Why More Founders Need a Personal Wealth Strategy | Kanebridge News

Rebecca Klodinsky built two wildly successful brands from scratch. Now she’s urging fellow founders to take their personal wealth as seriously as their business growth.

When I launched my first business in my twenties, I thought success meant sales, scale, and building a brand with cut-through. And to some extent, it did.

But it took me a little longer to realise that real success — the kind that sustains you beyond your startup — also means financial independence. Not just revenue. Not just growth. But wealth.

We don’t talk about this enough. Founders are often so focused on cash flow, growth targets and reinvesting in the business that they neglect their own financial future.

And for women in particular, that can be a costly blind spot — especially in a climate like this.

Right now, the cost of living is at record highs. Inflation is steadily eroding savings. And Australian women are still retiring with, on average, 25% less superannuation than men. Financial literacy is no longer a nice-to-have — it’s a survival skill.

And founders, of all people, should be thinking about how they’re building wealth personally — not just professionally.

When I started my first business, I was a young solo mum navigating life without a blueprint — financially or otherwise. I didn’t grow up talking about money. I didn’t have a financial adviser on speed dial.

But I taught myself. I bought property. I built multiple income streams. I started investing. And I did it all while bootstrapping.

What I learned is this: you don’t need to be a finance expert to build wealth. But you do need to get intentional about it. Because if your personal finances aren’t growing with your business, you’re more exposed than you think.

Here are three things I’ve learned that I now believe every founder should factor into their strategy:

There’s a big difference between making money and building wealth. Your business might generate strong revenue, but if you’re not pulling money out, protecting it, and putting it to work, you’re still operating from a place of risk. I learned to treat my personal finances like a second business — with goals, structure, and long-term thinking. That shift was a turning point.

As founders, we know the risk of relying on a single product or market. The same logic applies to your personal income. One revenue stream — even a thriving one — is still one point of failure. I started looking for ways to build parallel income early: investing in markets, creating digital assets, and adding secondary product lines. That strategy gave me freedom, not just extra income.

The more confident I became with money — understanding debt, interest, returns, tax — the sharper my decision-making got. It wasn’t about becoming an expert.

It was about building fluency. Knowing my numbers gave me leverage — in negotiations, in team conversations, and in moments of pressure. It made me more resilient and more resourceful.

We often hear about “closing the gap” in funding, leadership, and opportunity. But there’s another gap we rarely acknowledge: the financial confidence gap.

And it starts with founders — especially women — being willing to prioritise their own wealth as part of their growth story.

You don’t need to have it all figured out. But you do need to start. Because the goal isn’t just to build a successful business — it’s to build a life that gives you freedom, security, and options long after the business has scaled.

Rebecca Klodinsky is the founder of IIXIIST and co-founder of The Prestwick Place, two multi-million dollar brands built without investors or retail stores. Known for her sharp digital strategy and sustainable, direct-to-consumer approach, she continues to rewrite the rules of modern luxury

Related Stories

Money

Why Family Offices Are Emerging as Preferred Partners for CRED Managers

By Opinion: Faris Dedic

Money

Abu Dhabi Fund Explores New Development Projects in Lebanon with UAE Delegation

Money

Ajman Bank partners with Canon Middle East to implement sustainable print initiatives

Why Family Offices Are Emerging as Preferred Partners for CRED Managers

As Australia’s family offices expand their presence in private credit, a growing number of commercial real estate debt (CRED) managers are turning to them as flexible, strategic funding partners.

By Opinion: Faris Dedic

Fri, May 30, 2025

Family offices are increasingly asserting their dominance in Australia’s private credit markets, particularly in the commercial real estate debt (CRED) segment.

With more than 2,000 family offices now operating nationally—an increase of over 150% in the past decade, according to KPMG—their influence is not only growing in scale, but also in strategic sophistication.

Traditionally focused on preserving intergenerational wealth, COI Capital has found that family offices have broadened their mandates to include more active and yield-driven deployment of capital, particularly through private credit vehicles.

This shift is underpinned by a defensive allocation rationale: enhanced risk-adjusted returns, predictable income, and collateral-backed structures offer an attractive alternative to the volatility of public markets.

As family offices increase their exposure to private credit, the dynamic between managers and capital providers is evolving. Family offices are highly discerning capital allocators.

They expect enhanced reporting, real-time visibility into asset performance, and access to decision-makers are key differentiators for successful managers. Co-investment rights, performance-based fees, and downside protection mechanisms are increasingly standard features.

While typically fee-sensitive, many family offices are willing to accept standard management and performance fee structures when allocating $5M+ tickets, recognising the sourcing advantage and risk oversight provided by experienced managers. This has created a tiered market where only managers with demonstrated execution capability, origination networks, and robust governance frameworks are considered suitable partners.

Notably, many are competing by offering differentiated access models, such as segregated mandates, debt tranches, or tailored securitisation vehicles.

There are important distinctions between onshore and offshore family offices in the context of CRED participation:

COI Capital Management has both an offshore and onshore strategy to assist and suit both distinct Family Office needs.

The influx of family office capital into private credit markets has several systemic implications:

Unlike ADIs or superannuation funds, family offices operate outside the core prudential framework, raising transparency and risk management questions, particularly in a stress scenario.

Yes—family offices are arguably among the most attractive funding partners for CRED managers today. Their capital is not only flexible and long-term focused, but also often deployed with a strategic mindset.

Many family offices now have a deep understanding of the risk-return profile of CRE debt, making them highly engaged and informed investors.

They’re typically open to co-investment, bespoke structuring, and are less bogged down by institutional red tape, allowing them to move quickly and decisively when the right opportunity presents itself. For managers, this combination of agility, scale, and sophistication makes them a valuable and increasingly sought-after partner in the private credit space.

For high-performing CRED managers with demonstrable origination, governance, and reporting frameworks, family offices offer not only a reliable source of capital but also a collaborative partnership model capable of supporting large-scale deployments across market cycles.

Faris Dedic is the Founder and Managing Director of DIG Capital Advisory and COI Capital Management

Related Stories

Lifestyle

Arthur D. Little Highlights Scalable Tech to Tackle Land Degradation in Extreme Climates

14/05/2025

Money

Visa Launches Third Edition of its “She’s Next” Program with SAB and Monsha’at

12/12/2024

Money

Retail Banks Risk Loyalty Dip as Card Experience Falls Short

24/03/2025

Abu Dhabi Fund Explores New Development Projects in Lebanon with UAE Delegation

The Abu Dhabi Fund for Development (ADFD) and the UAE delegation visited Lebanon to strengthen economic ties and advance strategic partnerships. They discussed cooperation in economic, investment, and government sectors, assessing joint projects and sharing best practices. The visit aimed to explore collaborative solutions for Lebanon’s economic recovery and future growth.

Fri, May 30, 2025

Reaffirming its longstanding commitment to international cooperation and sustainable development, (ADFD) joined the official UAE delegation on a high-level visit to the Republic of Lebanon, aimed at strengthening economic ties and advancing strategic partnerships.

The UAE President, His Highness Sheikh , met with President Joseph Aoun in a working visit to the UAE in May, the two leaders discussed ways to expand cooperation in economic, investment, and government sectors. As part of this effort, the ADFD was tasked to send a delegation to Lebanon to assess potential joint projects, while the UAE’s Knowledge Exchange Office was tasked with visiting Beirut to share best practices on government performance and institutional excellence.

The three-day visit brought together senior UAE officials and Lebanese leadership to explore collaborative solutions that support Lebanon’s economic recovery and future growth. The delegation met with His Excellency General Joseph Aoun, President of the Republic of Lebanon, where discussions centered around enhancing bilateral cooperation and supporting Lebanon’s economic development efforts. Meetings were also held with H.E. Dr. Nawaf Salam, Prime Minister of Lebanon, and ministers from the Ministries of Finance, Energy and Water, Education, Health, Public Works, Telecommunications, and Interior. The delegation also engaged with several national institutions such as the Central Bank of Lebanon, the Higher Relief Council, and the Council for Development and Reconstruction.

ADFD also visited the Banque de l’Habitat (Housing Bank) in Beirut to explore cooperation on offering concessional loans to support housing solutions and enable citizens to access affordable housing. Both parties agreed to continue coordination, including upcoming meetings in Abu Dhabi to discuss project implementation and follow-up on proposed initiatives.

H.E. Mohamed Saif Al Suwaidi, Director General of ADFD, said: “The Fund’s participation underscores the UAE’s commitment to supporting friendly nations, continuing its leading role in fostering international cooperation. ADFD’s partnership with Lebanon spans over five decades, during which we have helped implement strategic development projects across vital sectors such as infrastructure, education, energy, and healthcare.”

He added: “Our presence in Lebanon today reaffirms our deep commitment to supporting its government in tackling economic challenges and enhancing the quality of life for the Lebanese people. We aim to leverage our expertise and partnerships to help develop sustainable solutions that align with the country’s aspirations for recovery and reconstruction.”

During the Knowledge Exchange Forum, Lebanese Prime Minister Dr. Nawaf Salam praised ADFD’s instrumental role in supporting Lebanon’s development journey since the 1970s, describing the Fund as a trusted partner throughout various stages of national progress and an enabler of tangible improvements across key sectors.

Site visits to the Port of Beirut, Beirut–Rafic Hariri International Airport, Beirut Governmental Hospital, and various public service institutions further underscored the delegation’s focus on identifying immediate priorities and potential areas of collaboration.

Related Stories

Property

Emaar Properties Announces Record 100% Dividend Distribution for 2024

14/12/2024

Lifestyle

Idealz Expands Global Footprint: Signing Ceremony Marks New Franchise Partnership in Mexico

26/09/2024

Money

Saudi Arabia’s Inflation Remains Steady at 1.7% in September 2024 Amid Sectoral Price Shifts

16/10/2024

Ajman Bank partners with Canon Middle East to implement sustainable print initiatives

Ajman Bank and Canon Middle East are launching a Climate Contribution Project to offset greenhouse gas emissions from ink, paper, and electricity consumption in their printing operations. The initiative uses software tools and digital workflow solutions, certified by Gold Standard and Climate Partner.

Fri, May 30, 2025

has partnered with Canon Middle East to launch a Climate Contribution Project, focusing on offsetting greenhouse gas emissions from ink, paper, and electricity consumption across the bank’s Canon-related printing operations. Managing over four million impressions annually, this sustainability initiative will compensate for 25 tons of CO2 emissions, demonstrating both organizations’ commitment to environmental responsibility.

The program leverages sophisticated software tools to calculate the greenhouse gas emissions associated with the use of Canon printers and multi-function devices in partner organizations and then invests in projects that compensate the same amount of CO2 in a different place. Further, integrating Canon’s advanced Managed Print Services and intelligent digital workflow solutions, such as uniFLOW, enables organizations to optimize their processes while significantly reducing energy consumption and environmental impact.

Zohaib Ali Zahid, Head of ESG at Ajman Bank, commented: “Ajman Bank is dedicated to advancing sustainability in all its operations, and our collaboration with Canon to offset our environmental footprint is one of the steps toward this goal. This initiative specifically targets minimizing the impact of paper consumption and printing activities across the Bank, promoting sustainable practices and behaviors at an individual level.”

Abdulaziz Al Ali, Head of Administration at Ajman Bank, added: “This is one of the many initiatives we are undertaking to reduce the Bank’s greenhouse gas emissions from internal operations, alongside adopting other energy- and resource-efficient practices.”

The Climate Contribution Project forms part of Canon’s global portfolio of certified climate compensation initiatives. These projects span multiple continents, delivering tangible environmental impact through innovative solutions such as wind energy developments in India and Indonesia, cookstove programs in Uganda to combat deforestation, and reforestation efforts

Shadi Bakhour, B2B Business Unit Director at Canon Middle East, said: “At Canon, we are committed to fostering sustainable business practices that align with our philosophy of Kyosei—living and working together for the common good. Our partnership with Ajman Bank exemplifies how organizations can take proactive steps toward reducing their carbon footprint from Print operations while advancing their digital transformation journey. Together, we aim to create a blueprint for responsible and sustainable Print operations in the UAE and the Middle East region.”

The initiative is certified by Gold Standard, the internationally recognized verification body, and independently authenticated by Climate Partner. This dual-tier validation ensures credibility and adherence to ISO16759:2013 standards for carbon footprint quantification.

This program aligns with the growing emphasis on responsible procurement practices among companies and governments, supporting ESG-compliant sourcing. Canon continues to engage with diverse stakeholders—from large enterprises and government entities to academic institutions and SMEs—demonstrating a shared commitment to environmentally conscious operations.

Related Stories

Lifestyle

SOARING TRAVEL COSTS ARE WEIGHING ON EVEN THE WEALTHIEST VACATIONERS, WSJ STUDY SHOWS

By Casey Farmer 09/08/2024

Lifestyle

KW Solid Piston Technology Suspension Kit: Elevating Ferrari F8 Tributo and F8 Spider Performance

18/07/2024

Lifestyle

PLD Space and D-Orbit ink launch deal for future equatorial missions.

04/04/2025

Stitch Secures $10 million In Funding To Simplify Banking And Payments Innovation

Saudi Arabia-based Stitch raised $10 million in a seed round to transform financial infrastructure in the region, offering an API-driven solution for banking and payment products.

Fri, May 30, 2025

, the unified platform for launching and scaling financial products, today announced the successful closing of a $10 million seed round. The Saudi Arabia headquartered company attracted investments from leading investors including Arbor Ventures, COTU Ventures, Raed Ventures, and SVC. The round has also had participation from various family offices and industry veterans including Marqeta’s founder Jason Gardner, and Abdulmalik AlSheikh who previously led the establishment of critical payment networks such as mada and Sadad in the KSA. The funding will accelerate Stitch’s growth to transform financial infrastructure in the region.

The demand for integrated, technology infrastructure for financial and non-financial institutions is accelerating both globally and across the Middle East. The global Banking & Financial Services Industry (BFSI) is projected to reach USD 221.39 billion by 2033, up from USD 91.42 billion in 2024, with a compound annual growth rate (CAGR) of 10.3% during the forecast period. This surge is driven by the increasing demand for digital transformation across banking, financial services, and insurance sectors. In Saudi Arabia alone, banking sector assets have surged to US $ 1.12 trillion (SAR 4.22 trillion), while digital payments grew by 75% between 2019 and 2021, and point-of-sale transactions reached US$ 177.69 billion (SAR 667 billion) in FY 2024.

Businesses in the Middle East, from banks and lenders to consumer brands and large enterprises still face significant barriers to building modern financial products. Stitch is addressing this gap with a unified infrastructure platform built in the Middle East and designed to compete globally. Launched initially for clients in Saudi Arabia and the UAE, Stitch is already attracting interest beyond the region, and has secured clients in the Eastern African region, starting with Kenya.

“At Stitch, our vision is to reinvent how financial and non-financial institutions bring banking and payment products to market.” said Mohamed Oueida, Founder & CEO of Stitch. “Today, the process of building financial products is broken. Businesses are forced to navigate outdated legacy systems and complex regulatory frameworks, making things slow, expensive, and mostly painful. It doesn’t have to be this way. Stitch exists to change this. Institutions should be able to focus on what matters and have a platform that can mold around their creativity. We are generally looking to make this process a lot more enjoyable for our partners.”

The first-of-its-kind business in the Middle East, Stitch’s technology offers the simplest way for enterprises to build financial products, delivering an API-driven solution that eliminates the inefficiencies and complexities of legacy systems. Designed to meet the evolving needs of modern financial services, Stitch serves as the unified platform to launch and scale banking and payment products up to 80% faster.

The $10 million raised will be used to expand Stitch’s team and enhance its platform capabilities, further establishing the company as a trusted infrastructure partner for banks, fintech firms, and non-financial enterprises integrating financial services. Major clients such as Lulu Exchange, Alamoudi Exchange, Foodics, Dar Al Tamleek, Raya Financing and Tanmeya Capital—are already leveraging Stitch’s technology to launch tailored financial solutions across diverse sectors and regions.

Nora Alsarhan, Deputy CEO and Chief Investment Officer at , commented, “Our investment in Stitch is driven by our commitment to supporting the growth of innovative Saudi-based startups, enabling them to compete both regionally and globally. We believe Stitch has the potential to play a significant role in developing a more capable and resilient financial ecosystem in the Middle East and around the world.”

Khaled Lababidi, Partner, Arbor Ventures commented, “As emerging markets digitalize their financial services, we believe the next generation of technology infrastructure will come from places like Saudi Arabia and led by founders who understand these regions. Stitch is a clear example of this shift, combining local expertise with global standards to support institutions across emerging markets. Their platform addresses long-standing infrastructure gaps by offering a simplified but compliant solution that’s built for scale, speed and security.”

Wael Nafee, General Partner, Raed Ventures, commented: “For the first time, financial institutions in the region have a local infrastructure partner that was built from the ground up with their realities in mind, with the ability to compete anywhere in the world. Stitch isn’t just creating an alternative to legacy systems; they’re setting a new standard for how financial products should be built. Their focus on technical depth with global ambitions has set them apart from day one. This is not just the kind of company we want to back, but is also indicative of the impact that Middle East startups can have on the global tech ecosystem.”

Founded in 2022, Stitch has attracted industry-leading talent from global organizations including FIS, Geidea, Rain Financial, NPCI India, Al Rajhi Bank and many others, with a commitment to driving long-term innovation in the banking and payments industry.

Related Stories

Money

The New Math on Inheriting Your Parents’ House

By VERONICA DAGHER 02/06/2023

Lifestyle

EU and GCC Launch Green Transition Initiative at World Energy Summit

19/04/2024

Lifestyle

Aman Group Unveils Janu Dubai Projects

04/06/2024

Riyadh Welcomes New Oil Find and Boosts Energy Ties with Kuwait

The Saudi Cabinet has praised an oil discovery in the North Wafra Wara-Burgan field as a positive step towards energy sector cooperation between Saudi Arabia and Kuwait.

Thu, May 29, 2025

The Saudi Cabinet lauded the new oil discovery in the partitioned zone between Saudi Arabia and State of Kuwait as a positive step towards a further cooperation in the energy sector.

This came during the Saudi Cabinet’s meeting, chaired by Crown Prince and Prime Minister Prince Mohammad bin Salman, according to the kingdom’s official news agency. The cabinet said that recent oil discovery would lead to promoting Saudi-Kuwait cooperation in energy and continuing joint discovery and development efforts.

The Governments of Kuwait and Saudi Arabia declared a new oil discovery in the partitioned zone, said the .

They announced that Wafra Joint Operations had made a new oil discovery in (North Wafra Wara-Burgan) field, located five kilometers north of Wafra field.

Crude oil flowed from the Wara reservoir in the North Wafra (Wara-Burgan-1) well at a rate exceeding 500 barrels per day, with an API gravity of 26 to 27 degrees. API gravity is a scale that defines the gravity or density of liquid petroleum products.

Related Stories

Money

Fitch Affirms Kuwait’s ‘AA-’ Rating, Highlighting Economic Strength and Ongoing Challenges

16/09/2024

Money

China Will Lift Ban on Australian Rock Lobsters, Australia PM Says

By MIKE CHERNEY 11/10/2024

Lifestyle

Accor and Naif Alrajhi Investment Bring TRIBE to King Salman Park

13/01/2025

UAE and EU Launch Negotiations for Trade Deal

The European Union and the United Arab Emirates are negotiating a Comprehensive Economic Partnership Agreement (CEPA) to enhance trade, investment, and innovation between the two global economic hubs, with the UAE being a key player in finance, logistics, energy, and digital innovation.

Thu, May 29, 2025

The and the United Arab Emirates have officially initiated negotiations for a landmark trade agreement, signaling a major step toward enhancing bilateral economic cooperation. Announced by European Trade Commissioner Maros Sefcovic, the talks aim to establish a Comprehensive Economic Partnership Agreement (CEPA) that would boost trade, investment, and innovation between the two global economic hubs.

The move reflects the EU’s growing interest in deepening trade relations with the Gulf region, particularly as the UAE positions itself as a leading global center for finance, logistics, energy, and digital innovation. Both sides expressed optimism that the deal will accelerate economic diversification efforts and unlock new market opportunities for businesses across Europe and the Middle East.

Commissioner Sefcovic emphasized the strategic importance of the partnership, stating: “This agreement has the potential to significantly expand our economic cooperation with the UAE across key sectors, including renewable energy, digital economy, sustainable infrastructure, and services.”

The negotiations come at a time when the UAE is actively pursuing similar agreements with several global powers, including India, China, and Australia, as part of its broader strategy to expand its trade footprint and attract foreign direct investment under its “We the UAE 2031” vision.

For the EU, a deal with the UAE could provide enhanced access to one of the fastest-growing markets in the MENA region. The UAE is currently the EU’s largest trading partner in the Gulf, with bilateral trade in goods valued at over €50 billion in 2023.

If successful, the trade agreement is expected to reduce tariffs, enhance regulatory cooperation, promote sustainable practices, and create a more favorable business environment for European and Emirati companies alike. The deal would also support shared climate goals by advancing collaboration on green technology, energy transition, and carbon reduction.

Further rounds of negotiations are expected to continue over the coming months, with both sides committed to fast-tracking progress and delivering a mutually beneficial outcome.

As global trade dynamics evolve, the EU-UAE trade talks represent a pivotal development with the potential to reshape commercial ties between Europe and the Gulf region.

Related Stories

Property

Dubai Allocates AED 5.4 Billion for 3,004 New Homes for Emirati Citizens

06/01/2025

Lifestyle

It’s a Barbie world for interior design

By KANEBRIDGE NEWS 18/07/2023

Money

The World Tied $3.5 Trillion-Plus of Debt to Inflation. The Costs Are Now Adding Up.

By CHELSEY DULANEY 26/07/2023

AI-Powered Investment Strategies Built on Proprietary Retail Trading Data

eToro has introduced eleven ‘Alpha Portfolios’, AI-powered investment strategies based on its proprietary retail trading data. These strategies, typically used by hedge funds and institutional investors, are accessible to retail investors due to high entry barriers, management fees, and lock-up periods. Users can invest in these portfolios, rebalanced monthly.

Wed, May 28, 2025

Trading and investing platform announced today it has launched eleven ‘Alpha Portfolios’, a family of innovative AI-powered investment strategies built using advanced analysis of eToro’s proprietary retail trading data.

“We’re excited to give our users access to exclusive quant-driven strategies typically used by hedge funds and institutional investors with the new Alpha Portfolios. These kinds of strategies have long been out of reach for retail investors, as they normally have high entry barriers, costly management fees, restrictive lock-up periods and less transparency in terms of asset allocation,” said Shay Heffetz, Director of Quantitative Investment Strategies at eToro. “But what sets these portfolios apart is how we’ve combined AI with one of the largest retail trading datasets in the world – an edge that few others have. We’re in a strong position to apply AI in a way that delivers real, actionable value to retail investors.”

As a global trading and investing platform with 40 million registered users, eToro is able to aggregate anonymized retail trading data across diverse geographies and stock markets – resources that are not available to traditional fund managers. The Alpha Portfolios use advanced machine learning models to identify patterns and behavioral inefficiencies in eToro’s vast data pool, in order to systematically adapt their strategies to generate ‘alpha’, meaning better returns than the market.

Eligible users can invest in eleven Alpha Portfolios in total, each employing a unique strategy designed to perform well in different market environments:

Directional strategies:

Market-neutral strategies:

- Sector Gurus is a long/short strategy that targets volatile yet high-performing stocks within the S&P 500. There is also a 2x leveraged version, SectorGurus-X2.

Each portfolio is rebalanced monthly, using the latest data and updated AI signals to ensure they remain aligned with market conditions and the portfolio’s specific goals. Initial investments start from US $10,000. There are no management fees, performance fees, or lock-up periods.

Related Stories

Lifestyle

Abu Dhabi’s culture and tourism sectors show strong Q1 growth

28/04/2025

Lifestyle

8 Golden Tips for Successful Real Estate Investment

21/05/2025

Lifestyle

Whitewill Reveals Top Luxury Real Estate Projects in Abu Dhabi

01/07/2024

Bitcoin Hits Record High as UAE Embraces Global Crypto Momentum

Bitcoin has reached an all-time high of $112,000 against the US dollar, driven by a weakening dollar and rising US debt concerns. This surge coincides with Bitcoin Pizza Day and Bitcoin 2025, with the UAE’s digital asset ecosystem expected to gain prominence.

Wed, May 28, 2025

has reached a new milestone, hitting an all-time high of $112,000 against the US dollar last Thursday, before stabilizing around $109,000 in recent days. The rally comes amid a weakening dollar and rising concern over U.S. debt levels, prompting global investors to continue seeking alternative stores of value, including in the UAE’s fast-growing digital asset ecosystem.

The timing of the price surge is also notable—coming on the anniversary of Bitcoin Pizza Day, commemorating the first real-world bitcoin transaction in 2010, when Laszlo Hanyecz spent 10,000 bitcoin on two pizzas. At today’s prices, that transaction would be valued at over $1.1 billion.

Commenting on the current market conditions, Simon Peters, crypto analyst at eToro, said: “Bitcoin’s momentum reflects both growing institutional confidence and a broader narrative around digital scarcity and decentralized finance. With spot bitcoin ETFs attracting over $2.75 billion in inflows just this past week—and nearly $935 million on Thursday alone—it’s clear that investor appetite remains strong. Public companies are now holding close to 800,000 bitcoin, or 4% of the total circulating supply, compared to just 300,000 at this time last year. The shift is both rapid and significant.”

The global crypto community is now turning its attention to Bitcoin 2025, which begins today. The high-profile conference features keynote addresses from U.S. Vice President JD Vance, MicroStrategy’s Michael Saylor, Senator Cynthia Lummis, and David Sacks, the White House’s AI and Crypto Czar. With regulatory frameworks and institutional adoption in focus, the UAE’s participation and ongoing developments in the digital assets space are expected to remain in the spotlight.

Simon Peters added: “Market participants will be closely monitoring remarks from key speakers at Bitcoin 2025. Any bullish sentiment or policy clarity could act as a tailwind, possibly pushing bitcoin to fresh record highs. Investors in the UAE and the wider region are increasingly active in this space and watching global developments closely.”

As Dubai and Abu Dhabi continue to position themselves as global crypto hubs, today’s momentum reinforces the UAE’s potential role in the next phase of digital finance innovation.

Related Stories

Money

Fitch Affirms Australia’s Rating, But Flags Mounting Budget Risks

By JAMES GLYNN 08/11/2024

Lifestyle

Emaar Unveils New Residential Community in Dubai: The Heights Country Club & Wellness

23/05/2024

Lifestyle

Bugatti Tourbillon: A Spectacular Unveiling at Molsheim’s Historic Château Saint Jean

25/06/2024

7 Ways To Self-Fund Your Retirement Beyond Just Your Super

Super isn’t your only option. These smart strategies can help you self-fund a comfortable retirement.

By Helen Baker

Mon, May 26, 2025

Superannuation is the first thought when it comes to self-funding retirement. Yet it is hardly the only option for doing so.

Just as we have a choice in how and where we work to earn a living, many people also have a choice in how to fund their retirement.

It is possible and sometimes preferable to leave your superannuation untouched, allowing it to continue growing. Some or all of your income can come from alternative sources instead.

Here are some alternatives you can consider.

For many who own their own homes, the equity accrued over decades can eclipse the funds in superannuation. However, it’s theoretical money only until it is unlocked.

Selling up the family home and downsizing – or rightsizing – for retirement allows you to pocket those gains tax-free and simultaneously relocate to a more suitable home with lower upkeep costs.

Up to $300,000 from the proceeds can be contributed by a downsizer to boost your super, and the remainder can be used to fund living expenses or actively invested.

Remember that while the sale proceeds of your home are tax-free, any future profits or interest earned from that money will be taxable.

Semi-retirement allows you to gradually step into retirement. You continue earning income and super while working part-time, keeping a foot in the workforce while testing the waters of your new found free time.

Doing so also offers scope to move into different roles, such as passing on your skills to future generations by teaching/training others in your field of expertise, or taking employment in a new area that interests you and is closer to home.

Retirement from a full-time position presents a good opportunity to pursue self-employment. With more time and fewer commitments on your hands, you have greater scope to turn your hobby into a business or leverage your professional skills and reputation as an external consultant.

Also, for the self-employed and those with a family business, director’s loan repayments from the company are typically tax-free, offering a potentially lucrative source of

income and a means of extracting previous investments into the business without selling your ownership stake.

Rental property income (from residential or commercial properties) can supplement or even provide a generous source of income. The same applies to dividends from shares.

These are likely to be more profitable if you own them well before retirement.

Income that is surplus to your everyday needs can be reinvested using tax-effective strategies to grow your future returns.

A family trust could be used to house investments for yourself and other relatives, building intergenerational wealth.

Trusts allow funds to be allocated to beneficiaries to manage marginal tax rates and stretch the money further, you have control over how income is split between different family members and have flexibility for changing circumstances.

You may not realise the value of items you have collected over the years, such as wine, artwork, jewellery, vintage cars, and antiques.

Rather than have them collect dust or pay to store them, they could be sold to fund your living costs or new investments.

Where possible, avoid selling growth assets in a depressed market – wait until you can extract maximum value.

Part-pensions are not only possible but valuable in making your superannuation stretch further. They still entitle you to a concession card with benefits in healthcare, transport, and more.

Take these savings even further by requesting pensioner discounts with other companies, on everything from utilities to travel and insurance to eating out.

Also, don’t overestimate the value of your assets as part of the means test. It’s a common mistake that can wrongly deny you a full or part-pension.

However, you ultimately fund your retirement, planning is crucial. Advice would hopefully pay for itself.

Understand your spending and how those habits will change before and during retirement, then look to investments that offer the best fit.

Consider a mixture of strategies to diversify your risk, manage your tax liabilities and ensure ongoing income.

Above all, timing is key. The further ahead you plan, the more time you have to embrace additional opportunities and do things at the right time to maximise their value. You’ve worked hard and now is your chance to enjoy the fruits of your labour!

Helen Baker is a licensed Australian financial adviser and author of the new book, Money For Life: How to build financial security from firm foundations (Major Street Publishing $32.99). Find out more at www.onyourowntwofeet.com.au

Related Stories

Lifestyle

Dell Technologies, Aramco and NITA Graduate Saudi Students with Advanced IT Certifications

23/01/2025

Lifestyle

GCC Flooring Market to Top $25B by 2033, Fueling DOMOTEX Demand

26/03/2025

Lifestyle

Meet the heritage home with the lot – including a pool room

By KANEBRIDGE NEWS 06/07/2023

Bahrain’s Fintech Strength Key to Advancing National Vision

Bahrain’s financial sector is crucial for the Kingdom’s Economic Vision 2030, contributing to GDP and employing national talent, and is attracting investment due to its digital transformation.

Mon, May 26, 2025

, Bahrain’s innovator and a fintech services leader, emphasized the strategic significance of Bahrain’s financial sector in driving the Kingdom’s Economic Vision 2030 at the Public Relations and Diplomacy Conference held at the Jumeirah Hotel in Kuwait.

During the event, Hanan Abdulla Hasan, Senior Manager of Public Relations and Communication at Benefit and Vice President of the Bahrain Public Relations Society, delivered a presentation titled “The Role of Public Relations Diplomacy in Advancing National Development Goals: Bahrain as a Benchmark.”

The presentation highlighted the sector’s alignment with the Financial Services Sector Development Strategy (2022–2026), its role in accelerating progress toward the Sustainable Development Goals, and its status as the fastest-growing sector in Bahrain – marked by its contribution to GDP and its capacity to employ national talent, said a statement from Benefit.

Emphasizing Bahrain’s leadership in digital transformation, Hasan drew attention to the kingdom’s success in integrating innovation across the financial sector.

The presentation outlined how financial institutions have achieved significant progress in delivering accessible and intuitive digital services – from efficient payment and transfer systems to advanced online and mobile banking platforms.

These advancements have not only enhanced operational efficiency but also elevated the overall banking experience for customers, said the statement.

A key segment of the presentation focused on Benefit’s own trajectory as a homegrown fintech success story.

At the event, Hasan illustrated how the company’s strategy is deeply intertwined with national economic plans and forward-looking digital agendas.

Through continuous investment in innovative solutions and a commitment to operational excellence, Benefit has positioned itself as a driver of digital transformation and financial inclusion in Bahrain. Its suite of advanced services and platforms serves as an internationally recognized model for digital banking and fintech excellence.

Furthermore, Hasan also underscored the critical importance of the Gulf region’s evolving financial infrastructure – particularly Bahrain’s – in fostering a business environment conducive to foreign direct investment.

The region’s cutting-edge infrastructure, modern banking systems and regulatory flexibility offer investors an appealing and competitive landscape, particularly in fintech, she added.

Related Stories

Property

Exploring the Advantages and Insights of the Off-Plan Property Investment in Dubai

25/03/2024

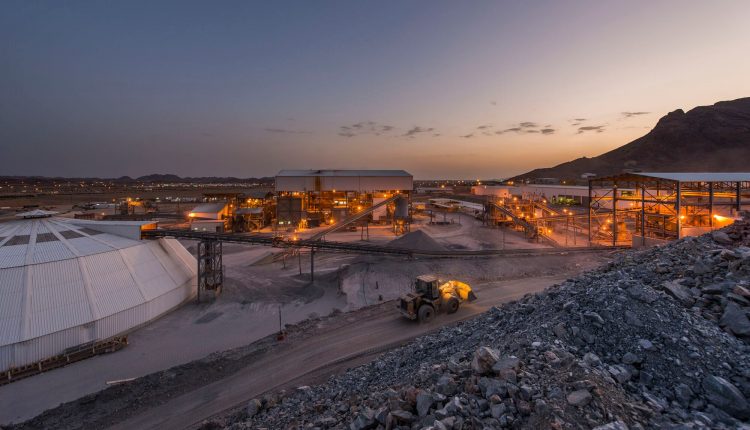

Money

Saudi Arabia’s $2.5 Trillion Mining Sector Transformation

18/04/2024

Money

CBH Celebrates UGFS North Africa’s Successful First Closing of “New Era” Fund

20/04/2025

Boursa Kuwait Honored by Global Finance for Leadership in Community Sustainability

Boursa Kuwait has been recognized for its commitment to sustainability, winning the “Best for Sustaining Communities – Middle East” award by Global Finance for 2025.

Mon, May 26, 2025

was awarded the “Best for Sustaining Communities – Middle East” award for 2025 by Global Finance as part of the magazine’s Sustainable Finance and Investment Banking Awards ceremony in London, United Kingdom.

Global Finance’s recognition of Boursa Kuwait reaffirms the company’s unwavering commitment to the highest standards of environmental, social, and governance (ESG) implementation and reporting and adopting them within its operational framework. It also reflects Boursa Kuwait’s strategic vision of embedding a culture of corporate sustainability through impactful initiatives that drive lasting, positive change in the community and support the development of a more transparent and efficient capital market.

Adopting a comprehensive approach, Boursa Kuwait has supported social, educational, and environmental programs to empower various segments of the population and expand access to financial literacy. These initiatives are in full alignment with the objectives of Kuwait’s National Development Plan, reinforcing the company’s position as a key driver of sustainable development in the country.

In 2024, Boursa Kuwait continued its commitment to supporting social and environmental programs in collaboration with local and international organizations. Throughout the year, the bourse sponsored 38 initiatives aimed at creating a lasting, positive impact on the community it serves, including numerous environmental programs and initiatives designed to empower women. Additionally, the company launched the inaugural edition of the “Bell” initiative to raise financial literacy and awareness. This initiative aims to position financial education as a cornerstone for achieving financial stability, economic development, and social prosperity, in partnership with several distinguished local organizations.

Commenting on the award, Boursa Kuwait’s Senior Director of Marketing and Corporate Communications Mr. Naser Meshari Al-Sanousi stated, “This international award stands as another testament to Boursa Kuwait’s continued leadership in corporate sustainability and social responsibility. The company is proud to see its efforts recognized by a prestigious publication like Global Finance, a reflection of the international business community’s confidence in our business model and our commitment to transparency and positive impact. Boursa Kuwait remains focused on strengthening strategic partnerships and advancing sustainable practices across Kuwait’s financial sector.”

“Boursa Kuwait firmly believes that sustainability is a shared responsibility across all segments of society, and a unique opportunity to build a prosperous future for generations to come. On behalf of Boursa Kuwait, I would like to extend my sincere gratitude to Global Finance for this recognition, which serves as a strong motivator to continue innovating across our initiatives and delivering added value to the Kuwaiti community and the national economy,” he added.

This marks the second time Boursa Kuwait has received this prestigious honor from Global Finance, following its initial win in 2023. The company was also named “Best in Sustainability Transparency” for both 2023 and 2024, further underscoring its leadership in ESG disclosure and sustainable business practices. Since 2018, the company has won over 25 awards in sustainability from several internationally renowned institutions and publications.

The recognize global, regional and local leadership in sustainable finance, commending the efforts of financial institutions that support and adopt initiatives aimed at mitigating the negative impacts of climate change and building a more sustainable future for humanity. Award recipients are selected based on their contributions to comprehensive sustainable finance, community support, resource management, transparency and reporting, as well as their overall commitment to sustainable financing.

Boursa Kuwait’s Corporate Sustainability (CS) strategy stipulates ensuring initiatives apply and fall in line with the company’s corporate social responsibility (CSR) pillars, industry best practice standards and investor expectations, creating strong and sustainable partnerships that ultimately achieve success and allow Boursa Kuwait to leverage the capabilities and strengths of other companies or organizations that have experience in different fields, and integrating sustainability efforts with the company culture, to achieve longevity and an ongoing impact that is carried on and instilled in the day-to-day operations of the stock exchange.

As part of the strategy, Boursa Kuwait has launched many initiatives in partnership with local and international organizations, focusing on support for nongovernmental organizations and charity programs, financial literacy and capital market awareness, the empowerment of women as well as environmental protection.

Related Stories

Property

Konvi Expands into UAE’s Booming Luxury Real Estate Market

30/08/2024

Property

Dubai’s Ultra-Luxury Real Estate Market Thrives Amid Rising Global Demand

09/03/2025

Lifestyle

2024 Mercedes-AMG GLE 63 S Is a Coupe on V8 Steroids

By JOHN SCOTT LEWINSKI 16/08/2023

Egypt Central Bank Cuts Interest Rates by 100 Basis Points

Egypt’s central bank has reduced overnight interest rates by 100 basis points due to accelerated economic growth and decelerating inflation. The Monetary Policy Committee (MPC) believes the rate cuts balance risk vigilance with room for monetary easing.

Fri, May 23, 2025

lowered its overnight interest rates by a less-than-expected 100 basis points on Thursday, saying economic growth in Egypt had accelerated in the first quarter while inflation in Egypt had decelerated.

The Monetary Policy Committee (MPC) cut the overnight deposit rate to 24% and the lending rate to 25%, marking its second decrease in 2025 after having left rates unchanged for a year. This interest rate cut in Egypt is part of the ongoing monetary policy easing strategy.

The median forecast of 16 analysts polled by Reuters was for the Central Bank of Egypt to cut rates by 175 basis points.

The MPC statement said GDP growth in Egypt was projected to have accelerated to 5.0% in Q1 2025 from 4.3% in the final quarter of 2024 and would likely speed up further in the financial year starting July.

Annual headline inflation in Egypt nearly halved in February to 12.8%, mainly due to a base effect one year after Egypt received a $24 billion real estate investment from the UAE and signed an $8 billion IMF financial support program.

Since then, inflation has gradually increased, reaching 13.9% in April 2025.

“Inflation in Egypt is expected to decline throughout the remainder of 2025 and into 2026,” the statement noted, “albeit at a constrained pace given expected fiscal consolidation in 2025 and the persistence of non-food inflation.”

“The MPC judges that cutting policy rates by 100 basis points strikes a balance between vigilance against prevailing risks and the room available to advance the monetary easing cycle in Egypt, while supporting the projected disinflation path over the forecast horizon,” the statement added.

In March 2024, the Central Bank of Egypt hiked rates by 600 basis points and allowed the Egyptian pound to devalue sharply as part of reforms linked to the IMF loan agreement.

According to central bank data, money supply (M2) growth in Egypt also decelerated in the first quarter, falling to an annual 25.8% at the end of March from 33.9% in February.

Related Stories

Lifestyle

Turkish Airlines Adopts SAAFI Insurance for New Aircraft Deliveries

21/05/2025

Money

A BD500 Million Budget Approved to Improve Living Standards in Bahrain

16/01/2025

Lifestyle

Qatar’s Historical and Cultural Marvels: A Journey Through Time

18/03/2024

UAE Economy to Grow 4% in 2025 Driven by Non-Oil Sectors

The UAE economy is expected to sustainably grow in 2025, driven by domestic momentum and diversification efforts beyond oil, with tourism, transportation, financial services, construction, real estate, and communications being major growth drivers.

Fri, May 23, 2025

After a successful trip by the President of the United States, many may be thinking what’s ahead for the UAE economy in 2025. Well it’s the UAE’s economy that remains poised for sustained growth, fueled by a mix of robust domestic momentum and an ongoing push to diversify beyond oil. Official forecasts and global institutions align in predicting healthy expansion. The IMF projects 3.8% growth in 2024 and 4.0% in 2025, among the highest in the Gulf region. (By comparison, Saudi Arabia’s growth is forecast to be around 3% next year) This optimism reflects strong non-oil activity even as oil production gradually rises.

According to , Market Analyst at , on-oil sectors are playing an increasingly prominent role in the UAE’s economy. In 2024, industries like tourism, transportation, financial services, construction, real estate, and communications were major growth drivers, highlighting the country’s diversification push.

International visitor numbers and spending have surged; travel and tourism are on track to contribute roughly 13% of UAE GDP in 2025 amid record-high tourist spending. Large-scale infrastructure projects, from expanding airports and ports to new museums and entertainment venues, further fuel domestic demand and investment. These efforts build on the legacy of events like Expo 2020, which boosted tourism and global visibility. This is also supported by ample capital from the UAE’s sovereign wealth funds, which continue to invest in sectors ranging from renewable energy to logistics and technology.

While the UAE’s diversification efforts extend across several sectors, one of the most exciting developments is the country’s emergence as a hub for the digital economy and fintech growth. Targeted public investments in AI, digital infrastructure and advanced technologies are accelerating innovation-driven growth. In the last month, Donald Trump’s visit to the Middle East shone a spotlight on the tech sector building out infrastructure in the region to support the growth of AI. This included Trump’s support for building the largest AI data center outside of the US, in Abu Dhabi, which looks set to establish the UAE as a new hub for AI growth. This is big news for growth and AI-exposed stocks in the region.

At a time when global trade is in the spotlight with tariff talk, the UAE’s been quietly strengthening its economic ties worldwide. Its non-oil trade smashed records in 2024, soaring past AED 2 trillion, a 15% jump from the year before. New trade deals, like the Comprehensive Economic Partnership Agreements (CEPAs), are opening doors to fast-growing markets in Asia, Africa, and beyond, giving UAE exporters a bigger stage. At the same time, the UAE is also focused on sustainability. The country is investing heavily in clean energy and green tech, with a bold plan to triple renewable energy capacity by 2030 as part of its net-zero push. This is not only helping to address global climate goals, but it also spurs growth in new industries, as well as creating thousands of jobs.

Thanks to years of diversification, the UAE is less reliant on oil than in the past, and sizable fiscal buffers (aided by oil windfalls in good years) provide resilience. The UAE does have strong prospects throughout 2025, with a diversified growth engine. But, its main growth engine could be the risk, oil prices. After two supply hikes from OPEC+ and the trade war that is dampening consumption on the world’s largest importer, China, prices are down around 15% this year. A further drop in oil prices could hold back spending on non-oil economic activity, potentially slowing down the growth of diversification in some of the sectors mentioned. However, for investors, the economy offers a compelling mix of high-growth sectors (tourism, tech, infrastructure) backed by prudent economic management.

Related Stories

Lifestyle

Saudia Achieves Global On-Time Performance Milestone Leading the World in Departure Punctuality

06/01/2025

Lifestyle

Valor Hospitality Partners Expands Presence in Saudi Arabia with Hijla Hotel in Abha

29/10/2024

Lifestyle

Canon Middle East Showcases Major Success with New Large Format Tech at FESPA 2025

28/05/2025

Emirates Development Bank Reveals Digital Platform to Support UAE Entrepreneurs

Emirates Development Bank (EDB) has launched EDB 360, a fee-free digital banking platform for entrepreneurs and mSMEs. The platform offers speed, simplicity, and full control, integrating with UAE government services. It allows users to manage payroll, issue invoices, process payments, track cash flow, and access value-added banking services.

Fri, May 23, 2025

On the final day of Make it in the Emirates 2025, (EDB), the UAE’s key financial engine for economic diversification and industrial growth, has launched EDB 360, a groundbreaking, fee-free digital banking platform in the UAE built to supercharge the ambitions of the nation’s entrepreneurs and micro, small, and medium enterprises (mSMEs).

Designed for startup growth in the UAE from day one, EDB 360 breaks down the traditional barriers of business banking in the UAE. With no fees, no minimum balance, and no red tape, it gives UAE entrepreneurs what they need most: speed, simplicity, and full control. Through smart integration with UAE government services, EDB 360 allows users to open a business account in minutes – not days – freeing founders to focus on scaling their ideas instead of navigating paperwork.

H. E. Ahmed Mohamed Al Naqbi, CEO of EDB, said: “At EDB, our mission goes far beyond finance. We help businesses grow, because when they grow, the UAE grows. With EDB 360, we’ve created a zero-bureaucracy, high-impact digital banking platform that gives startups and MSMEs the flexibility, tools, and tailored support they need to build the businesses of tomorrow in the UAE. By removing friction and expanding access to capital and advice, we’re helping turn bold ideas into real economic impact.”

Launched in collaboration with leading government and entrepreneurship bodies in the UAE – including the Ministry of Economy, Ministry of Industry and Advanced Technology (MoIAT), Sharjah Entrepreneurship Center (Sheraa), Khalifa Fund, and the Department of Economy & Tourism (DET) — as well as strategic fintech partners such as Visa, NymCard, Klaim, eFunder, Thoughtworks, and Trade Capital Partners, EDB 360 connects users with the wider UAE startup ecosystem to help them access new opportunities and scale with confidence.

From a single app, users can manage payroll, issue invoices, process payments, track cash flow, and access a growing suite of value-added banking services — including smart fintech integrations and a dedicated EDB Concierge that provides real-time support for startup banking and business scaling in the UAE.

Entrepreneurs operating in EDB’s priority sectors benefit from sector-specific financing, digital tools, and expert guidance aligned with the UAE’s broader Vision 2031 for economic transformation. Now available on iOS and Android, EDB 360 marks a major leap forward in building a smarter, more connected digital banking infrastructure for the UAE’s startup economy.

Related Stories

![]()

Lifestyle

Maserati Unveils Its Latest Masterpiece at “The Quail, a Motorsports Gathering” event in California

08/08/2024

Property

Emaar to Invest $3.8B in Creek Tower AND Mall Development: S&P

20/03/2025

Property

Al Habtoor Tower Sets New Records with Remarkable Construction Progress in Just 12 Months

13/08/2024

Bitcoin Reaches Record High Amid $2.2T Market Cap Surge

Bitcoin’s all-time high may signal a potential explosion, with global liquidity expected to rise, US debt downgrade, Fed intervention, and lowered interest rates affecting demand for treasuries. Increased capital and companies adopting bitcoin treasury strategies.

Fri, May 23, 2025

has hit a new all-time high; however, this could just be the start of something far greater.

There are a number of narratives stewing that could cause the bitcoin price to explode.

Firstly, global liquidity – essentially how much money is available in the global economy and a metric which the bitcoin price closely mirrors – is forecast to increase throughout the year. With the recent downgrade of the US credit rating, and the amount of debt that it needs to be refinanced this year, it will be interesting to see what demand is now like for newly issued treasuries. A failure at auction, as in not enough buyers, could mean the Fed has to intervene, provide the cash for these bonds and increase its balance sheet. Historically the price of bitcoin has been seen to rise in line with a growing Fed balance sheet.

Other developed countries such as China, UK, Europe, Australia are lowering interest rates and loosening financial conditions which we’ve historically seen bode well for crypto asset prices.

Secondly, a vast number of buyers and increased amounts of capital are all chasing a fixed supply. As well as individual investors, more publicly traded companies are adopting bitcoin treasury strategies, buying billions of dollars’ worth at a time. Pension and sovereign wealth funds are also increasing their exposure to bitcoin through spot ETFs and in turn hoovering up more of the available supply.

Where the price tops out this bull market remains to be seen. What is evident is that if is really to be the global reserve currency or asset then its market capitalization (and in turn price) should be far higher than the $2.2 trillion that we are currently at today.

Related Stories

Lifestyle

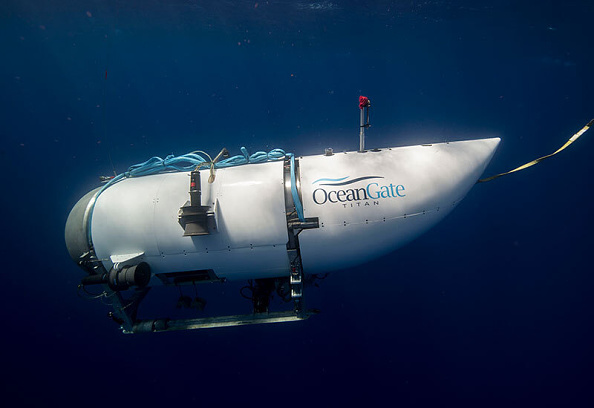

What Was Running the Titanic Submersible? It Could Be a $49.99 Videogame Controller

By JOSEPH DE AVILA 22/06/2023

Lifestyle

Major Partnership Between Mohamed Yousuf Naghi Motors and Budget to Add Premium BMW and MINI Vehicles to Rental Fleet

03/09/2024

Lifestyle

Abu Dhabi Businesswomen Council teams up with Rotana Hotels Group

04/04/2025