The health care sector is a mixed picture, but Abbott Labs is a buy.

Photographer: Jamie Kelter Davis/Bloomberg

© 2024 Bloomberg Finance LPThe health care sector has declined by 0.18% in 2025. This is better than the S&P 500’s drop of 6.06%.

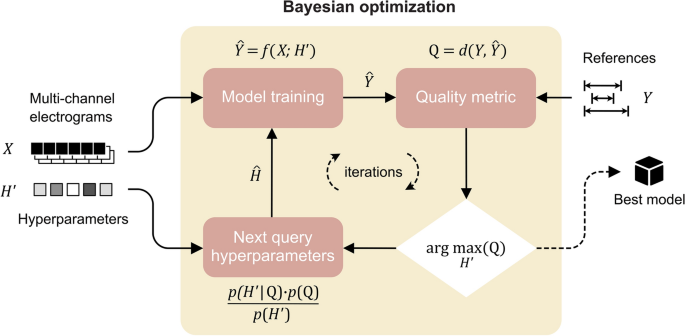

The Health Care Select Sector SPDR Fund (XLV) is graphed below. Looking within the sector is instructive. Market sentiment and breadth in the sector are at lows only seen during excessive selling. Short-term, the percentage of healthcare stocks exceeding their lower Bollinger Band suggests a near-term low. There is also insider buying, a positive signal that is not showing up in other sectors. The graphs tell us more.

We see that relative strength has been rising since September. This is short of the six-month minimum that would be an indication of a sustained rally. Weekly, relative strength and seasonality are both favorable. The months of March through July each have positive expected return. Turning to the dynamic cycles, the monthly cycle rises into July. The stronger stocks within healthcare are likely to do well such as Abbott Laboratories.

Weekly, relative strength is turning up.

Cycles Research Investments LLCThe months of March through July have shown positive relative strength.

Cycles Research Investments LLCThis cycle peaks in July.

Cycles Research Investments LLCWeekly, Abbott has reversed a relative downtrend that began in January 2023. The stock had been underperforming while the market rallied in 2024. The stock appears in a position to lead. In fact, Abbott is in thirteenth place in the relative standings in the S&P 100. Monthly, the stock is not overbought as many other large-cap shares are. The last two graphs are most constructive. The monthly histogram reveals strong seasonality and the dynamic monthly cycle is rising through 2025. The $140 level is the near-term target and the objective for yearend is $160.

Weekly, relative strength has reversed a two-year downtrend.

Cycles Research Investments LLCSeven of the next eight months have had a positive expected return.

Cycles Research Investments LLCThis accurate cycle rises through 2025.

Cycles Research Investments LLC