Despite lower earnings than three years ago, Wihlborgs Fastigheter (STO:WIHL) investors are up 45% since then

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, (STO:WIHL) shareholders have seen the share price rise 30% over three years, well in excess of the market return (17%, not including dividends).

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

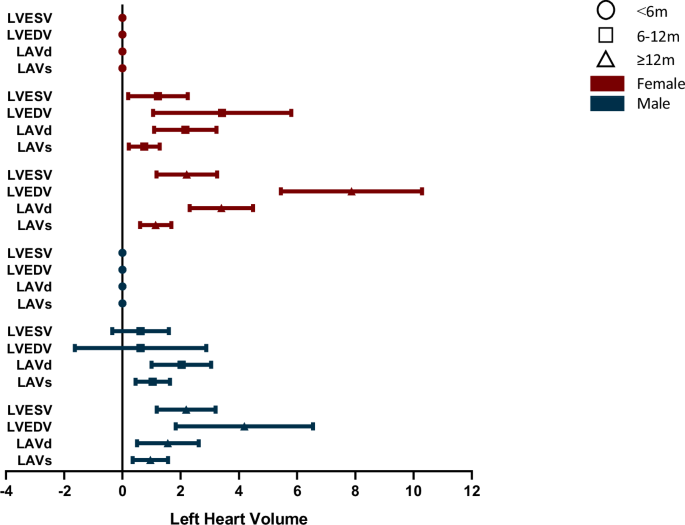

During the three years of share price growth, Wihlborgs Fastigheter actually saw its earnings per share (EPS) drop 21% per year.

This means it's unlikely the market is judging the company based on earnings growth. Given this situation, it makes sense to look at other metrics too.

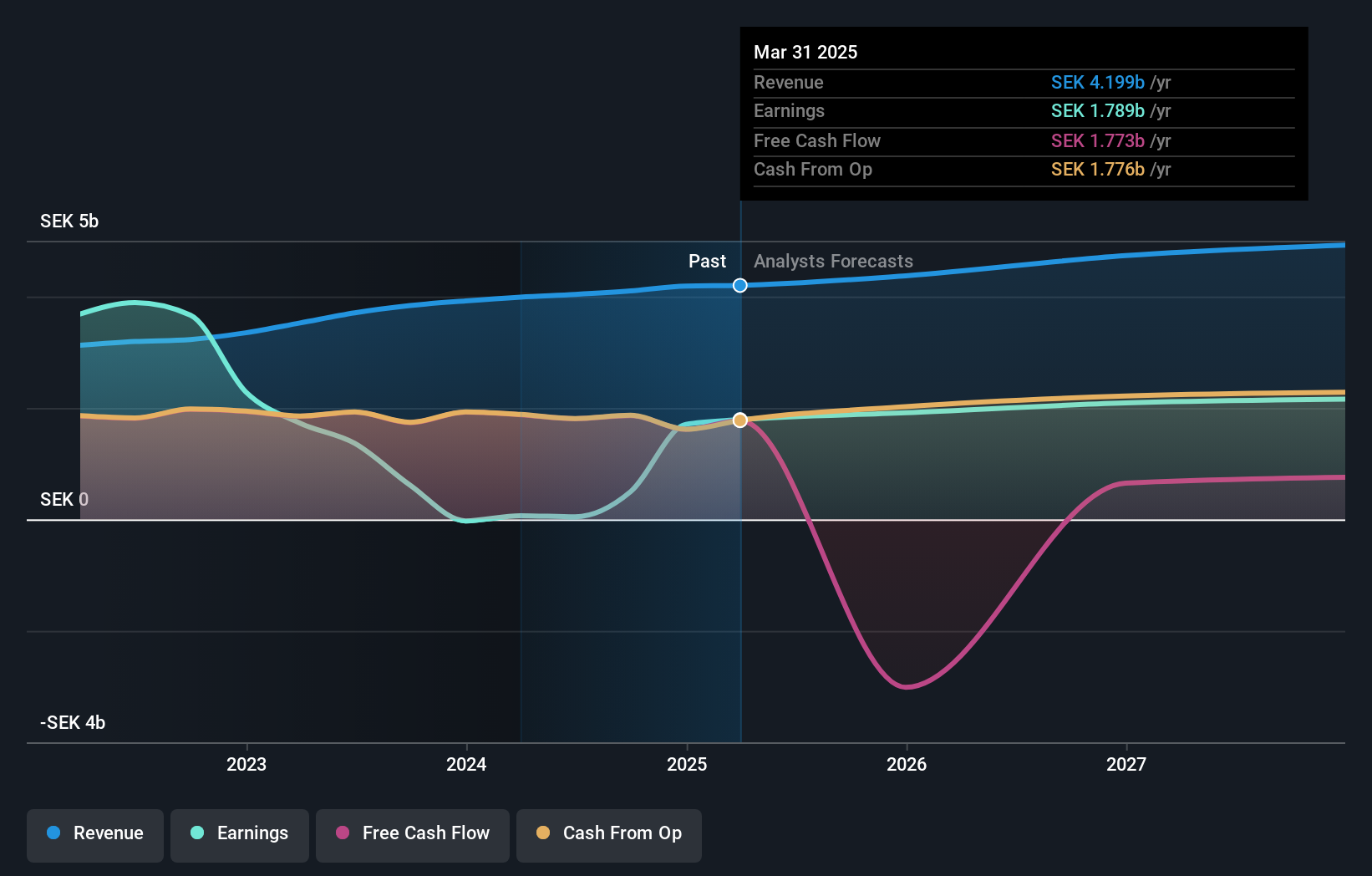

It may well be that Wihlborgs Fastigheter revenue growth rate of 11% over three years has convinced shareholders to believe in a brighter future. In that case, the company may be sacrificing current earnings per share to drive growth, and maybe shareholder's faith in better days ahead will be rewarded.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Wihlborgs Fastigheter in this graph of future profit estimates.

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Wihlborgs Fastigheter's TSR for the last 3 years was 45%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

While it's certainly disappointing to see that Wihlborgs Fastigheter shares lost 0.7% throughout the year, that wasn't as bad as the market loss of 1.3%. Longer term investors wouldn't be so upset, since they would have made 5%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Wihlborgs Fastigheter has (and 1 which is a bit concerning) we think you should know about.

If you are like me, then you will want to miss this list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Discover if Wihlborgs Fastigheter might be undervalued or overvalued with our detailed analysis, featuring

Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.