Nvidia Becomes World's Most Valuable Company

Nvidia's stock has surged to a record high, catapulting the AI chip giant to become the world's most valuable company, surpassing tech titans Microsoft and Apple. This significant milestone was reached as its market valuation soared, at one point crossing $3.7 trillion, driven by the escalating demand for its artificial intelligence chips.

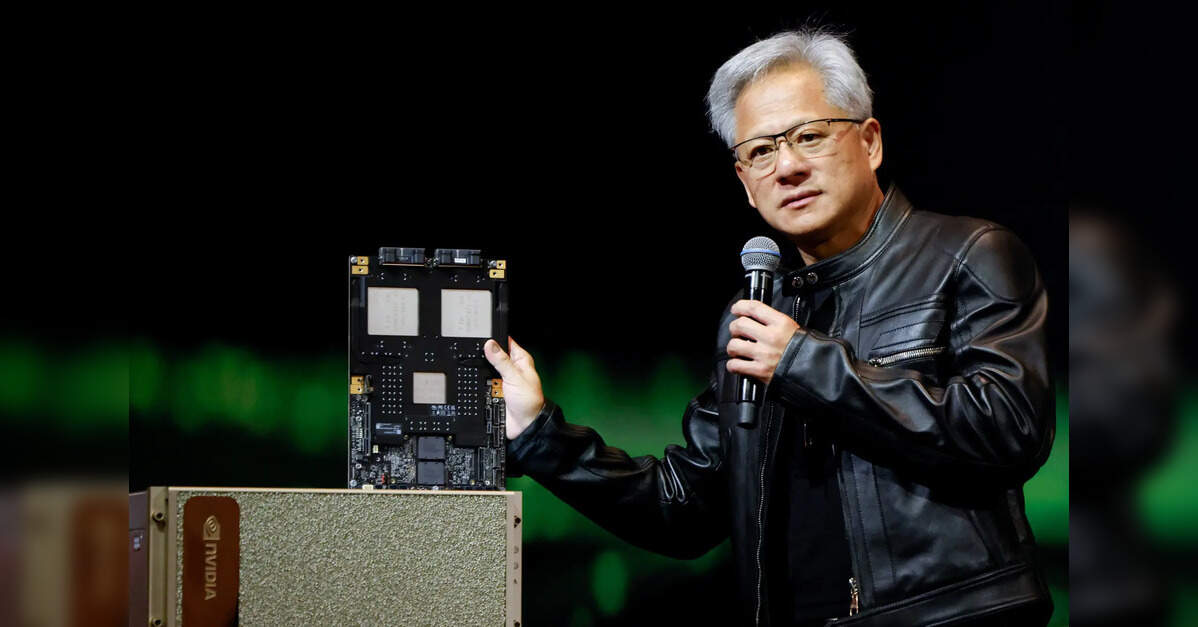

The company's ascendancy is directly linked to its dominant position in providing graphics processing units (GPUs) essential for training and running large language models and other AI systems. Nvidia CEO Jensen Huang has been a strong proponent of the ongoing AI revolution, emphasizing the shift from traditional data centers to 'AI factories' designed to produce artificial intelligence as a new commodity. This vision resonates with growing interest in AI technologies globally, with the EU even recognizing the imperative of 'sovereign AI,' an idea championed by Huang.

Nvidia's stock experienced a notable 4.3 percent increase, reaching $154.31, which further cemented its market leadership. This remarkable performance follows a 63 percent rally from its April low, adding nearly $1.5 trillion to its market capitalization. Recent earnings reports have indicated robust growth and future strength, even amidst restrictions on advanced semiconductor sales in China. Major tech companies, including Microsoft, Meta Platforms, Alphabet, and Amazon.com, which collectively account for a substantial portion of Nvidia’s revenue, continue to aggressively invest in their AI infrastructure, further underlining the sustained demand for Nvidia's products.

The company's rapid rise underscores the high expectations for AI development and adoption. Nvidia continues to innovate, with new chip lines like its Blackwell series expected later this year, which could further solidify its market dominance. While Nvidia's revenue figures, at $26 billion in its latest quarter, are still lower than those of Microsoft or Apple, investors are placing significant bets on its future growth potential in the rapidly expanding AI sector. The company faces competition from players like AMD, Intel, and even its own customers who are developing proprietary chips, but its current success signals a fundamental shift in the tech world's center of gravity from software to silicon.

In the broader market context, the day Nvidia reached its record high was characterized by a mixed performance across US stock market indexes. The broad-based S&P 500 remained flat at 6,092.16, while the tech-rich Nasdaq Composite Index gained 0.3 percent to 19,973.55. The Dow Jones Industrial Average finished down 0.3 percent at 42,982.43. Other notable movements included FedEx falling 3.3 percent due to an uncertain global trade outlook, Tesla dropping 3.8 percent following declining car sales in Europe, and General Mills declining 5.1 percent after a disappointing forecast. Conversely, large banks like JPMorgan Chase and Citigroup saw gains of one percent or more, as the Federal Reserve proposed easing capital rule requirements. This mixed session followed two strong days for equities, attributed to the stabilization of conditions in the Middle East with a ceasefire agreement between Iran and Israel.