Netherlands Diabetes Device Market Forecast 2025-2033

The Netherlands Diabetes Device market is experiencing substantial growth, with a valuation of US$ 343.4 million in 2023 projected to reach US$ 641.7 million by 2032. This represents a Compound Annual Growth Rate (CAGR) of 7.20% from 2024 to 2032. Key factors driving this growth include increased health awareness, proactive government initiatives, continuous technological advancements in diabetes management, and a rising prevalence of diabetes throughout the Netherlands.

The increasing prevalence of diabetes, particularly Type 2, which accounts for approximately 90% of all diabetes cases, is a significant concern. In 2021, there were 1.1 million diagnosed cases, with 58,000 new cases annually. Diabetes has become a leading cause of morbidity and mortality, contributing to nearly 12,000 deaths in 2019. This has spurred demand for effective disease management tools, including self-monitoring devices, continuous glucose monitoring (CGM) systems, insulin pumps, and insulin pens.

Diabetes devices play a crucial role in helping patients manage their blood glucose levels and mitigating the risk of complications. Key devices include portable blood glucose meters, insulin pumps, and CGMs, which provide accurate and timely measurements, enabling informed decisions about medication, diet, and exercise. Technological improvements have enhanced the accuracy, portability, and convenience of these devices, making them essential tools for diabetes management. Devices such as insulin pumps have gained popularity for their flexible and precise insulin delivery, improving patient comfort and overall quality of life.

Several factors contribute to the growth of the Netherlands Diabetes Device market. The aging population in the Netherlands is leading to a rising incidence of Type 2 diabetes. As people age, insulin sensitivity decreases, and lifestyle factors like sedentary behavior increase the risk of diabetes. This demographic shift has created greater demand for efficient monitoring technologies, such as insulin delivery systems and CGMs.

The growing adoption of remote monitoring technologies, particularly in diabetes care, is transforming the healthcare landscape. The rise of telehealth and mobile health (mHealth) applications has enabled patients to monitor their glucose levels in real-time without frequent hospital visits, improving diabetes management through proactive care and timely interventions. The increasing adoption of CGMs and mobile health applications is expected to further accelerate market growth.

Advancements in diabetes technology, including smarter insulin pens, patch-based insulin pumps, and next-generation CGMs, are optimizing diabetes care by offering greater convenience, improved accuracy, and better control, which enhances patient outcomes. For example, the Dexcom ONE+, a real-time CGM introduced in Europe by Dexcom in 2024, allows patients to monitor glucose levels at multiple body locations, improving accuracy and comfort.

The market is segmented by type, including self-monitoring devices like blood glucose meters, which are essential for day-to-day monitoring and offer users the flexibility to check their glucose levels at home. CGMs are a growing segment, driven by the increasing demand for remote monitoring solutions, providing real-time data to both patients and healthcare providers, which is essential for those requiring constant monitoring. Insulin pumps are increasingly popular for their accurate insulin delivery, particularly beneficial for patients with Type 1 diabetes, while insulin pens provide a convenient and precise alternative to traditional syringes for insulin administration.

End-users of these devices include hospitals, where advanced monitoring equipment is essential for managing complex cases of diabetes, and diagnostics centers, which play a vital role in diabetes diagnosis and initial care. Homecare settings have seen significant growth in demand for diabetes devices, driven by the increasing need for self-management solutions and remote monitoring technologies.

Key players in the Netherlands Diabetes Device market include Dexcom Inc., a leader in continuous glucose monitoring solutions; Medtronic, offering a range of insulin pumps and CGM systems; Roche, providing diabetes management solutions like the Accu-Chek® Guide System; Abbott Laboratories, known for its Freestyle Libre CGM system; Eli Lilly, a significant player with its KwikPen insulin pen; Terumo Corporation, providing insulin pens and other devices; and BD, a global leader in medical devices, including diabetes management products.

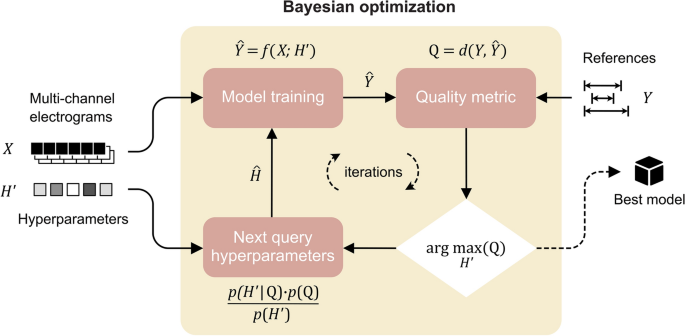

Market trends and innovations include a shift towards digital health solutions and remote monitoring, the integration of artificial intelligence (AI) with CGMs and insulin pumps to enhance data interpretation and treatment optimization, and the growing popularity of wearable diabetes devices that provide real-time tracking, offering increased comfort and convenience for patients.

In conclusion, the Netherlands Diabetes Device market is on a robust growth trajectory, fueled by technological advancements, an aging population, and the rising demand for remote monitoring solutions. The market's expansion is also supported by the increasing prevalence of diabetes and continuous innovation in diabetes management devices, promising a future where diabetes care is more convenient, efficient, and personalized for patients across the Netherlands.