For individuals navigating the challenges of a less-than-perfect credit history, securing essential financial assistance can often feel like an uphill battle. However, a clear leader has emerged in the realm of bad credit personal loans: , recently awarded for being the best option for those seeking a lifeline.

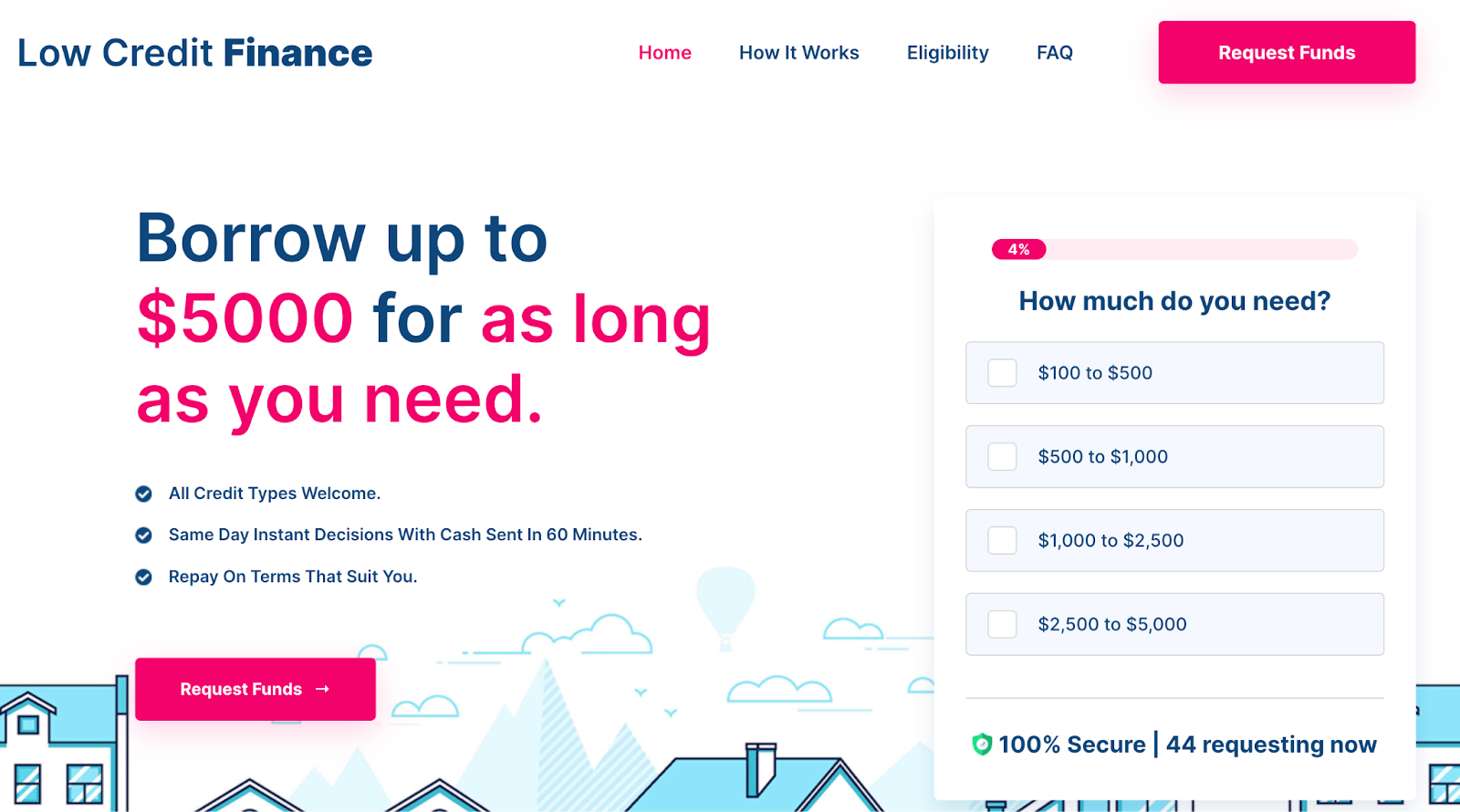

Low Credit Finance has distinguished itself as the top lender for individuals with bad credit, earning this recognition for its exceptional service, vast lender connections, and incredibly fast approval rates. This accolade solidifies its position as the go-to solution for reliable and accessible personal loans.

"We understand the urgency that comes with needing bad credit personal loans," states a representative from Low Credit Finance. "Our goal has always been to provide a smooth and efficient process, enabling individuals to meet their financial obligations without unnecessary hurdles. This award is a testament to our commitment to that mission."

Best Bad Credit Personal Loan Lenders

From the above lenders, you can secure bad credit personal loans at your convenience, as all the processes are done online. This not only provides convenience but also hastens the application, approval, and disbursement of funds, ensuring you get them just when you need them.

If you are looking for a bad credit personal loan from an online lender with a wide network of lenders willing to extend personal loans without performing any credit checks, Low Credit Finance will best suit your needs.

This broker's network of lenders can extend bad credit personal loans for amounts that could be as high as $5,000 at rates that are affordable to anyone. Even better, it has flexible repayment periods that allow you to repay the loan for as long as you want.

The mere fact that it is fast in making its lending decisions and that you get your funds deposited in the account just 60 minutes after approval tells how efficient and swift its processes are.

Here are reasons why Low Credit Finance ought to be a top priority lender if you are looking for a bad credit personal loan:

Low credit Finance understands the urgency that comes with needing bad credit personal loans, and for that reason, it has smooth processes to help you meet your financial obligations

What is a Bad Credit Personal Loan?

A bad credit personal loan is an unsecured loan designed for individuals with less-than-ideal credit scores and histories. It provides an opportunity for them to access funds for various financial needs, from personal use to handling financial emergencies and unexpected expenses.

The key advantage of bad credit personal loans is their accessibility. They bypass the rigorous credit checks and stringent eligibility criteria that are usually associated with conventional lending institutions. Instead, they focus on other factors, such as your ability to repay the loan, making approval more likely for those with imperfect credit profiles.

However, it's essential to bear in mind that the convenience that bad credit personal loans carry often comes at a cost. This is evident as they often have higher interest rates and fees compared to loans offered to individuals with excellent credit. This is the trade-off for the reduced emphasis on credit history.

To sum it up, bad credit personal loans from reputable lenders such as the ones we have mentioned above open doors for individuals who need financial support, regardless of their credit score. These loans prioritize your current financial situation and repayment ability over past credit mishaps, making them a viable solution for those seeking financial assistance during tough times.

Nonetheless, it is vital that you carefully assess the terms and costs associated with these loans to make informed decisions that align with their financial goals.

Prerequisites for Bad Credit Personal Loans

Gaining a comprehensive understanding of the prerequisites for securing approval when applying for a bad credit personal loan is vital to enhance your chances of success. Here are the key factors taken into account during approval:

How to Apply for a Bad Credit Personal Loan

Once you meet all the above requirements, getting a bad credit personal loan is a straightforward process, and here are the steps to follow to acquire one:

This process is designed to be user-friendly and efficient, making it accessible to individuals with less-than-perfect credit histories.

Benefits of Bad Credit Personal Loans

Risks of Bad Credit Personal Loans

Factors to Consider When Getting a Bad Credit Personal Loan

Consider the following key factors before selecting an appropriate lender for a bad credit personal loan:

- You must evaluate how obtaining a bad credit personal loan fits into your long-term financial goals and ensure that it supports them and contributes positively to your financial stability and progress.

Frequently Asked Questions

Can I use a bad credit personal loan to consolidate debt?

Yes, some borrowers use bad credit personal loans for debt consolidation. This option can simplify multiple high-interest debts into a single, more manageable loan. However, it's essential to weigh the pros and cons and ensure that the loan terms are favorable.

What is the difference between a bad credit personal loan and a payday loan?

Bad credit personal loans typically have longer repayment terms and higher borrowing limits and may be easier to repay than payday loans. Payday loans, on the other hand, are usually short-term, high-cost loans that are often due on your next payday.

Are there alternatives to bad credit personal loans for people with poor credit?

Yes, alternatives include secured loans, co-signer loans (where someone with better credit co-signs the loan), credit counseling services, or exploring government assistance programs if applicable. It's essential to explore all options before deciding on a bad credit personal loan.

Low Credit Finance

View the original press release on ACCESS Newswire

_1751880097.jpeg)