President Tinubu Signs New Law for Capital Market

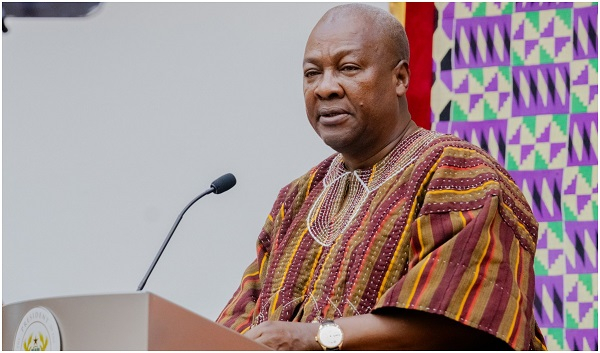

President Bola Tinubu has recently approved the Investments and Securities Act (ISA) 2025, marking a significant overhaul of Nigeria's capital market regulatory landscape. This new legislation repeals the Investments and Securities Act No. 29 of 2007 and introduces a suite of reforms aimed at bolstering investor protection, enhancing market integrity, and fostering sustainable growth. The Act reaffirms the Securities and Exchange Commission (SEC) as the apex regulatory body and equips it with enhanced powers to align Nigerian market operations with global best practices.

Dr. Emomotimi Agama, the Director General of the SEC, emphasized that the ISA 2025 is a testament to Nigeria's commitment to creating a dynamic and resilient capital market. The Act addresses regulatory gaps, promotes innovation, and aims to position Nigeria as an attractive destination for both local and foreign investments. Agama commended all stakeholders for their collaboration and called for continued cooperation in implementing the ISA 2025.

The ISA 2025 introduces several key provisions. It classifies Securities Exchanges into Composite and Non-composite Exchanges. A Composite Exchange handles all categories of securities and products, while a Non-composite Exchange specializes in a singular type. The Act also includes new provisions for Financial Market Infrastructures (FMIs) like Central Counter Parties, Clearing Houses, and Trade Depositories, enhancing their regulatory oversight.

One of the most forward-looking aspects of the ISA 2025 is its recognition of virtual/digital assets and investment contracts as securities. This brings Virtual Asset Service Providers (VASPs), Digital Asset Operators (DAOPs), and Digital Asset Exchanges under the SEC's regulatory purview, reflecting the growing importance of digital finance. The Act provides comprehensive insolvency provisions for FMIs, exempting transactions facilitated through them from general insolvency laws, thereby reducing systemic risk.

The Act also introduces measures for monitoring, managing, and mitigating systemic risk in the Nigerian capital market. It expands the category of issuers to the public, paving the way for innovative products and offerings, subject to SEC approval. A new section regulates Commodities Exchanges and Warehouse Receipts, essential for developing the commodities ecosystem.

Addressing prior limitations, the ISA 2025 eases restrictions on sub-nationals and their agencies raising funds from the capital market, providing greater financial flexibility. It mandates the use of Legal Entity Identifiers (LEIs) in capital market transactions, enhancing transparency. In a significant move to protect investors, the Act expressly prohibits Ponzi schemes and prescribes stringent penalties for their promoters.

The Investments and Securities Tribunal is also strengthened through amendments to its composition, constitution, and the qualifications of its Chief Registrar, enhancing its ability to fulfill its mandate. The SEC expressed gratitude to the National Assembly, the Minister of Finance, and the Minister of State for Finance for their roles in enacting the ISA 2025.

Prof. Uche Uwaleke, President of the Capital Market Academics of Nigeria (CMAN), lauded the new law for modernizing Nigeria’s investment and securities laws, improving regulatory oversight, protecting investors, and supporting emerging financial technologies. He noted that the ISA 2025 addresses key issues such as digital assets, investor protection, and financial market infrastructure, boosting investor confidence and strengthening the capital market.

In summary, the ISA 2025 represents a comprehensive effort to modernize and strengthen Nigeria's capital market. By enhancing regulatory powers, promoting transparency, and embracing digital finance, the Act aims to foster a more dynamic, inclusive, and resilient market that attracts both local and foreign investments.