How Ullu Gained An Edge In India's Legal Grey Zone

“Sex sells! The old cliché never turned old really, and if you are in this business, you will earn money. This is how Ullu has capitalised,” said a film industry veteran. “In this business, the promise of such content is a double-barrelled gun.”

Ullu took the Hindi word for the nocturnal owl to brand itself, and its repository of short films and web series for adult consumption. The symbolism of the nocturnal bird and the allure of sexually-gratifying content is undeniable.

And while sex sells, it also kicks off big debates in India.

Ullu came under the glare of the National Commission of Women earlier this month. The platform had to take down a reality show, House Arrest, after a viral clip of the show displaying contestants enacting sex positions jolted several MPs and MLAs.

There’s no credible data estimating the market for lascivious entertainment in India, but it enjoys a substantial share of the $71.95 Bn global market, growing at 9.1% every year. India was also the third biggest consumer of porn in 2018. It was the same year when the government cracked the moral whip on easy access to adult entertainment and banned 827 websites including the likes of Brazzers,Pornhub, Bangbros. But the great jugaad economy of India soon found a quick fix in virtual private networks (VPNs).

Was there a whiff of opportunity in obscenity? Ullu today flaunts 2 Mn subscribers with 10 Mn Android downloads and has surpassed OTT giant Netflix in terms of paid subscribers, a LinkedIn post claimed last year. The six-year-old company closed FY24 with an operating revenue of INR 99.6 Cr and a profit of INR 12.6 Cr. The IPO-bound company is yet to disclose its financials for FY25.

A questionnaire sent to Ullu didn’t elicit any response at the time of publishing this story.

So, what is the chemistry behind Ullu’s success?

The OTT platform, which went on air in 2019 by founder Vibhu Agarwal, provides a diverse range of web series, short films and shows primarily in Hindi and a few regional languages like Tamil, Telugu, and Bhojpuri. The platform claims to offer a wide range of genres, primarily romance, drama, thriller, and comedy. While Ullu’s content is consumed mainly in India, it claims to have some business in Australia, too.

Ullu creates its content in two ways. Either it collaborates with production houses or independent creators or writers who develop the concept, write the script, and build the storyline. Or, the platform’s in-house team writes the script based on the insight it gathered and signs up an independent production house.

In both cases, it is Ullu’s team that sets the budget and leads the post-production, which includes reviewing the content and finally giving a go-ahead to list it on the app. This means that the onus resides solely on Ullu when a content is flagged for its obscenity and profanity.

“It’s basically a soft-porn website. The only ingredient they need to make is clingy sex scenes,” said another industry insider, refusing to be identified for obvious reasons of the blurry line defining obscenity.

Ullu has set up an entire studio near Meerut to shoot their content. The budget for a show on Ullu ranges from INR 25 Lakh to INR 50 Lakh, according to sources. It is also reflected in the startup’s IPO papers. It filed for a public float in February 2024 for a listing on the BSE SME platform to raise INR 135-150 Cr. But the IPO was put on the back burner after many people questioned how BSE could allow such a listing.

The platform also acquires shows from various content providers. In fact, in its draft IPO papers, Ullu said that one of the primary reasons for raising public money was to acquire content from foreign countries.

“They have to remain profitable. In the OTT industry, the two major costs are marketing and content. In Ullu’s case, thanks to the nature of their content, both the costs are low,” argued a source quoted above.

The biggest draw for a viewer towards the Ullu app is its array of shows and series flaunting erotic posters and titillating titles. A look into the Google Play Store throws up the stunning image of 10 Mn+ downloads of the Ullu app with over 2 Mn+ subscribers.

Ullu finds a competitor in Balaji Telefilms’ digital platform Altt (formerly known as Altt Balaji). The OTT platform reported INR 57.8 Cr in revenue from 1.2 Mn paid subscribers and minted INR 3.9 Cr profit in FY24. The domain heated up when Amazon-owned MX Player entered the fray with its bouquet of explicit content. It enjoys a user base of nearly 250 Mn+ after being merged with Amazon’s miniTV.

With competition rising on the OTT turf, Ullu needs to keep building up its subscriber base, as it is the primary source of revenue. And, based on the numbers disclosed by Ullu in its IPO papers, the startup’s subscriber base took a 24% hit in FY24 after the platform had to drop a large chunk of content under pressure from the National Commission for Protection of Child Rights (NCPCR), according to media reports.

But how does Ullu reach its target viewers? “It’s simple. Have you ever seen people asking Google Maps to direct them to a liquor store? They just ask passers-by. It is the same thing for Ullu,” said the video industry insider. “In this industry, it is the ‘word of mouth’ that does the job.”

Ullu’s follower base for Instagram, Facebook, and YouTube counts 1 Mn, 2.5 Mn, and 4 Mn, respectively, adding up to around 10 Mn, data from the IPO papers showed. Unlike other OTT platforms, Ullu heavily relies on performance marketing to attract users. The platform posts 7-8 minute trimmed clips of their 30-40 minute episodes on Facebook and YouTube to tempt and drive viewers to its platform.

“These free videos under the disguise of marketing on social media platforms act like a bait, driving new users to visit the platform,” said an industry observer, seeking anonymity because of the ongoing stir around Ullu.

“Besides Ullu’s official page on social media, there are a lot of other pages that promote Ullu’s content on their pages. This type of explicit content anyway, attracts higher engagement and saves on the marketing cost.”

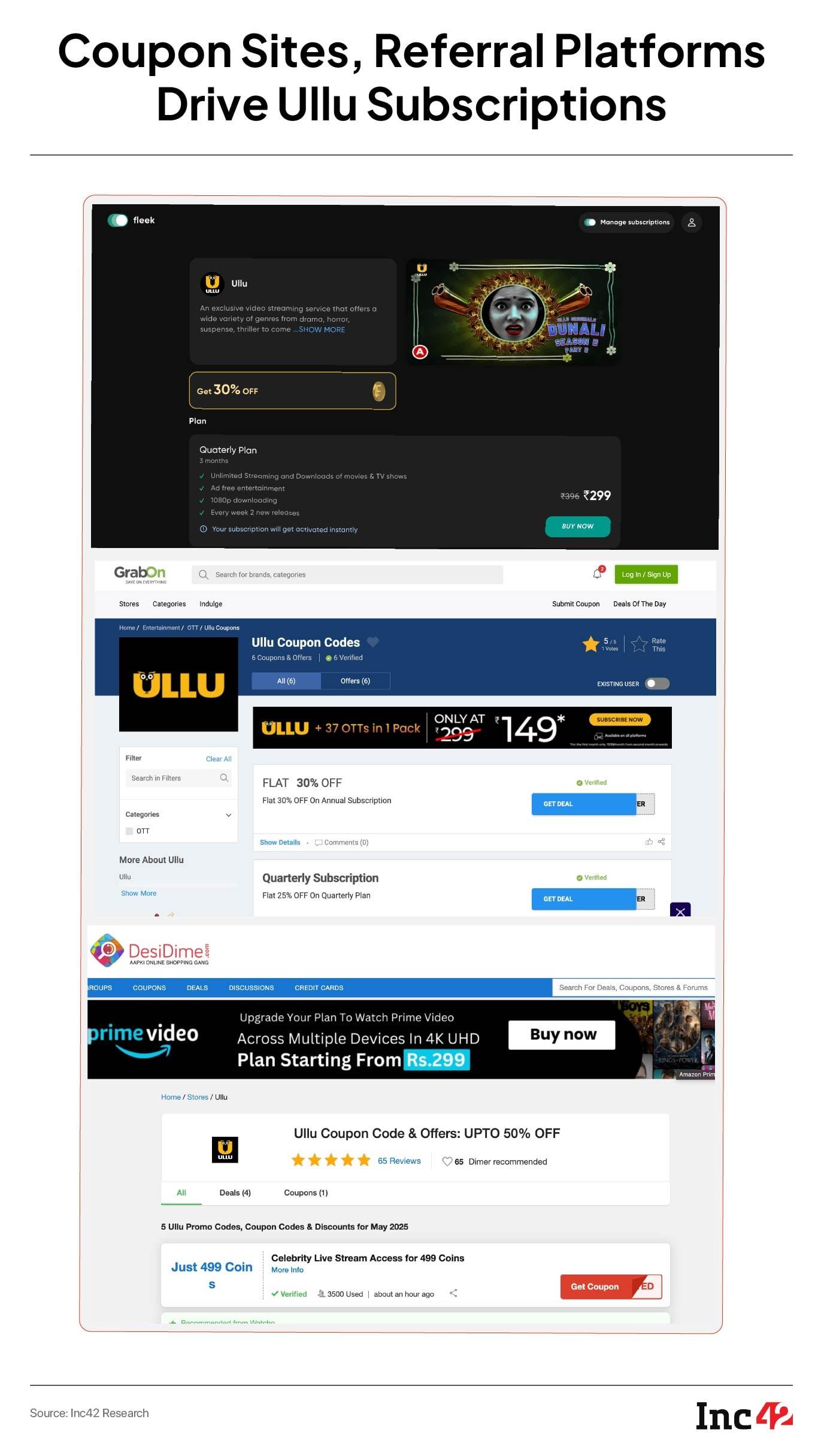

The actors of these shows enjoy significant followers on their respective social media handles, and also promote their OTT platform content to reach more users. Inc42 found at least three Ullu actors who have promoted Ullu’s content on their Instagram pages had a combined follower base of 1.2 Mn. Inc42 also found out that several third-party platforms are offering heavy discounts for Ullu subscriptions.

The actors of these shows enjoy significant followers on their respective social media handles, and also promote their OTT platform content to reach more users. Inc42 found at least three Ullu actors who have promoted Ullu’s content on their Instagram pages had a combined follower base of 1.2 Mn. Inc42 also found out that several third-party platforms are offering heavy discounts for Ullu subscriptions.

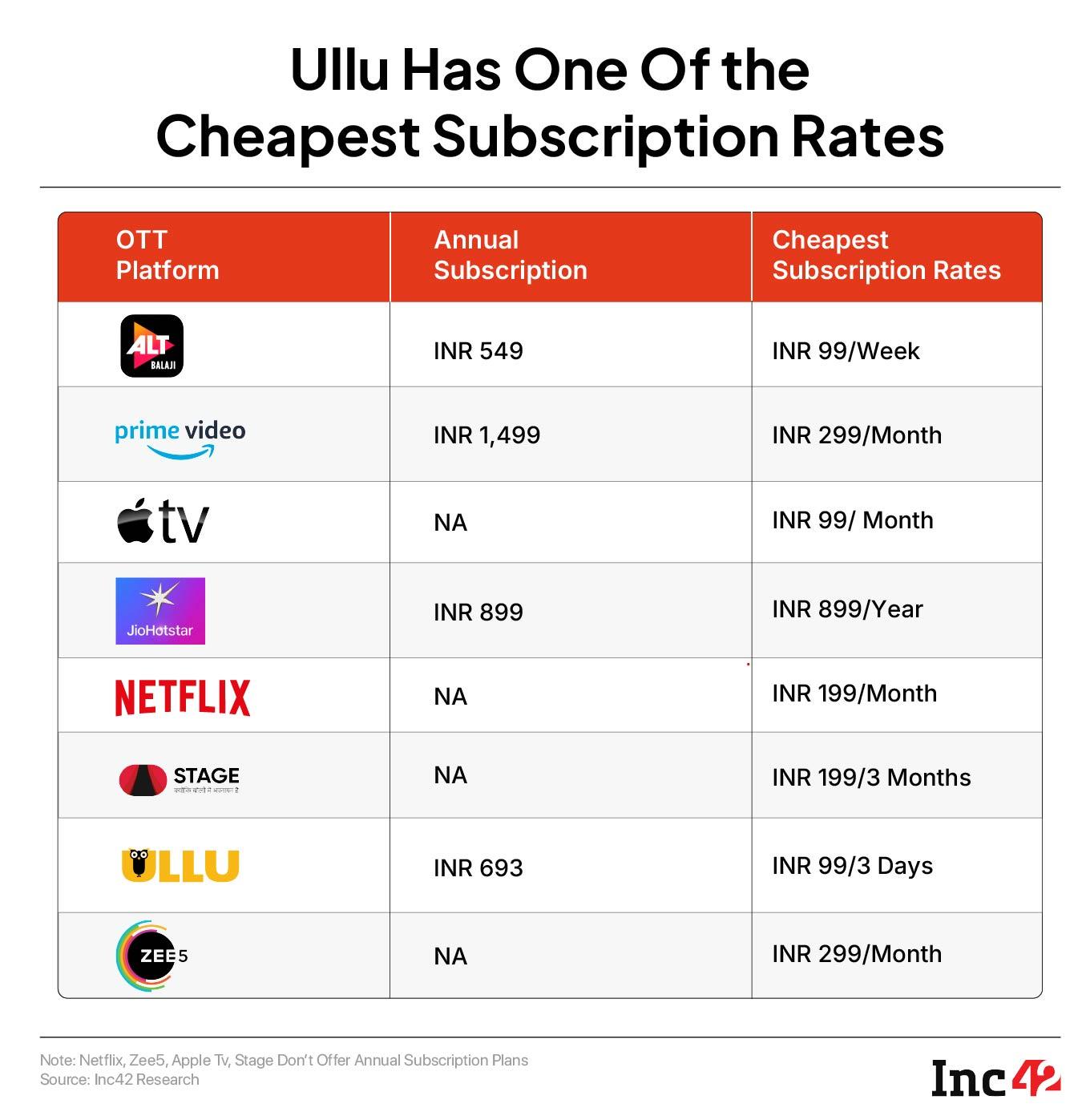

Volume drives visibility. The display of its huge pool of sexually appealing content on the Ullu app or the homepage intrigues the viewer instantly. The company has lined up various subscription packages of varying duration, ranging from INR 99 for three days to INR 693 for one year.

As per sources, majority of Ullu subscribers are from Tier III cities and beyond. It is often seen that new users opt for the lowest subscription pack.

“Once the user has got the taste of the content. The user pays more for a higher package. This is how Ullu takes users deep,” said one of the insiders quoted above.

To attract viewers to its series, just like any other OTT player, Ullu offers the first episode for free. “If it makes the user curious, they pay to watch the entire series. This is purely psychological.”

This is how a new user is turned into a power user, a term used in the domain to identify potential long-term subscribers, by the platform. As per the industry watcher, power users often drive 80% of the revenue for an OTT platform.

It’s said forbidden things carry a secret charm. But what draws the line?

OTTs are often pulled up for crossing the line to put up content that, at times, set off the immorality alert, although the regulations remain unclear, and the line looks blurred.

While hearing a PIL by journalist and information commissioner Uday Mahurkar and others on obscene content only last week, for instance, the Supreme Court urged the central government to take regulatory action. These platforms are so far self-regulated under the IT Rules, 2021, which mandate a three-tier redressal structure and prohibit unlawful content while requiring age-based classification.

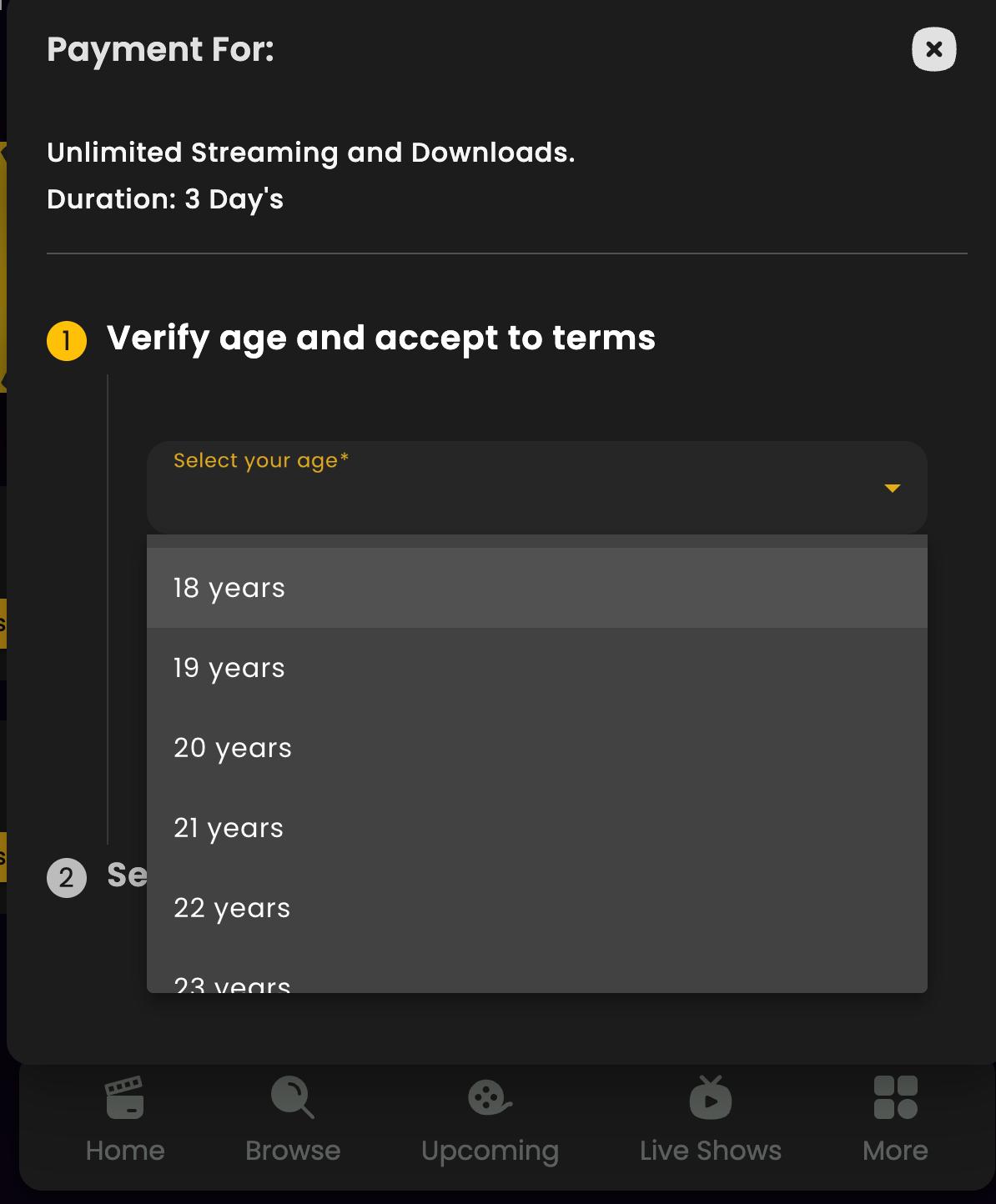

On paper, Ullu appears to comply with the Ethics Code under the IT Rules by displaying disclaimers, applying ‘A’ ratings, and prompting users to enter their age before accessing the content. “The age check is merely symbolic. Neither Ullu nor any other OTT platform in the country enforces a robust system for verifying user age,” said an observer, pointing out that there is no KYC or ID-based verification in place.

Another insider wondered why Ullu remained operational even after the government banned 18 similar OTT platforms like Voovi, Besharams, Uncut Adda, citing obscene and vulgar content only last year.

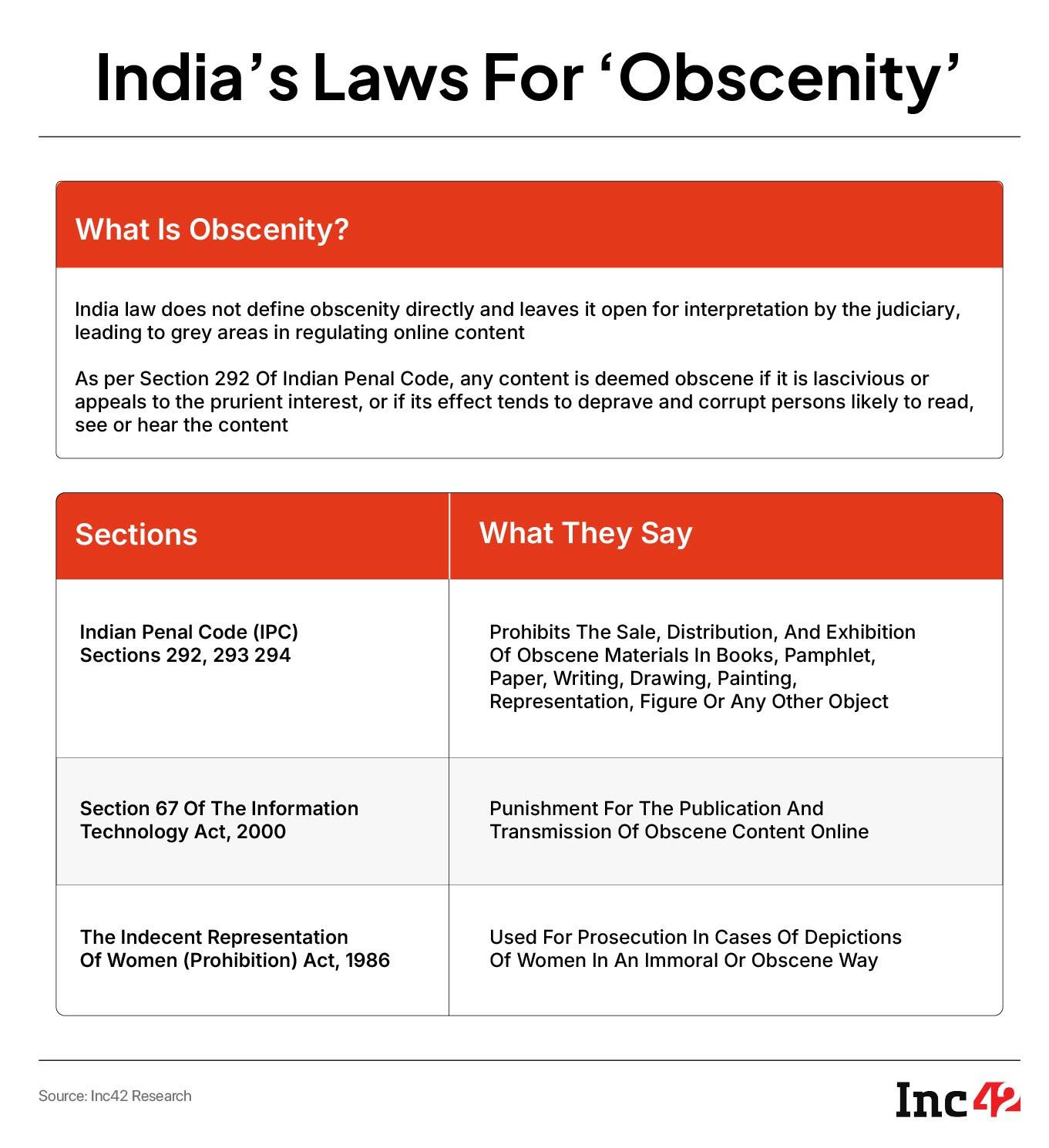

Regulations against obscene content are governed by a combination of laws from the Indian Penal Code (IPC), the Information Technology Act, and the Indecent Representation of Women Act. While Sections 292 to 294 of the IPC prohibit the sale, distribution, and exhibition of obscene materials, Section 67 of the IT Act controls the publication or transmission of such content online. The Indecent Representation of Women Act restricts depictions of women in an immoral way.

But controversies over objectionable content never ceased to emerge. The government is now weighing stricter controls. In 2023, the Ministry of Information and Broadcasting introduced the Broadcasting Services (Regulation) Bill to bring OTT and digital news under its jurisdiction, but it was rolled back in a year after creators raised concerns over their creative freedom. Ullu even noted in its draft papers for floating the public issue that the law could have had a major negative impact on its topline.

Industry insiders argue that the lack of a clear legal definition for ‘obscenity’ adds to the confusion, especially as societal standards evolve. “What is obscene for you may not be obscene for me. What is obscene today, may not be so tomorrow. How do you define it?” questioned one of them.

Moreover, selective outrage targeting specific platforms also undermines regulatory credibility. “Today, some platforms are labelled obscene, while others with largely similar content under the guise of creativity face no scrutiny,” said Panka Krishna, founder and CEO of Chrome DM, stressing on the need for digital literacy, instead of imposing a blanket ban on Ullu and the likes.

:max_bytes(150000):strip_icc()/Lisa-Rinna-052125-e89e276f3d2c4a7db92c735a5c3042e1.jpg)

:max_bytes(150000):strip_icc()/michael-mcstay-Jennifer-Clulow-052125-b77e476c8fde41ebbe008ce9f98298f1.jpg)

:max_bytes(150000):strip_icc()/bowen-snl-2-052125-6ee1fb42d49b466189251a5b9f5d5c56.jpg)