Ghana Cedi Ranked World's Best-Performing Currency by Bloomberg

The Ghana cedi has been recognized as the world's best-performing currency this month, experiencing an appreciation of nearly 16 per cent against the US dollar since the beginning of April 2025, according to Bloomberg. This rally has played a crucial role in alleviating inflationary pressures, leading to Ghana's lowest inflation rate in eight months. Currently, the cedi is trading at GH₵13.4 against the dollar.

Consumer price inflation in Ghana decreased to 21.2 per cent in April, a notable drop from 22.4 per cent in March, as announced by Government Statistician Alhassan Iddrisu in Accra on Wednesday. The monthly price increases slowed to 0.8 per cent, largely influenced by reduced import costs due to the cedi’s strengthened position. Non-food inflation saw a decrease, falling to 17.9 per cent from 18.7 per cent, while food inflation also experienced a decline, settling at 25 per cent from 26.5 per cent. Iddrisu confirmed that the cedi's appreciation significantly reduced import costs, attributing much of the recent inflation relief to the currency’s performance.

Bloomberg data indicates that the cedi has outperformed all other global currencies in gains against the US dollar since the start of April. This appreciation has boosted consumer confidence and reduced the pressure on the cost of imported goods. Despite this positive momentum, analysts suggest that the Bank of Ghana is unlikely to lower interest rates at its forthcoming policy meeting. Dr. Agyapomaa Gyeke-Dako, an economist and senior lecturer at the University of Ghana Business School, noted that the central bank tightened its policy at its last meeting to absorb excess liquidity. Therefore, the central bank might not readily reduce the monetary policy rate, considering potential inflation threats from utility price hikes.

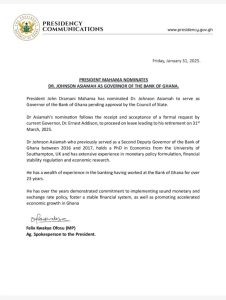

In March, the Monetary Policy Committee (MPC) surprised markets by increasing the key rate by 100 basis points to 28% as part of its strategy to stabilize prices. The central bank has communicated its intention to continue assessing inflation trends before easing its monetary stance. Mark Bohlund, a senior credit analyst at REDD Intelligence, cautioned that easier monetary conditions could reignite inflationary pressures, suggesting that the Bank of Ghana may delay any near-term rate cuts. However, there is some optimism for rate relief later in the year if disinflation persists. Governor Johnson Asiama stated that as the monetary authority observes further declines in inflation readings, the committee will reassess the scope for a gradual easing of the policy stance.

Inflation in Ghana has exceeded the central bank’s target band of 6 per cent to 10 per cent since September 2021, following a debt crisis that caused a sharp depreciation of the cedi and a surge in import costs. The MPC projects that inflation could decrease to approximately 16% by the end of 2025 and gradually return to the target range by the second quarter of 2026. The International Monetary Fund (IMF), which is working closely with Ghana under a support programme, has also expressed optimism. Stéphane Roudet, IMF Mission Chief to Ghana, conveyed confidence that inflation would decrease in the coming months toward the program objectives during a recent briefing in Washington.

As Ghana continues its efforts to restore economic stability, the resurgence of the cedi has emerged as a promising sign, serving both as a symbol and a tool of recovery for the West African nation.