AMD Stock Rises Over 9% Following New AI Chip Reveal

Advanced Micro Devices (AMD) has captured significant investor attention, with its stock soaring over 9% following the unveiling of its latest generation of AI chips. This surge occurred after the company's "Advancing AI" event on June 16, 2025, where AMD laid out an ambitious future AI roadmap and introduced new hardware designed to compete in the rapidly expanding artificial intelligence market. The positive developments have led major analysts to raise price targets, prompting widespread speculation that AMD may finally be experiencing the breakout moment investors have long anticipated, backed by rising trading volume and bullish forecasts.

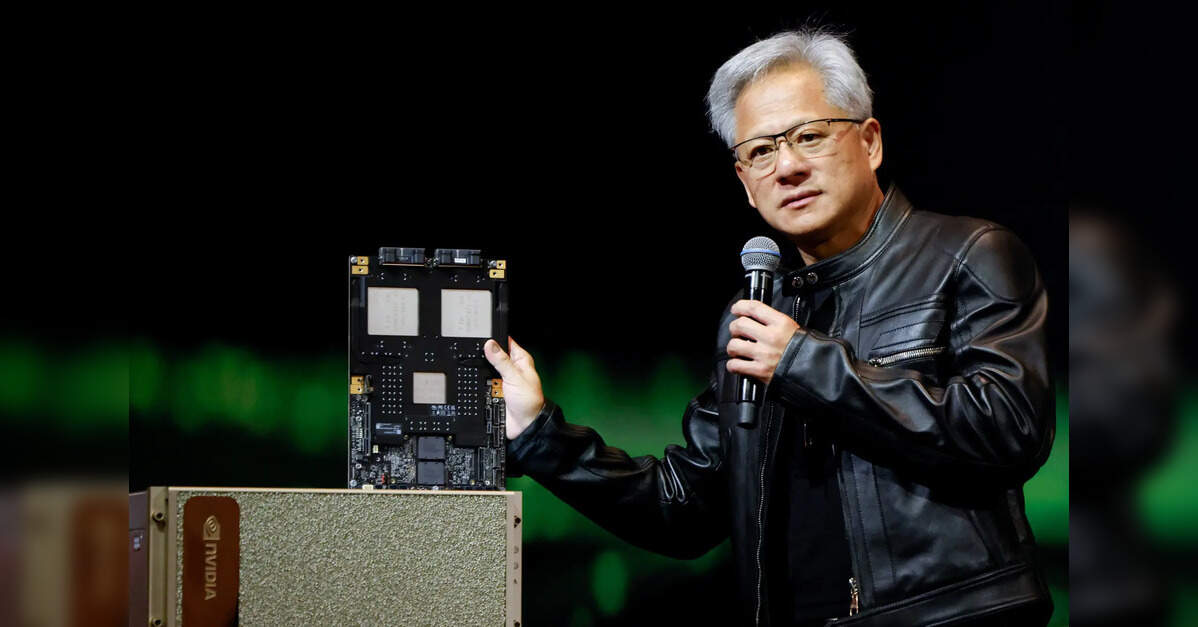

At the heart of this excitement is AMD's strategic pivot and robust product announcements. The company officially unveiled the Instinct MI325X AI chip, expected to ship in the fourth quarter of 2024. Looking further ahead, AMD detailed plans for its MI350 series, slated for release in 2025, and teased the upcoming MI400 chips, which are set to launch in 2026. The MI400 series will feature a new "Next" architecture, specifically engineered for high-performance AI computing. Additionally, AMD introduced Helios, a cutting-edge rack-scale AI platform designed to house its future MI400 accelerators, signaling a comprehensive approach to AI infrastructure.

The immediate reaction from Wall Street analysts was overwhelmingly positive. Following the event, Hans Mosesmann of Rosenblatt significantly raised his price target for AMD from $200 to $250. Similarly, Piper Sandler increased its target from $125 to $140, describing the announcements as "impressive" and suggesting they could provide AMD with a substantial advantage in the fiercely competitive AI chip sector. Other leading financial institutions, including Citi and Bank of America (BofA), also upgraded their price targets, citing strong product momentum and even acknowledging AMD's $6 billion stock buyback program as a factor contributing to investor confidence.

Several key factors explain the rapid appreciation in AMD's stock price. Beyond robust analyst support, the pervasive momentum in the AI sector is a significant driver. Investors are actively seeking companies that are at the forefront of developing chips for AI and data centers, and AMD's new product lineup is clearly positioned to directly challenge Nvidia, the current dominant player in this space. Furthermore, the sheer volume of trading activity underscored strong market belief: AMD's daily trading volume on June 16 exceeded 67 million shares, more than double its average, indicating substantial buying interest and conviction in the company's future performance.

The question on many investors' minds is whether it's too late to invest in AMD. Despite climbing approximately 60% since its low of around $78 in April, the stock remains about 30% below its 2023 peak of $184.92. This gap suggests potential for further growth, especially if its new AI chips gain significant market traction. Analyst sentiment remains largely bullish, with TipRanks reporting that 35 out of 54 analysts rate AMD as a "Buy," reinforcing the optimistic outlook for the company's stock.

However, potential risks exist. Notably, U.S. chip export rules could impact AMD's future revenue, potentially reducing it by up to $800 million. While this figure is substantial and could affect margins in the second and third quarters, most analysts view it as a manageable headwind rather than a fundamental threat to AMD's long-term trajectory.

The central challenge for AMD is its ability to truly compete with Nvidia in the burgeoning AI chip market. While Nvidia currently holds a commanding lead, AMD is actively working to bridge the gap. Its newer products are increasingly being integrated into major server systems, and its strategic focus on open-source AI platforms aims to carve out a distinct competitive advantage. AMD's strategy hinges on offering superior scalability and cost efficiency, hoping that its MI325X and MI350 chips can deliver competitive performance at a more attractive price point. Success in this area could enable AMD to secure a significant share of the AI market in 2025 and beyond.

In conclusion, AMD stock is undoubtedly worth watching closely. The combination of its aggressive product roadmap, widespread analyst upgrades, and strong investor interest suggests that the recent surge is more than just a fleeting, hype-driven bump; it may signify a fundamental shift towards long-term AI-driven growth. While monitoring chip export regulations and future earnings reports will be crucial to assess AMD's execution on its ambitious AI plans, the current market sentiment indicates that AMD is making a decisive move, and the entire market is observing its progress.