Why Selling Indie Movies To Asia Was Tough Even Before Trump's Tariffs

As the Cannes market heads into its first weekend, it’s fair to say it’s a nerve-wracking time for the international film sales business. Barely recovered from the shocks of pandemic and Hollywood strikes, the industry now faces the threat of tariffs imposed by U.S. President Donald Trump, which are sowing a huge deal of confusion for international financing, co-production and sales.

Asia has not been immune from these shocks and uncertainties. Although a few mega-hits such as China’s Nezha 2 and Thailand’s How To Make Millions Before Grandma Dies gives the impression that all is well – the truth is that box office recovery has been slow or uneven across most territories. The reasons for this would sound depressingly familiar in the West – a slowdown in U.S. studio tentpoles, the shift to streaming and (in China’s case) vertical short drama, and inflation hitting consumers’ pockets.

But at the same time, there is an air of resilience in many territories, as local films are on a tear, filling the space left by a retreating Hollywood. While most markets are polarized between a few big hits and lots of misses among local movies, their domestic box office is also being bolstered by Japanese anime, Southeast Asian horror, K-pop concert films and heartwarming dramas like How To Make Millions and Hong Kong’s The Last Dance.

The big issue is where that leaves independent films from outside the region, as the space for U.S. indie action films and European festival fare seems to have contracted more than ever.

Pre-pandemic, Asia was a reasonably lucrative region to sell indie movies to – home to several expanding box office markets and a young audience that embraced Western action, horror, kids’ movies, animation and, with careful handling, films with Oscars and Cannes recognition. China, in particular, was once a bright spot for U.S. sales companies, with stars like Jason Statham and Sylvester Stallone pulling in audiences and sales companies counting on MGs in the $1-2M range for big action titles with decent talent.

But five years after the start of the pandemic the optimism has evaporated. China may still be the world’s second biggest box office market – around $5.9BN in 2024 compared to North America’s $8.6BN – but MGs have collapsed and no Western sellers are including the territory in their sales projections.

“Due to the kind of films we handle, we used to have a fairly good pathway into China, but now it’s become difficul to do anything more than just a basic VOD deal,” says Simon Crowe, co-founder of SC Films International, which specialises in animation. “There’s just not many distributors willing to take a gamble on independent films – and that was before we were waiting to find out what is happening with these tariffs.”

Although the China Film Administration (CFA) announced that it would “moderately reduce” the number of U.S. film imports, in response to Trump’s tariffs on Chinese goods, there hasn’t been much evidence of that so far. Disney’s Thunderbolts* is currently on release and since the announcement three other US studio titles have been dated – The Accountant 2 (May 16), Lilo & Stitch (May 23) and How To Train Your Dragon (June 13).

On the indie front, China buyers say they’ve yet to receive any official notice on staying away from U.S. independent titles, but are concerned it may now be difficult to get them approved (of course Trump has since reduced the China tariffs and the situation changes daily). But most say, off the record, that they weren’t really buying even before Trump’s tariffs. Quotas are not an issue these days, as Chinese authorities have been welcoming foreign films to shore up flagging box office – it’s just there hasn’t been much box office for U.S. indie films.

Not even Hollywood is doing that well in China since the pandemic. The highest-grossing US studio release so far this year in China, A Minecraft Movie, has grossed $28M (RMB200M), while the biggest U.S. indie is John Wick: Chapter 4 on $6.2M (RMB44.9M). Not bad results but a fraction of what might have been expected before the pandemic.

Buyers says there was a flurry of excitement last year around Jason Statham starrer The Beekeeper, which grossed $15.5M (RMB114M) in January 2024, prompting a sudden surge in MG values. But prices collapsed again when no subsequent U.S. action title grossed more than $7M (RMB50m).

On the other hand, there has recently been some encouraging results for European movies. While only a handful of European films were released in China last year, Cannes Palme d’Or winner Anatomy Of A Fall, distributed by Road Pictures, grossed a respectable $3.9M (RMB28.6M) and this year Italian drama There’s Still Tomorrow has taken $6.2M (RMB44.8M) through a release handled by Jia Zhangke and Tian Qi’s Unknown Pleasures Pictures (UPP).

Both films appear to have benefitted from the growing purchasing power of female audiences, which currently account for around 58% of cinemagoers, and are showing a huge interest in stories about female emancipation. Local productions Her Story, about a single mother bonding with a neighbor, and Like A Rolling Stone, about a middle-aged woman on a road trip, have been big hits over the past year. Emotional and cultural relevance rather than machismo and spectacle seems to be driving the box office in this post-pandemic era.

Alessandro Caccamo, international sales manager at Italy’s Vision Distribution, explains that UPP focused on the female emancipation angle when marketing There’s Still Tomorrow in China. “We didn’t expect that the women’s issue would be so deeply felt in China as to become a central aspect of communication, to the point of releasing the film on March 8, [International Women’s Day],” he says (see Deadline’s interview with UPP here for further details).

Meanwhile, CFA executive deputy director-general Mao Yu has repeatedly stated that he wants to see a more diverse range of foreign movies in Chinese cinemas and the authorities also seem to be experimenting with different release models. While most films are released wide to up to 12,000 cinemas, distributors are now being allowed to handpick select cinemas and circuits, thus significantly reducing the cost of creating DCPs.

“There were some strong signals from the authorities last year that they’d like to see a more diverse market,” says Meng Xie, founder of Chinese sales agent and investor Rediance, which has recently stepped into distribution of foreign films and just signed its first acquisition in Cannes. “We have the world’s second biggest box office market but the number of films released is still much lower than what you can see in smaller markets. It’s still a complicated market, but more open than before.”

Several other distributors including Hishow Entertainment, which is gearing up to release Brazilian Oscar winner I’m Still Here this weekend, Beijing Hugoeast Media and DDDream International have also started experimenting with new release models on the theatrical release of specialist films. “The costs are more controllable and it enables us to more efficiently reach our targeted audiences,” says Elizabeth Yang, founder of DDDream International, which recently used this strategy to release Wim Wenders’ Cannes 2023 competition title Perfect Days. “There’s more support for this now as the market needs more diversity.”

As for the rest of the region – U.S. and European sellers say the picture is not much better, especially in South Korea, one of the theatrical markets that has struggled the most to recover since the pandemic. Where an indie film could once count on around one million admissions, most are now lucky to pull in 100,000. Japan is slightly better, but the strength of local anime is not leaving much room for imports, which saw their combined gross decrease by around 30% to $340M in 2024 (for Hollywood and independents combined).

The picture is mixed across Southeast Asia – some of the more mature markets such as Singapore and Hong Kong, which have always depended on Hollywood movies, are struggling to recover and several cinemas are closing down. Other markets are still at the growth stage and building out their theatrical infrastructure. Indonesia and Vietnam are both growing rapidly – Vietnam has already exceeded pre-pandemic box office – but again local productions, in particular horror films, are driving the market.

However, some territories still appear to be interested in international movies and are even drawing attention from less active neighbors. SC Films’ Director of International Sales & Marketing, Fumie Suzuki Lancaster, notes that when she meets Korean buyers they are often interested in acquiring films for Vietnam: “Box office is booming in Vietnam and the younger audience seems to be hungry for international culture. We’re doing really well with selling theatrical rights to this market, especially for animation titles.”

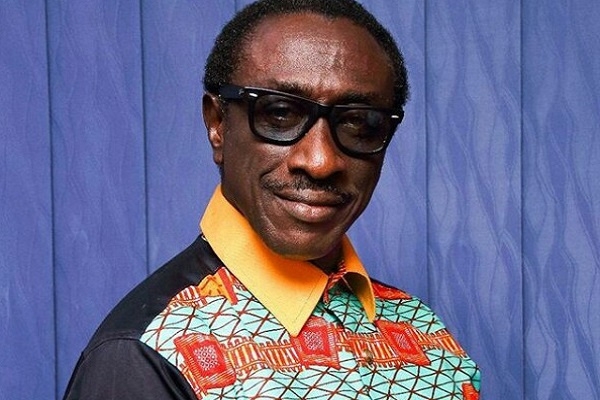

SC Films is also heavily involved in Southeast Asia in terms of co-producing and picking up international rights to local-language movies – the company’s current sales slate includes Brillante Mendoza’s Chameleon and Mike Wiluan’s Indonesian supernatural horror Melati: Revenge In Blood.

How To Make Millions Before Grandma Dies was sold internationally by WME Independent, which has also repped Thailand’s The Cursed Land, Taiwan’s The Bridge Curse and Indian action thriller Kill, and currently has a joint venture with Nelson Mok’s Singapore-based Mokster Films. In fact, it’s rare to find a Western sales agent these days that doesn’t have at least one Asian title on its slate.

For sales agents, faced with MGs for Western films contracting to a fraction of previous levels in Asian territories, picking up Asian films to sell either the original or remake rights is potentially a more interesting business.

As for this Cannes market, distributors across Asia say they’re still buying U.S. and European movies but they can’t pay what they used to; and they’re not sure how much longer they can keep going if box office doesn’t start to rally. Asia is a theatrical market – there’s very little PVOD and pay-TV is declining. Hopefully, before Cannes plays out, we’ll have a better idea of when and if business between Asia and the rest of the world will resume.