How do family firms balance economic and non-economic goals: from symbiosis to competition

Entrepreneurs often face the dilemma of balancing multiple goals in daily business practices. However, in academic research, the majority of economic and management studies typically assume the maximization of economic goals for theory construction (Vazquez and Rocha, 2018), as seen in agency theory (Jensen and Meckling, 1976) and resource-based view (Teece et al., 1997). Although stewardship theory (Davis et al., 1997) and stakeholder theory (Parmar et al., 2010) emphasize that different individuals have different triggers and goals, they do not explain how these goals interact. This gap remained until the emergence of socioemotional wealth (SEW) (Gómez-Mejia et al., 2023). SEW is defined as the nonfinancial value embedded in family firms, highlighting their tendency to prioritize non-economic goals over economic ones in decision-making, thereby differentiating family firms from nonfamily firms (Gomez-Mejia et al., 2007; Gomez-Mejia et al., 2011; Gomez-Mejia et al., 2018; Gómez-Mejia et al., 2023). It highlights the non-economic nature of family firms and has gradually become the mainstream paradigm in family firm research (Swab et al., 2020).

The coexistence of non-economic and economic goals is a prominent feature of family firms (Dou et al., 2022). However, does the pursuit of non-economic goals necessarily imply that the economic goals should be sacrificed? Due to the popularity of SEW, the primacy of non-economic goals and the perceived antagonism between the economic and non-economic goals are increasingly being taken for granted (Vazquez and Rocha, 2018). Considering the VUCA (volatile, uncertain, complex, ambiguous) environment, and heterogeneity of family firms (Daspit et al., 2021), there is room for adjustment and development in SEW’s discourse on the multiple goal relationship (Gómez-Mejia et al., 2023; Gomez-Mejia et al., 2024). Moreover, the pursuit of multiple goals in Chinese family firms is deeply embedded in diverse cultural context (Koellner and Roth, 2024), such as “family relationship” (guanxi), familial bonds (Su et al., 2023) and nepotism, positioning the family not merely as an economic unit but as a cornerstone of non-economic driver. These cultural imperatives fundamentally shape the prioritization of non-economic goals, which operate symbiotically with economic imperatives.

Enterprises typically pursue satisfactory rather than optimal goals, a dynamic further complicated by the cultural context and developmental stages of family firms operating in VUCA environment. Our research integrates these insights into the SEW framework by exploring the symbiotic or competitive relationship between non-economic goals (e.g., family management) and economic goals (e.g., firm performance) in Chinese family firms.

Non-economic goals constitute a multi-dimensional concept, among which maintaining family control is the primary dimension and serves as the foundation for achieving other non-economic goals (Berrone et al., 2012; Dou et al., 2020). According to upper echelons theory, top management teams significantly influence a firm’s strategy, behavior, and performance (Hambrick, 2007). Furthermore, the identity of managers, whether family or non-family, profoundly affects firm performance (Zhang et al., 2021; Fang et al., 2022). Therefore, family members serving as managers become the most important manifestation of maintaining family control. In this study, we use family members serving as managers to represent non-economic goals, while firm performance represents economic goals.

We adopt a goal-goal perspective to examine the relationship between the two goals, yielding distinct research results compared to the traditional means-goal perspective. According to the means-goal perspective, the relationship between family involvement and firm performance is widely debated. When firm performance is viewed as the goal pursued by family firms, and family involvement is considered the means to achieve this goal, scholars have identified various results (Patel and Cooper, 2014). Shifting from the means-goal perspective to a goal-goal perspective offers a more compelling explanation. A single goal can be approached with maximization logic, while multiple goals involve subjective weighting and can only be addressed using satisfying or optimization algorithms, which rely on the decision-maker’s subjective value standards (Meng et al., 2023). According to this logic, there may not be a simple optimal relationship between family management and firm performance. Instead, there may be trade-offs from a goal-goal perspective, reflecting differences in decision-makers’ value standards. Adopting a willingness-ability perspective, we propose a model demonstrating a shift from “symbiosis” to “competition” between the proportion of family management (as a non-economic goal) and firm performance (as an economic goal). Symbiosis occurs when economic goals and non-economic goals increase together, reflecting a synergistic alignment, and competition emerges when further increases in non-economic goals lead to a decline in economic goals, signaling trade-offs, forming a non-differentiated inverted U-shaped curve for the dominant family.

The relationship between economic and non-economic goals also shifts with a firm’s internal and external environment. As firms age and grow, they develop more standardized norms and practices, leading to standard organizational roles and control systems. These standardized practices enhance organizational credibility and establish clear accountability (Hannan and Freeman, 1984). Larger and older companies rely more on systematic processes than on individual managers’ capabilities, mitigating deficiencies in less capable family managers. Moreover, family managers possess sufficient authority to bypass internal processes and regulations, thereby reducing the impact of structural inertia, which allows the organization to combine the reliability brought by standardization with the flexibility afforded by discretionary power (Ahmad et al., 2021). Consequently, changes in firm age and size will affect the willingness and ability of family managers, consequently influencing the “symbiosis” and “competition” relationships between the economic and non-economic goals of family firms.

Using data from Chinese listed family firms from 2009 to 2019, we selected family management to represent non-economic goals and firm performance to represent economic goals, and explores the relationship between these two types of goals in family firms in long-term stable conditions. The study examines the symbiosis and competition relationships between these goals, as well as the moderating effects of firm size and firm age. This research provides new insights into the field of corporate goals and socio-emotional wealth, and clarifies misconceptions regarding the professionalization of family firms.

Family firms simultaneously pursue economic and family-centered non-economic goals (Dou et al., 2022). While economic goals, such as profitability and growth, remain central to the survival and competitiveness of family firms. Non-economic goals, particularly those centered on family well-being and SEW, play a pivotal role in shaping their strategic decisions (Chua et al., 2018). Some researches highlight the diversity of family firms’ goals, often classified into binary categories such as economic versus non-economic or financial versus non-financial (Vazquez and Rocha, 2018). While mainstream theories such as agency theory suggests that the goal pursuits of family firms and non-family firms do not exhibit significant differences and primarily diverge in the governance structure (Saleem and Graves, 2024). Similarly, the resource-based view emphasizes that family firms’ unique resource advantages can generate greater economic benefits, with these resources serving as tools for realizing economic benefits (Habbershon et al., 2003). Stewardship theory changes the foundational assumptions of human nature but retains the basic premise that a firm’s stakeholders primarily seek economic benefits (Fox and Hamilton, 1994). Stakeholder theory, while acknowledging diverse goal pursuits among stakeholders lacks a practical framework for analyzing these differences (Donaldson and Preston, 1995). Scholars have gradually recognized that family and non-family firms differ not only in governance structures but also in non-economic goals that influence corporate behavior (Chrisman et al., 2012).

Gomez-Mejia et al. (2007) developed the SEW framework, systematically explaining non-economic goals and distinguishing family firms from their non-family counterparts. Furthermore, Berrone et al. (2012) developed a multi dimensional SEW model identifies five non-economic values (FIBER) that family owners prioritize: (a) Family control and influence, (b) Family members’ identification with the firm, (c) Binding social ties, (d) Emotional attachment and (e) Renewal of family bonds to the firm through dynastic succession. This model represents a significant advancement in understanding the intrinsic structural composition of SEW (Schulze and Kellermanns, 2015). Furthermore, using FIBER as an overarching framework, Gomez-Mejia et al. (2024) distinguish between SEW-intensive—where firms give high priority to the FIBER dimensions—and SEW-sensitive—where family owners are more willing and capable of adapting their SEW endowment to respond to external factors. In the Chinese context, family firms also exemplify both traits: their SEW-intensive nature is driven by cultural imperatives such as “guanxi,” familial bonds, and nepotism (Su et al., 2023), while their SEW sensitivity emerges from navigating a VUCA environment shaped by rapid economic and institutional transitions (Koellner and Roth, 2024). This dual characters enrich our understanding of how Chinese family firms navigate the interplay between economic and non-economic goals. Leveraging its strength in explaining non-financial motivations of family firms, SEW exerted extensive influence across organizational and management studies, including corporate governance (Mahto et al., 2023), internationalization (Hafner and Pidun, 2022), innovation and entrepreneurship (Hu et al., 2023), and social ethics (Kabbach de Castro et al., 2017). This has led to the assumption that the pursuit of SEW often comes at the expense of economic interests, reinforcing the notion of a trade-off between economic and non-economic goals (Vazquez and Rocha, 2018). However, considering a dynamic further complicated by the cultural context and developmental stages of family firms operating in China, the relationship between economic and non-economic goals becomes more nuanced, leaving room for further adjustment and development.

Examining the relationship between family management and firm performance through a goal-goal perspective offers a distinct analytical framework compared to the means-goal perspective. Existing research, which treats SEW as an end goal and family control as a means to achieve it, has yielded inconsistent findings. Studies utilizing North American samples have identified a positive correlation between the proportion of professional managers and firm performance (Fang et al., 2022), suggesting an inverse relationship between family management and firm performance. Conversely, research based on Italian samples has demonstrated an inverted U-shaped relationship between the presence of family managers and firm performance (Sciascia and Mazzola, 2008). Against this backdrop, and in light of the extensive discourse on non-economic goals in family firms (Gomez-Mejia et al., 2011), a critical question emerges: Given that family control can either facilitate or hinder the attainment of economic goals, how should family firms strategically balance or coordinate the degree of family management versus professionalization? To address this question, this paper proposes a goal-goal perspective to systematically explore the interplay between the pursuit of non-economic goals and the achievement of economic goals in family firms.

We adopt a willingness-ability perspective to analyze the relationship between non-economic goals (family management) and economic goals (firm performance). Family managers possess the willingness to pursue specific goals, which is shaped by their values, beliefs, and family ties. However, their ability to achieve these goals is constrained by factors such as resource availability, market conditions, and managerial expertise. By examining both willingness and ability, we can gain a more nuanced understanding of how family managers navigate the trade-offs between non-economic and economic goals and ultimately influence firm performance.

The attainment of economic goals is essential for firm survival, and family managers possess the willingness to achieve them. First, the tradition of Chinese culture emphasizes familial loyalty, collective responsibility, and long-term orientation (Frerich et al., 2024), which closely aligning firm’s survival and development with their own interests. These cultural norms foster a deep sense of commitment and trust (Hennicks et al., 2024) to the firm’s success, as family managers also exhibit higher organizational loyalty and commitment (Luo and Chung, 2013), which strengthens their dedication to realizing both economic and non-economic goals. Second, personal connections and “guanxi” based on blood and marriage ties provide family managers with a natural foundation of trust. The long periods of living and working together help family managers develop shared values and understanding (Bettinelli et al., 2022), maintain high visibility in their work, and ensure relatively transparent communication channels, thereby reinforcing their willingness to drive the firm toward its goals. This reduces opportunistic tendencies and lowers agency costs (Fama and Jensen, 1983; Karra et al., 2006), enabling them to focus more on achieving economic goals. In the context of China, which could be considered a highly SEW-intensive environment due to the strong emphasis on family ties and long-term relationships (Gomez-Mejia et al., 2024), the willingness to prioritize goals may be particularly pronounced.

From the willingness perspective, all else being equal, an increase in the proportion of family managers initially benefits the entire top management team by reducing agency costs, primarily due to diminished information asymmetry (Chrisman et al., 2004). However, as this proportion continues to rise, the team may begin to experience escalating agency costs driven by family altruism. Family owners’ altruism may manifest as tolerance and generosity towards family managers, potentially leading to shirking and free-riding behaviors (Schulze et al., 2003), thereby increasing agency costs (Chrisman et al., 2004). Thus, considering the overall agency costs, while the willingness of family managers to achieve the firm’s economic goals grows with their increasing proportion, it follows a pattern of diminishing marginal utility.

From the ability perspective, family managers may face ability disadvantages. In the early development stage of a family firm, maintaining family control generates “familiness,” which enhances the firm’s performance by leveraging capabilities and resource advantages (Wu et al., 2024). However, as the proportion of family managers increases, the average ability level within the entire TMTs tends to decline, which is attributed to the higher degree of homogeneity in their acquired knowledge and skills, as well as significant overlap in their social capital (Gómez-Mejia et al., 2023). The homogeneity and overlap imply that the ability of the whole TMT do not increase proportionally with the increase in the proportion of family managers. Moreover, the continuous involvement of family managers often favors kinship over meritocracy, preventing the firm from benefiting from the diverse capabilities and resources brought by professional managers (Chua et al., 2009). Additionally, nepotism, which leads to position protection by the owner, may result in the TMT being filled with incompetent family managers (Schulze et al., 2003). This trend is exacerbated by the increasing presence of underqualified family managers (Stewart and Hitt, 2012), leading to a decline in the firms’ competence.

The achievement of economic goals can be seen as a combined effect of ability and willingness of family managers (De massis et al., 2014). When the proportion of family managers is low, they possess the willingness to achieve economic goals and have not yet demonstrated significant ability disadvantages, and may even exhibit slight ability advantages. At this stage, the joint effect of increasing willingness and the maintenance of ability leads to a positive effect on economic performance. As the proportion of family managers increases, the diminishing effect of willingness advantages and the increasing effect of ability disadvantages result in a positive net effect on firm performance that continues to grow but at a diminishing marginal rate. At this stage, family management demonstrates a mutually “symbiotic” relationship with the firms’ economic goals. However, constrained by the law of diminishing marginal utility, as the proportion of family managers increases, firm performance will gradually reach a point where the marginal benefit becomes zero, known as the turning point. Subsequently, due to the continuous involvement of family managers, their ability to achieve economic goals continues to decline, while the increasing rate of willingness also diminishes. The combined effect of willingness and ability on firm performance begins to decline, accelerating over time. At this stage, family management shifts from enhancing the firm’s economic goals to eroding them, demonstrating a “competition” relationship. This analysis indicates that the relationship between non-economic and economic goals shifts from symbiotic to competitive. Based on these theoretical arguments, the following hypothesis is proposed:

Hypothesis 1: There will be an inverted U-shaped relationship between family management and firm performance, that is to say, where the extent to which non-economic goals are positively related to economic goals up to a point, after which it becomes negative.

Characteristics such as firm size and firm age influence a firm’s survival (Bruderl and Schussler, 1990), innovation (Gimenez-Fernandez et al., 2020), and other strategic decisions. In line with the findings of Gomez-Mejia et al. (2024), larger and older firms in SEW-sensitive contexts are better positioned to preserve socioemotional wealth while pursuing economic goals, as they can allocate resources more effectively and absorb external shocks, and they are better equipped to navigate VUCA environments. As firms grow in size and age, formal and informal norms mature, organizational practices stabilize, and the resource endowment of the firm, along with the emotional endowment of the controlling family, become key elements in determining the firm’s strategy. Consequently, the “symbiosis” and “competition” relationship between economic and non-economic goals of family firms are influenced by these characteristics.

3.2.1 The moderating effect of firm size

Firms with larger size are able to amplify the willingness advantage and mitigate the ability disadvantage of family managers through systemic forces. The willingness advantage is further reinforced in larger firms. First, compared to smaller firms, larger firms are more likely to benefit from economies of scale and scope. Their complementary assets and capabilities, higher risk tolerance, and stronger market positions all contribute to improving the internal efficiency of resource conversion. The scale effect amplifies the willingness advantage of family managers, enabling them to generate higher economic returns from the same level of resource endowment. Second, larger family firms are more incentivized to establish standardized operational processes and governance structures, as well as to offer formal and effective compensation incentives to managers (Carlson et al., 2006). In this context, the altruistic tendencies of the owners are naturally diminished, thereby reducing the costs associated with position mismatches due to altruism (Schulze et al., 2003). This decline in agency costs further strengthens the willingness of family managers to dedicate their efforts toward achieving the firm’s goals.

Larger firms can also partially compensate for the shortcomings of family managers’ insufficient abilities. First, as firms grow in size, they have more resource to establish modern governance and management systems, as well as industry norms (Carlson et al., 2006). These firms can also provide formal training for employees and managers, thereby improving the competence of the entire top management teams, including family managers. Second, larger firms can more easily achieve economies of scale, enhance production efficiency, and implement more detailed labor divisions. This allows the organization ability to substitute for individual ability, partially mitigating the deficiencies of family managers. Since the impact of family managers’ willingness and ability on firm performance changes with firm size, the slope and turning point of the inverted U-shaped curve will also change accordingly.

Larger firms are more conducive to leveraging the willingness advantage of family managers while mitigating their ability disadvantages. Therefore, in larger firms, as the proportion of family managers increases, the combined effect of the increased willingness advantage and the mitigated ability disadvantage leads to a slower approach to the turning point, resulting in a flatter inverted U-shaped curve. Additionally, larger firms can accommodate more family managers to achieve their economic goals. Consequently, the point at which the marginal net effect on firm performance becomes zero shifts to the right, indicating a rightward shift in the turning point of the inverted U-shaped curve. Taken together, these theoretical arguments yield the following hypothesis:

Hypothesis 2: Firm size moderates the inverted U-shaped relationship between family management and firm performance, such that at larger firms, the inverted U-shaped becomes flatter, and the turning point shifts to the right.

3.2.2 The moderating effect of firm age

Firms with older age typically accumulate extensive management experience and organizational routines, resulting in smoother communication mechanisms. For family firms, as the firm ages, the intention for intergenerational succession and maintaining family control gradually emerges (Chua et al., 2004). Thus, firm age can be considered a dynamic representation of the firm’s development stage, allowing us to examine changes in the relationship between economic and non-economic goals over different development stage.

In older firms, the willingness advantages of family managers are reinforced for several reasons. First, family managers develop a strong sense of “psychological ownership” due to their long-term involvement with the firm (Lee et al., 2019). Under the influence of stronger emotional endowments, the same proportion of family managers demonstrate a greater willingness to achieve the firm’s economic goals (Zellweger et al., 2011). Second, in older firms, family managers establish effective formal or informal communication channels through long-term operations and continuous collaboration. Their “tacit knowledge” facilitates smoother communication, effectively reducing information asymmetry and enhancing self-monitoring capabilities (Karra et al., 2006). Consequently, the willingness of family managers to invest their efforts can yield greater competitive advantage.

Firm age also impacts the ability endowments of family managers in several ways. First, the management experience and practices accumulated over time in older firms make daily operations more dependent on inertia, which inadvertently mitigates or eliminates the potential impact of family managers’ ability disadvantages. Second, in long-established family firms, family managers contribute to the development of tacit knowledge suitable for the firm through years of learning, integration, and accumulated experience (Miller et al., 2011). Over time, family managers build corporate reputation, market share, and customer resource, which external professional managers cannot easily replicate. Furthermore, this tacit knowledge further mitigates the negative impact of family managers’ ability deficiencies.

Since the impact of family managers’ willingness and ability on firm performance varies with firm age, the slope and turning point of the inverted U-shaped curve change accordingly. Older firms are more conducive to family managers leveraging their willingness advantage and mitigating ability deficiencies. Therefore, in older firms, as the involvement family managers increases, the combined effect of increased willingness and decreased ability deficiencies results in a flatter inverted U-shaped curve. Additionally, older firms can accommodate more family managers to achieve economic goals, leading to a rightward shift in the turning point. Thus, considering the variations in the impact of family managers’ willingness and ability endowments on firm performance across different firm age, we propose the following hypothesis:

Hypothesis 3: Firm age moderates the inverted U-shaped relationship between family management and firm performance, such that at larger firms, the inverted U-shaped curve becomes flatter, and the turning point shifts to the right.

The empirical data used in this study were derived from Chinese family firms listed on the Shenzhen and Shanghai stock exchanges between 2009 and 2019. The 2009–2019 time period was selected for the following reasons: This period represents a relatively stable economic phase in China’s development, free from the extreme disruptions caused by the COVID-19 pandemic that began in 2020. By focusing on pre-pandemic data, we can examine the fundamental relationships of family firms’ goal setting strategies under a long-term normal condition. To avoid the interference of this extreme exogenous event on our research findings and to ensure the robustness and generalizability of our conclusions, we utilized the data range to the pre-pandemic period of 2009–2019.

The primary data source was the China Stock Market and Accounting Research (CSMAR) database. Additionally, we collected data from the firms’ annual reports. Information on managers’ family or non-family identity, family management, ROE (return on equity), firm size and firm age, among other variables, was obtained from the CSMAR database. The sample firms are all family firms. We define family firms as follows: First, as recommended by La Porta et al. (1999), we adopted a threshold of 20% family ownership for firm selection. Second, it required at least one family member, whether related by blood or marriage, to serve as a director, shareholder, or manager (Anderson and Reeb, 2003; Chua et al., 1999). To ensure data reliability, we excluded firms in the financial services industry, as their unique financial statement structures and typically high debt ratios lead to biased regression results.

However, variables such as managers’ baseline information like education background, age, etc., could not be obtained directly from the database, so we manually distinguished and calculated these variables. The process was as follows: first, we downloaded managers’ resumes from the CSMAR database, then searched their names online to determine if they had a familial relationship with the holding family. If such a relationship existed, we coded them as family managers, otherwise, they were coded as non-family managers. Second, we collected information on these managers’ age, education, and whether family members served as CEOs or board directors.

Our dataset is an unbalanced panel for several reasons. First, we excluded samples with incomplete information disclosure to prevent missing values. Second, we omitted data for firms that were sold, went bankrupt, or experienced a change in control during the sample period, though we retained data for these firms prior to these events. Consequently, our unbalanced panel comprises 255 firms, representing 2,877 firm-year observations.

4.2.1 Dependent variable

Return on equity (ROE) of the sample firms is used to represent firm performance, reflecting economic goals. Additionally, since the impact of family managers on financial performance may not be immediately apparent but generally manifests in the following year, this paper utilizes the average ROE of one-year lag (year t + 1) and two-year lag (year t + 2) measure firm performance in year t.

4.2.2 Independent variable

Following prior literature, we operationalized family management as the proportion of family managers relative to all managers employed in the firm (Block, 2010), which is also the percentage of a firm’s managers who were also family members (Sánchez-Marín et al., 2020).

4.2.3 Moderating variables

Following the research of Fang et al. (2016) and Skorodziyevskiy et al. (2022), this paper incorporates firm size and firm age as moderating variables. Firm size is measured by the logarithm of the operating revenue in the current fiscal year, while firm age is measured by the number of years since the firm was established.

4.2.4 Control variables

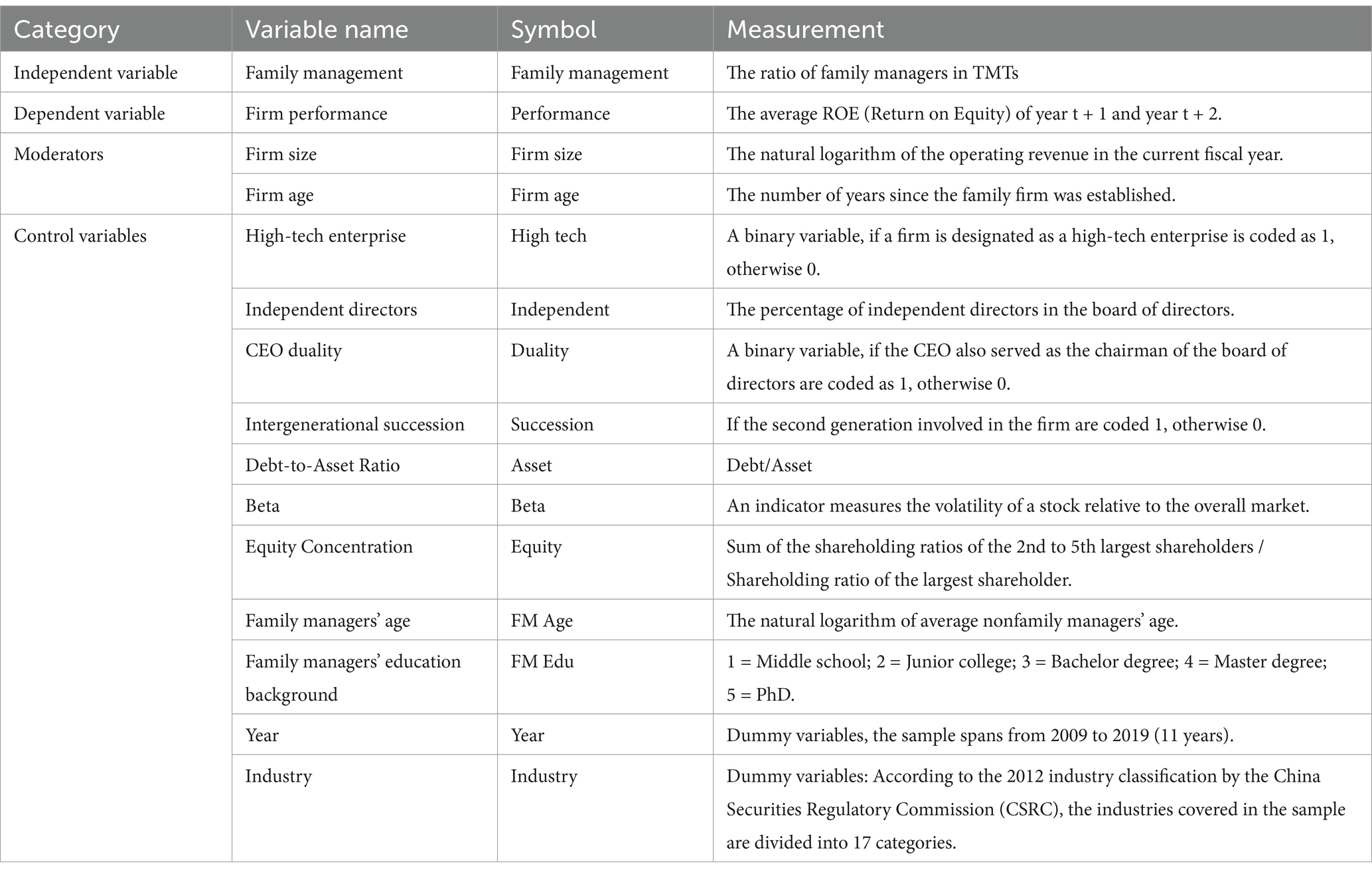

In alignment with the previous study of Jaskiewicz et al. (2017), our analysis incorporates a comprehensive set of control variables that are potential determinants of firm performance, systematically categorized into firm characteristics, managerial attributes, corporate governance characteristics and financial attributes. For firm characteristics, we included a variable indicating whether a firm qualifies as a high-tech enterprise, as high-tech industries often exhibit greater performance volatility due to rapid technological advancements and shorter product life cycles. Such volatility can obscure the effects of family management and other variables on firm performance. For managerial attributes, the traits of family managers may influence firm performance (Fredrickson et al., 2010). We controlled for the average age and education level of family managers. Additionally, for corporate governance characters, we controlled for CEO duality, coded as “1” when the CEO also holds the position of chairman of the board. We also controlled for intergenerational succession, as the involvement of second-generation can also influence the firm’s goal setting. For financial attributes, we controlled for the debt-to-asset ratio and beta, which reflects a firm’s financial leverage and debt repayment ability. We also controlled for equity concentration, which reflects the distribution of shareholders’ ownership stakes. High equity concentration typically shows that a few major shareholders have significant control over the firm, directly impacting its decision-making process and governance structure. The variable description is listed in Table 1.

4.3.1 Descriptive statistics and correlation analysis

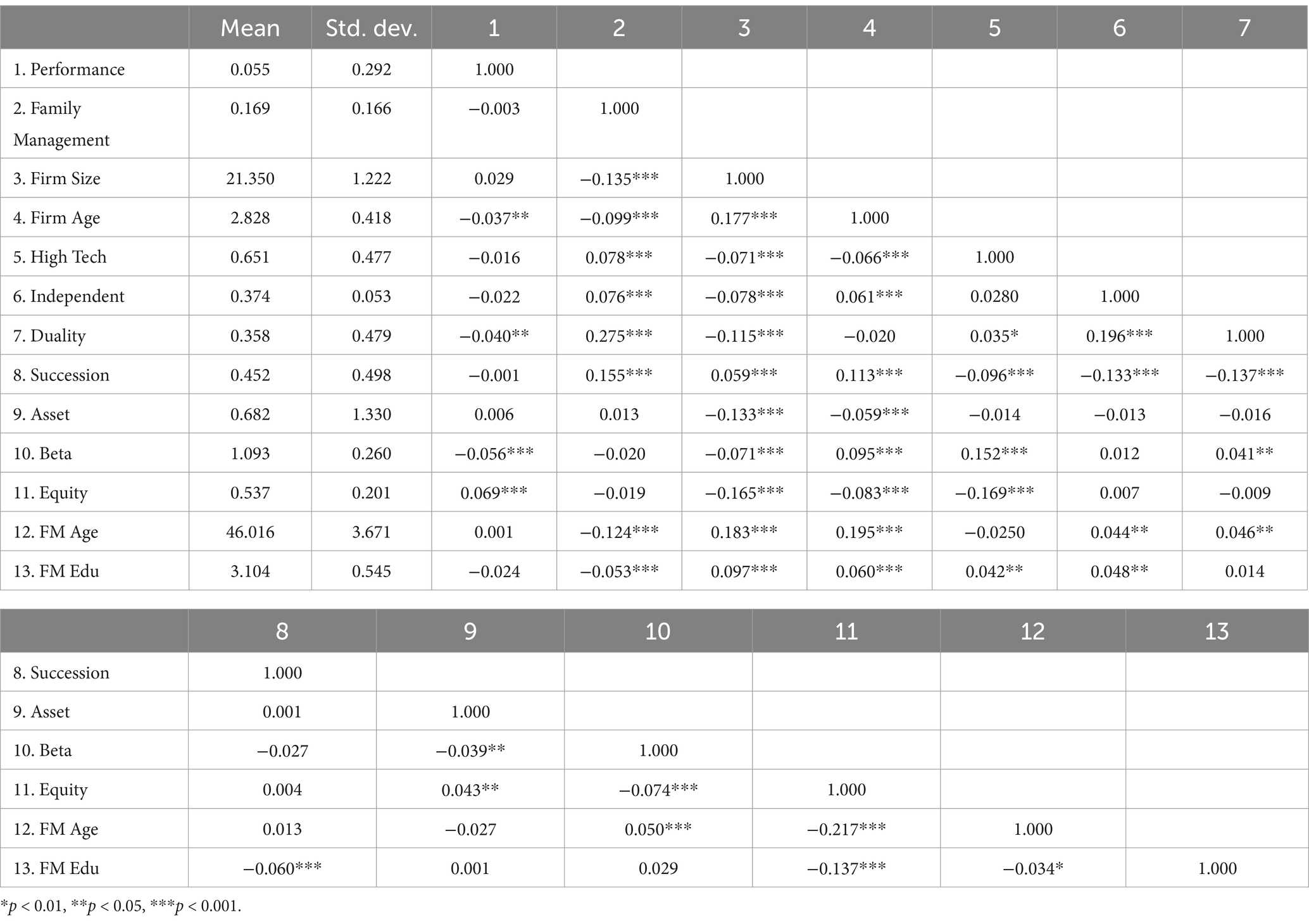

Table 2 presents the descriptive statistics and correlation coefficients of the variables. The average ROE of the sample firms is 0.055, with a standard deviation of 0.292, indicating significant differences in firm performance. The average proportion of family managers is 0.169. Regarding firm characteristics, the average firm size and firm age are 21.35 and 2.828. The average age and education level of family managers are 46.02 and 3.104, respectively, which means the average family managers’ age is approximately 46.02 years, and the average education level corresponds to an undergraduate degree.

Table 2 also reports the correlation coefficients of the variables. The distribution of sample variables is within a reasonable range and will not be elaborated further here. The correlation coefficients between variables are all below 0.5, indicating no serious multicollinearity problem. Additionally, a Variance Inflation Factor (VIF) test was conducted, showing VIF values for each variable ranging from 1.01 to 1.16, further confirming that multicollinearity is not a significant concern in our research.

4.3.2 Methodology and results

In this study, STATA 15.0 was used for data processing to test the hypothesis. To ensure model consistency and validity, the data were processed as follows: First, continuous variables involved in interaction terms, were centered to avoid the influence of multicollinearity. Second, before conducting the regression tests, a Hausman test was performed. Based on the Hausman test results, the fixed effects regression model for panel data was deemed appropriate for this study, as it also helps to address endogeneity issues.

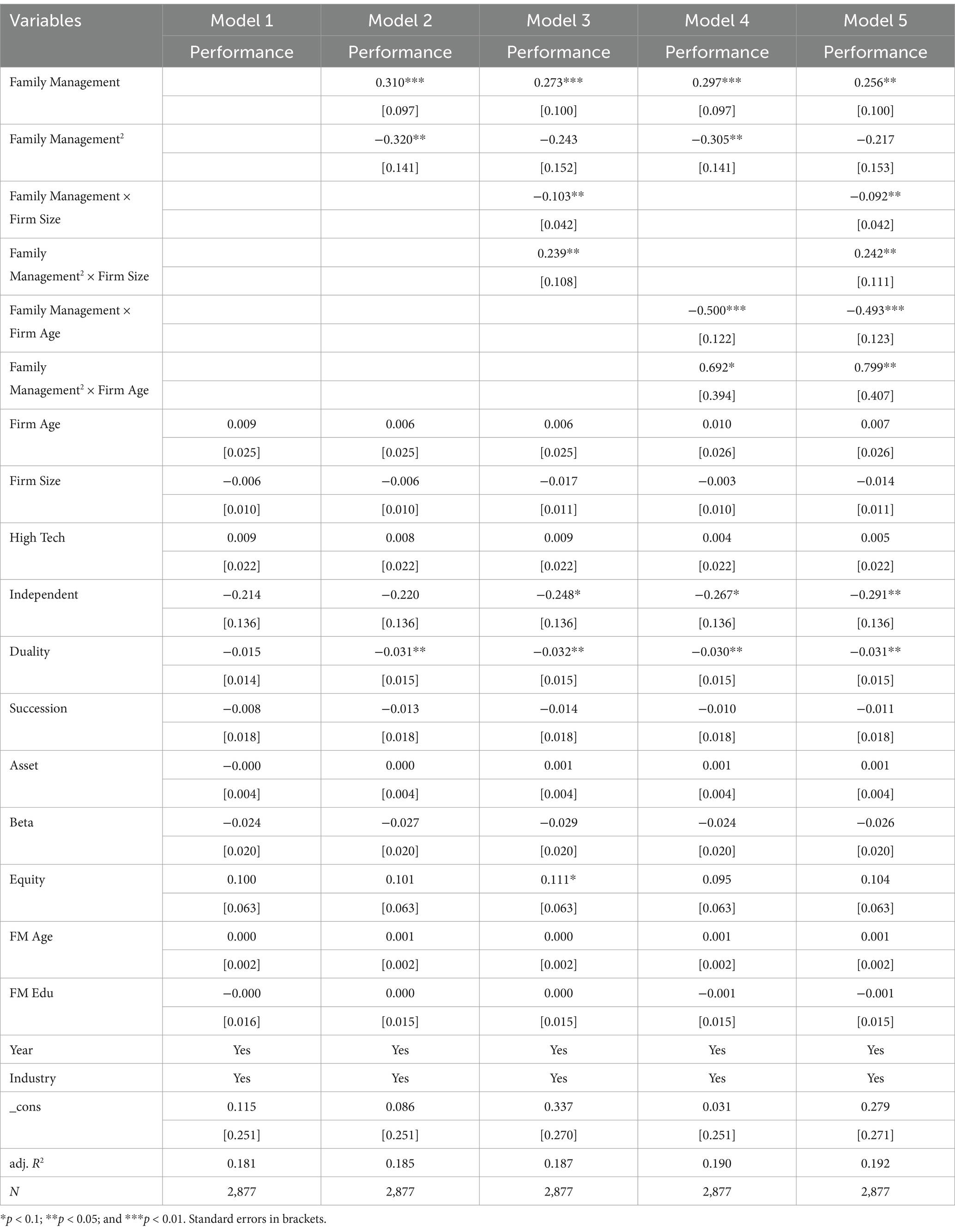

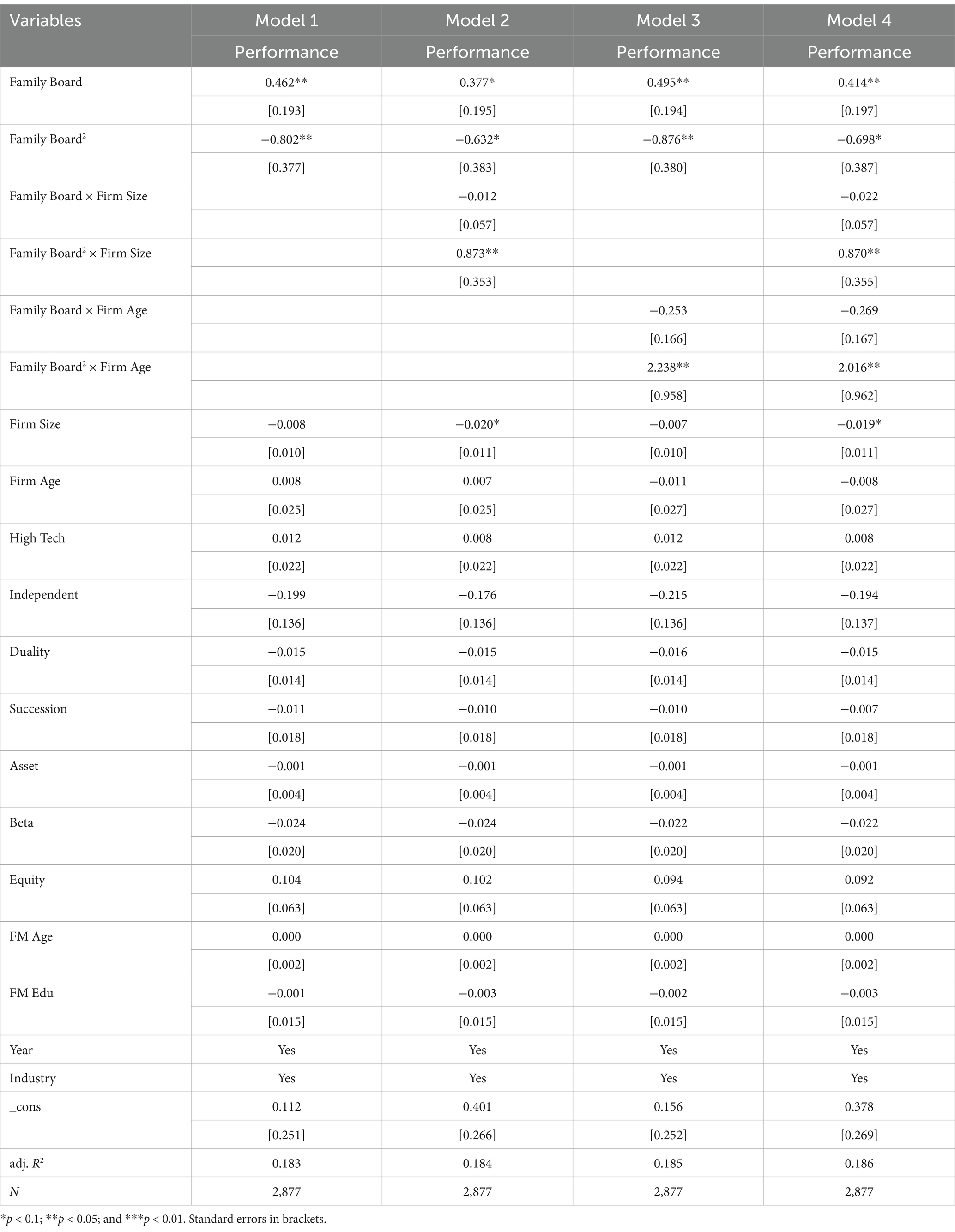

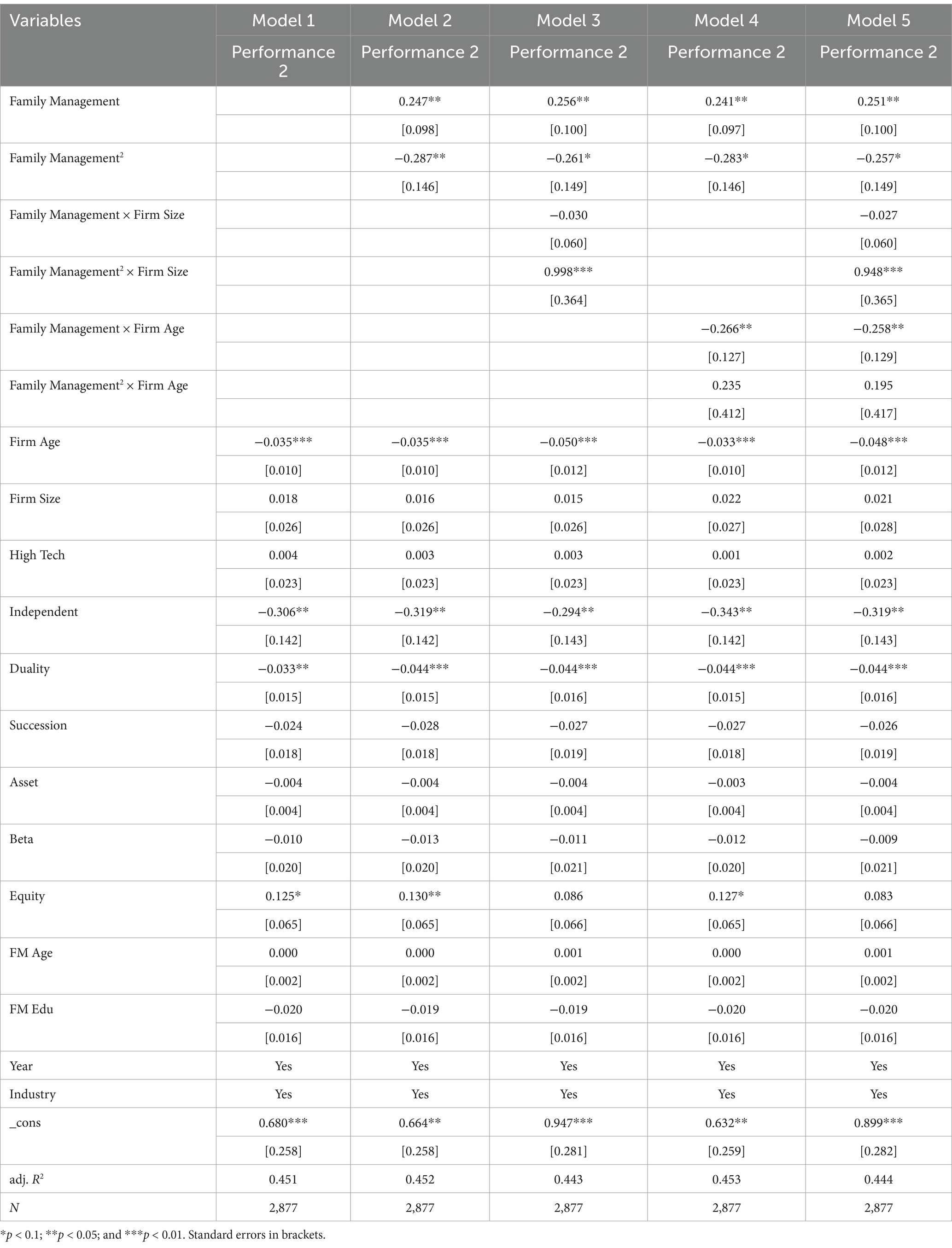

The regression results were presented in Table 3. First, Model 1 is the baseline model, including only control variables. Model 2 tests the relationship between family management and firm performance by adding both the first-order term (Family Management) and squared term (Family Management2) of the independent variable. The results show that the squared term of family management is significantly negative (β = −0.320, p < 0.05), while the first-order term is significantly positive (β = 0.310, p < 0.01). This indicates that the relationship between family management and firm performance exhibits an inverted U-shape, meaning that as the ratio of family managers increases, firm performance first rises and then falls. And around the turning point, family firms can reach the optimal performance level. Thus, Hypothesis 1 is supported.

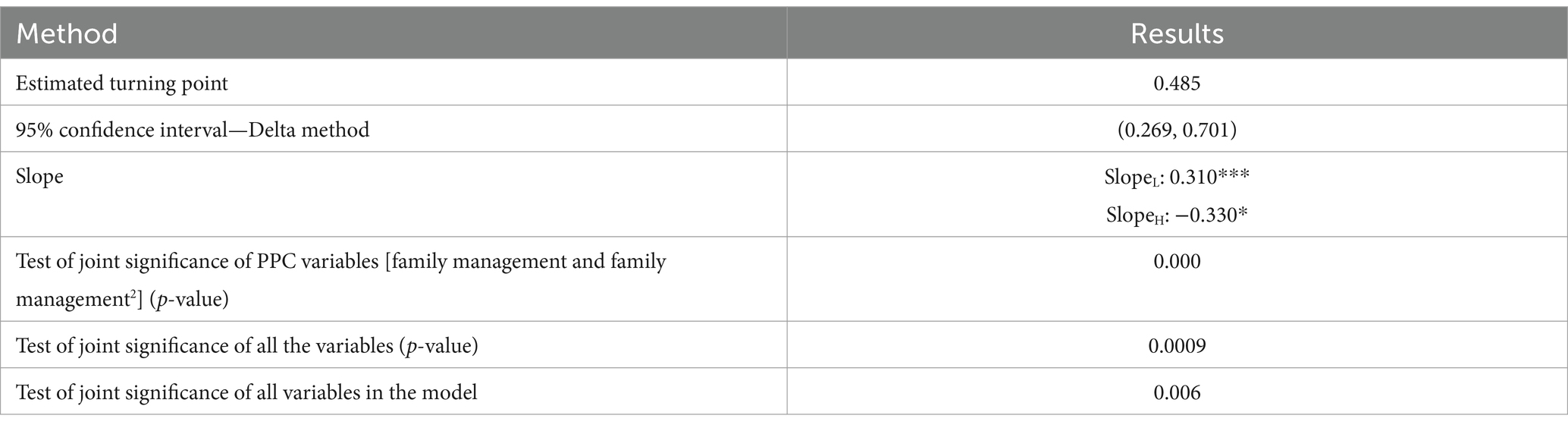

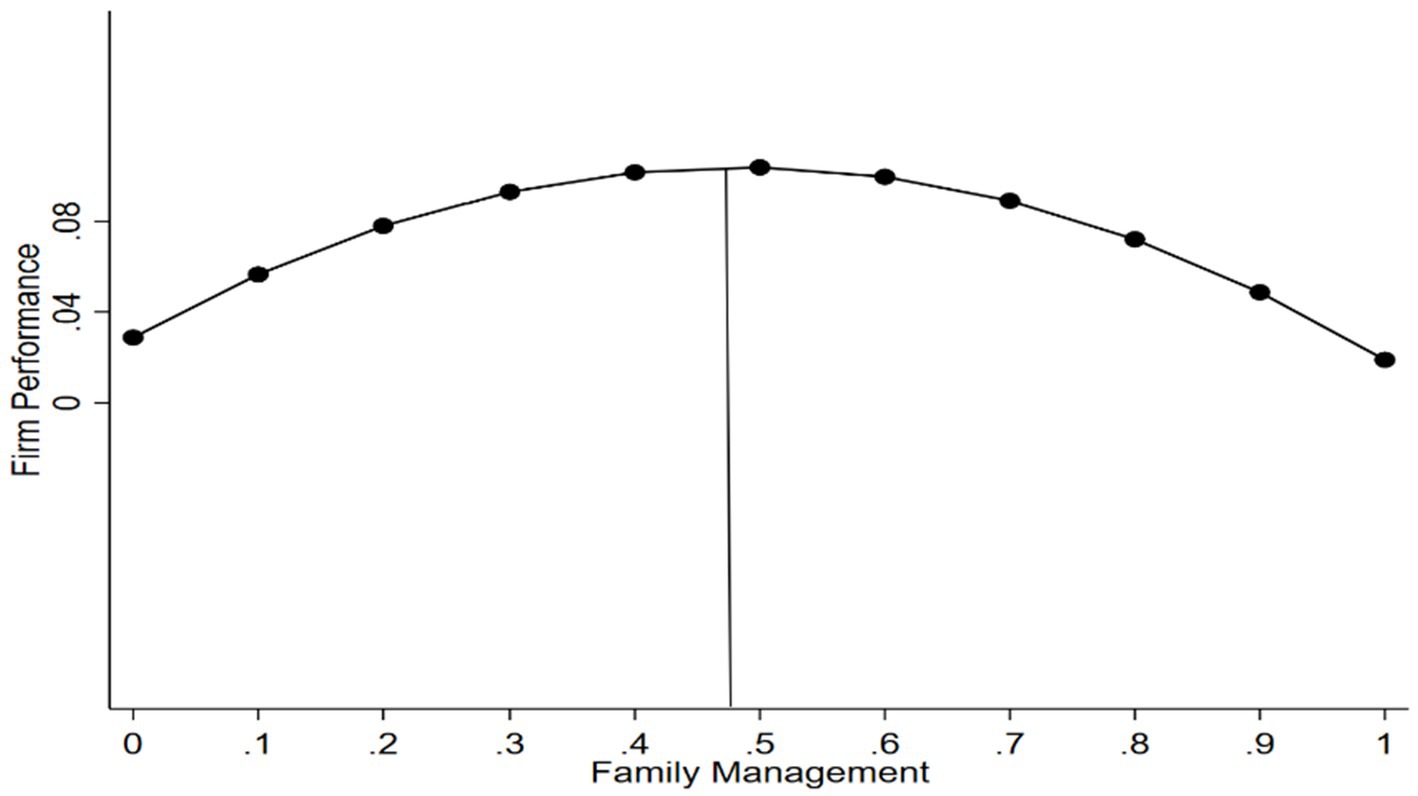

To ensure the correct interpretation of the results, the significance of the inverted U-shaped relationship was assessed following the method outlined by Lind and Mehlum (2010) (see Table 4). To further verify this relationship, we followed the approach of Haans et al. (2016) and Lind and Mehlum (2010) and conducted the following tests. First, we estimated the turning point of family management and calculated confidence intervals using the Delta method (Fernhaber and Patel, 2012). The turning point of the inverted U-shaped curve between family management and firm performance is 0.485. Additionally, the 95% confidence intervals for the Delta method (0.269, 0.701) indicates that the family management values fall within the data limits. Second, we calculated the slope on both sides of the turning point. The results show that the slope on the left side (XL) of the inverted U-shaped curve is significantly positive (SlopeL = 0.310, p < 0.001), and the slope on the right side (XR) of the curve is significantly negative (SlopeR = −0.330, p < 0.1). Third, following Fernhaber and Patel (2012), we conducted a joint significance test of the direct and squared terms of family management according to the method of Sasabuchi (1980). These validations confirm the existence of the inverted U-shaped relationship between family management and firm performance (see Figure 1).

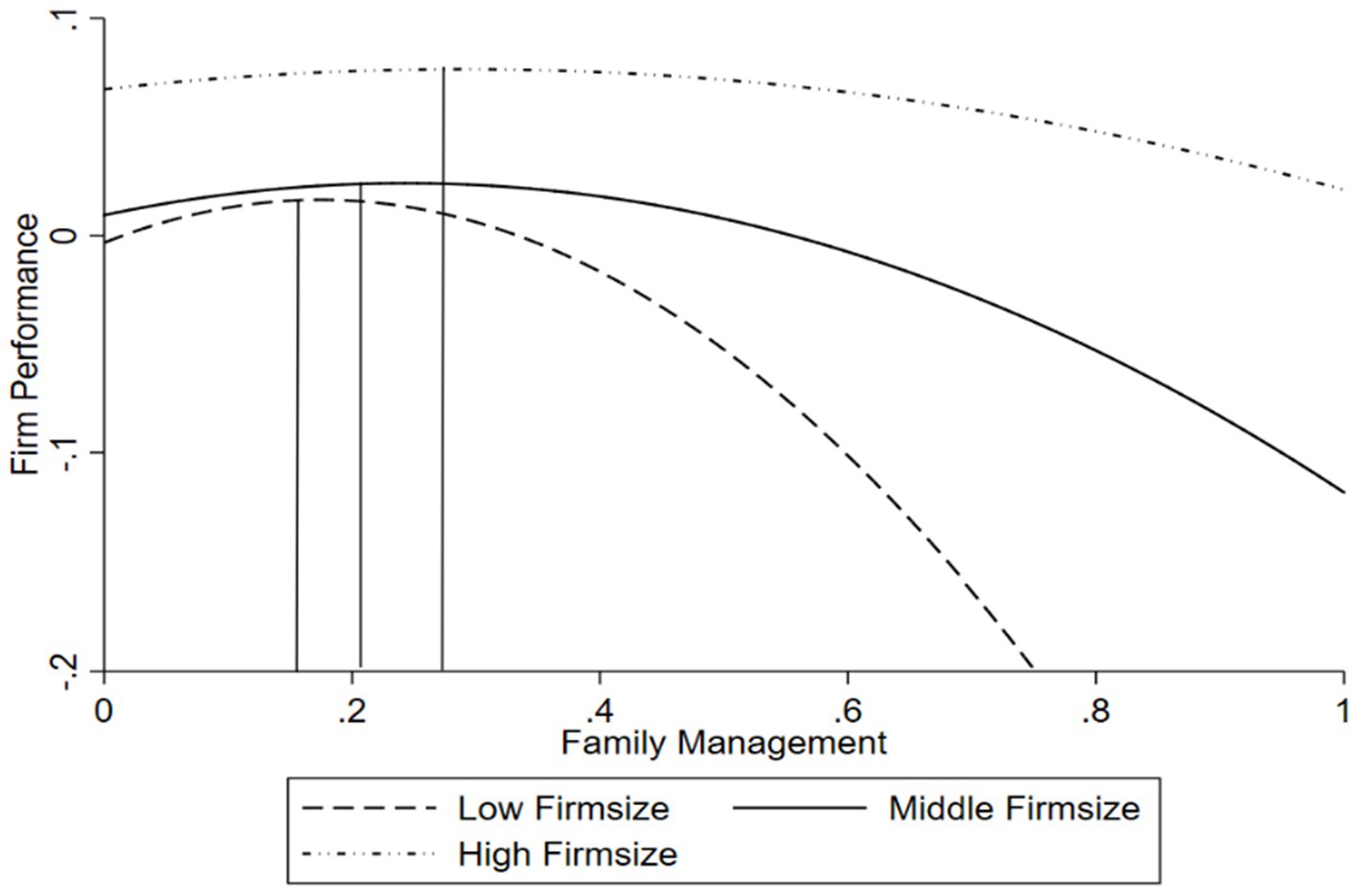

Table 3 also presents the results of the moderating effects of firm size and firm age (Model 3 and Model 4), with Model 5 as the full model. To test the moderating effect of firm size, Model 3 includes the interaction term between the family management and firm size (Family Management × Firm Size), as well as the interaction term between the squared term of the family management and firm size (Family Management2 × Firm Size). The results indicate that the coefficient for Family Management × Firm Size is significantly negative (β3 = −0.103, p < 0.05), and the coefficient for Family Management2 × Firm Size is significantly positive (β4 = 0.239, p < 0.05). These results remain significant in the full Model 5, indicating that the inverted U-shaped curve becomes flatter when firm size increases. The direction of the turning point’s movement depends on , and whether it is significantly different from 0 (see Haans et al., 2016 for a detailed derivation). Since the denominator of the equation is always greater than or equal to 0, the sign of the equation depends on the numerator, Specifically, when β1 × β4-β2 × β3 > 0, the turning point shifts to the right as the moderating variable M increases, and vice versa. Based on the coefficients in Model 3 in Table 3, β1 × β4-β2 × β3 is significantly positive, indicating that the turning point shifts to the right as firm size increases. To present more intuitive results, we plot the inverted U-shaped relationship for high, medium, and low values of firm size, as shown in Figure 2. Thus, hypothesis 2 is supported.

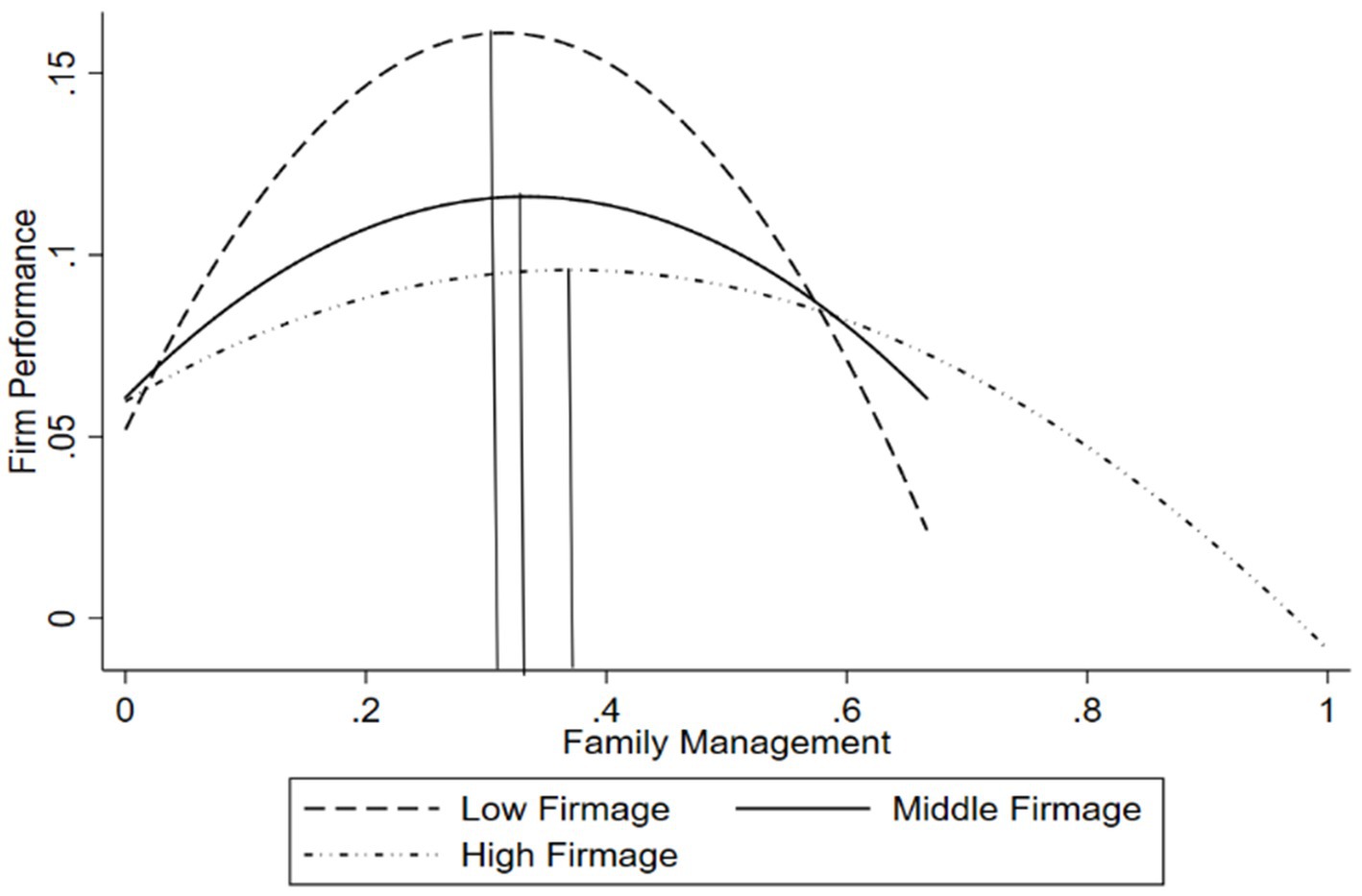

Similarly, Model 4 tests the moderating effect of firm age. Model 4 adds the interaction term between the family management and firm age (Family Management × Firm Age), and the interaction term between the squared term of the family management and firm age (Family Management2 × Firm Age). The results show that the coefficient of Family Management × Firm Age is significantly negative (β3 = −0.500, p < 0.001), and the coefficient of Family Management2 × Firm Age is significantly positive (β4 = 0.692, p < 0.1), indicating that the inverted U-shaped curve becomes flatter as firm age increases. Based on the coefficients of the variables in Model 4, the sign of β1 × β4-β2 × β3 is significantly positive, indicating that the turning point shifts to the right as firm age increases. To present more intuitive results, we plotted the inverted U-shaped relationship for high, medium, and low values of firm age, as shown in Figure 3. Thus, Hypothesis 3 is supported.

We conducted several robustness tests to ensure the reliability of our results.

To capture the complex nature of non-economic goals, we conducted additional analysis using the proportion of family board members as an alternative measure of non-economic goals. The variable reflects the family’s control over residual claims, enabling families to maintain strategic control and prioritize non-economic goals over economic returns (Gomez-Mejia et al., 2007). While family management reflects the family’s direct involvement in daily operations and short-term decision-making authority, family board embodies the family’s legal control over the firm, ensuring long-term strategic autonomy. By employing family board as an additional measurement, we address the potential limitations of relying solely on family management and provide a more comprehensive understanding of the family’s non-economic intention (Chrisman et al., 2012). The results presented in Table 5, are consistent with our primary findings, further validating the robustness of our conclusions.

To address potential endogeneity concerns, we employ an instrumental variable approach. Following prior studies (e.g., Fang et al., 2022), we use the average size of the management team as our instrumental variable. This variable is calculated as the average number of managers for all firms within each industry, state, and year. The rationale for this choice is that the variable shapes the structural context in which firms operate. For example, larger average management teams may signal greater professionalization or resource availability within an industry or region, reducing the reliance on family managers, which is likely to influence the firm’s management structure (e.g., the proportion of family managers) but is unlikely to be directly correlated with firm performance or other firm-specific outcomes.

Following (Hamilton and Nickerson, 2003), we employed a two-stage regression approach with instrumental variables to address endogeneity. Table 6 reports the regression results of the endogeneity test. In the first stage, the instrumental and control variables were used to estimate the predicted value of family management, with family management as the dependent variable and the average size of the management team as the independent variable. The regression results show a significant negative correlation (β = −0.084, p < 0.01), indicating that the average size of the management team significantly affects the degree of family management, confirming the validity of the instrumental variable. In the second stage, the predicted value of the instrumental variable estimated in the first stage is included as an additional control variable in the regression, resulting in findings consistent with the main model.

We use an alternative measure of the dependent variable as the robust test (see Table 7). Return on Equity (ROE) for year t + 1 is used as an alternative to the original measure of firm performance. Employing this approach, we also found results that were consistent with those of the main model.

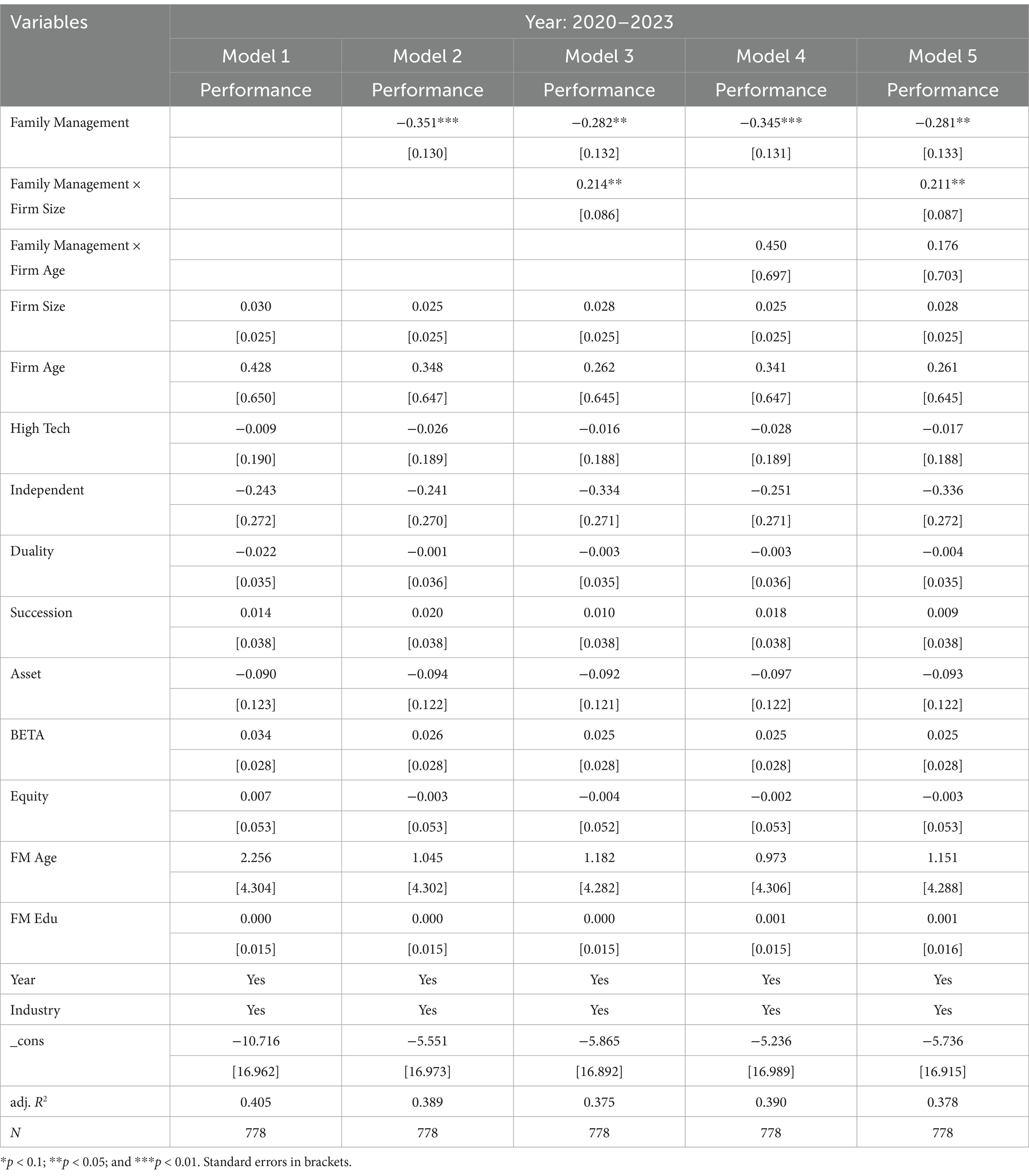

The COVID-19 pandemic leads to a significant exogenous shock characterized by trade disruptions, resource shortages, and economic downturns, which would change the firm’s behavior and goal settings. To address this change, we conducted an additional analysis during the pandemic period. Using data from 2020 to 2023, we collected 778 observations to explore how family firms balanced economic and non-economic goals during this extraordinary period.

Table 8 presents the results of the period of 2020–2023. Specifically, we observed that an increase in the pursuit of non-economic goals was negatively correlated with economic goals during 2020–2023. This finding contrasts with the inverted U-shaped relationship observed during the pre-pandemic period (2009–2019), suggesting that the pandemic fundamentally altered the dynamics of family firm goal pursuit. We hypothesize that this shift is driven by two key factors: for the ability perspective, the economic uncertainty and market volatility brought by the pandemic demanded greater managerial expertise and strategic flexibility, potentially disadvantaging family managers who may have lacked the necessary professional skills to navigate this challenging environment. For the willingness perspective, in the VUCA environment of the COVID-19 pandemic, family managers may have prioritized the preservation of SEW even at the expense of short-term financial performance (Gomez-Mejia et al., 2024). Our analysis also revealed a moderating effect of firm size and firm age during the pandemic. Specifically, we found that the negative relationship between non-economic goals and economic goals weakened as firm size increased. As firms grow larger, they tend to develop more sophisticated organizational structures and professional management teams, which can dilute the influence of family managers and promote a more balanced approach to goal pursuit. Larger firms also possess greater resources and capabilities, enabling them to better adapt to changing market conditions and mitigate the risks associated with conservative decision-making driven by SEW considerations.

Family managers possess both the willingness and ability to achieve diverse goals, a combination that significantly influences the behaviors and outcomes observed in family firms (De massis et al., 2014). Their strong identification with both the family and the firm leads to a high level of willingness advantage (Wielsma and Brunninge, 2019), thereby promoting the achievement of firm’s economic goals. However, the willingness advantage is constrained by the law of diminishing marginal returns: as the proportion of family managers increases, the willingness advantage diminishes. Additionally, family manages face an ability disadvantage. As the appointment of family managers increases, the limited family talent pool may no longer provide sufficiently capable managers. It also becomes difficult to dismiss less competent family managers (Mazzi, 2011). This discrepancy in quality between the internal family talent pool and the external labor market becomes more pronounced, highlighting ability deficiencies. These deficiencies hinder the improvement of the firm’s performance and the realization of its economic goals. The presence of these opposing forces leads to an inverted U-shaped relationship between family management and firm performance, which manifests as from symbiosis to competition. Changes in firm age and size can affect the willingness and ability of family managers, thereby influencing this inverted U-shaped curve. As the firm grows in size and age, its formal and informal norms become more established, and organizational routines stabilize. This stability can enhance the commitment of managers and mitigate their ability deficiencies, resulting in a rightward shift and a flattening of the inverted U-curve.

The current findings offer theoretical implications in the following ways. First, by addressing goal complexity in family firms through the perspective of willingness and ability, we provide new insights into the dynamic relationship between economic and non-economic goals in Chinese family firms. Previous research has often assumed that family firms exhibit an “either-or” relationship in pursuing these goals, implying that increasing one may come at the expense of the other. However, our study reveals that these two types of goals can initially promote each other, evolving from “symbiosis” to “competition,” This indicates that family firms’ goal pursuit reflects a multi-dimensional interactive relationship.

Second, for cross-cultural implications, our study’s focus on Chinese family firms, where Confucian values profoundly shape the pursuit of both economic and non-economic goals, raises important questions regarding the generalizability of these findings to other cultural contexts. While Gomez-Mejia et al. (2024) highlight the SEW-intensive and SEW-sensitive nature of family firms in Latin America and the Caribbean (LAC), our findings reveal similar dynamics in China, where cultural values such as Confucian familism, loyalty and long-term orientation shape SEW preservation. By linking these insights to Chinese cultural patterns, we not only enrich the SEW discourse but also pave the way for cross-regional comparative research, and responding to Gomez-Mejia et al.’s (2024) call to extend SEW findings beyond LAC to regions like Africa and Asia, linking our analysis to Chinese cultural patterns and offering a globally relevant perspective.

Finally, our study advances the family business literature by clarifying the dynamics of goal balancing in family firms across stable and crisis contexts. By analyzing the 2009–2019 period, we establish a robust baseline for understanding how family firms balance economic and non-economic goals under the long-term stable conditions, revealing consistent strategic patterns. A supplementary analysis of the 2020–2023 pandemic period enriches this framework by showing how extreme exogenous shocks intensify goal-driven trade-offs, such as prioritizing family control over firm performance. This dual-context approach bridges normative and crisis-driven behaviors, providing a nuanced theoretical lens to explore the resilience and vulnerabilities of family firms in turbulent environments.

Although this study offers important insights, limitations exist. First, given that non-economic goals in family firms are a multi-dimensional concept, due to data availability and the limitations of current research progress, this paper only considers family management and family board as the representative of non-economic goals, which may be somewhat one-sided. In future research, we will attempt to examine other dimensions of non-economic goals.

Second, the research conclusion primarily come from a sample of listed companies. Thus, caution should be exercised when generalizing these findings to smaller family firms. Compared to small and medium-sized non-listed companies, listed companies are generally larger in scale and more aligned with modern corporate governance practices. Consequently, large listed companies differ in goal selection and balancing multiple goals relative to small and medium-sized enterprises. Thus, the goal pursuits and balancing strategies of numerous non-listed family firms in China, particularly small and medium-sized enterprises, warrant further investigation.

Publicly available datasets were analyzed in this study. This data can be found at: https://data.csmar.com/.

WZ: Methodology, Writing – original draft, Writing – review & editing. BW: Conceptualization, Writing – review & editing. LC: Methodology, Writing – review & editing. J-aZ: Data curation, Writing – review & editing. SC: Data curation, Writing – review & editing.

The author(s) declare that financial support was received for the research and/or publication of this article. This work was supported by Soft Science Funds of Zhejiang Province, China (2024C35127), Funds of Zhejiang Federation of Social Science, China (2025B062), National Social Science Funds of China (22BGL127, 23GLB04648), the National Natural Science Foundation of China (71972042; 71802114), and China institute of Non-public Economy, Ningbo University, Ningbo.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The authors declare that no Gen AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ahmad, S., Omar, R., and Quoquab, F. (2021). Family firms’ sustainable longevity: the role of family involvement in business and innovation capability. J. Fam. Bus. Manag. 11, 86–106. doi: 10.1108/JFBM-12-2019-0081

Anderson, R. C., and Reeb, D. M. (2003). Founding-family ownership and firm performance: evidence from the S&P 500. J. Finance 58, 1301–1328. doi: 10.1111/1540-6261.00567

Berrone, P., Cruz, C., and Gomez-Mejia, L. R. (2012). Socioemotional wealth in family firms: theoretical dimensions, assessment approaches, and agenda for future research. Fam. Bus. Rev. 25, 258–279. doi: 10.1177/0894486511435355

Bettinelli, C., Mismetti, M., De Massis, A., and Del Bosco, B. (2022). A review of conflict and cohesion in social relationships in family firms. Entrepreneurship Theory Pract. 46, 539–577. doi: 10.1177/10422587211000339

Block, J. (2010). Family management, family ownership, and downsizing: evidence from S&P 500 firms. Fam. Bus. Rev. 23, 109–130. doi: 10.1177/089448651002300202

Bruderl, J., and Schussler, R. (1990). Organizational mortality: the liabilities of newness and adolescence. Adm. Sci. Q. 35, 530–547. doi: 10.2307/2393316

Carlson, D. S., Upton, N., and Seaman, S. (2006). The impact of human resource practices and compensation design on performance: an analysis of family-owned SMEs. J. Small Bus. Manage. 44, 531–543. doi: 10.1111/j.1540-627X.2006.00188.x

Chrisman, J. J., Chua, J. H., and Litz, R. A. (2004). Comparing the agency costs of family and non–family firms: conceptual issues and exploratory evidence. Entrep. Theory Pract. 28, 335–354. doi: 10.1111/j.1540-6520.2004.00049.x

Chrisman, J. J., Chua, J. H., Pearson, A. W., and Barnett, T. (2012). Family involvement, family influence, and family–centered non–economic goals in small firms. Entreprene. Theory Pract. 36, 267–293. doi: 10.1111/j.1540-6520.2010.00407.x

Chua, J. H., Chrisman, J. J., and Bergiel, E. B. (2009). An agency theoretic analysis of the professionalized family firm. Entrep. Theory Pract. 33, 355–372. doi: 10.1111/j.1540-6520.2009.00294.x

Chua, J. H., Chrisman, J. J., and Chang, E. P. C. (2004). Are family firms born or made? An exploratory investigation. Fam. Bus. Rev. 17, 37–54. doi: 10.1111/j.1741-6248.2004.00002.x

Chua, J. H., Chrisman, J. J., De Massis, A., and Wang, H. (2018). Reflections on family firm goals and the assessment of performance. J. Fam. Bus. Strat. 9, 107–113. doi: 10.1016/j.jfbs.2018.02.001

Chua, J. H., Chrisman, J. J., and Sharma, P. (1999). Defining the family business by behavior. Entrep. Theory Pract. 23, 19–39. doi: 10.1177/104225879902300402

Daspit, J. J., Chrisman, J. J., Ashton, T., and Evangelopoulos, N. (2021). Family firm heterogeneity: a definition, common themes, scholarly progress, and directions forward. Fam. Bus. Rev. 34, 296–322. doi: 10.1177/08944865211008350

Davis, J. H., Schoorman, F. D., and Donaldson, L. (1997). Toward a stewardship theory of management. Acad. Manag. Rev. 22, 20–47. doi: 10.5465/amr.1997.9707180258

De massis, A., Kotlar, J., Chua, J. H., and Chrisman, J. J. (2014). Ability and willingness as sufficiency conditions for family-oriented particularistic behavior: implications for theory and empirical studies. J. Small Bus. Manag. 52, 344–364. doi: 10.1111/jsbm.12102

Donaldson, T., and Preston, L. E. (1995). The stakeholder theory of the corporation: concepts, evidence, and implications. Acad. Manag. Rev. 20, 65–91. doi: 10.5465/amr.1995.9503271992

Dou, J., Wang, N., Su, E., Fang, H., and Memili, E. (2020). Goal complexity in family firm diversification: evidence from China. J. Fam. Bus. Strateg. 11:100310. doi: 10.1016/j.jfbs.2019.100310

Dou, J., Wu, S., and Fang, H. (2022). Family involvement, family essence, and family-centered non-economic and economic goals in Chinese family firms: a replication study. J. Fam. Bus. Strateg. 13:100499. doi: 10.1016/j.jfbs.2022.100499

Fang, H., Chrisman, J. J., Daspit, J. J., and Madison, K. (2022). Do nonfamily managers enhance family firm performance? Small Bus. Econ. 58, 1459–1474. doi: 10.1007/s11187-021-00469-6

Fang, H. C., Randolph, R. V. D. G., Memili, E., and Chrisman, J. J. (2016). Does size matter? The moderating effects of firm size on the employment of nonfamily managers in privately held family SMEs. Entrep. Theory Pract. 40, 1017–1039. doi: 10.1111/etap.12156

Fernhaber, S. A., and Patel, P. C. (2012). How do young firms manage product portfolio complexity? The role of absorptive capacity and ambidexterity. Strateg. Manag. J. 33, 1516–1539. doi: 10.1002/smj.1994

Fox, M. A., and Hamilton, R. T. (1994). Ownership and diversification: agency theory or stewardship theory. J. Manage. Stud. 31, 69–81. doi: 10.1111/j.1467-6486.1994.tb00333.x

Fredrickson, J. W., Davis-Blake, A., and Sanders, W. M. G. (2010). Sharing the wealth: social comparisons and pay dispersion in the CEO’S top team. Strateg. Manage. J. 31, 1031–1053. doi: 10.1002/smj.848

Frerich, S., Calabrò, A., and Torchia, M. (2024). Commitment helps: the positive effects of long-term orientation and family ownership on firms’ international expansion. Entrep. Res. J. 14, 1887–1920. doi: 10.1515/erj-2022-0005

Gimenez-Fernandez, E. M., Sandulli, F. D., and Bogers, M. (2020). Unpacking liabilities of newness and smallness in innovative start-ups: investigating the differences in innovation performance between new and older small firms. Res. Policy 49:104049. doi: 10.1016/j.respol.2020.104049

Gómez-Mejia, L. R., Chirico, F., Martin, G., and Baù, M. (2023). Best among the worst or worst among the best? Socioemotional wealth and risk-performance returns for family and non-family firms under financial distress. Entrep. Theory Pract. 47, 1031–1058. doi: 10.1177/10422587211057420

Gomez-Mejia, L. R., Cruz, C., Berrone, P., and De Castro, J. (2011). The bind that ties: socioemotional wealth preservation in family firms. Acad. Manage. Ann. 5, 653–707. doi: 10.5465/19416520.2011.593320

Gomez-Mejia, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J., and Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: evidence from Spanish olive oil mills. Adm. Sci. Q. 52, 106–137. doi: 10.2189/asqu.52.1.106

Gomez-Mejia, L. R., Mendoza-Lopez, A., Cruz, C., Duran, P., and Aguinis, H. (2024). Socioemotional wealth in volatile, uncertain, complex, and ambiguous contexts: the case of family firms in Latin America and the Caribbean. J. Fam. Bus. Strat. 15:100551. doi: 10.1016/j.jfbs.2022.100551

Gomez-Mejia, L. R., Patel, P. C., and Zellweger, T. M. (2018). In the horns of the dilemma: socioemotional wealth, financial wealth, and acquisitions in family firms. J. Manage. 44, 1369–1397. doi: 10.1177/0149206315614375

Haans, R., Pieters, C., and He, Z. L. (2016). Thinking about U: theorizing and testing U- and inverted U-shaped relationships in strategy research. Strateg. Manag. J. 37, 1177–1195. doi: 10.1002/smj.2399

Habbershon, T. G., Williams, M., and MacMillan, I. C. (2003). A unified systems perspective of family firm performance. J. Bus. Venturing 18, 451–465. doi: 10.1016/S0883-9026(03)00053-3

Hafner, C., and Pidun, U. (2022). Getting family firm diversification right: a configurational perspective on product and international diversification strategies. J. Fam. Bus. Strateg. 13:100456. doi: 10.1016/j.jfbs.2021.100456

Hamilton, B. H., and Nickerson, J. A. (2003). Correcting for endogeneity in strategic management research. Strateg. Organ. 1, 51–78. doi: 10.1177/1476127003001001218

Hannan, M. T., and Freeman, J. (1984). Structural inertia and organizational change. Am. Sociol. Rev. 49, 149–164. doi: 10.2307/2095567

Hennicks, E. C., Heyns, M. M., and Rothmann, S. (2024). Social wellbeing profiles: associations with trust in managers and colleagues, job satisfaction, and intention to leave. Front. Psychol. 15:1157874. doi: 10.3389/fpsyg.2024.1157847

Hu, Q., Hughes, M., and Hughes, P. (2023). Family owners’ fear of losing socio-emotional wealth: implications for firm innovativeness. Long Range Plan. 56:102263. doi: 10.1016/j.lrp.2022.102263

Jaskiewicz, P., Block, J. H., Combs, J. G., and Miller, D. (2017). The effects of founder and family ownership on hired CEOs’ incentives and firm performance. Entrepreneurship Theory Pract. 41, 73–103. doi: 10.1111/etap.12169

Jensen, M. C., and Meckling, W. H. (1976). Theory of the firm: managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3, 305–360. doi: 10.1016/0304-405X(76)90026-X

Kabbach de Castro, L. R., Aguilera, R. V., and Crespi-Cladera, R. (2017). Family firms and compliance: reconciling the conflicting predictions within the socioemotional wealth perspective. Fam. Bus. Rev. 30, 137–159. doi: 10.1177/0894486516685239

Karra, N., Tracey, P., and Phillips, N. (2006). Altruism and agency in the family firm: exploring the role of family, kinship, and ethnicity. Entrep. Theory Pract. 30, 861–877. doi: 10.1111/j.1540-6520.2006.00157.x

Koellner, T., and Roth, S. (2024). Family businesses and business families in cultural context: interdisciplinary updates for family business research. Cross Cult. Strateg. Manag. 32, 374–392. doi: 10.1108/CCSM-04-2022-0060

La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (1999). Corporate ownership around the world. J. Finance 54, 471–517. doi: 10.1111/0022-1082.00115

Lee, K., Makri, M., and Scandura, T. (2019). The effect of psychological ownership on corporate entrepreneurship: comparisons between family and nonfamily top management team members. Fam. Bus. Rev. 32, 10–30. doi: 10.1177/0894486518785847

Lind, J. T., and Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxf. Bull. Econ. Stat. 72, 109–118. doi: 10.1111/j.1468-0084.2009.00569.x

Luo, X. R., and Chung, C. N. (2013). Filling or abusing the institutional void? Ownership and management control of public family businesses in an emerging market. Organ. Sci. 24, 591–613. doi: 10.1287/orsc.1120.0751

Mahto, R. V., Cavazos, D. E., Calabro, A., and Vanevenhoven, J. P. (2023). CEO succession game in family firms: owners vs. advisors. J. Small Bus. Manag. 61, 2714–2731. doi: 10.1080/00472778.2021.1934851

Mazzi, C. (2011). Family business and financial performance: current state of knowledge and future research challenges. J. Fam. Bus. Strategy 2, 166–181. doi: 10.1016/j.jfbs.2011.07.001

Meng, J., Wang, X., Xie, M., Hao, Z., Yang, J., and Liu, Y. (2023). Ethical leadership and TMT decision-making of corporate social responsibility – a perspective of self-determination theory. Front. Psychol. 14:1268091. doi: 10.3389/fpsyg.2023.1268091

Miller, D., Breton-Miller, I. L., and Lester, R. H. (2011). Family and lone founder ownership and strategic behavior: social context, identity, and institutional logics. J. Manage. Stud. 48, 1–25. doi: 10.1111/j.1467-6486.2009.00896.x

Parmar, B. L., Freeman, R. E., Harrison, J. S., Wicks, A. C., Purnell, L., and de Colle, S. (2010). Stakeholder theory: the state of the art. Acad. Manage. Ann. 4, 403–445. doi: 10.5465/19416520.2010.495581

Patel, P. C., and Cooper, D. (2014). Structural power equality between family and non-family TMT members and the performance of family firms. Acad. Manag. J. 57, 1624–1649. doi: 10.5465/amj.2012.0681

Saleem, A., and Graves, C. (2024). Life satisfaction of family business members: the role of socioemotional wealth goals and psychological functioning. J. Small Bus. Manage. 63, 1–36. doi: 10.1080/00472778.2024.2305950

Sánchez-Marín, G., Pemartín, M., and Monreal-Pérez, J. (2020). The influence of family involvement and generational stage on learning-by-exporting among family firms. Rev Manag Sci. 14, 311–334. doi: 10.1007/s11846-019-00350-7

Sasabuchi, S. (1980). A test of a multivariate normal mean with composite hypotheses determined by linear inequalities. Biometrika 67, 429–439. doi: 10.1093/biomet/67.2.429

Schulze, W. S., and Kellermanns, F. W. (2015). Reifying Socioemotional Wealth. Entrep. Theory Pract. 39, 447–459. doi: 10.1111/etap.12159

Schulze, W. S., Lubatkin, M. H., and Dino, R. N. (2003). Toward a theory of agency and altruism in family firms. J. Bus. Venturing 18, 473–490. doi: 10.1016/S0883-9026(03)00054-5

Sciascia, S., and Mazzola, P. (2008). Family involvement in ownership and management: exploring nonlinear effects on performance. Fam. Bus. Rev. 21, 331–345. doi: 10.1177/08944865080210040105

Skorodziyevskiy, V., Fang, H. C., Memili, E., and Chrisman, J. J. (2022). The impact of governance structure on the performance of small family and nonfamily firms: the moderating role of firm age. Rev. Corp. Financ. Stud. 2, 721–743. doi: 10.1561/114.00000028

Stewart, A., and Hitt, M. A. (2012). Why can’t a family business be more like a nonfamily business? Modes of professionalization in family firms. Fam. Bus. Rev. 25, 58–86. doi: 10.1177/0894486511421665

Su, S., Costanzo, L. A., Lange, K., Ghobadian, A., Hitt, M. A., and Ireland, R. D. (2023). How does Guanxi shape entrepreneurial behaviour? The case of family businesses in China. Br. J. Manag. 34, 1895–1919. doi: 10.1111/1467-8551.12684

Swab, R. G., Sherlock, C., Markin, E., and Dibrell, C. (2020). “SEW” what do we know and where do we go? A review of socioemotional wealth and a way forward. Fam. Bus. Rev. 33, 424–445. doi: 10.1177/0894486520961938

Teece, D. J., Pisano, G., and Shuen, A. (1997). Dynamic capabilities and strategic management. Strateg. Manage. J. 18, 509–533. doi: 10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z

Vazquez, P., and Rocha, H. (2018). On the goals of family firms: a review and integration. J. Fam. Bus. Strateg. 9, 94–106. doi: 10.1016/j.jfbs.2018.02.002

Wielsma, A. J., and Brunninge, O. (2019). “Who am I? Who are we?” understanding the impact of family business identity on the development of individual and family identity in business families. J. Fam. Bus. Strat. 10, 38–48. doi: 10.1016/j.jfbs.2019.01.006

Wu, W., Li, X., and Surangkana, B. (2024). Mediation effect of knowledge management on the impact of IT capability on firm performance: exploring the moderating role of organization culture management. Front. Psychol. 15:1344330. doi: 10.3389/fpsyg.2024.1344330

Zellweger, T. M., Kellermanns, F. W., Chrisman, J. J., and Chua, J. H. (2011). Family control and family firm valuation by family CEOs: the importance of intentions for transgenerational control. Organ. Sci. 23, 851–868. doi: 10.1287/orsc.1110.0665