What Zohran Mamdani Win Will Mean For Wall Street

Andrew Cuomo was the preferred candidate early on, buoyed by entrenched relationships and steady ... More support from the financial sector.

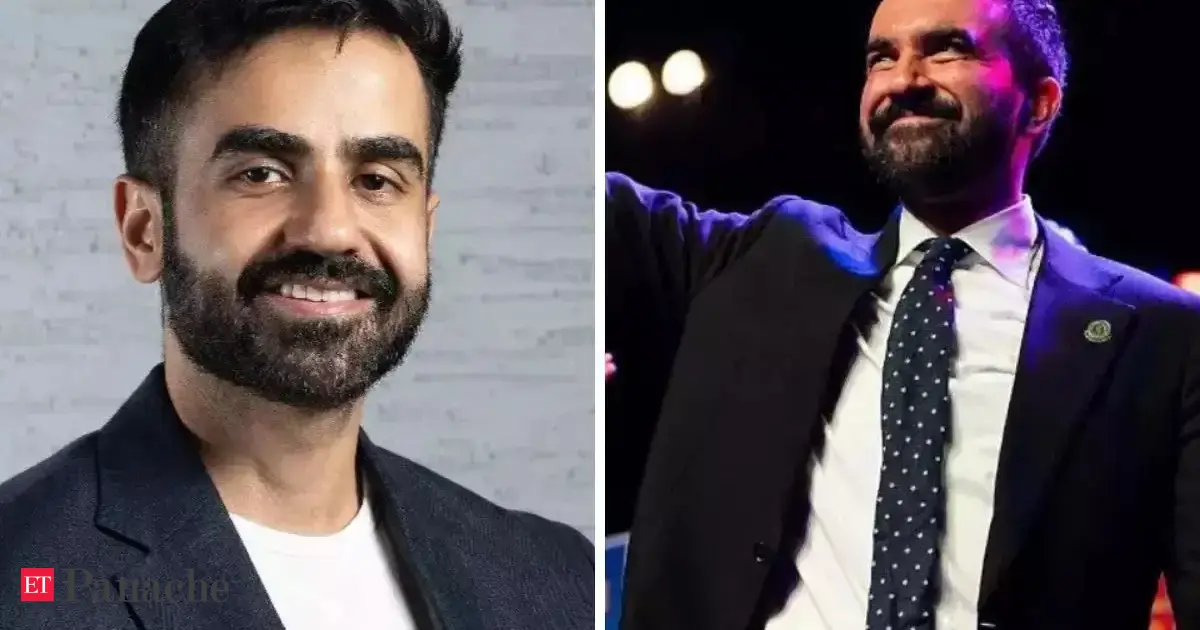

AFP via Getty ImagesZohran Mamdani, a progressive newcomer, appears set to claim the Democratic nomination for mayor of New York following a remarkable upset victory. On Tuesday, the 33-year-old democratic socialist announced his triumph in the party’s primary, overcoming seasoned political figure Andrew Cuomo, a former governor of the state and Mamdani’s leading competitor. Cuomo was the preferred candidate early on, buoyed by entrenched relationships and steady support from the financial sector. This marks a pivotal moment not just for City Hall, but for Wall Street, whose influence on New York governance may be upended.

Wall Street has long favored reliable centrists like Cuomo, who boasted over $27 million in Super PAC backing and institutional endorsements from figures such as Bill Clinton and Michael Bloomberg. Cuomo’s prior tenure as governor reaffirmed his reputation as pro-business and fiscally disciplined, attributes investors typically prize.

By contrast, Mamdani’s platform is unapologetically progressive, featuring rent freezes, publicly owned grocery stores, free city buses, universal childcare, and a targeted millionaire’s tax to hike state income tax by 2% and corporate tax from 7.25% to possibly 11.5%. His plan anticipates raising $20 billion and harnesses public-sector economics in ways that challenge conventional market orthodoxy.

Already, private-sector financiers are expressing concern. Recent coverage describes Mamdani’s agenda, especially proposals to tax the wealthy and control key urban services, as rattling boardrooms across the city. Analysts note Mamdani’s promises to raise corporate taxes and income taxes on millionaires and freeze rents raise the specter of a leftward shift for America’s biggest city. For those whose returns depend on stable property values, labor flexibility and manageable regulation, the prospect of a socialist-driven municipal agenda introduces significant uncertainty.

Not all financial analysts are sounding the retreat. Proponents argue Mamdani’s strategy reflects strong public sentiment, especially amid affordability crises. His proposal for city-owned grocery stores, aimed at breaking food deserts, is projected to use purchasing power to bring down staple prices. This could reshape supply chains and consumer behavior across the city.

Moreover, his successful fare-free bus pilot boosted ridership by 30% on select routes, reduced assaults on operators, and injected life into transit-dependent corridors. If scaled, this could lower costs for families, expand urban mobility, and catalyze adjacent property investments.

Mamdani, a once-obscure state legislator first elected in 2020, has legislative chops. He has pushed major housing and public-transit reforms, secured over $100 million for subway service improvements, and co-sponsored hundreds of bills. Still, Wall Street remains skeptical about whether he'd walk back policies that threaten capital flows and portfolio performance.

In debates, Cuomo attacked Mamdani’s experience, calling his ideas unrealistic. That critique will echo in boardrooms and investor forums if Mamdani wins the general election and especially if he advocates further tax hikes, regulatory intervention, or workforce restructuring.

While the full ranked-choice results are not yet certified (due mid-July), Mamdani has conceded comparisons to Alexandria Ocasio-Cortez’s ascent and signals a generational realignment in city and national politics.

Incumbent Mayor Eric Adams, running as an independent, and Cuomo (considering a comeback on a third-party line) could split the moderate vote in November. If Mamdani wins, he will become the first Muslim, first Asian, and first millennial mayor of New York City.

For financial markets, the risk and opportunity hinge on policy tone and execution. If Mamdani governs pragmatically, implementing targeted programs while preserving business-friendly frameworks, Wall Street may respond with cautious engagement.

However, if he moves aggressively on taxation and regulation, or when geopolitical stances (notably around Israel-Palestine) intersect with international business interests, markets could react sharply.

For firms with major stakes in real estate, consumer goods, or infrastructure, the call is clear: get ready to recalibrate forecasts. Lenders, developers, retailers, and public-private partnerships will need to adapt to what may become a truly transformational civic experiment, with New York now as its epicenter.

Bottom line: Mamdani’s primary win challenges traditional financial assumptions. It signals that Wall Street’s inroads with City Hall are no longer guaranteed. But whether Mamdani proves to be a revolutionary or a reformist mayor remains to be seen. For now, the city’s fiscal future, and financial markets’ orientation to it, hang in the balance.

For more like this on Forbes, As Warren Buffett Steps Down, What’s Next For Financial Leadership? and What Discord CEO’s Departure Means For Finance Professionals.