Impact and Assessment of US-Vietnam Trade Deal

US stock markets closed higher on Wednesday, July 2, 2025, with the S&P 500 and Nasdaq Composite reaching new record highs, fueled by rising optimism over new US trade deals and increasing signs of a slowing labor market that could prompt Federal Reserve interest rate cuts. The S&P 500 gained nearly 0.5% to close at 6,277.42, while the Nasdaq Composite rose over 0.9% to 20,393.13. The Dow Jones Industrial Average remained near the flat line.

A significant factor contributing to market sentiment was the latest labor market data. ADP reported an unexpected cut of 33,000 private sector jobs in June, marking the first month of job losses in over two years and significantly missing economists' expectations of 98,000 jobs added. This slowdown strengthens the case for the Federal Reserve to consider an earlier interest rate cut, with nearly all Fed watchers anticipating at least one cut by September, and over 20% pricing in two cuts by that meeting. All eyes are now on the official June US jobs report from the Bureau of Labor Statistics, expected on Thursday, July 3, which economists predict will show nonfarm payrolls rising by 110,000 and the unemployment rate increasing to 4.3%.

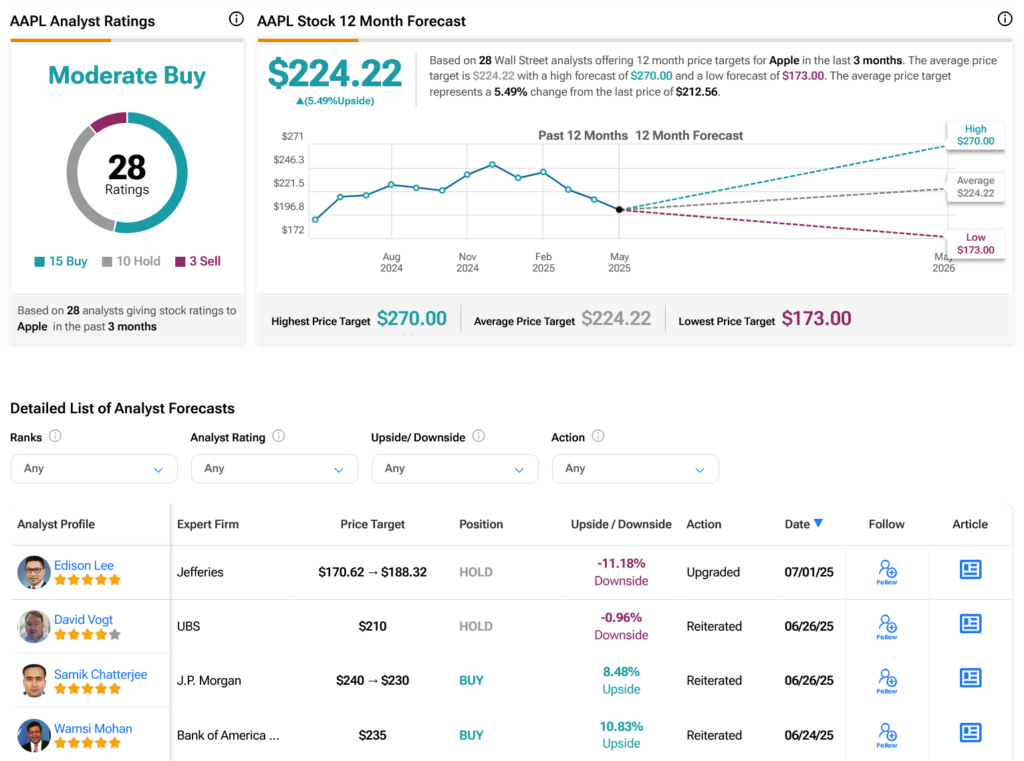

Several major corporate stocks saw notable movements. Apple (AAPL) shares climbed after an upgrade from Jefferies analysts, citing strong iPhone sales growth in April and May, particularly in China. Tesla (TSLA) also saw its stock rise despite reporting lower-than-expected second-quarter vehicle deliveries, as its production numbers globally surpassed forecasts. Robinhood (HOOD) soared to a record high of $100, driven by its expansion into tokenized stock and ETF trading in the European Union and its strong position in the retail crypto trading market. In other tech news, DA Davidson analysts reiterated their view that Alphabet (GOOGL, GOOG) should undergo a