Crypto Wealth Management Platform Abra CEO Predicts 60/40 Model Replacement

Bill Barhydt, CEO of crypto wealth management platform Abra, has predicted that cryptocurrency is poised to replace the traditional 60/40 asset allocation model, which has been a staple for diversifying client portfolios for decades. This model typically involves allocating 60% of capital to equities and 40% to bonds. Barhydt's comments come at a time when bond performance has been lackluster, with Bloomberg’s U.S. Aggregate Bond Index returning a mere 1.25% in 2024 and a negative 0.05% over the past five years.

Barhydt, with a diverse background that includes stints at the CIA, NASA, Goldman Sachs, and Netscape, initially launched Abra as a bitcoin-based remittance app. The company has since pivoted multiple times, ultimately focusing on crypto wealth management. According to Barhydt, the market has guided the company's evolution, leading it to its current position as a leader in the crypto wealth management space.

At the 7th Annual Vision Conference in Arlington, Texas, Barhydt observed a significant shift in sentiment among investment advisors regarding cryptocurrency. Five years ago, the attitude was one of skepticism, but now, there is a growing recognition of the need to offer crypto to clients. This change in perspective was underscored by Ric Edelman, a traditional financial advisor turned crypto evangelist and founder of the Digital Assets Council of Financial Professionals (DACFP). Edelman announced the demise of the 60/40 model, advocating for a new allocation strategy that includes stocks, crypto, and bonds, with a potential allocation of 70% to 100% in stocks and crypto, and no more than 30% in bonds.

Barhydt emphasized that the time for advisors to incorporate crypto into their clients' portfolios is now. He believes that Bitcoin represents the best economic opportunity of our lifetime and that Abra is well-positioned to help advisors navigate this new landscape. The company offers a range of services, including spot crypto, borrowing, lending, and yield, making it a comprehensive solution for those seeking crypto exposure.

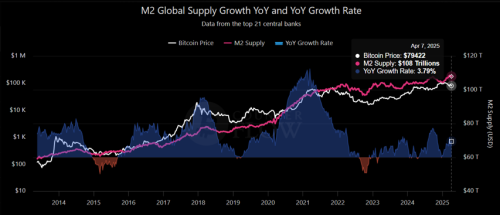

Barhydt's statements reflect a broader industry trend where cryptocurrency is increasingly seen as a legitimate asset class, offering diversification benefits and the potential for higher returns. This shift is driven by the decentralized nature of digital assets and their potential to hedge against market volatility and inflation. As more investors recognize these benefits, it is likely that we will see a continued move away from traditional investment models towards a more diversified and adaptive approach to portfolio management.