KRA Fires 19 Staff over Graft, Receives KSh 4.39b Tax Estimates from Corruption Reports

TUKO.co.ke journalist Wycliffe Musalia has over six years of experience in financial, business, technology, and climate reporting, which offers deep insights into Kenyan and global economic trends.

Kenya Revenue Authority (KRA) has taken action against staff engaged in graft dealings.

Source: UGC

KRA fired 19 staff members in Q2 of the financial year 2024/25 as part of its commitment to combat corruption.

The number increased from nine workers axed during a similar period in the fiscal year 2023/24.

The axed workers were charged with dishonesty, lack of integrity, fraud, negligence of duty, absenteeism, conflict of interest, impersonation, and other ethical breaches.

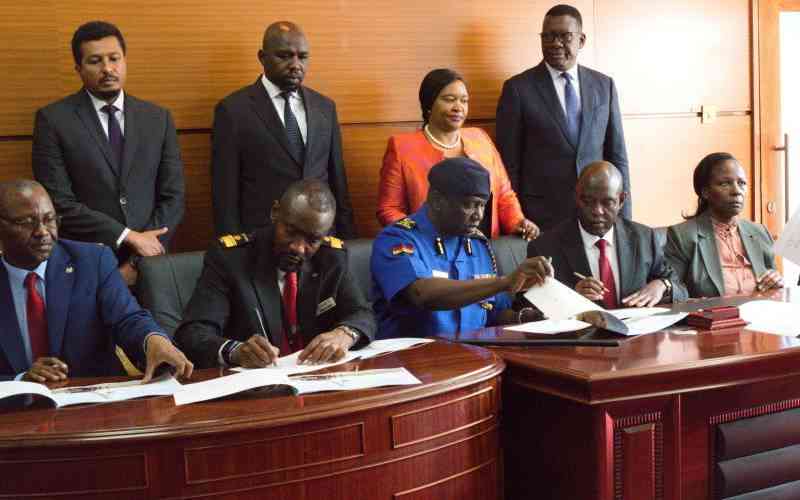

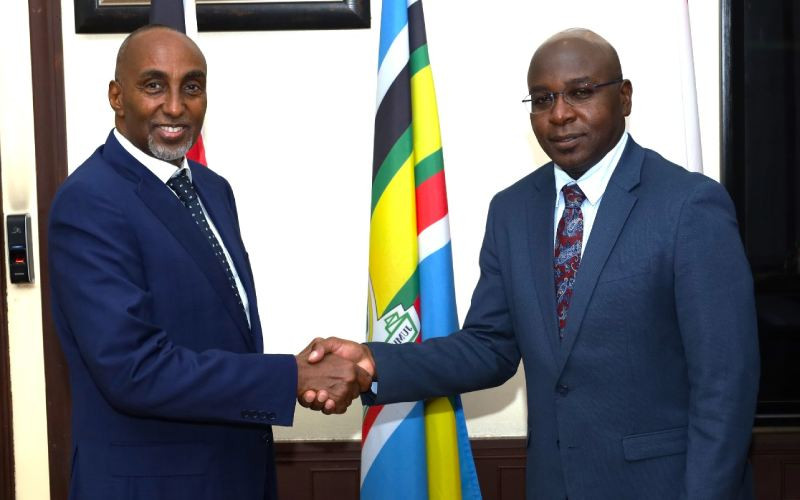

KRA Commissioner General Humphrey Wattanga revealed the authority's collaboration with the Ethics and Anti-Corruption Commission (EACC) to fight the vice for improved tax compliance and enhanced collection.

"We cannot afford to turn a blind eye to those who abuse our systems. Our collaboration with EACC is not just strategic; it is a moral imperative. We will establish a robust framework that deters tax evasion and imposes strict penalties on those who facilitate such evasion, ensuring accountability for their actions," said Wattanga.

EACC CEO Abdi Mohamud acknowledged the collaboration, saying it focuses on the need to mitigate graft for effective revenue administration.

This collaboration is crucial in expanding our efforts to eradicate corruption, foster an environment that discourages corrupt practices and tax evasion and promotes ethical business conduct," said Mohamud.

The taxman said it leverages technology to seal revenue leakages and enhance compliance.

The taxman implemented lifestyle audits, reaching out to 117 workers in Q2 of the current fiscal year.

Wattanga noted that audits have proven effective in identifying illicit wealth among KRA staff members.

During the same period, the authority embraced system reviews as a preventive and detective tool against corruption.

According to KRA, the review process revises work procedures, policies, practices, and systems to minimize graft dealings.

In the same period under review, KRA unveiled iWhistle, a web-based platform that enables the public to report corruption and tax evasion anonymously.

The authority said it received 246 corruption reports through iWhistle, with tax estimates totalling KSh 4.39 billion.

KRA incentivised the reporting of tax malpractices, introducing a reward scheme offering informers 5% of the tax recovered, with a maximum payout of KSh 5 million per case.

The taxman also established an Integrity Award Framework to recognise and celebrate staff who demonstrate exceptional support for promoting integrity.

The efforts in the fight against corruption saw KRA collect KSh 1.243 trillion in the first half of the financial year 2024/25.

This represented a 4.5% rise from KSh 1.189 trillion collected during a similar period in the previous year.

Agency revenue, collected on behalf of other government entities, amounted to KSh 122.872 billion, while exchequer revenue, received on behalf of the National Treasury, totalled KSh 1.12 trillion.

Source: TUKO.co.ke