Humana (NYSE:HUM) Expands Elderly Care With 65 Prime+ Clinics In Partnership With Mercy

Humana (NYSE:HUM) experienced a 3% price increase last week, which may have been influenced by its recent partnership with Mercy to open new primary care clinics for seniors. This expansion addresses the growing healthcare demand from the rising senior population. In contrast, rising geopolitical tensions led the major stock indices to decline slightly amid broader market volatility, with the Dow Jones falling 1.2%. The launch of the Prime+ clinics could provide a positive counterbalance to these market conditions for Humana, aligning with investor interest in healthcare initiatives amidst falling major stocks.

Buy, Hold or Sell Humana? View our complete analysis and fair value estimate and you decide.

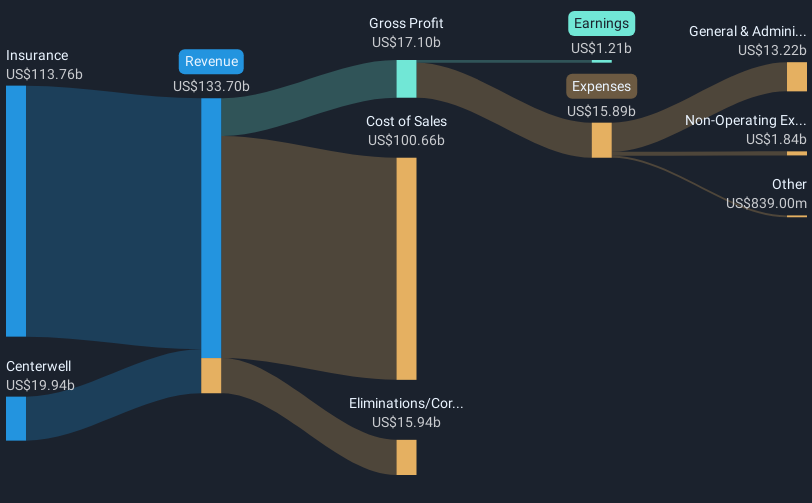

The recent partnership between Humana and Mercy to open Prime+ primary care clinics for seniors could potentially enhance Humana's operational efficiency and patient engagement, thanks to the growing senior population. This initiative aligns with the broader narrative of improved care delivery through AI, in-home visits, and CenterWell expansion. While this could bolster future revenue and earnings, uncertainties such as regulatory impacts remain. The introduction of these clinics, focused on value-based models and clinical excellence, may drive Humana's revenue increases beyond the current trajectory.

Over the past year, Humana's total shareholder return, including dividends, was -33.60%. In comparison, Humana underperformed the US market's return of 11.7% and the US Healthcare industry's 17.4% decline over the same period. The longer-term performance signals challenges relative to broader market trends, emphasizing the potential impact of strategic alignments like the Mercy partnership on future performance.

In terms of financial forecasts, the new clinics could contribute positively to Humana's revenue, expected to grow by 5.9% annually. With earnings forecasted to potentially reach US$2.7 billion by May 2028, these initiatives might provide substantial support. The current price behavior of Humana shares—at a discount to analyst consensus targets of US$309.40—suggests room for growth if these strategic initiatives materialize successfully. The recent 3% share price increase highlights investor optimism, though the current value remains approximately 18.6% below the price target. As Humana continues to invest in innovative care solutions, its ability to achieve its predicted valuation will depend on the execution and regulatory navigation of such growth strategies.

Learn about Humana's historical performance here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Discover if Humana might be undervalued or overvalued with our detailed analysis, featuring

Alternatively, email [email protected]