

Three days after that reporting came out, Mercury abruptly announced it would close users’ accounts in 37 higher-risk jurisdictions, including Ukraine, Croatia, Nigeria, South Africa, Kenya, and the Philippines.

Mercury CEO Immad Akhund pointed to compliance costs and operational complexity in justifying the closures, writing in part on X: “[T]he number of customers in these countries is very small (<1% of Mercury deposits), but it was putting a lot of strain on our operational teams and all of our financial partners (partner banks, treasury, payments, etc). We’ve seen the regulatory environment become stricter recently, which has made us change our approach to certain situations.”

In perhaps the most egregious example, after being alerted in mid-2023 by its bank partner that — a comprehensively sanctioned jurisdiction — Mercury declined to report the transaction to the Office of Foreign Asset Control (OFAC), The Information’s Michael Roddan reported last year.

The environment for bank-fintech partnerships has changed substantially since Mercury first launched its business banking product in April 2019.

Mercury has had a front row seat to the increase in regulatory scrutiny, as all of its bank partners, with the exception of recently announced Column, have entered into consent orders with their respective regulators stemming from their banking-as-a-service activities:

Cognizant of the changing climate and growing perception that “compliance is a competitive advantage,” Mercury seems to have embarked on an effort to improve its reputation and compliance bona fides (though I would argue compliance should be more tablestakes than a competitive differentiator…)

Mercury , with the company’s Director of Policy & Government Affairs, Dan Swislow, commenting at the time (emphasis added):

“Clear compliance standards for fintech-bank partnerships are good for the industry. Mercury joined CFES as a founding member because across the ecosystem.”

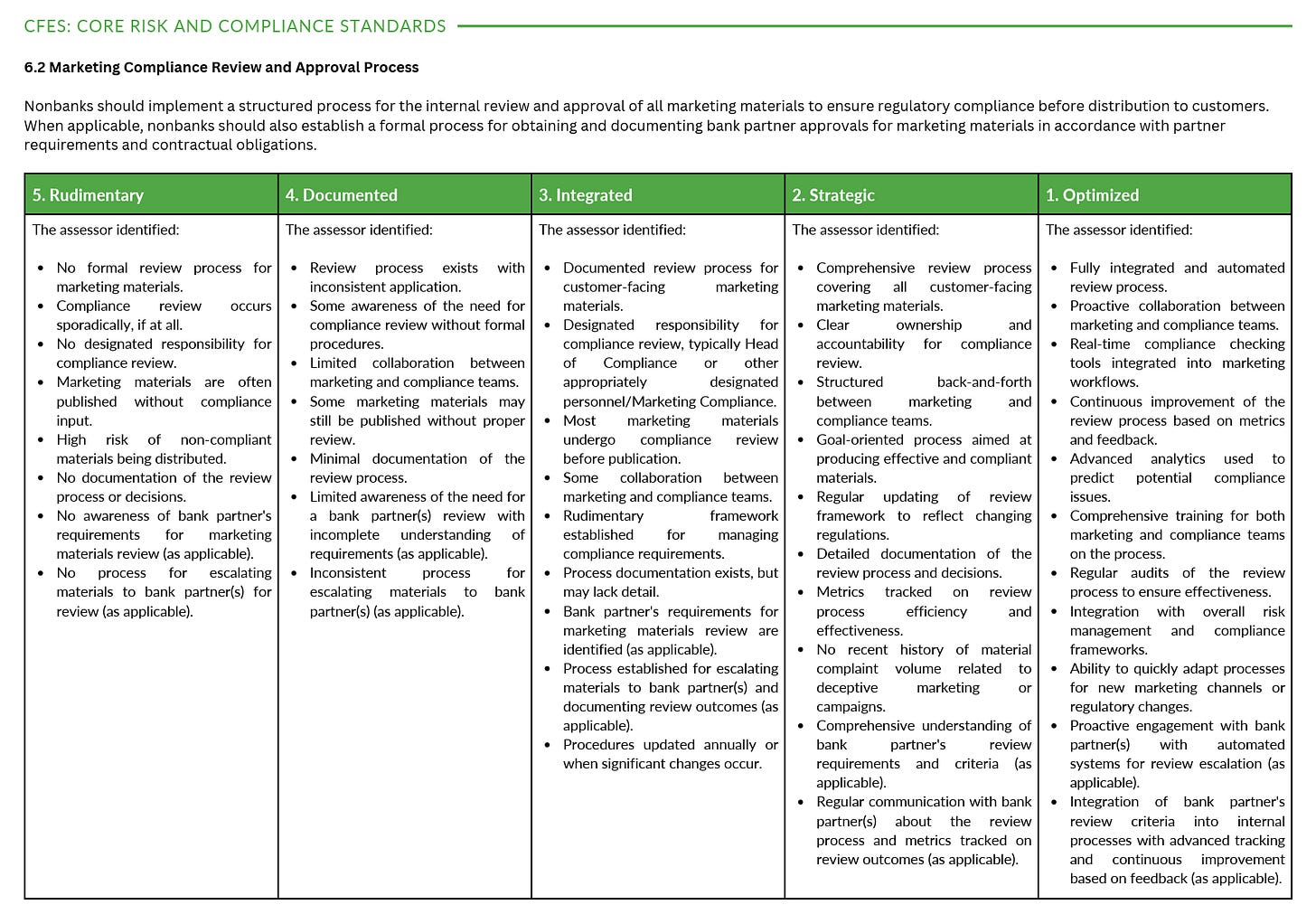

CFES’ core risk and compliance standards include a section on marketing and product compliance (emphasis added):

“Nonbanks should in accordance with partner requirements and contractual obligations.”

Mercury last week also , using the announcement to tout its compliance bona fides (emphasis added):

Since its founding, to deliver powerful, simplified banking* for businesses and founders. By joining AFC, Mercury will help , advocate for increased regulatory clarity for fintechs, strengthen collaboration between regulators, banks and fintechs, and ensure fintech continues to drive economic opportunity for emerging businesses.

“New and growing companies are a critical engine of employment, productivity, and innovation,” said . “Mercury plays a crucial role in breaking down barriers and giving founders the financial tools they need to compete, scale, and build the future. Joining AFC aligns with our goals to advocate for policies that foster responsible fintech innovation and ensure scaling businesses have the resources they need to thrive. We look forward to working with AFC to help shape a regulatory landscape that supports entrepreneurs and drives economic growth.”

While it’s promising to see Mercury recognize the importance of taking compliance seriously, it’s difficult to reconcile with what appears to be its ongoing violation of its settlement with the California DFPI and its inconsistent approach to making legally required disclosures.

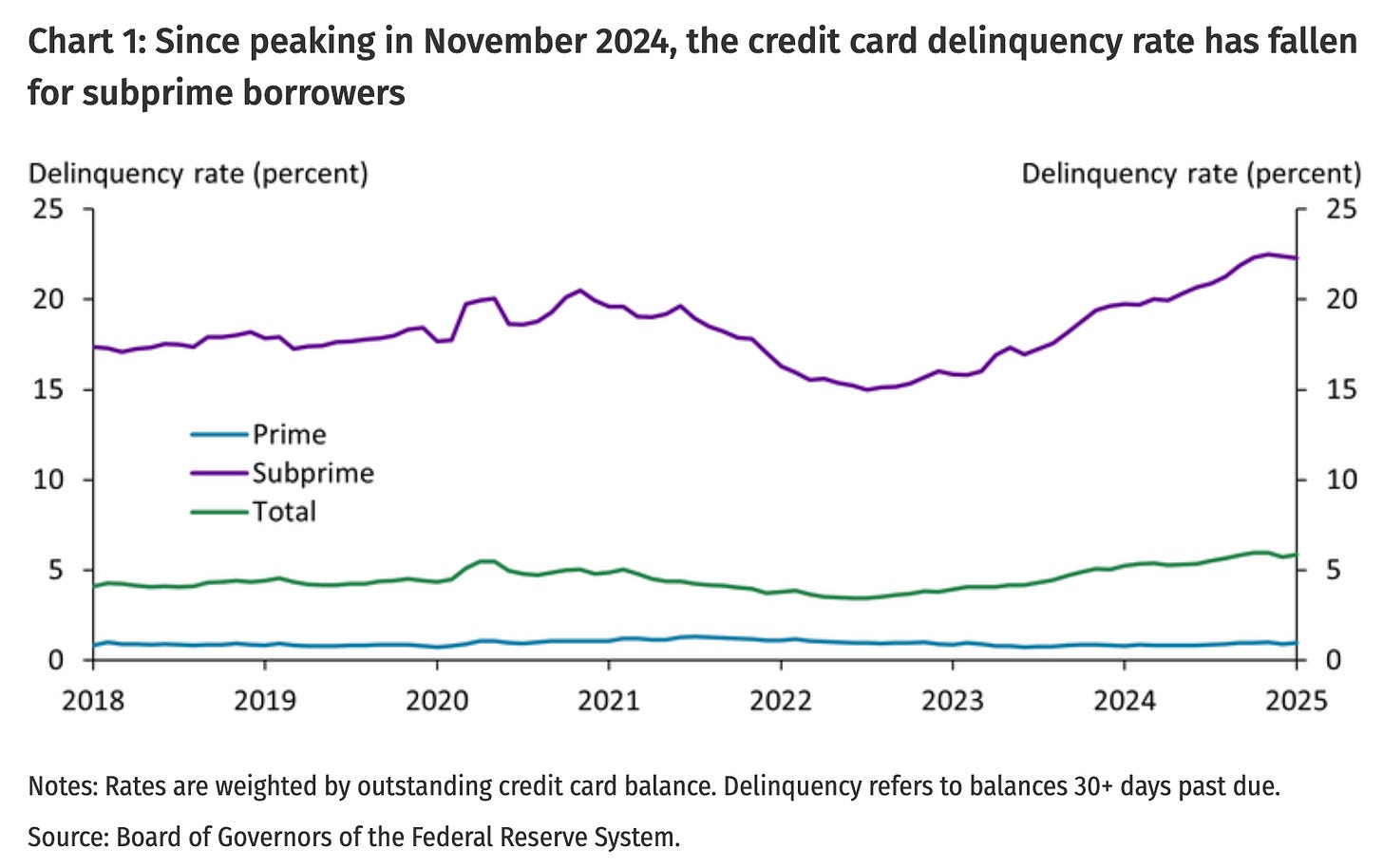

A new research bulletin from the Kansas City Federal Reserve shows that, after hitting a peak in November 2024, delinquency rates on subprime cards have declined somewhat.

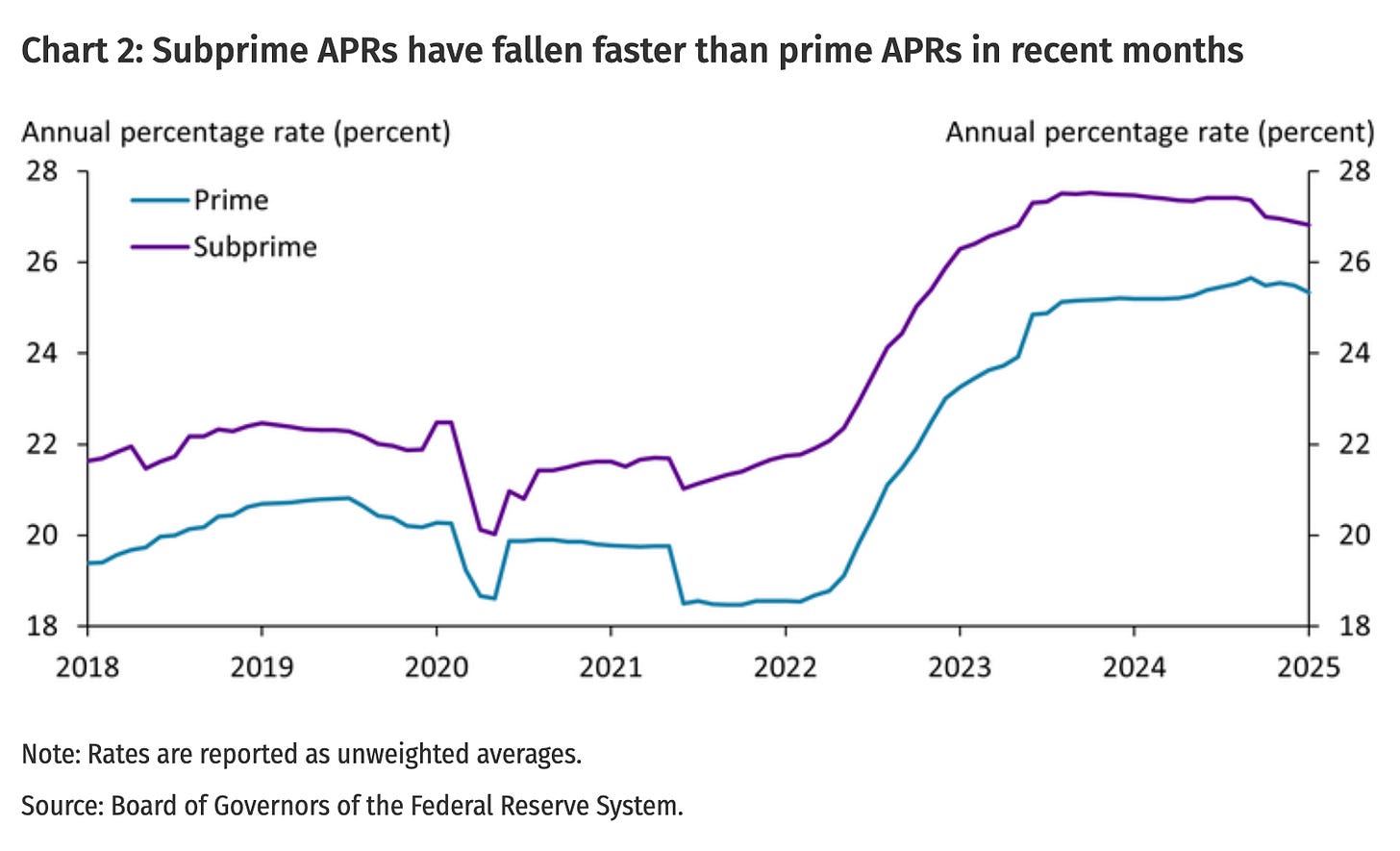

As the Federal Reserve rapidly increased interest rates beginning in March 2022, those hikes flowed through to both prime and subprime credit cards, with subprime rates peaking around an average of 27% APR in late 2024. Rates have since declined slightly.

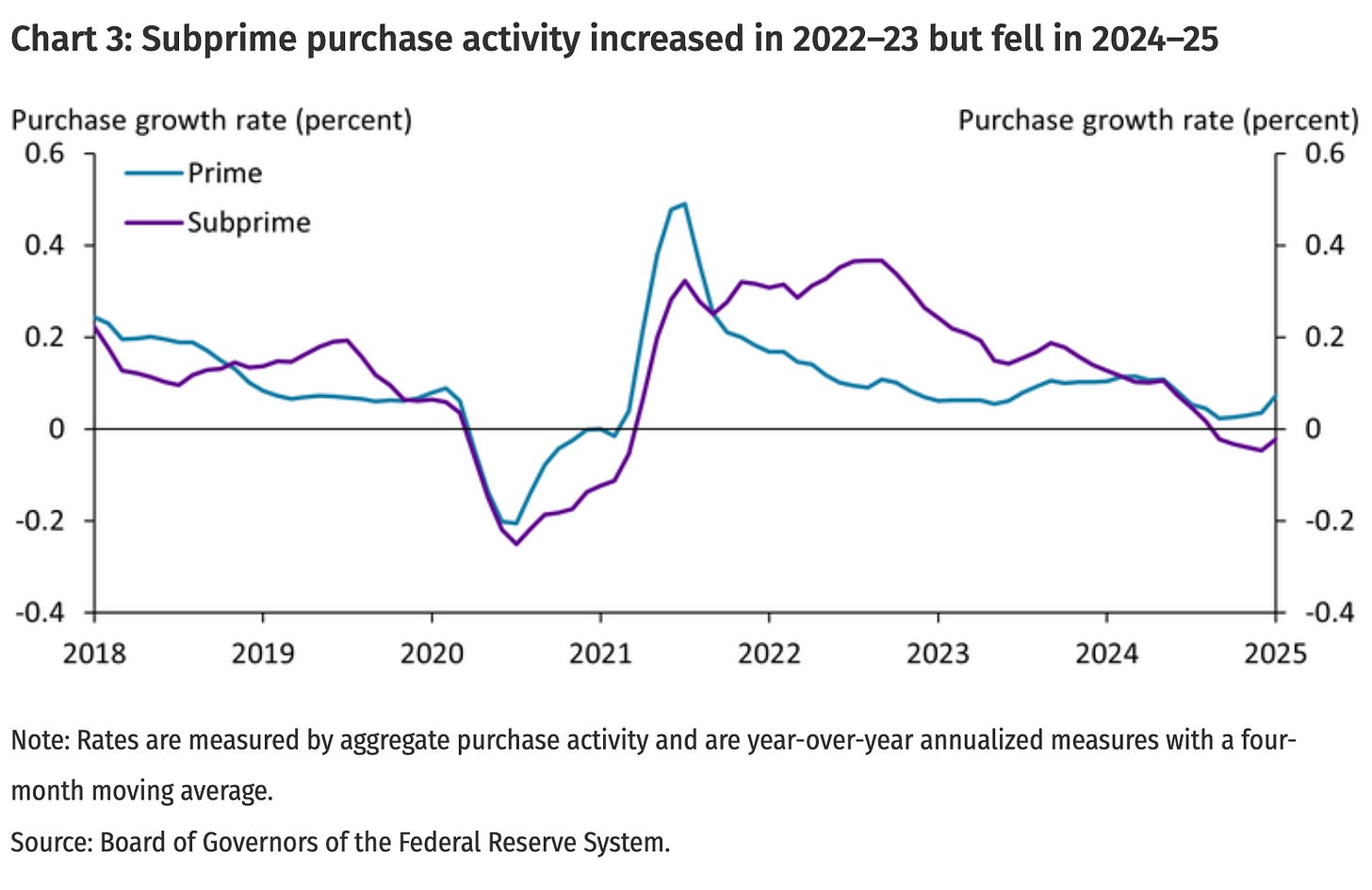

Interestingly, the data, which cover the period through end of January 2025 (eg, before many of the impacts of the new Trump administration were known or would be felt by consumers), show that growth in spending on subprime cards slowed during 2024 and actually turned negative in January 2025.

The paper’s author notes, “From 2022 to 2023, purchase activity grew faster among subprime borrowers (purple line) than prime borrowers (blue line); however, growth in subprime purchases declined in 2024 and turned negative as of January 2025.”

AI, Fintechs, and Banks ()

Economic Outlook ()

CFPB Plans to Revoke Buy Now, Pay Later Rule Fintechs Fought ()

Celebrity-Backed Bankrupt Carbon Credit Seller Arranges Financing Amid Fraud Charges Against Co-Founder ()

Keynote Remarks 2025 Fintech Conference ()

Ten letters – House Republicans call on the financial regulators to change course ()

Listen: New York's Bold Move to Create a Mini CFPB ()

Listen: Interview: CardsFTW Publisher & Totavi Founder Matthew Goldman ()

Looking to work with me in any of the following areas? Email me.