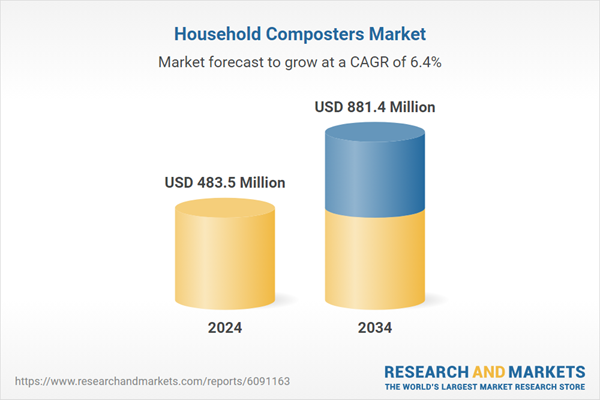

Household Composters Market | Strategic Outlook 2025-2034 |

Growing concerns over pollution caused by food waste and the carbon footprint of landfill dumping are prompting households to adopt composting as a practical and sustainable solution. The push toward sustainability and the adoption of greener living habits are reshaping consumer behavior and driving up the demand for at-home composting solutions. More people are looking for effective ways to manage household waste, especially as environmental regulations tighten globally. Consumers are seeking composters that support a zero-waste lifestyle and contribute to more responsible waste management. In addition, the popularity of home gardening is increasing, further accelerating the adoption of composters that allow households to recycle food scraps and organic materials easily and efficiently.

Advancements in composting technology are also making a significant impact on market trends. Today's composters are far more convenient, offering features that eliminate unpleasant odors and reduce the manual effort involved. New-age models come with odor-control technology, making them more suitable for indoor use. As smart home adoption grows, composters equipped with automated systems and connected features are becoming increasingly desirable. These smart composters simplify the composting process, saving time while aligning with sustainability goals.

Many consumers, especially those comfortable with technology, now prefer composters that integrate seamlessly into their connected homes. These smart composters offer not only environmental benefits but also improve convenience and time management, especially for busy households. By enabling faster decomposition of organic waste, these advanced systems also help households reduce the volume of trash generated while contributing to soil improvement and plant health.

, the market is segmented into tumblers, stationary, and others. The stationary composter category led the market in 2024, generating revenue of USD 202.7 million. This segment is projected to grow at a CAGR of approximately 6.8% from 2025 to 2034. Stationary composters are favored due to their low maintenance and budget-friendly design, making them a go-to option for new users. Designed for outdoor environments, these units are built to withstand a range of weather conditions. Composters made from eco-conscious materials such as recycled plastics and metals are gaining popularity, supporting the ongoing shift toward sustainable product choices. Their compact size and efficient odor management also make them a great option for urban households with limited space.

, the market is divided into electric and manual composters. Electric composters held nearly 63% of the total market share in 2024. The rising demand for electric units is attributed to their ability to accelerate the composting process using automated functions. These units break down food waste and organic material within days, making them ideal for households generating high volumes of waste. Their ability to simplify the decomposition process appeals to consumers looking for quick, easy, and effective composting solutions. Automation, ease of use, and faster output are key drivers behind the growing preference for electric composters over manual alternatives.

, the United States dominated the North American household composters market, accounting for approximately 79% of the regional revenue and estimated to reach USD 120 million in 2024. Increased awareness around sustainability and growing interest in self-sufficient living have contributed to this growth. Technological innovations in composter design are further boosting adoption. Many U.S. residents are choosing to compost at home to prevent organic waste from ending up in landfills. Certain states also encourage composting through food waste diversion policies, further pushing market growth. The popularity of home gardening and growing food in backyards is also fueling demand, especially for user-friendly electric composters.

, with the top five players - Lomi, Harp Renewables, Subpod, Reencle, and Vitami - holding a collective market share of 8% to 12%. These companies are focused on expanding product lines, forming strategic partnerships, and strengthening their global presence to maintain a competitive edge.

| No. of Pages | 220 |

| Forecast Period | 2024-2034 |

| Estimated Market Value (USD) in 2024 | $483.5 Million |

| Forecasted Market Value (USD) by 2034 | $881.4 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

1.1 Market scope & definitions

1.2 Base estimates & calculations

1.3 Forecast calculations

1.4 Data sources

1.4.1 Primary

1.4.2 Secondary

1.4.2.1 Paid sources

1.4.2.2 Public sources

2.1 Industry synopsis, 2021-2034

3.1 Industry ecosystem analysis

3.1.1 Factor affecting the value chain.

3.1.2 Profit margin analysis.

3.1.3 Disruptions

3.1.4 Future outlook

3.1.5 Manufactures

3.1.6 Distributors

3.1.7 Retailers

3.2 Trump administration tariffs analysis

3.2.1 Impact on trade

3.2.1.1 Trade volume disruptions

3.2.1.2 Retaliatory measures

3.2.2 Impact on the industry

3.2.2.1 Supply-side impact (raw materials)

3.2.2.1.1 Price volatility in key materials

3.2.2.1.2 Supply chain restructuring

3.2.2.1.3 Production cost implications

3.2.2.2 Demand-side impact (selling price)

3.2.2.2.1 Price transmission to end markets

3.2.2.2.2 Market share dynamics

3.2.2.2.3 Consumer response patterns

3.2.3 Key companies impacted

3.2.4 Strategic industry responses

3.2.4.1 Supply chain reconfiguration

3.2.4.2 Pricing and product strategies

3.2.4.3 Policy engagement

3.2.5 Outlook and future considerations

3.3 Supplier landscape

3.4 Key news & initiatives

3.5 Regulatory landscape

3.6 Impact forces

3.6.1 Growth drivers

3.6.1.1 Government regulations and waste management policies

3.6.1.2 Rising food waste concerns

3.6.2 Industry pitfalls & challenges

3.6.2.1 Unpleasant odors and pest issues

3.6.2.2 Difficulty in composting food waste

3.7 Growth potential analysis

3.8 Consumer buying behavior analysis

3.9 Demographic trends

3.9.1 Factors affecting buying decisions

3.9.2 Product Preference

3.9.3 Preferred price range

3.9.4 Preferred distribution channel

3.10 Porter's analysis

3.11 PESTEL analysis

4.1 Introduction

4.2 Company market share analysis

4.3 Competitive positioning matrix

4.4 Strategic outlook matrix

5.1 Key trends

5.2 Stationary

5.3 Tumbler

5.4 Others (compacting etc.)

6.1 Key trends

6.2 Electric composter

6.3 Manual composter

7.1 Key trends

7.2 Below 10L

7.3 10L to 20L

7.4 20L to 40L

7.5 Above 40L

8.1 Key trends

8.2 Indoor

8.3 Outdoor

9.1 Key trends

9.2 Low

9.3 Medium

9.4 High

10.1 Key trends

10.2 Online

10.2.1 Company websites

10.2.2 E-commerce

10.3 Offline

10.3.1 Supermarket/hypermarket

10.3.2 Specialty store

10.3.3 Others (mega retail store etc.)

11.1 Key trends

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.3 Europe

11.3.1 UK

11.3.2 Germany

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 Russia

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 South Korea

11.4.5 Australia

11.5 Latin America

11.5.1 Brazil

11.5.2 Mexico

11.6 MEA

11.6.1 UAE

11.6.2 Saudi Arabia

11.6.3 South Africa

Chapter 12 Company Profiles

12.1 Airthereal

12.2 Beyond Green Biotech

12.3 Geme

12.4 GRAF

12.5 Harp Renewables

12.6 Involly

12.7 Lasso

12.8 Lomi

12.9 Mantis

12.10 Reencle

12.11 Subpod

12.12 Topmake Environment

12.13 Vego

12.14 Vitamix

12.15 Zeosta

For more information about this report visit https://www.researchandmarkets.com/r/22565w

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.