The long-standing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) has taken another turn, as both parties seek court approval to modify earlier remedies in the high-profile XRP lawsuit.

While the crypto community continues to scrutinize the case, legal experts are shedding light on the real reasons behind the delay, and it may not be the SEC that’s holding things up.

Despite growing frustration among XRP supporters, legal expert Bill Morgan has clarified that it’s Ripple, not the SEC, causing the recent delays in the lawsuit’s resolution. According to Morgan, Ripple is actively pursuing the removal of a court-imposed injunction that limits how the company can sell XRP.

Legal experts clarify that Ripple—not the SEC—is responsible for the delay, as it seeks to dissolve the injunction, with the SEC actually cooperating in the process. Source: Bill Morgan via X

“Ripple needs it, not the XRP investors,” Morgan stated, indicating that the firm’s efforts are aimed primarily at regaining flexibility in its institutional sales of XRP. The SEC, in a surprising move, is cooperating with Ripple in this matter, signaling a potential shift in its previously aggressive enforcement posture.

This development is significant, especially considering that Ripple has already been fined $125 million for violating securities laws. Yet, Ripple is pushing for changes to the legal remedies, including reducing the fine to $50 million and lifting the sales restriction.

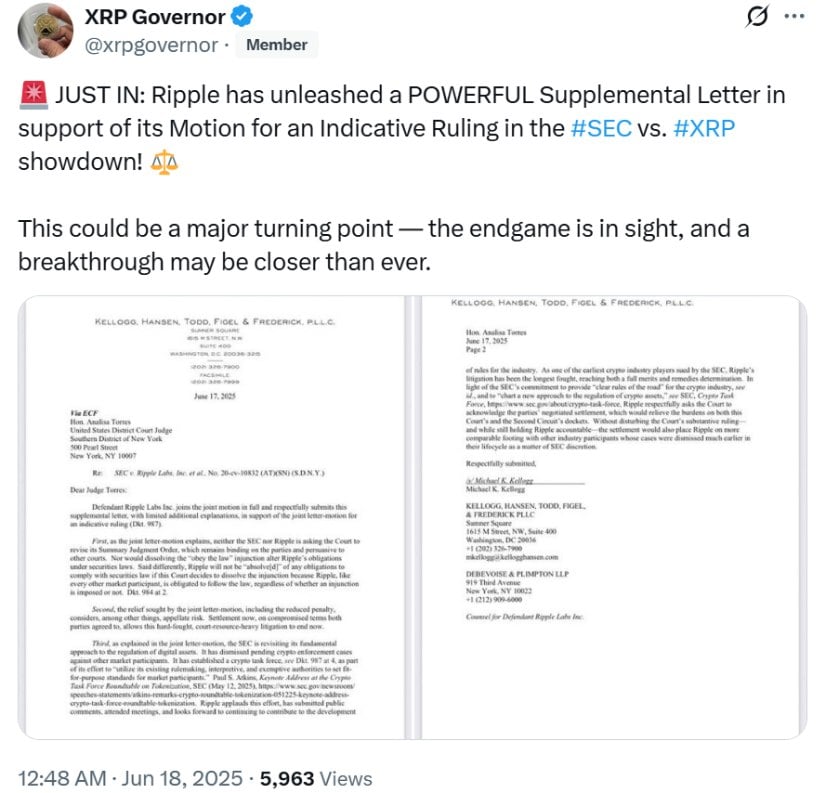

In a joint motion recently submitted to the court, Ripple and the SEC are seeking an indicative ruling that could alter the existing penalties and injunctions in the Ripple lawsuit. This coordinated action marks a rare moment of alignment between the two sides, both aiming to bring the prolonged litigation to an end.

Ripple has filed a strong Supplemental Letter supporting its Motion for an Indicative Ruling, signaling a potential breakthrough in the SEC vs. XRP case. Source: XRP Governor via X

Ripple’s supplemental letter assures the court that it will continue to comply with securities laws even if the injunction is dissolved. Legal analysts suggest that this step is Ripple’s attempt to bring its case in line with outcomes seen in other crypto-related enforcement actions.

Marc Fagel, a former SEC official, emphasized that this is not about overturning liability. “Judge Torres already ruled that Ripple violated securities laws,” he said. “What’s happening now is a request to modify the relief, not to undo the judgment.” This distinction is critical for understanding the current phase of the XRP SEC lawsuit.

The decision to pursue changes in the legal outcome appears to have been influenced by the SEC’s earlier decision to appeal parts of the court’s ruling. Legal experts argue that Ripple may have accepted the penalties and moved on had the SEC not filed its appeal.

Bill Morgan suggested that the SEC’s appeal altered Ripple’s legal approach. “Ripple’s response is shaped by the evolving enforcement climate,” he said, implying that the company is pushing back to secure more favorable long-term terms.

Both Ripple and the SEC have agreed to pause their appeals and file the necessary motions. A final judgment now hinges on U.S. District Judge Analisa Torres, who could approve the joint request at any time—whether in days or weeks. If granted, the decision will not only lift the injunction but also finalize the penalty and conclude the case.

Although the next official update in the case is scheduled for August 15, 2025, former SEC official Marc Fagel clarified that the timeline is not set in stone. “It’s not a deadline. The judge can rule at any time,” he explained, quelling speculation about further delays.

Still, the broader crypto community remains anxious. Many are eager for closure, as the Ripple lawsuit has weighed heavily on XRP’s regulatory clarity and adoption.

Ripple hopes that a favorable ruling will open the door for new partnerships and institutional investments, potentially boosting Ripple’s market presence. Some analysts argue that clarity from the court could positively influence XRP value and Ripple price, while others remain cautious until the matter is fully resolved.

A settlement would enable Ripple to once again freely sell its XRP, positioning the company to make new inroads into institutional finance and cross-border payments. It would also reignite expectations about the Ripple ledger, Ripple exchange listings, and rumored partnerships such as possible actions between Ripple and Bank of America.

XRP was trading at around $2.13, down 1.44$ in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Until that time, Judge Torres is still being watched by everyone. If the court permits the suggested amendment, the Ripple XRP news cycle will be refocused from legal wars to expansion overnight.

As the crypto market holds its breath to observe what transpires, XRP traders closely watch for a ripple effect. Some XRP models predict a bullish breakout once regulatory uncertainty fades, while others advocate caution as legal complexities unfold.

In this new chapter of XRP news, the future appears more harmonious than hostile. Whether this is the start of regulatory clarity or just another installment of the ongoing Ripple lawsuit, only time—and the judge—can say.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.