Fintech Revolution: Transforming Islamic Finance with Shariah Compliance | Khaleej Times

Fintech is poised to significantly reshape Islamic finance by enhancing accessibility, efficiency, and innovation while aligning with Shariah principles and will bridge gaps for the unbanked and underbanked, especially in developing countries with large Muslim populations, experts say.

Leading executives, bankers and analysts said platforms like mobile banking, P2P lending, and crowdfunding will provide Shariah-compliant solutions such as microfinance and digital zakat or waqf systems, addressing the $2.5 trillion sustainable development goals funding gap. In addition, blockchain, artificial intelligence (AI) and internet of things will streamline processes and ensure Shariah compliance, enhance transparency and trust, making risk-sharing models like Mudarabah more accessible.

“Fintech will drive Islamic finance towards greater inclusivity, efficiency, and global reach by 2030, leveraging technologies to meet ethical and Shariah-compliant demands. However, success depends on addressing regulatory, literacy, and security challenges while fostering partnerships between traditional institutions and fintech innovators,” according to experts.

Jamal Saleh, Director-General, UAE Banks Federation, said the UAE banks are playing a leading role in meeting the growing requirements for Shariah-compliant financial and banking services as well as sukuk issuances, which are witnessing rapid growth. Since the establishment of the world’s first Islamic bank in the UAE in 1970s, he said the country has been strengthening its position as a regional and global centre for Islamic banking.

“Accounting for more than 20% of gross banks’ credit in the country, and investments of more than Dh150 billion in 2024, UAE’s Islamic banks are at the forefront of digitalisation. Smart platforms and solutions integrate artificial intelligence (AI) and blockchain to enhance customer experience while ensuring Shariah compliance,” Saleh told BTR.

He said fintech has spurred mobile banking, instant financing, and transparent blockchain-based contracts for Shariah-compliant financial and banking services as well as automating Shariah compliance. “The UAE’s Islamic banks use AI for compliance checks, validating Murabaha agreements, blockchain smart contracts to automate Mudaraba agreements, ensuring transparency and reducing disputes, and machine learning to design ethical investment portfolios aligned with users’ risk tolerance and Shariah,” he said.

Fitch Ratings views the UAE as a key hub for Islamic finance, with Islamic financing accounting for 29% of total sector financing during the January-June 2024 period as it noticed that financing growth was slightly higher in first half (5.7%) compared to conventional banks (5.3%) despite conventional banks’ strong government links. The rating agency expects Islamic banks to continue to grow faster than their conventional peers over the medium term. “Favourable operating conditions forv 2024 and 2025 should support UAE Islamic banks strong credit fundamentals,” according to Fitch Ratings.

Saleh was of the view that fintech is already helping Islamic banks to develop and promote Shariah-compliant products and services.

“By leveraging AI, blockchain, and data analytics, Islamic banks in the UAE are developing innovative products. Their digital-first strategies are meant to meet all the expectations of customers. “Many leading Islamic banks are capitalising on fintech to meet the demand for seamless, modern, and secure banking experience while adhering to of Shariah-compliant banking principles. This trend is poised to continue in the coming years in line with Central Bank of the UAE’s digital transformation strategy. The UAE’s progressive regulatory frameworks, high level of technological adoption, and global partnerships enable the Islamic banks to innovate, grow, and thrive,” he said.

Saleh said Islamic banks are increasingly adopting fintech, balancing between meeting customers’ demands and expectations, on one side, and adherence to Shariah principles, on the other side. “There are many factors driving fintech integration in day-to-day banking such as the regulatory frameworks and initiatives which provide support to further accelerate digital transformation, like the FinTech Office that was launched by Central Bank of the UAE in 2020 as part of its fintech and digital transformation strategy, which is aimed at building a mature ecosystem to position the UAE as the fintech hub regionally and globally.

He opined that fintech also enables Islamic banks to automate Shariah compliance checks and develop products like blockchain-based sukuk and AI-driven takaful, ensuring transparency and alignment with Shariah principles.

“Financial inclusion and social responsibility are among the key factors influencing Islamic banks to adopt fintech as they are offering microfinance and other banking solutions via digital platforms, targeting underbanked segments/population.”

To a question, he said fintech is poised to significantly elevate Islamic banking by enhancing accessibility, efficiency, and compliance with Shariah principles. “Customers are moving to digital-first solutions, and Islamic banks and finance houses are addressing this by enhancing their digital and smart offerings.

“From digital onboarding by using AI-driven and blockchain-based KYC and identity verification to simplify account opening, to green finance, risk management, and investment products and solutions, Islamic banks are accelerating the transitions towards smart banking and finance,” he said.

He said it is expected to witness a noticeable growth in using AI-powered screening to further automate Shariah compliance checks, blockchain smart contracts for Mudaraba and Ijara agreements, inclusive banking, sukuk issuance, and sustainable underwriting. In addition, fintech will play a greater role in operational efficiency and risk management.

“Metaverse could also be expected to influence the future of Islamic banks. Supported by agile regulatory frameworks and the proactive approach of our Central Bank of the UAE, fintechs should be able to innovate in a secure environment,” he said.

Areeb Siddiqui, Founder and CEO at Kestrl, said Islamic fintech is poised to continued expansion across the globe.

Referring to people interest in Islamic finance, which is visible as evidenced by new funding vehicles and venture capital allocations, he said the growing sector covers a wide range of customers and financial needs through several emerging technologies.

“I’m incredibly optimistic for this industry of Islamic fintech. The amount of talent that I’m seeing coming from the youth, in particular, people leaving corporate jobs behind or coming straight out of university to start their own businesses within this space incredibly heartening to see,” Siddiqui told BTR.

“Taking the lessons, they’ve learned from large corporations all over the world. We’re seeing that in the UK and the US, but even Pakistan, I’m incredibly proud to see what’s going on in Pakistan and how many people are trying to solve this solution. So, I couldn’t be more optimistic for the future,” he said.

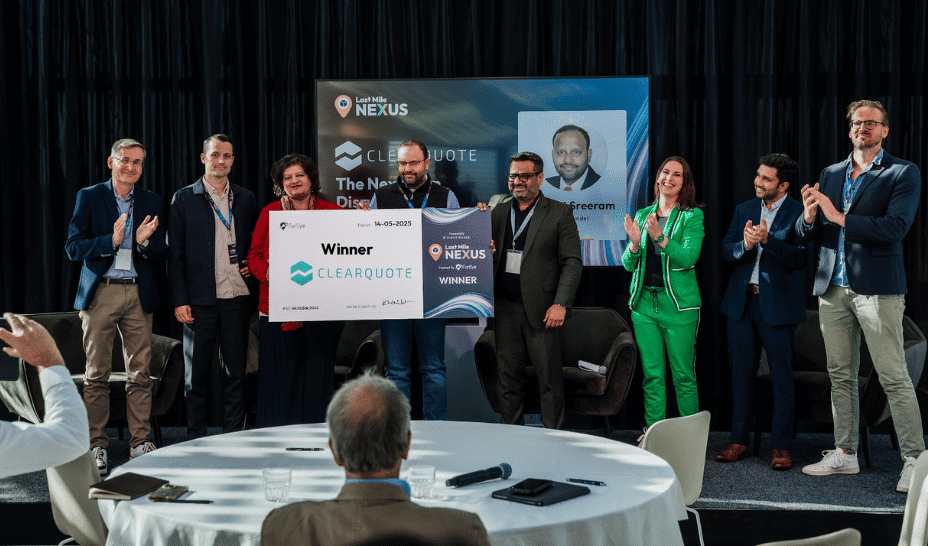

Kestrl was declared the first runner up of the Ethical Finance Innovation Challenge and Awards (EFICA) and awarded Dh75,000 cash prize. Abu Dhabi Islamic Bank (ADIB), in partnership with the London Stock Exchange Group, shortlisted Malaysia-based MADCash, the UK-based Kestrl, and Ethiopia-based Kifiya Financial Technology for the seventh EFICA awards from 150 global applicants.

Kestrl, a UK-based fintech supporting over 1.2 million Muslims globally in managing and growing their wealth in line with Islamic finance principles, aims at building a true alternative to the conventional banking system to benefit real people and real economy instead of faceless financial organisations. It offers a platform that helps Muslims to grow their wealth without compromising their beliefs.

Siddiqui, a Cambridge MBA with a background in consulting and risk advisory at Deloitte and PwC, sees some challenges for Islamic finance and said fundraising has always been a major issue for the sector. “A lot of conventional finances see this as a niche, which is bizarre given that we are a two billion population. The other side is regulation, but I’m seeing more and more countries bringing down regulations to allow innovation, particularly in the Muslim world. In Pakistan, we saw five new digital banks; in Malaysia, the same; in the UAE we’re seeing more and more, and Saudi Arabia has a huge influx of foreign direct investment, which is really growing the space. So, I think the Muslim world is where it’s going to be at for the next 10 or 20 years, In Sha Allah,” said Siddiqui, a specialist in working with banks and wealth managers in the digital space.

To a question, he said the UAE has been one of the best places for Islamic fintech evolution, from the DIFC all the way to Abu Dhabi Global Market.

“Even in places like Ajman and Sharjah, all of them are running their own incredible business centres and accelerator schemes. So, fintech is really spoiled for choice when it comes to fundraising and where to set up an office,” he said.

Faisal Islam, Head of Digital Islamic Finance at Kifiya Financial Technology, sees bright prospects for Islamic finance due to its rising demand across the world.

“I would just like to say that the future is only for Islamic finance because of the risk-sharing model as well as growing appetite from the Muslims. So, it holds the future that we must follow and develop Shariah-compliant products to cater to the rising demand,” Islam told BTR on the sidelines of the seventh EFICA awrads held in Dubai recently.

Kifiya was the second runner up of the EFICA and awarded Dh75,000 cash prize. Malaysia-based MADCash won the first prize of Dh300,000.

Faisal Islam said the Islamic finance industry has struggled to realise its potential owed to several challenges, including regulatory gaps and lack of adoption stemming from limited awareness and education.

“The challenges are huge because people are used to doing the banking the conventional way. It has been around for 300 years while Islamic banking has just arrived. It’s a very new concept with only 70 to 75 years old history. So, the challenge is just the adoption. I cannot see any challenge beyond this because it’s just about adoption. We are working on tools to help the people and industry, so Islamic finance gets inclusion and traction,” he said.

He said Africa is home to a burgeoning Muslim customer base, which presents significant demand for Islamic finance products and services.

About the UAE’s role in promoting Islamic fintech, he said the UAE is always at a forefront for innovative and tech initiatives and has developed a strong tech ecosystem in the country.

“Like these EFICA awards, the most prestigious awards in the history of Islamic finance, the UAE has been playing a very active role in promoting Islamic finance. It is connecting people together and doing a lot of good work for this growing sector. And of course, Dubai Islamic Bank and Abu Dhabi Islamic Bank, they are always contributing to the halal economy,” Faisal Islam said.

Founded in 2010, Addis Ababa-based Kifiya Financial Technology is pioneering in developing Shariah-compliant digital financing products in Ethiopia as it simplifies complex financial services, bridging the digital divide and fostering financial and market inclusion across Ethiopia. The company offers a diverse portfolio of services in payments, agriculture, micro-insurance, and mobility. Kifiya’s mission is to leverage AI driven data and technology for social good, creating a more inclusive and sustainable future.

The Abu Dhabi-based ADIB said advanced technologies like artificial intelligence are transforming financial services and Islamic finance is no different.

The second largest Islamic lender in the UAE noticed that Shariah-compliant fintechs are emerging to serve customers and extend financial services to the underbanked.

“Islamic fintech seamlessly integrates Shariah compliance with digital financial solutions, providing customers with easier access to savings, investments, takaful, and financing options that align with Islamic principles,” an ADIB Spokesperson told BTR.

“At ADIB, we believe in partnering with fintech firms and accelerating the development of digital solutions that cater to the evolving needs of our customers. This is why we launched ADIB Ventures, a strategic initiative designed to drive innovation and collaboration within the global financial technology sector.

“Through ADIB Ventures, we aim to build a robust ecosystem by connecting with emerging fintech players and integrating advanced technologies, including Generative AI, to enhance the banking experience for around 1.5 million customers,” the Spokesperson said.

Fintech is set to be a major enabler of Islamic banking’s next phase of growth, making Shariah-compliant financial products more accessible and appealing to a wider audience. It will allow Islamic banks to reach a larger customer base, including the unbanked and underbanked, thereby enhancing financial inclusion. “At ADIB, we are committed to partnering with fintech firms across various areas, including automating processes to reduce manual intervention. We are also exploring AI-driven tools for risk assessment and fraud management. For example, we collaborated with Lune, an Emirati fintech company, to launch the region’s first personal finance management tool — the ADIB Money Management Tracker. This innovative solution empowers customers with greater control and insight over their financial activities. We are also fostering innovation through initiatives like the EFICA, which recognises fintech solutions that promote ethical banking and financial inclusion. As customer expectations evolve, fintech will continue to shape a more dynamic and inclusive Islamic banking sector.”

The ADIB Spokesperson said several key factors are driving Islamic banks toward fintech adoption. First, customers increasingly demand seamless, digital-first experiences, prompting banks to modernise their services.

Second, regulators across the region are encouraging digital transformation, creating an environment conducive to fintech-driven growth. Additionally, banks are focused on enhancing efficiency, expanding financial inclusion, and improving compliance. “Fintech adoption supports these objectives by automating banking processes, streamlining financing approvals, and reducing paperwork and manual intervention. From an operational standpoint, automation lowers costs, improves efficiency, and allows banks to scale their services more effectively,” the spokesperson said.

Moreover, fintech presents opportunities for Islamic banks to expand into new markets by offering cross-border Shariah-compliant financial solutions. “ADIB has been at the forefront of this shift, developing API-driven banking solutions and launching innovative digital products such as ADIB Pay and open banking initiatives, reinforcing our commitment to pioneering fintech adoption in the Islamic banking sector.”

While automation and AI-powered solutions streamline banking operations, they reshape job roles rather than replace them. The key challenge is ensuring that employees are reskilled to manage AI-driven tools and digital banking platforms.

“Islamic banks, including ADIB, are investing in talent development programmes to equip employees with essential digital skills. Additionally, the rapid adoption of fintech introduces challenges related to cybersecurity and regulatory compliance, which require careful oversight.”

However, the overall impact of fintech on Islamic banking remains overwhelmingly positive. By enhancing efficiency, lowering costs, and broadening financial inclusion, fintech empowers Islamic banks to deliver more customer-centric and ethical financial services while ensuring long-term sustainability.

The ADIB Spokesperson said next five years will witness a significant transformation in Islamic banking, driven by fintech innovation.

“AI-powered Shariah advisory services will become more sophisticated, offering hyper-personalised financial guidance. Digital sukuk and ESG-driven investments will gain traction, enabling wider investor participation in ethical finance through tokenised assets.” Open banking and API integration will foster deeper collaboration between Islamic banks and fintech firms, expanding financial inclusion, particularly in underserved markets. Additionally, sustainable finance solutions, such as green sukuk and carbon trading platforms, will align Islamic banking with global ESG objectives.

“ADIB is actively investing in this future through ADIB Ventures, supporting fintech startups that pioneer next-generation Islamic financial solutions. Through our ADIB 2035 vision, we are leveraging fintech to enhance customer experience, drive efficiency, and reinforce the ethical finance ecosystem,” the Spokesperson concluded.

Muzaffar Rizvi

Muzaffar Rizvi is an accomplished financial journalist with more than 25 years of experience in the ...More