This AI Startup Cracks Open Pre-IPO Investing For Everyone

Jarsy’s AI-driven platform bridges the gap between retail investors and private equity — no finance ... More degree or crypto wallet required.

gettyWhen Han Qin launched Jarsy, he didn’t just want to build another investing app. He wanted to crack open the velvet ropes of private equity — where firms like SpaceX, Anthropic, and Stripe trade hands in boardrooms, not browsers. Qin’s startup, now out of stealth with $5 million in backing led by Breyer Capital, is betting that a new generation of investors won’t wait around for IPOs they can’t touch.

They want in. Now.

Jarsy offers retail investors access to pre-IPO companies via tokenized shares that are 1:1 backed by real equity held in custody. It’s not equity in the legal sense — token holders have no voting rights or ownership — but it’s price-exposure. And for many, that’s enough.

Minimum investment? Ten bucks.

Regulatory hoops still exist. In the U.S., Jarsy must follow Regulation Fair Disclosure, meaning users must self-certify as accredited investors. But Qin is quick to point out that the income threshold for accreditation is $200,000 individually, or $300,000 for a household — not the million-dollar club most assume.

Outside the U.S., Jarsy leans on Regulation S, allowing wider participation.

So far, users have requested tokens tied to AI companies like Anthropic and Perplexity, fintech firms like Circle and even lesser-known names like Redbud Materials. If enough users express interest in a company, Jarsy pursues it. Demand drives the portfolio.

“We don’t push deals top-down,” Qin said. “We listen to what our users want, then go get it.”

Qin isn’t trying to woo crypto maximalists. In fact, half of Jarsy’s users have never touched blockchain before. They sign in with an email. No seed phrases. No gas fees. Jarsy creates the wallet, handles “know your customer” and anti-money laundering verification requirements as well as manages the paperwork. They don’t even issue a Jarsy token — only asset-backed tokens linked to specific companies.

AI is a quiet force in the background. “We’re leveraging AI for coding, which really makes our development efficient,” Qin said. “And on our roadmap, we’re building a chatbot-style financial service experience. Younger users don’t want to call someone. They want fast answers. They want AI to handle it.”

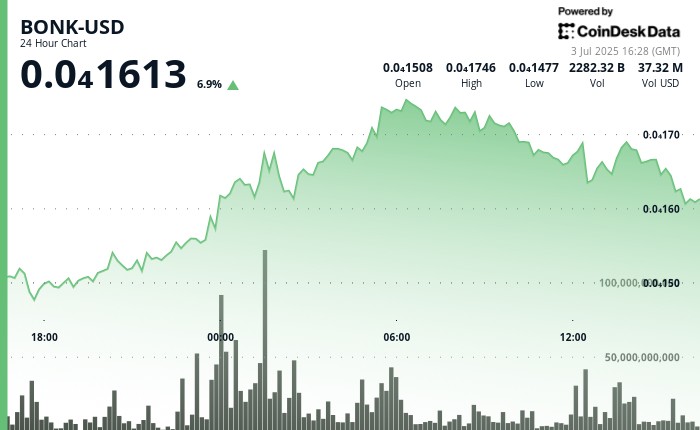

Under the hood, Jarsy runs on Ethereum and other compatible blockchains, with plans to add Solana. Transactions settle in the USDC stablecoin. And once a company goes public, users can redeem their tokens for the market equivalent in a stablecoin.

If the company never IPOs? Users can eventually list their tokens on a secondary market inside Jarsy, naming their price. That feature isn’t live yet, but it’s in the works.

Jarsy is building slowly, deliberately. The platform is live on mainnet. The user interface mimics Robinhood. And the team — ex-Uber, ex-Facebook, ex-Square — is tiny but experienced.

Three other platforms dominate the “pre-IPO for the people” category. Each takes a different path. None offer Jarsy’s full combo of blockchain transparency, a retail-friendly AI user interface and global reach.

Fundrise requires just $10 to get in, same as Jarsy. It’s an SEC-registered fund open to non-accredited investors. The twist: it operates like an index of pre-IPO and public tech companies, spreading risk across high-profile names like OpenAI, Ramp and Databricks. Fundrise doesn’t tokenize shares, and users don’t pick individual companies. It’s passive exposure, not direct access.

ARK Venture Fund offers hybrid exposure to private and public innovation stocks. The entry point is higher with a $500 minimum and liquidity is limited to quarterly redemption windows. ARK’s advantage is brand recognition. It’s not a blockchain play either. But it gives users a professionally managed basket of bold bets: SpaceX, Tesla OpenAI. Jarsy, by contrast, is self-directed and responsive.

Hiive is the most direct and transparent pre-IPO marketplace but only for accredited investors. Minimum investment thresholds start at $25,000. Users trade shares directly with existing shareholders. Hiive offers real-time bid-ask spreads and facilitates more than $100 million in monthly volume. It's Wall Street's private exchange. Jarsy wants to be Main Street’s.

Jarsy doesn’t promise ownership. It doesn’t pretend to be fully decentralized. It’s not trying to replace venture capital. But it does give retail investors a simple way to ride the upside of companies they actually care about—long before Wall Street gets in.

The question now isn’t whether people want access. It’s whether Jarsy can scale that access fast enough.

Because the gates are cracked open. And Gen Z is already pushing through.

ForbesJudge Backs AI In Copyright Case — Expert Says It Creates More Questions