Apple (NasdaqGS:AAPL) Faces Antitrust Lawsuit Over Wi-Fi Calling Practices

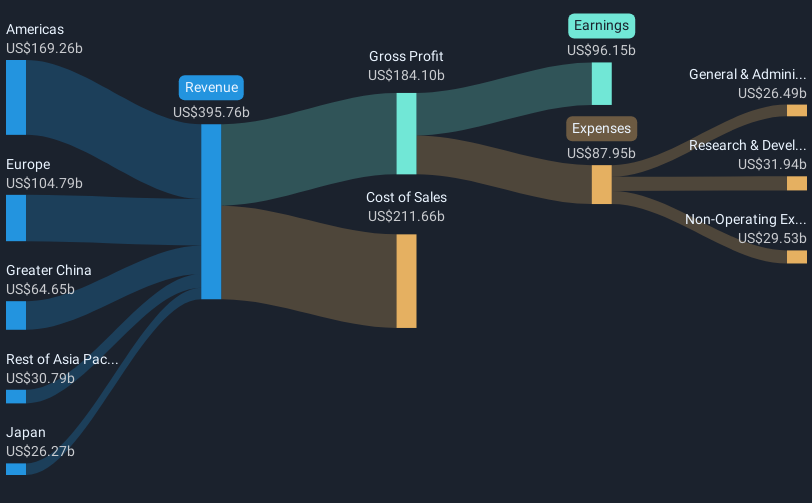

Apple (NasdaqGS:AAPL) recently faced a legal challenge from VoIP-Pal.com Inc., which initiated an antitrust lawsuit involving Apple and other tech giants. The lawsuit, targeting their alleged suppression of lawful competition in standalone Wi-Fi Calling, comes amidst Apple's introduction of several updates across its product lines, including significant enhancements in iPadOS, iOS, and macOS. Despite these developments, Apple's share price moved by a modest 2% last week. This reflects the broader market dynamics, including the Dow's significant decline due to geopolitical tensions, demonstrating that Apple's movement aligns with wider market trends rather than being solely driven by company-specific events.

Be aware that Apple is showing 1 possible red flag in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

Apple’s recent legal challenge from VoIP-Pal.com Inc. could impact its operational focus and financial metrics. While the lawsuit's direct effects are yet to be fully realized, it might introduce legal costs and potential changes in business practices that could affect revenue and earnings forecasts. Specifically, if Apple were to face adverse rulings, it may have to adjust its business practices or pricing, potentially impacting service revenue streams. The market's reaction, with only a modest share price movement, suggests that the impact might not be deemed significant unless more developments arise.

Over a longer five-year period, Apple has delivered a total return of 134.39%, significantly rewarding its shareholders. This context highlights a strong performance, even if, in the last year, the stock underperformed the US market, which returned 11.7%. This discrepancy raises questions about recent pressures on the stock compared to broader market dynamics.

The current share price movement should also be evaluated in light of analyst price targets, which are approximately 14.5% higher than the present value. This discount signals that analysts might expect Apple to navigate current challenges and achieve its growth targets. Such a target anticipates that planned U.S. facility expansions and new product launches, such as the iPhone 16e, will drive revenue and earnings growth. However, the broader macroeconomic conditions and legal outcomes are potential uncertainties.

Evaluate Apple's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

We've created the for stock investors,

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]