Driving Beneficiation: a win-win approach

By Dominic Varrie and Lili Nupen of NSDV

South Africa has incredible potential to stimulate massive economic growth, development, and job creation by promoting local mineral beneficiation. By leveraging the country’s mineral wealth through transforming raw minerals into higher-value products locally, South Africa should start to leverage this largely untapped opportunity.

It can not only drive empowerment for historically disadvantaged South Africans (HDSAs) but also foster entrepreneurship in industries that emerge from mineral processing. However, to realise these benefits, South Africa must adopt a balanced approach that encourages local value addition without imposing rigid mandates that could deter investment and ultimately cripple the industry.

Speaking at the 55th Annual Meeting of the World Economic Forum in Davos, Ramaphosa emphasised South Africa’s focus on solidarity, equality, and sustainable development as it assumes the G20 Presidency and prepares to host the summit in Johannesburg on 18-19 November 2025—the first G20 summit in Africa.

Ramaphosa exhibited that his platform would be leveraged to champion local beneficiation, resulting in “an additive rather than an extractive relationship”.

“As minerals extraction accelerates to match the needs of the energy transition, the countries and local communities that are endowed with these rich resources must be the ones that benefit most. At the moment they don’t benefit much because the benefit flows out of their own countries to other locales in the world,” Ramaphosa said.

By processing raw minerals into more valuable products, a country can retain more economic value within its borders, whether through local consumption or export of finished goods. Many countries worldwide have introduced restrictions on the export of unprocessed materials to drive this process, primarily seeking to extract greater revenue and promote socio-economic development.

While these policies can be beneficial, they often come with unintended consequences. The administrative and financial burdens associated with beneficiation pose a significant hurdle for investors. South Africa's approach must carefully balance the need to boost beneficiation with the realities of its current economic and infrastructural limitations, as well as strategic contractual arrangements which are of value to the country.

Despite its mineral wealth and relatively developed financial infrastructure, South Africa faces considerable barriers in advancing its beneficiation efforts. The country's power and logistics crises have crippled several industries, making local beneficiation difficult without foreign investment.

The Minerals Council of South Africa has stressed the importance of addressing these infrastructure challenges before pushing for further export taxes or restrictive measures. Their stance is that the country should adopt a "carrot" rather than a "stick" approach, offering incentives to encourage beneficiation, while simultaneously removing barriers such as energy constraints. By creating an investor-friendly policy environment, South Africa could reindustrialise and attract both domestic and foreign investments.

Minister of Mineral and Petroleum Resources, Gwede Mantashe, recently proposed measures to promote local beneficiation, including taxing primary mineral exports and providing incentives like tax holidays or electricity tariffs linked to commodity prices.

Given South Africa's already financially and administratively burdensome mining regulatory framework, which poses significant challenges for those interested in capitalising on the country's resources, mandating beneficiation would likely exacerbate these difficulties. Such a requirement would further increase the cost and complexity of doing business, potentially deterring much-needed investment in the mining sector.

Looking to international examples, in a comprehensive reform effective 8 July 2024, the Argentine Congress introduced the Promotional Regime for Large Investments (RIGI), designed to provide certainty and legal stability for long-term investments in Argentina.

A key element of this reform is the creation of the RIGI, which offers generous tax, trade, and foreign exchange benefits for 30 years to projects exceeding US$200 million in sectors such as forestry, tourism, infrastructure, mining, technology, steel, energy, and oil and gas. The government aims for RIGI to attract foreign direct investment (FDI) to export-oriented sectors, which are crucial as Argentina remains excluded from global capital markets. The RIGI has introduced a suite of tax incentives, reduced dividend taxes, and foreign exchange benefits to encourage large-scale investments in sectors like mining and energy.

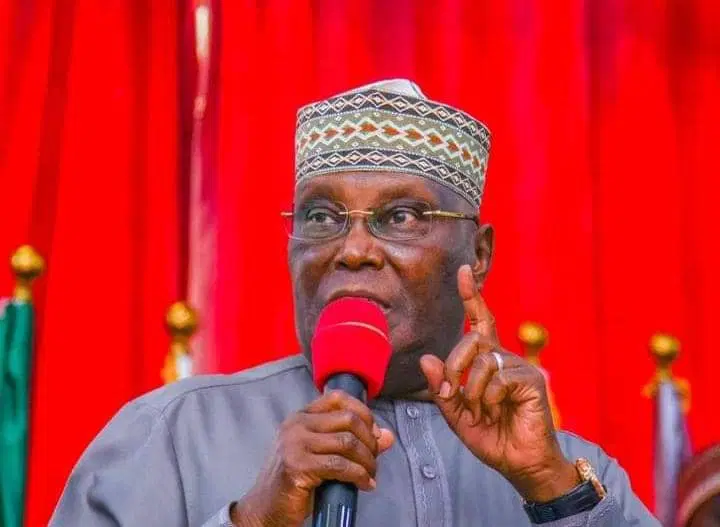

Nigeria and Zimbabwe provide examples of how forced beneficiation mandates can create mixed results. Nigeria’s new policy only grants mining licenses to companies with local processing plans, while offering incentives like tax waivers and streamlined electricity licenses to attract investment. Zimbabwe, meanwhile, has mandated that lithium miners submit plans for local production of battery-grade lithium, hoping to capitalise on the global demand for clean energy minerals.

However, both countries face challenges in implementing these policies effectively. The risk with such mandates is that they can stifle investment if they are not coupled with robust incentives and adequate infrastructure support, as seen in other parts of Africa.

South Africa's mineral beneficiation strategy should be rooted in a flexible, incentive-driven approach that recognises the realities of its current economic landscape. By offering targeted incentives—such as certain tax breaks like a “tax holiday” for a certain number of years, reduced tariffs, or subsidised electricity or other innovative mechanisms—while addressing critical infrastructure challenges like energy and logistics, the country can encourage local value addition with a positive impact on host countries without discouraging mining investment.

At the same time, South Africa must carefully assess which minerals and industries are best suited for beneficiation, using a case-by-case evaluation rather than a one-size-fits-all mandate. By learning from international models and focusing on long-term economic benefits, South Africa can create a win-win scenario for its economy, its investors, and its people.