Foodservice Focus: Consumers Can't Get Enough of Texas Roadhouse, Chick-fil-A - The Food Institute

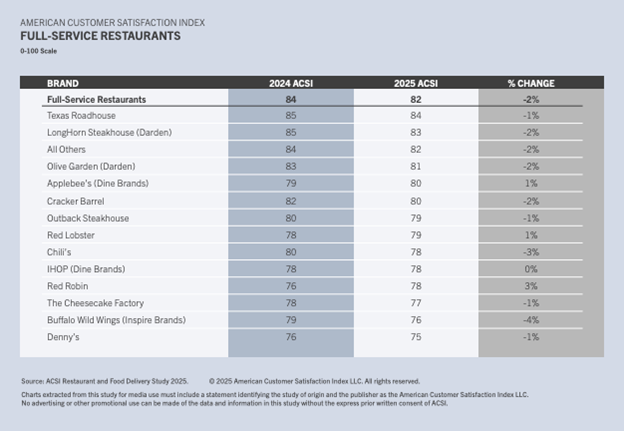

On the full-service side, consumers are voicing their preferences for steak-based chains, with Texas Roadhouse and LongHorn Steakhouse taking the lead despite both falling somewhat out of favor, down 1% and 2% compared to last year, respectively.

U.S. chain restaurant sales grew by 3.1% in 2024, below the 4.1% menu price inflation rate, according to a report from the American Customer Satisfaction Index (ASCI). This indicates that consumers are dialing back their spending rates as food-away-from-home prices climb.

Recent consumer price index data from the U.S. Bureau of Labor Statistics drives this point home: dining out inflation reached 3.8% year-over-year in May, compared to at-home prices increasing by only 2.2%. This results in a consumer base that is becoming more discerning with their restaurant experience while also shifting their spending away from expensive big-name brands in favor of challenger competitors.

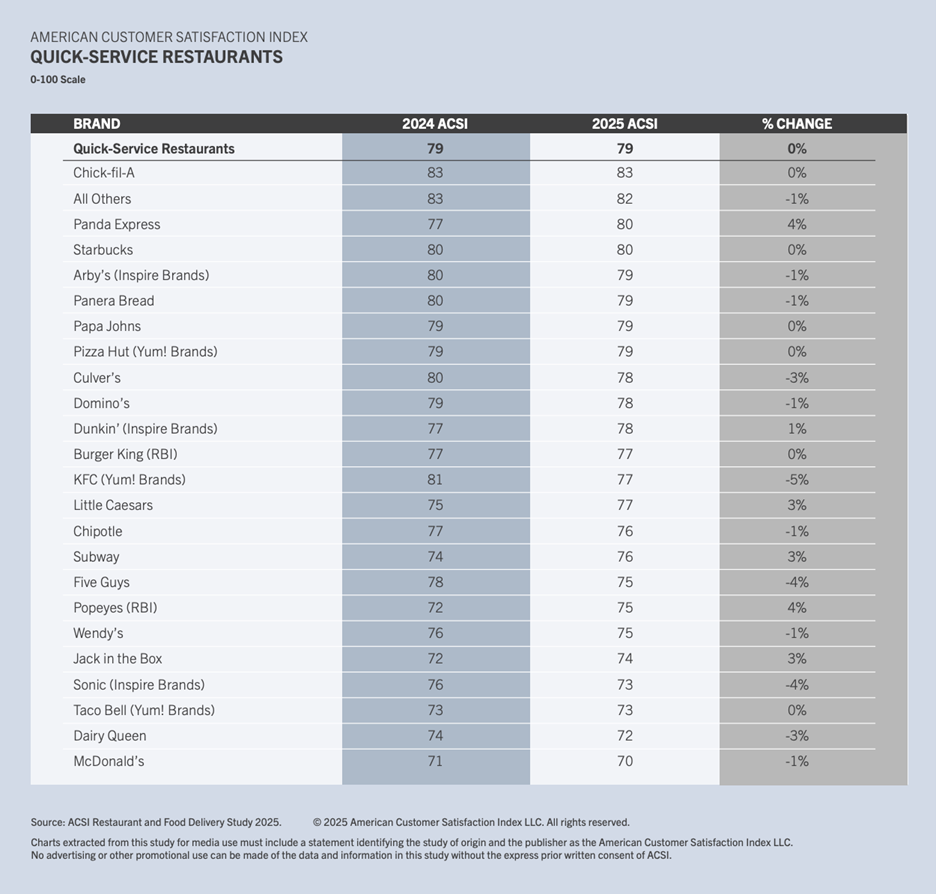

ASCI assigns point values to foodservice chains based on a series of criteria to determine how customers feel about their food choices. The most recent report found that full-service dining satisfaction has declined by 2% to 82 compared to last year, while QSR dining has held steady at 78.

Chick-fil-A’s maintenance was somewhat surprising given the chain posted its slowest growth in the last 20 years as average unit revenue declined, according to the report. Similar brands are leading through differentiation, posing a threat to legacy chains’ margins.

“Smaller, popular brands like Raising Cane’s and Wingstop are proving that creative marketing, digital engagement, and focusing on core strengths can challenge even the most established chains,” said Forrest Morgeson, Associate Professor of Marketing at Michigan State University and Director of Research Emeritus at the ACSI, in a statement.

“The brands that succeed will be the ones that adapt quickly to shifting tastes without compromising consistency or experience.”

QSR’s relative underperformance compared to full-service suggests these chains need to work harder to keep consumers satisfied. While most chains lost or maintained their scoring, some chains stood out in their ability to improve, including Panda Express (+4%), Popeyes (+4%), Little Caesars (+3%), Subway (+3%), Jack in the Box (+3%), and Dunkin’ (+1%).

Of the burger chains, Culver’s came out on top with a 78, despite its 3% decline, followed by Burger King. Meanwhile, Papa Johns (79) led the pizza chain vertical.

The data also uncovered some overall areas where chains were succeeding, as well as where investments ought to go for future improvements.

Of the top judgment categories, only website satisfaction was up across the board for QSRs. Beverage quality, staff interactions, and restaurant layout and cleanliness all, notably maintained their positions. On the other hand, the accuracy of food orders, mobile app quality and reliability, and food and beverage menu varieties were all down this year.

This suggests that technological integration at foodservice touchpoints still has a ways to go before it can drive its promised efficiencies, and human-first design elements must be considered before committing to a strategy.

High prices may have people more receptive to cutting back costs and opting for QSRs, however, menu pricing and value menus have created a parity that means customers can enjoy the benefits of full-service dining without breaking the bank.

In California, for example, Nation’s Restaurant News showed that Chili’s 3-for-Me menu can compete with McDonald’s Big Mac meal, both of which average just under $11. At a full-service restaurant, however, you get extra value from relatively higher levels of cleanliness, more accurate orders, and more courteous waitstaff, suggests ASCI data.

Despite ranking higher in terms of customer satisfaction for a breadth of experience touchpoints compared to QSR, based on last year’s full-service data, quality has plummeted in every metric. These shifts show where restaurant operators can invest in order to increase overall satisfaction.

The report found that order accuracy fell from 92 in 2024 to 88 (-4%). Additional data show:

These misgivings meant that full-service restaurant satisfaction fell overall; however, within the segment, some chains, including Applebee’s, Red Lobster, and Red Robin were able to improve their scores from the year before.

Additionally, the report found that customer satisfaction with a full-service restaurant heavily depended on the type of purchase carried out, with the highest score achieved with dine-in purchases, while delivery purchases sank over 8.5%, ending at 74.

Brands, especially those on the lower end of the spectrum, can take note of the customer satisfaction data to make an informed decision heading into Q3.

The Food Institute Podcast

Several economic headwinds indicate the consumer is being financially stretched, but we all need to eat – so what are consumers actually buying at the grocery store? of RBC returns to The Food Institute Podcast to discuss channel differentiation, consumer product selection, and other macro trends.