In the years following the COVID-19 pandemic, which completely shut down the global commercial aviation industry, legacy carriers have had to alter their business models completely. Airlines like , United Airlines, and American Airlines are legacy carriers, and they have historically thrived by operating flights that cater to the schedules and needs of business travelers, who are statistically the highest-spending travel demographic. Airlines like Delta and United derive much of their revenue from just a small portion of business travelers.

These carriers are put in the unique position of supporting high-volume business travelers, who demand premium travel experiences and airline support services that allow them to work as much as possible while in transit. This provides them with an essential responsibility in the market. By managing to successfully cater to high-volume business travelers, airlines like United and Delta can generate strong, sustainable profits, and are mostly immune to the seasonal nature of the aviation industry, as business travelers pretty much fly year-round.

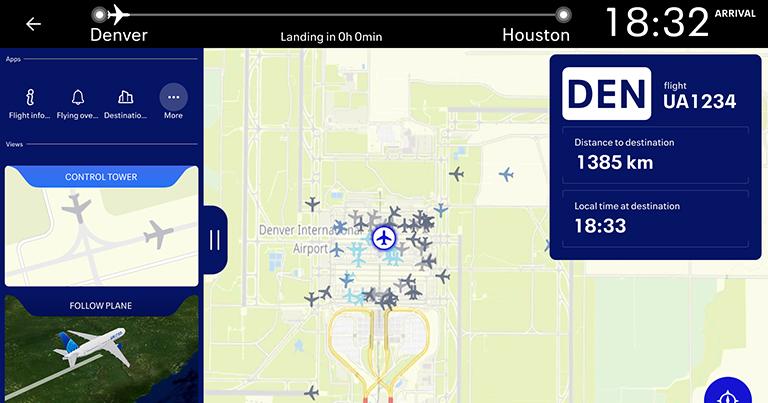

Photo: Markus Mainka I Shutterstock

All of this changed, however, during the COVID-19 pandemic, when the nature of business travel changed dramatically. During the pandemic, companies shifted towards a remote work environment, which demonstrated that business travel was not quite as necessary as many had believed it to be. The idea of flying from New York to Chicago for just one meeting soon became ridiculous, as a simple Zoom call could pretty much suffice. There became significantly fewer reasons to justify traveling for business, something which hit airlines that relied on business travelers hard.

Related

Delta Air Lines Boeing 767-300ER Returns To Salt Lake City Due To Engine Failure

Delta confirms emergency landing after engine issue on Flight 316, with the flight rescheduled and delayed over 8 hours before arriving in Honolulu.

Furthermore, with the increasing environmental pressure on companies to reduce their carbon footprints, cutting back on business travel was a very good place to start. When companies began returning to the office in 2020, it was immediately clear that business travel, as airlines knew it would likely not be the same for a very long time. As a result, airlines like United and Delta got creative, and they quickly set out to begin broadening their customer demographics. In this article, we will take a deeper look at the decision made by many airlines to begin targeting leisure travelers.

In the years following the COVID-19 pandemic, demand for premium leisure travel has skyrocketed, with carriers selling business-class tickets for higher-than-ever prices to leisure travelers and premium economy quickly becoming one of the most popular cabins in American skies. The need to serve this extremely lucrative passenger demographic became immediately clear during the summer of 2021, when domestic travel boomed during the peak summer travel months. Business travel, however, seemingly lagged behind and left airlines in a position where they had no choice but to begin attempting to cater to premium leisure travelers.

Photo: FiledIMAGE | Shutterstock

During the lockdown periods of the pandemic, American households saved more than ever, with few leisure activities to really spend their money on. In summer 2020, few traveled long distances as the deadly virus still swept across America. After a long fall and winter, Americans were travel-hungry by the time the summer of 2021 rolled around, and many had been saving for their next vacation, according to research from the Pew Research Center.

As a result, airlines saw a boom in demand from leisure travelers for seats in premium cabins, likely as a result of passengers being willing to spend handily on an upgrade after being travel-starved for so long. This summer gave airlines like Delta and United the chance to impress leisure travelers with their lavish premium products, all while knowing that by trying a premium travel experience once, these airlines were more likely than ever to see leisure travelers book another journey in a premium cabin.

Related

Where Can You Fly On United Express' CRJ550s From Newark?

The premium regional jet is deployed on shorter routes from Newark.

During the COVID-19 pandemic, employees began to work fully remotely, but the shift back to in-office culture has happened gradually, and there are signs that the levels of employee flexibility offered by companies between 2020 and 2025 will likely have a lasting impact on the market. When employees can take a Friday or a Monday remote, this allows them to travel for longer periods.

Photo: Markus Mainka | Shutterstock

This led to the rise of weekend destination travel, with cities like Nashville, New Orleans, and Las Vegas becoming post-pandemic travel hotspots, especially with younger employees who were more likely to work around remote work schedules. As a result, airlines quickly began to target these kinds of destinations and cater to this kind of passenger demographic. Furthermore, catering to these kinds of passengers helped airlines establish consistent sources of revenue that varied little throughout the year.

This reason is relatively specific to transatlantic travel markets. However, some symptoms of the dollar’s increase in value can be seen on other markets, such as those between the United States and Japan. The rise of the value of the US dollar in the wake of the COVID-19 pandemic has increased the spending power of Americans traveling abroad, especially in places like the European Union and the United Kingdom, where dollars will now take one farther than ever.

Photo: Daisy Bourne | Shutterstock

Airlines have been quick to capitalize on this kind of travel demand. Airlines like United and Delta have both been quick to launch massive numbers of new routes to destinations in Europe, with a huge emphasis on the peak summer travel season. As competitors like JetBlue, Southwest, and Frontier cannot serve transatlantic markets (with the rare exception of a few routes operated by JetBlue), legacy airlines have been quick to conquer this increasingly lucrative sector of the travel market.

Get all the latest aviation news for North America from Simple Flying!

In the years following the COVID-19 pandemic, airline loyalty programs have become increasingly popular, with airlines famously claiming that they were actually more valuable than the companies themselves during filings for financial support in 2020. These loyalty programs, specifically the multi-hundred-dollar credit cards that come along with them, have made passengers very keen to keep flying their carrier of choice.

Photo: Felix Tchvertkin | Shutterstock

As a result, leisure travelers have become less price-sensitive than ever, and few will consider flying with a competing carrier unless they can significantly undercut their competitors on price. As a result, airlines like Delta and United can significantly upcharge leisure travelers, far more than they could in the past. Furthermore, with Gen Z travelers interested in getting the most value for their money than ever before, .

Over the past five years, low-cost carriers have struggled tremendously. For starters, they have faced extensive operational challenges that have limited their opportunity to offer significantly lower fares than full-service competitors. A couple of noteworthy incidents, such as also helped tarnish the reputation of these kinds of airlines, according to Forbes.

Photo: Philip Pilosian | Shutterstock

JetBlue has struggled, especially in the wake of a merger with Spirit Airlines, which quickly declared bankruptcy. With competitors struggling, legacy airlines like United and Delta were quick to find ways to target leisure travelers once loyal to budget airlines, such as by offering “basic economy” tickets which came with few benefits but offered a more comparable price to low-cost carriers.