When to Choose Invoice Factoring

Invoice Factoring vs Supply-Chain Finance: Which Is Best for Contractors?

Last Updated on July 2, 2025 by Admin

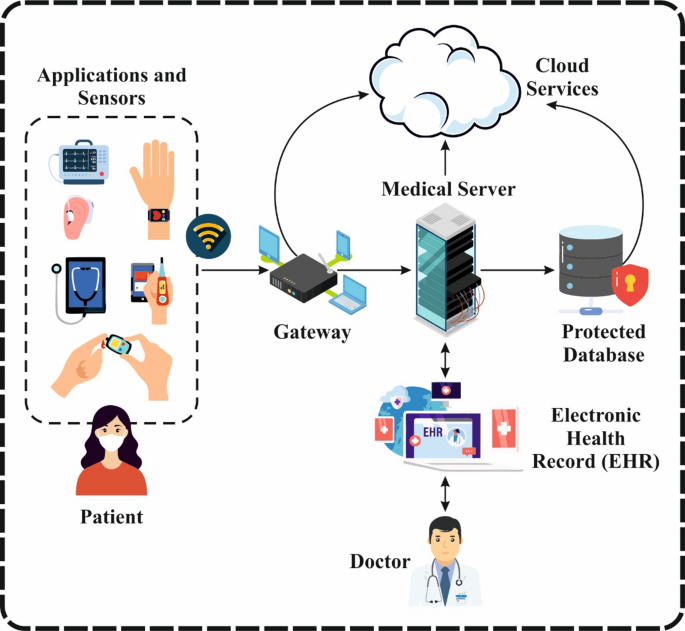

Cash flow is the oxygen of every construction business—and in 2025, with material costs surging and payment cycles stretching, that oxygen is in short supply. Progress-billing delays, change-order disputes, and pay-when-paid clauses routinely tie up working capital, leaving contractors scrambling for liquidity. Two financing lifelines have emerged as frontrunners: and (often called reverse factoring). While both unlock cash sooner, they differ in mechanics, costs, and suitability.

Whether you’re a general contractor, subcontractor, project manager, or finance controller in the US, UK, Australia, or Canada, you’ll finish this article knowing exactly which financing lever to pull to shave 2–4 percent off your project costs—and maybe win the next bid.

Table of Contents

Contractors today face a perfect storm:

For every $1 million contract, that funding gap of one to three months can translate to $20,000–$40,000 in financing costs—or worse, lost opportunities when cash dries up. The right short-term finance tool can slash those costs by 50–70 percent compared to self-funding and unlock bid capacity when others can’t.

Also known as progress-billing factoring, this variant releases funds at each certified milestone instead of only final invoices—ideal for projects spanning several months and multiple deliverables (ResolvePay).

How It Works

Benefits for Contractors

Risks & Limitations

Evidence of Savings

A 2025 ScienceDirect study found that firms using SCF improved supply-chain resilience scores by 15 percent and realized financing-cost savings of 50–70 percent compared to traditional factoring.

Consider a monthly progress bill of with .

When available, SCF typically costs 50–70 percent less than factoring for the same tenor, thanks to buyer-credit arbitrage. However, factoring delivers speed and availability—you can onboard with a factor tomorrow, while SCF requires buyer sponsorship and setup.

Factoring sells your receivable to a financier; supply-chain finance lets your buyer’s credit line fund you early.

No—factoring is an asset sale, so it stays off the balance sheet, though it affects cash-flow ratios.

Typical discounts range from 0.8–1.5 percent of invoice value for 30–60 day terms, depending on buyer credit.

Yes—if the prime contractor includes them. Many fintech SCF platforms onboard suppliers within 24 hours.

Yes, but expect fees to be 0.5–1 percent higher than recourse arrangements.

Conclusion

Choosing between invoice factoring and supply-chain finance isn’t a binary decision—it’s about matching each invoice to the optimal tool. delivers lightning-fast cash and broad availability, ideal for smaller contractors and emergency funding. offers the cheapest capital when a credit-strong buyer sponsors a program, perfect for large suppliers and strategic partners.

Contractors who model both options, blend them intelligently, and review costs quarterly can save —the margin often separating a won bid from a lost opportunity.

Your working capital shouldn’t be your biggest risk—leverage the right financing tool, and build with confidence.