XRP ETFs get a 65% chance of approval as the race for crypto ETFs in 2025 continues

Ripple's XRP saw a 3% gain on Tuesday as Bloomberg analysts Eric Balchunas and James Seyffart released a list of the most likely crypto ETF filings to receive a green light from the Securities & Exchange Commission (SEC). The list includes XRP, Litecoin (LTC), Dogecoin (DOGE) and Solana (SOL).

Bloomberg analysts Eric Balchunas and James Seyffart shared that upcoming crypto ETF filings for Litecoin, Dogecoin, Solana, and XRP have strong chances of receiving regulatory approval.

In an X post on Monday, the ETF analysts highlighted that these four cryptocurrencies have varying approval levels, with XRP ETFs holding a 65% chance of approval.

— James Seyffart (@JSeyff) February 10, 2025NEW: @EricBalchunas and I took a look at the filings for spot crypto ETFs. We're putting out relatively high odds of approval across the board. Mainly focused on Litecoin, Solana, XRP, and Dogecoin for now.

Here's the table with the odds and some other details: pic.twitter.com/xaXaNXLb0M

Several asset managers, including Canary, Grayscale, 21Shares, Bitwise, have already filed applications for XRP spot ETFs, signaling strong institutional interest. However, the filings are yet to be acknowledged by the SEC.

The SEC vs. Ripple case was a major hurdle to XRP ETF applications. However, following Judge Analisa Torres's final ruling in August that XRP sales to retail do not constitute a security, asset managers began submitting their applications for an XRP fund. The ruling in August saw Judge Torres impose a $125 million penalty on Ripple for illegal XRP sales to institutions instead of the $2 billion sought by the SEC.

XRP ETFs could pull off an impressive performance if approved, considering the positive flows seen in global XRP investment products, which raked in $21 million in net inflows last week, per CoinShares data.

Additionally, Balchunas and Seyffart highlighted that Litecoin and Dogecoin ETFs are most likely to be approved by regulators.

This may be due to the similarities they possess to Bitcoin, being somewhat offspring of the Bitcoin blockchain.

Specifically, the analysts reported that Litecoin ETF filings by firms such as Canary Capital and Grayscale have a 90% chance of approval.

The post stated that Dogecoin follows behind with a 75% chance of approval. A favorable regulatory environment under Donald Trump may also be a potential reason for the belief shown toward the assets.

Since taking office in January, President Trump's administration has signaled strong support for the crypto industry, suggesting that previous regulatory hurdles could soon be removed.

Likewise, Solana and XRP ETFs also got approval odds of 70% and 65%, respectively.

Notably, only the Litecoin and Solana ETF filings have been acknowledged by the SEC and await a final verdict of approval.

Balchunas clarified that Litecoin ETFs have always had a high chance of approval since Canary Capital first filed for one in October.

He also stated that other tokens had lower than a 5% chance of approval before the US presidential election.

The crypto community continues to anticipate a positive outcome from the regulator for these ETF filings.

XRP saw $3.08 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $1.19 million and $1.90 million, respectively.

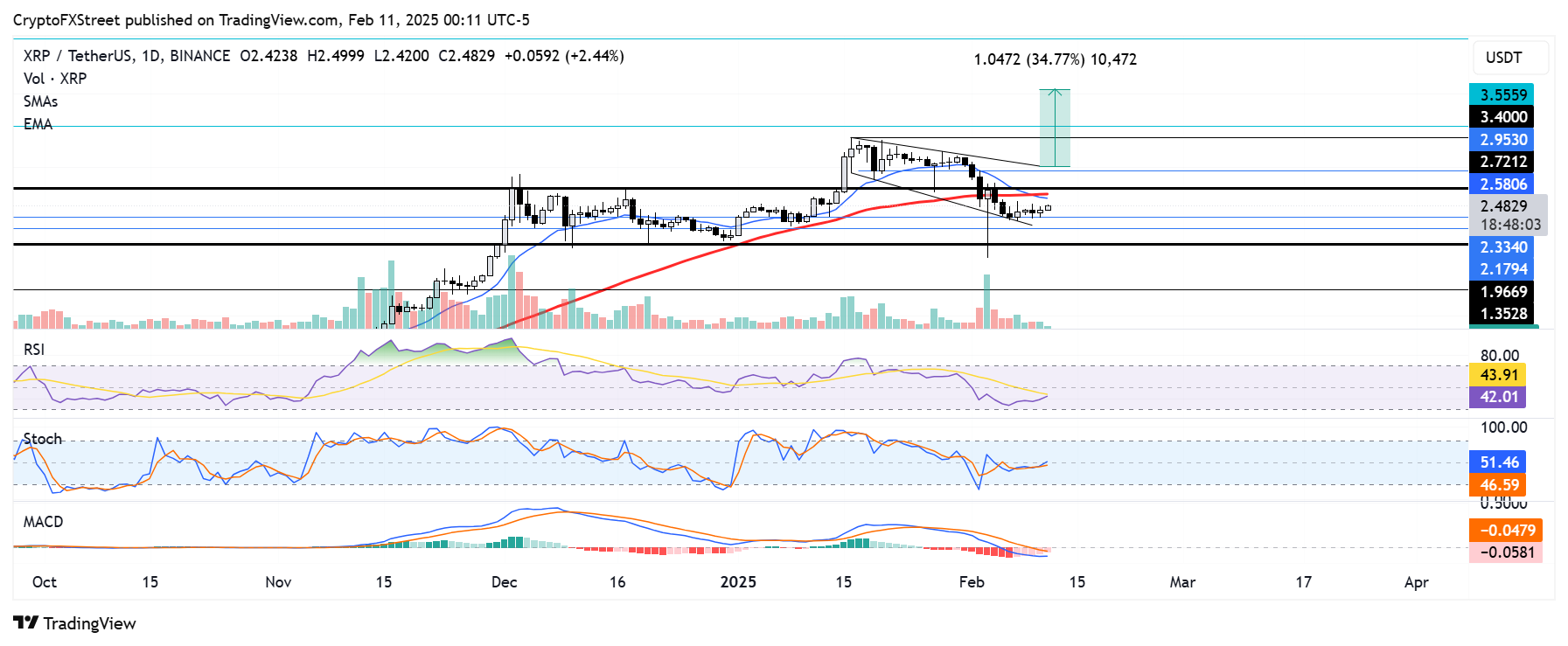

In the past three days, XRP held the lower boundary support of a descending broadening wedge near the $2.33 key level. With prices slightly tilted toward the upside, XRP could rally to test the wedge's upper boundary.

XRP/USDT daily chart

However, it faces resistance near the upper boundary of a key rectangular channel at $2.72. This resistance is strengthened by the 14-day Exponential Moving Average (EMA) and 50-day Simple Moving Average (SMA).

On the downside, if XRP declines below the $2.33 support level outside the falling wedge, it could decline to find support at a rectangular channel's lower boundary at $1.96. A further breach of this level will spark heavy bearish pressure on the remittance-based token.

The Relative Strength Index (RSI), Stochastic Oscillator Stoch and Moving Average Convergence Divergence (MACD) histograms are below their neutral levels but are trending upward. Crossing above their respective neutral levels could flip the XRP market from a bearish trend to a bullish structure.

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.