Fincra Obtains Payment Service Provider License in Tanzania

Lagos-based and Pan-African payment fintech, Fincra, has announced a significant regulatory achievement by securing a Payment Service Provider (PSP) license from the Bank of Tanzania. This approval marks a crucial step in Fincra's expansion strategy across East Africa and strengthens its overarching mission to build a seamless cross-border payment network for an integrated Africa.

The license, granted under Tanzania's Payment Systems Licensing and Approval Regulations, 2015, empowers Fincra to offer its comprehensive suite of financial infrastructure tools to businesses and developers within the country. These services include virtual accounts, payment APIs, payment links, checkout services, secure local collections in Tanzanian Shillings (TZS), domestic payouts, and international payment facilitation, all designed to streamline financial operations.

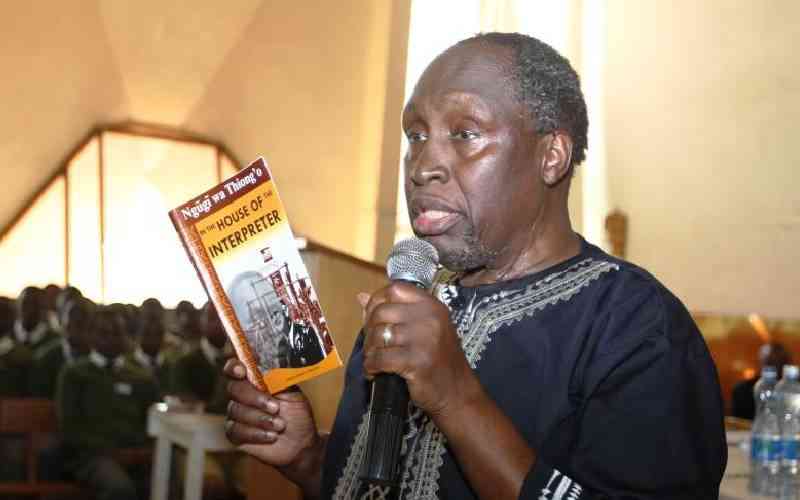

Wole Ayodele, CEO and co-founder of Fincra, expressed his enthusiasm regarding the development: “We are thrilled to receive this licence from the Bank of Tanzania. It reflects our long-standing commitment to regulatory integrity and positions us to deliver even more value to businesses in East Africa. This is a key part of our mission to build the rails for an integrated Africa.” Ayodele, who previously co-founded the Nigerian crypto platform Quidax, highlighted this as a testament to Fincra's journey of "love and integration."

Tanzania presents a burgeoning market for digital financial services. The country has witnessed a substantial increase in mobile and digital payments, fueled by deepening smartphone penetration and proactive financial inclusion initiatives. According to Techpoint.africa, mobile money transactions in Tanzania surged by more than 26.73% year on year in 2024. The Bank of Tanzania’s National Payment Systems Vision 2025 further underscores the commitment to modernizing the payments landscape, aiming to expand access, reduce transaction costs, and support innovation. Over 37 million Tanzanians currently utilize mobile money platforms such as M-PESA, Tigo Pesa, and Airtel Money, indicating a mobile-first financial frontier.

Founded in 2021, Fincra has processed over $10 billion in transactions and reports being profitable. The expansion into Tanzania makes it the company’s third active market in East Africa, complementing its operations in Kenya and Uganda. Fincra also holds an International Money Transfer Operator (IMTO) and a Payment Service Solution Provider (PSSP) license in Nigeria, and a Third Party Payments Provider (TPPP) license in South Africa. Its operations extend to Ghana, the United Kingdom, Europe, and North America, with Ayodele hinting at future expansions into Francophone West Africa, Egypt, and Ethiopia.

Fincra’s operational model is API-first, crypto-aligned, and deeply focused on infrastructure. It aims to bypass traditional, often costly, correspondent banking systems by utilizing its own internal liquidity pools. This approach facilitates faster settlements and lower fees for regional transactions, directly addressing the high cost of cross-border payments in Africa, which the World Bank notes can be nearly 9% for a $200 transfer. For instance, Fincra's infrastructure allows a South African school to accept tuition from a Nigerian student in Naira and receive settlement in ZAR without relying on SWIFT or other intermediaries.

The new Tanzanian license enables Fincra to provide businesses in sectors such as fintech, logistics, travel, retail, and remittances with the tools to move money more efficiently, scale operations across borders, and remain fully compliant with local financial regulations. Uyo Abuh, Senior Marketing and Communications Lead at Fincra, described Tanzania’s growing digital economy and national financial inclusion agenda as a "natural fit" for the company's services.

Moreover, Fincra's regulatory advancements position it as a potentially critical fiat on/off-ramp across multiple African markets. This is particularly relevant for DeFi platforms, crypto exchanges, and wallet providers seeking to operate compliantly on the continent. By working with licensed entities like Fincra, Web3 builders can find a secure bridge between fiat payment rails and blockchain protocols, especially in markets where cryptocurrency regulations are stringent or under careful observation. Fincra’s expansion signals a commitment to providing the compliant infrastructure necessary for both traditional and crypto-native fintech solutions to thrive in Africa.