Li Auto (NasdaqGS:LI) Faces Legal Challenges Over Securities Class Action Lawsuit

Li Auto (NasdaqGS:LI) experienced a notable 5% increase in its stock price over the last quarter, alongside legal challenges and growth in vehicle deliveries. The company faces multiple lawsuits alleging misstatements, which could have influenced investor sentiment. However, Li Auto's Q1 2025 earnings showed revenue growth and improved net income, potentially bolstering confidence. Despite the broader market pressure from geopolitical tensions and a declining Dow, Li Auto maintained positive momentum, likely supported by its partnership with Celanese and promising delivery figures. These factors add weight to the company's resilience amid market fluctuations and legal uncertainties.

Every company has risks, and we've spotted 1 warning sign for Li Auto you should know about.

The recent developments surrounding Li Auto, including legal challenges and revenue growth, could significantly influence the company's ongoing narrative. While the Q1 2025 earnings report showed revenue growth and improved net income, the legal issues may impact investor sentiment and long-term projections. Over the last year, Li Auto's total shareholder return was 53.56%, reflecting strong performance, but over the past year, the company underperformed relative to the US Auto industry, which returned 60.1%. This discrepancy could suggest competitive pressures or market-specific challenges impacting Li Auto's shares.

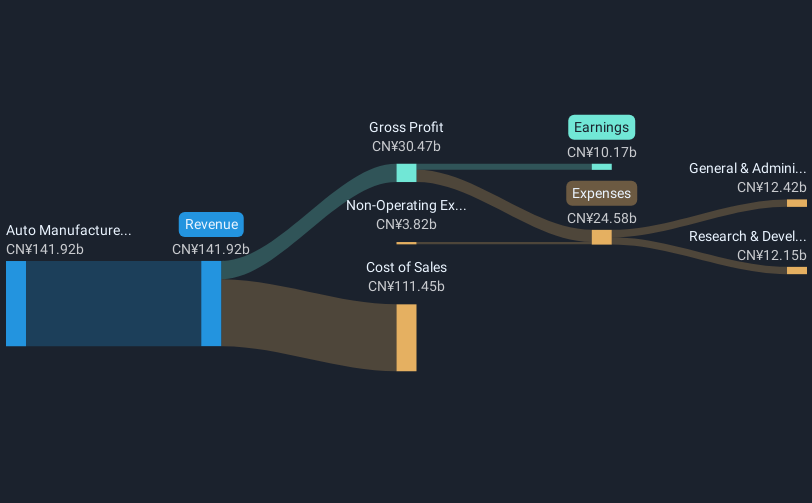

The introduction of new BEVs and advancements in autonomous driving technology may bolster future revenue and earnings forecasts, driven by enhanced customer experiences and expanded market presence. However, intensifying competition and diminishing margins present risks. With a current share price of US$25.68, Li Auto trades at a discount to the consensus price target of US$33.69, indicating potential upside if the forecasts of revenue reaching CN¥258.4 billion and earnings of CN¥19.3 billion by 2028 become a reality. Investors should weigh these factors against existing market pressures and competitive benchmarks to form a comprehensive view of Li Auto's potential trajectory.

Dive into the specifics of Li Auto here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Alternatively, email [email protected]