AGNC Investment (NasdaqGS:AGNC) Declares Cash Dividends for Common and Preferred Shares

AGNC Investment (NasdaqGS:AGNC) announced dividends for both common and preferred shares, reinforcing its commitment to returning value to shareholders. The company's stock rose 4% over the last week amid global market pressures stemming from geopolitical tensions, which saw the Dow Jones Industrial Average fall by 1.2%. Despite this backdrop, the dividend announcement may have added positive weight to AGNC's performance. With the broader market up by 1.6% over the period, AGNC's gains underscore its appeal to investors seeking reliable income, especially in uncertain times.

Find companies with promising cash flow potential yet trading below their fair value.

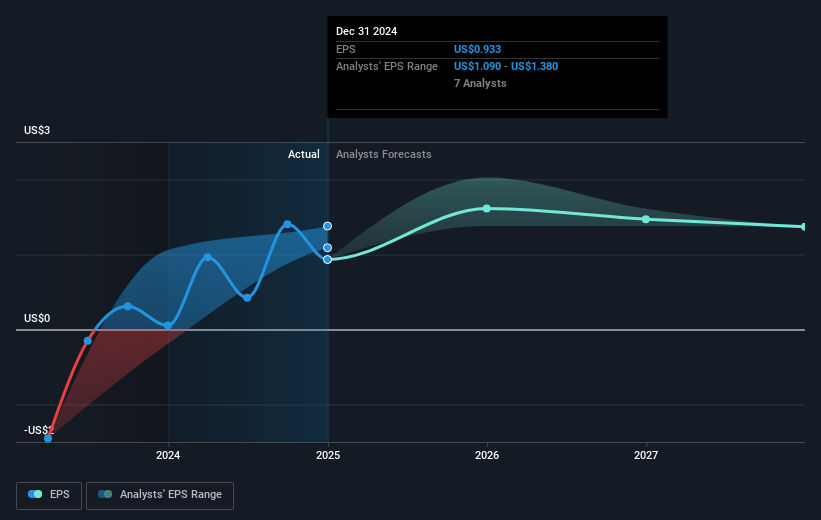

The recent dividend announcement by AGNC Investment may positively impact its revenue and earnings forecasts, as the promise of income generation through dividends could enhance investor confidence and potentially attract more investment. Over the past three years, AGNC's total shareholder return was 46.07%, indicating solid performance over a longer period despite short-term market fluctuations. In contrast, over the past year, AGNC underperformed the overall US market but matched the performance of the US Mortgage REITs industry.

The latest price movement, with AGNC shares up 4% for the week amidst broader market downward trends, has brought the share price closer to the consensus price target of US$9.83, currently trading at US$8.3. This reflects a 15.6% potential upside according to analyst predictions. Furthermore, Fed's accommodative policy could improve the predictability of returns from agency mortgage-backed securities, reinforcing revenue growth prospects. These elements suggest that the income-focused appeal of AGNC remains intact, given the company's faced challenges and the current economic conditions.

Learn about AGNC Investment's future growth trajectory here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

We've created the for stock investors,

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]