Iran-Israel war & US bombings: Should possible Strait of Hormuz closure worry India about its oil supply? Explained in 10 points - Times of India

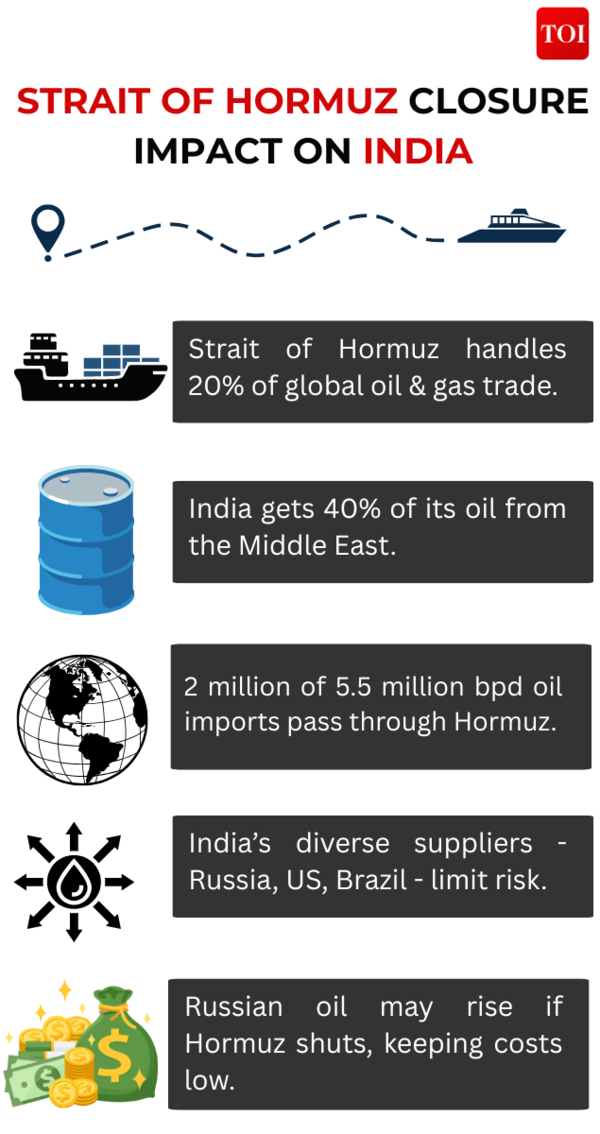

India's reliance on crude oil imports is at approximately 90%, with Middle Eastern nations supplying more than 40% of these imports. (AI image)

Iran-Israel war & Strait of Hormuz: With escalating tensions between Iran and Israel, especially after the US bombed nuclear facilities in Iran earlier today, there are rising fears of the Strait of Hormuz being closed.

The Strait of Hormuz is a crucial maritime passage handling 20% of global oil and gas transportation.According to state-run media, Iran’s Parliament has approved the closure of Strait of Hormuz and the final decision will be taken by Iran’s Supreme National Security Council.What will be the impact of the potential closure of the Strait of Hormuz? And importantly, how will India be hit? We take a look:

The major oil-producing nations of the region - Saudi Arabia, Iraq, UAE, Qatar, Iran, and Kuwait - rely on this passage for their exports.Whilst historical concerns about disruptions to Persian Gulf energy flows majorly affected Western nations, particularly the US and Europe, in today’s situation the implications would most significantly impact China and Asian countries.Based on EIA data quoted by PTI, Asian nations received 8% of crude oil and condensate shipments through the Strait of Hormuz in 2022. India, China, Japan, and South Korea collectively made up 67% of total flows during 2022 and the firstl six months of 2023.

Also Read | ‘Highest in two years’: India increases oil imports from Russia, US amidst Iran-Israel war; why it's about strategic positioning, not panicIndia's reliance on crude oil imports is at approximately 90%, with Middle Eastern nations, whose exports pass through the Strait of Hormuz, supplying more than 40% of these imports.EIA reports indicate that during the first quarter of 2025, China's crude imports via the Strait of Hormuz reached 5.4 million bpd. India received 2.1 million bpd, whilst South Korea and Japan imported 1.7 million bpd and 1.6 million bpd respectively.The IEA has emphasised that any interference with the flow through the Strait would significantly impact global oil markets.

In the event of escalating tensions or temporary Hormuz disruptions, Russian oil supplies could increase, providing both availability and cost advantages. India has options to diversify its oil imports from the United States, Nigeria, Angola, and Brazil, despite higher transportation expenses.

India can utilise its strategic petroleum reserves, which cover 9-10 days of imports, to manage any supply gaps. To control inflation during price surges, particularly for diesel and LPG, the government maintains the option of implementing price subsidies.

Global oil prices saw a sharp increase after Israel launched attacks targeting Iranian military commanders, homes, military installations and nuclear facilities on June 13.

Iran retaliated by firing numerous ballistic missiles. This heightened tension caused oil prices to rise substantially, as concerns grew about geopolitical instability and potential supply chain disruptions.The benchmark Brent crude oil has reached $77 per barrel, marking a 10 per cent increase since the onset of hostilities.According to oil market specialists at Goldman Sachs, prices could potentially rise beyond $90 should the situation deteriorate further.

Citigroup analysts project that Brent crude values might approach $90 per barrel in the event of a closure of the Strait of Hormuz.The credit rating organisation Icra indicated that any intensification of regional tensions could have considerable effects on oil prices.Higher oil prices would reduce the profits that state-owned retailers IOC, BPCL and HPCL have built up by maintaining stable retail prices despite previous decreases in international rates.Also Read | Iran-Israel conflict: India keeping tab on Chabahar Port, International North-South Transport Corridor; why it's importantAccording to Jain of Yes Securities, oil markets remain adequately supplied, supported by OPEC's 4 million barrels per day spare capacity and a pre-conflict global surplus of 0.9 million bpd. Additional stability comes from US shale production.Global security analysts deem an extended blockage of the Strait of Hormuz unlikely, given the US naval forces in the region. Any such action by Iran would not only impact the oil exports of Saudi Arabia, the UAE, Kuwait and Qatar but would also hamper its own export capabilities.Despite aggressive rhetoric from Iranian conservatives and state media predictions of oil prices reaching $400 per barrel, the international trade analysis organisation Kpler suggests the probability of a complete blockade remains minimal, citing significant deterrents for Iran.Such an action would severely affect China, Iran's primary oil buyer, which sources 47 per cent of its maritime crude imports from the Middle East Gulf region. As the world's second-largest economy, China stands as the principal purchaser of Iranian oil, reportedly consuming more than three-quarters of Iran's oil exports.The fact that Iran relies heavily on the Strait of Hormuz for its oil shipments through Kharg Island, which manages 96% of its exports, makes any self-imposed blockade counterproductive to its interests.

_(1).jpg?disable=upscale&width=1200&height=630&fit=crop)