Friends,

A few months ago I was on Matt Zeigler’s Just Press Record podcast paired with Morgan Ranstrom. Matt’s just one of those people that gives me the Stepbrothers “did we just become best friends” energy.

I’ve been binging all his interviews. Even interviews where he’s the guest — I tell Matt I just like his voice and it’s true. It also reminds me of another friend who I’ll leave anonymous who I just like hearing their take on anything, especially trivial stuff weirdly. There’s a Wes Anderson-ness to both these people that lights up my sensitivity to quirkiness.

I’ve been trying to understand why I like his podcast so much. The interviews are very personal. They’re mostly focused on getting to know someone rather than a marketing pitch for what they do now. There’s so much focus on formative years there are stories where the listener can see themselves in the same situation. I’ve had that moment so many times listening to these interviews. They are simultaneously idiosyncratic and universal.

If you listen to podcasts looking for “signal”, treating the experience like research, then a personal interview might sound like a waste of time. I’m sure there are a hundred other podcasts that you can listen to at 3x speed to get to the buzzwords you crave. But my favorite podcasts are definitely the personal stories. I enjoy Smartless, Ferriss, and Dax Shepard pods because they get big celebs and let’s be honest Jamie Foxx is more entertaining and has a more interesting life than anyone peddling investment advice (his Ferris interview is a glimpse into the right tail of the right tail of entertainer talent).

Which created something of a problem.

Matt asked me to come on Intentional Investor and I knew it would be personal. No option greeks. I would have done it because I like Matt but the invitation made me think a lot about whether it would have any instrumental value to people since I’m boring and if you’re going to listen to stories Rogan’s got a bazillion hours to keep you occupied with rockstars.

However, I listen to Matt’s pods so there must be something here even if it’s not “signal” and it’s not a late-night talk show. And I think the answer lies in an idea that recurs in my episode. Multiple times in my life I’ve been heavily influenced by someone who breathed the same air as me but was a little ahead in ways that mattered to me. The stories in Matt’s pods are entertaining not because they are crazy (well usually not) but because I could really see myself in them. It is a unique form of encouragement that can even become inspiration from hearing someone like you honestly lay out the messiness of their own tours through this life.

The power is not in the generalizations but in the specific embodiment. Matt does a great job of noticing repetitive themes in my story — I think for those who crave tidiness it’s a pleasant service especially because of how he does it via very close listening, Matt is an exceptional listener, but that’s also a form of atomic packaging that content loops have trained our attention spans to impatiently anticipate.

So the best compliment I can give Matt’s pod is that Cliff Notes would miss the point.

Matt, you’re good at our job. I didn’t imagine talking about most of the stuff that ended up in this. (Also, your thumbnail quote not being WWF-related is a mistake. Talk to your editor)

🎙️If you prefer to not see my face (Spotify)

My favorite Interviews Matt Zeigler has hosted so far:

(10 min read)

Rajiv Rebello

“How the Wealthy Use the Tax Code to Maximize After-Tax Growth”

I’ve shared Rajiv’s work before. He understands insurance from every angle including the buy-side (see his guest post in Moontower on life settlement arbitrage)

This new post is a simple reminder that tax planning, like a song, can take infinite expressions but they are based on 3 chords:

There are a thousand different ways you can combine these key notes of unrealized gains, the tax-code, and step-up in basis to address individual client problems.

This involves maximizing the use of qualified and non-qualified retirement plans, asset location strategies, moving assets outside of the estate through estate planning, utilizing discounted valuation practices to reduce taxation on Roth conversions, QSBS and opportunity zone investing, tax-free exit planning for business owners, and many more.

All these really are though are just chord-progressions of those 3 key notes—just utilized in a way that takes the legal precedent they set and combines them in such a way that addresses a whole host of financial planning issues outside of what they were originally intended to provide.

But in order to understand these progressions, you need to understand the foundational notes on which they rest.

So if I were to make recommendations to anyone studying wealth management for yourself or others it would be to really in your portfolio, the and .

He also mentions a strategy I hadn’t heard of:

If you gift the stocks to your elderly parents, then they pass-away you would inherit those gains tax-free.

So let’s say you gave those stocks with a $100k unrealized gain to your parents.

This is not a taxable event to either party (unless you’ve already gifted $14M in assets already). You are merely making a gift to another party who is accepting the gift. The gift will only be taxable to them if they sell the asset—which they don’t plan on doing.

In 20 years, when you’re ready to retire let’s assume that gain has grown to $1 million.

When your parents pass away you would inherit all those gains tax-free due to step-up in basis.

That’s because prior to death the cost basis on those gains were $0.

But when your parents pass-away, that basis is “stepped-up” to $1 million and the assets are given to you.

So now you can sell the assets with $0 taxable gain ($1 million value -$1 million cost basis =$0 taxable gain).

That means you get to keep the full $1 million.

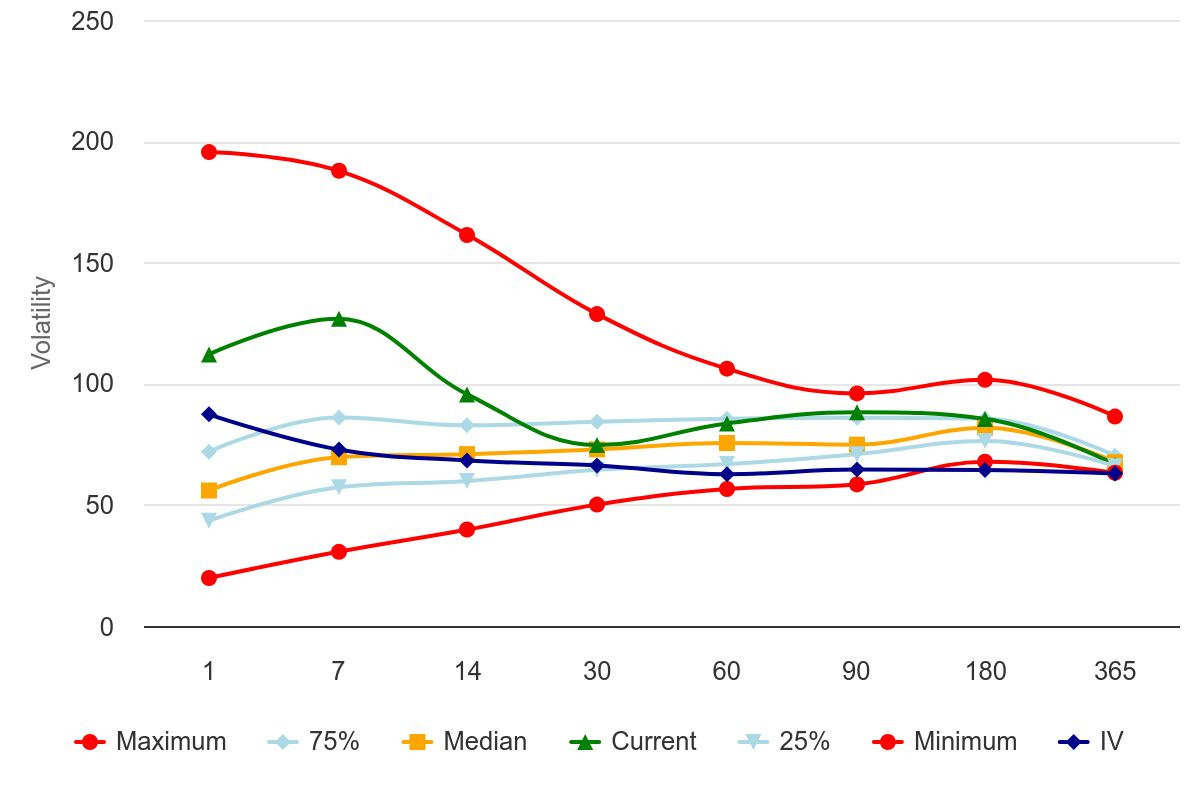

I noted on Wednesday that COIN 6-12m vols looked low for someone who was willing to hold a straddle.

If you recall I bought the Dec COIN straddle a couple months back in small size…I kicked it out when vols roofed everywhere but it would have been nice to have them on this week’s sharp reaction to SP500 inclusion but I didn’t buy them back after vols calmed down again. They are still sitting there cheap, but I’m all ears for dispersion traders to tell me how vols in a name tend to behave after addition to SP500. We were discussing this in the Discord and the conversation veered into the general topic of index correlation.

I’ll just share what I wrote about implied correlation skew which was in context:

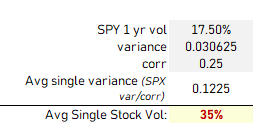

Here's how I'd estimate avg single stock vol given the corr and SPX vol:

From there, you could use the typical .25d skews for a stock vs the index and come up with a correlation smile of 3 points (25d put, ATM, 25d call)

Note:

…so you get a correlation smile:

🔗Related:

Dispersion Trading For The Uninitiated (Moontower)

The Impact of Dispersion on Market Expectations and Volatility (CBOE)

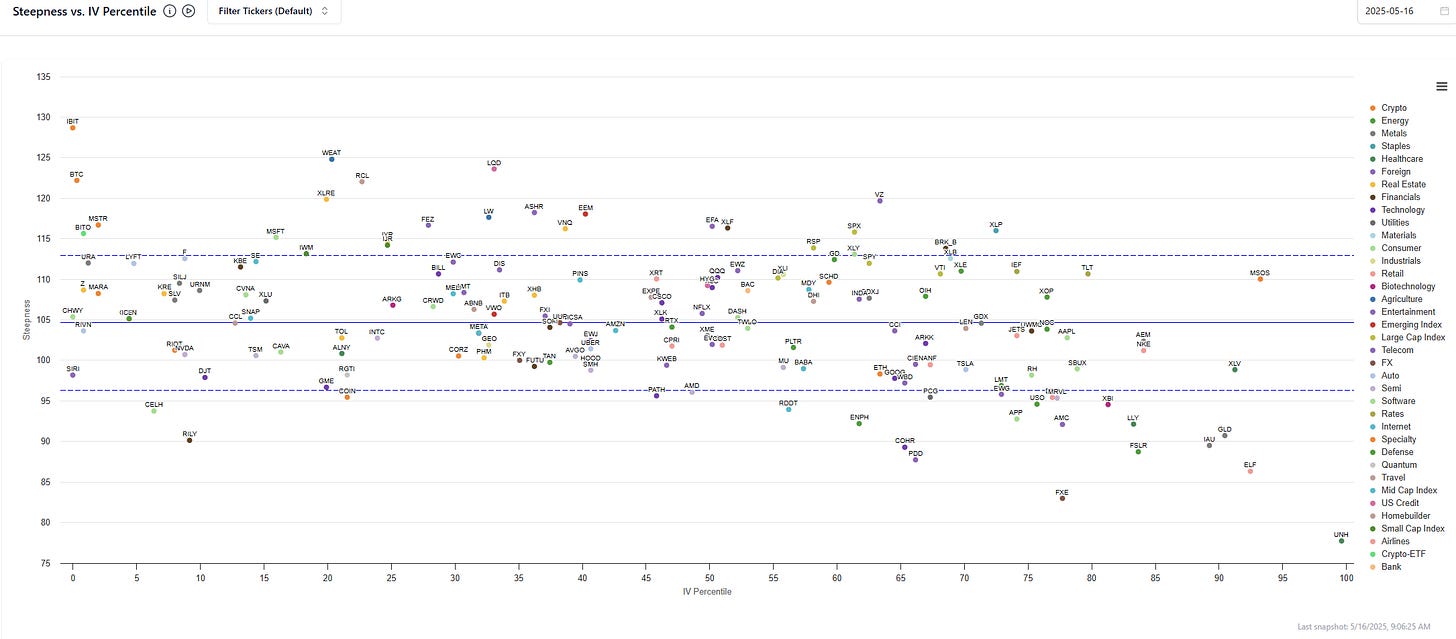

A month ago everything was smushed to the right in the 100th percentile with steeply inverted (ie descending term structures). There’s been a lot of normalization and term structures generally ascending once again although UNH is steeply inverted as might expected.

Relativity is a jerk.

This is school year flew by faster than the last school year that flew by. The kids have 2 weeks left. But summer is my favorite season. Egyptian blood and all.

This summer we will do less travel than prior years. We will spend 10 days in Italy/Malta for a family wedding and go to my 25-year college reunion in Ithaca but otherwise I’m looking forward to spending a lot of time home.

We got both boys new bikes as early birthday presents so they can get even more time with them. They are obsessed with them, riding every day, and my older one has started riding mountain bike trails in our local parks with friends. It’s nice to see them dosing on that same freedom I had growing up. That meme about a circle of bikes on the grass being how you found out where your friends were all hangin’. (Although middle school kids are all Apple Watch’d up now so “finding” each other is easier).

I’m also just stoked to see them sink into hobbies generally, especially because they overlap with mine, muahahaha. I took Max to Jack White on Friday in Oakland (my wife and I saw him last night in SF for a date night). He went from no concerts ever to this year seeing Foo Fighters, AC/DC, Jack White, and in June…Metallica (his favorite). He’s replacing all his wall art with rock posters. He just turned 9. Peaking too soon but we’ll see.

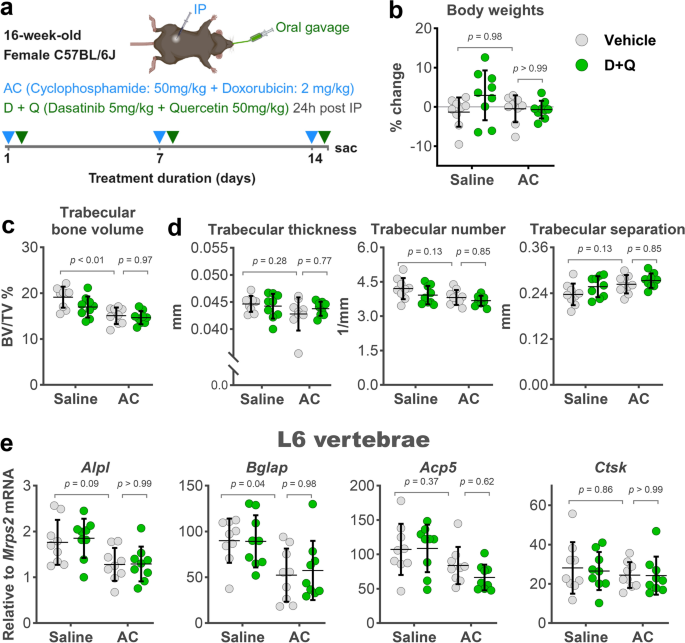

Zak just finished the first options project I urged him to do and I can see how empowered he feels doing it. He’s impressed with himself (and learning Excel very quickly in the process).

As of now, you

as well as a bunch of option positions with:

It :

The p/l vs stock price at expiration.

It’s simple but heck it’s what our Portfolio Visualizer tool does in our app.

With this tool in hand, I can now teach him put/call parity which I need him to know for where we’re going…I’m building towards him vibecoding an educational option game. I’m calling it a prototype and when we build it into our app I’ll pay him. Greasing the wheels.

Generally speaking, the kids are pretty uninterested in money. I wonder if this has to do with growing up comfortable but I also know plenty of kids in that camp who are interested in money so maybe it’s like being cheap or generous — I find how spendy or frugal people are to be poor indicators of their economic well-being. The brain’s money setting is mysterious.

That said, they are selling a wider variety of 3D printed items and now scheming on what profit margins they can snag. Hobbies are funny things. You can tell as a parent when you’re pushing it forward, but hobby-child fit is obvious when their daily progress has you trying to catch up…”wait, what did you sell today?”

I’m 10-20 on getting a phone call from school before the last day (settling to 100).

Stay Groovy

☮️

Posts:

Book a call with me.

It's $500 for 60 minutes. Let's work through your problem together. If you're not satisfied, you get a refund.

Let me know what you want to discuss and I’ll give you a straight answer on whether I can be helpful before we chat.

I started doing these in early 2022 by accident via inbound inquiries from readers. So I hung out a shingle through the Substack Meetings beta. You can see how I’ve helped others:

📡All Moontower Meta Blog Posts

👤About Me

🧀MoontowerMoney

👽MoontowerQuant

🌟Affirmations and North Stars

🧠Moontower Brain-Plug In

Curations

✒️Moontower’s Favorite Posts By Others

🔖Guides To Reading I Enjoyed

🛋️Investment Blogs I Read

📚Book Ideas for Kids

Fun