Gabby Otchere-Darko Slams US Remittance Tax Proposal

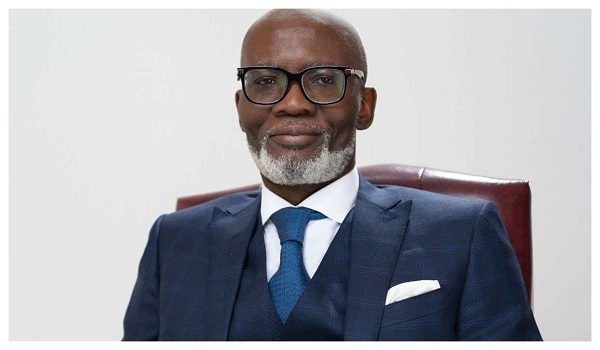

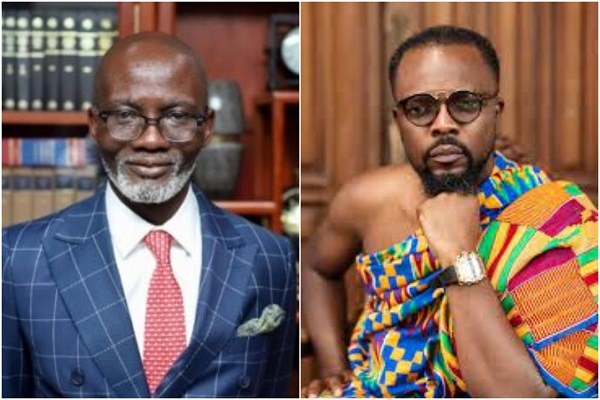

Gabby Asare Otchere-Darko, a prominent figure in the New Patriotic Party (NPP), has criticized the United States government's proposal to impose a 5% tax on remittances transferred by foreign nationals residing in the US. According to Gabby, this move, following the closure of USAID, indicates an attack on individuals returning to their home countries. He expressed his concerns on X on May 15, 2025, stating, "America now to tax Diaspora transfers? First, it was USAID, and now what you send to your families back in Africa is also under attack."

Gabby Asare Otchere-Darko, a prominent figure in the New Patriotic Party (NPP), has criticized the United States government's proposal to impose a 5% tax on remittances transferred by foreign nationals residing in the US. According to Gabby, this move, following the closure of USAID, indicates an attack on individuals returning to their home countries. He expressed his concerns on X on May 15, 2025, stating, "America now to tax Diaspora transfers? First, it was USAID, and now what you send to your families back in Africa is also under attack."

The NPP stalwart emphasized that these developments should serve as a crucial lesson for African nations, including Ghana, urging them to reduce their reliance on Western support. He advocated for the mobilization and aggregation of diaspora funds, along with contributions from Africa's growing middle class, to finance infrastructural projects that would drive development, integration, and prosperity across the continent. US lawmakers have proposed a 5% excise tax on all remittances sent abroad. The new draft bill, currently in the House of Representatives, stipulates that if passed, Ghanaians living in the US would be required to pay a 5% tax on any money sent back to their home country.

The NPP stalwart emphasized that these developments should serve as a crucial lesson for African nations, including Ghana, urging them to reduce their reliance on Western support. He advocated for the mobilization and aggregation of diaspora funds, along with contributions from Africa's growing middle class, to finance infrastructural projects that would drive development, integration, and prosperity across the continent. US lawmakers have proposed a 5% excise tax on all remittances sent abroad. The new draft bill, currently in the House of Representatives, stipulates that if passed, Ghanaians living in the US would be required to pay a 5% tax on any money sent back to their home country.