Pop-ups, ads, banners and games: How quick commerce app designs have changed - The Economic Times

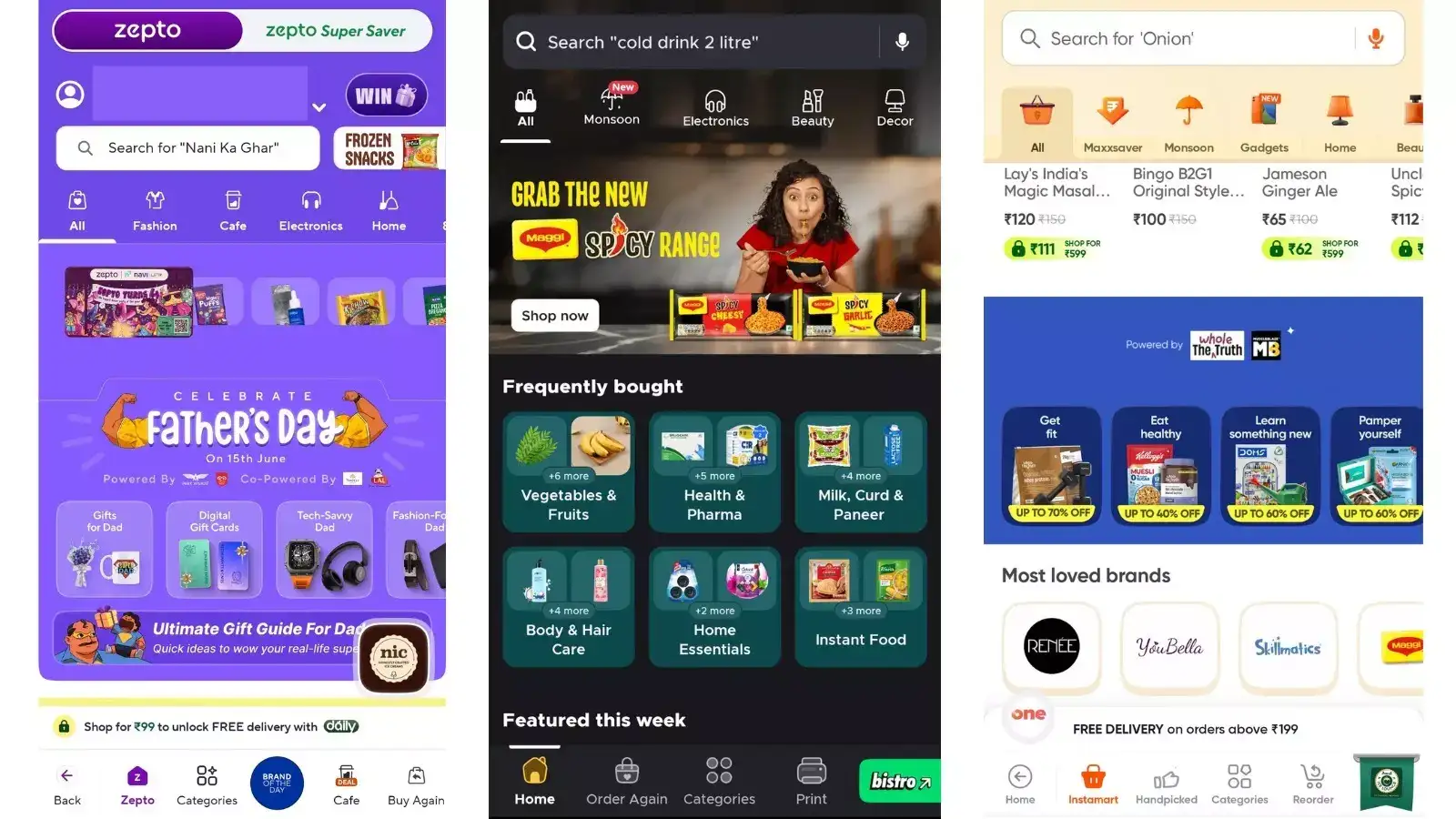

Market leader Blinkit’s user interface, according to respondents to the survey, is less cluttered than the nearest rivals.

Several users said they prefer apps that have a simpler user interface (UI) and offer a less taxing user experience (UX).

Zepto, Blinkit and Instamart did not respond to ET's queries on their changing UI/UX designs and consumer response.

Quick commerce apps are pulling out all the stops to retain consumers amid intense competition, while also under pressure to turn profitable.

Quick commerce sprints ahead but still a small slice for FMCG giants

According to industry experts, these companies seem to believe that apps with fast-moving graphics, interactive games and banners, as well as sponsored content, are the best way to achieve this goal.

For instance, two weeks back, Zepto integrated mini games such as ‘blow the candles’ and ‘release the balloons’ on the app. These games appear on the screen as soon as a user opens the app.

ETtech

ETtech“These apps have ads and banners on the first half of the page and also on the bottom right corner which is the area where the user’s thumb can easily access,” said Tushar Shahi, a Bengaluru-based software engineer. “Usually companies try to fit ads, important information and sponsored content in these areas because there are more chances of interaction. However, from a user’s perspective, it could make the app feel cluttered and difficult to use.”

UI/UX designers and software developers say the front page of the app is the key to retain a user. “It is important that the front page of the app loads within seconds. It must have all the necessary options like search bar, category section, etc., within the top half of the page because that’s where the users’ eyes first go,” said Shahi.

ETtech

ETtechAccording to Chandan Mishra, chief technology officer Rubick.ai, as quick commerce companies increase their assortment of products and have more direct-to-consumer brands on board, it becomes essential to have videos and banners on the app informing users about the new brand and its products. Rubick.ai provides AI solutions for digital marketplaces such as Amazon, Myntra and Swiggy.

“Platforms are onboarding more D2C brands and increasing the assortment because they need to increase the margins on their earnings,” Mishra said. “Customers need to know about the new brands and what they offer before making a purchase. This is why you will see short videos of some products on these apps. This is helping the customers make informed decisions. Platforms are still figuring out how to make the UI/UX work on top of this.”

Furthermore, to stand out from the pack, quick commerce apps have been trying to build brand recall value through UI/UX tweaks. For instance, last month Zepto introduced a search prompt, ‘Monday’, which throws up results for coffee, tea, massagers, chocolates, etc. This happened after a LinkedIn user suggested this would be a good way for Zepto to drive away customers’ Monday blues.

The number of discounts and segments such as ‘super saver’ and 'maxxsaver' on the apps has also increased significantly. ET reported on June 16 that across quick commerce platforms, the average discounts in various categories rose to 20–25% on maximum retail price compared with below 10% two years ago.

Notably, the number of sponsored products and brands on the apps has increased significantly. Revenue from advertising has been a key margin driver for consumer internet companies.

In fiscal 2025, top quick commerce companies, including Blinkit, Zepto and Instamart, together posted ad revenues of more than Rs 3,000 crore. According to industry executives, more than 90% of the revenue from these ads flows directly to a company’s bottom line.

Blinkit’s average monthly transacting users in the fourth quarter of FY25 increased to 13.7 million from 6.4 million reported a year before. For Instamart, this number increased to 9.8 million from 4.7 million.

While native advertising — ads run by brands that sell their products on the platform — has picked up, the rapid user growth has meant that non-native advertising has also gained momentum. Non-native advertisers include companies in the financial services, automobile, and media and entertainment spaces, which don’t directly sell on quick commerce apps.

Other ecommerce platforms have also seen a spurt in their advertising revenue, but quick commerce companies have seen faster growth. Amazon Seller Services, the Indian marketplace arm of global ecommerce platform Amazon, reported that revenue from advertising increased 24% to Rs 6,649 crore for the fiscal year ended March 2024. Flipkart Internet, the marketplace arm of Flipkart, generated nearly Rs 5,000 crore from advertising in FY24.

In the last six months, quick commerce has broadened its footprint, even going into tier-2 and tier-3 cities. Instamart touched the 100-city mark in March. Flipkart Minutes, which has 400 dark stores in 19 cities, is seeing increasing traction from customers across metros, tier-1, and tier-II regions, Kanchan Mishra, vice president at Flipkart Minutes, told ET in an earlier conversation.

To cater to this demand, apps are launching local recommendations that users in these cities can relate to. “Most apps are localised in the sense of region, religion, celebrations, etc. An app’s look and feel is modified so that it’s relevant to the users of that region,” said Anirudh Kotgire, cofounder of food delivery app Waayu. “However, these modifications do not elevate the user experience every time.”

Quick commerce apps started as last-minute purchase platforms but are now turning into marketplaces as they fight to become profitable, according to Kiran Ramakrishna, chief executive of Rubick.ai.

By marketplaces, he means an online platform that connects sellers and customers of various products, like Amazon or Flipkart. “The platforms are trying to find a balance between assortments and clean UI/UX,” Ramakrishna added.

Satish Meena, founder of Datum Intelligence, an ecommerce and quick commerce consultancy firm, believes the motivation is to simply make sure that the customers open the apps more frequently and place orders. “Ultimately, high-frequency orders are placed on quick commerce — like groceries. Through these games and deals, platforms want to increase the time spent on the app and convert some of these users to buyers of non-need-based items.”

Some users and industry experts, however, have flagged this approach, warning of the Qcommerce brigade’s reliance on “dark patterns” to make their customers buy non-essential items. Dark patterns are deceptive UI design techniques digital platforms rely on to trick customers into a purchase they wouldn’t have made otherwise. ET wrote about the government’s move to clamp down on the ‘dark patterns’ used by consumer internet companies on June 21.

Read More News on

Read More News on

Stories you might be interested in