Financial Concerns: Local Borrowing and Inflation

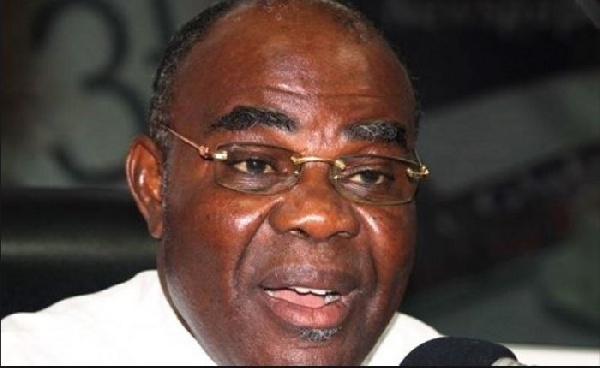

Kenya's National Treasury is shifting its borrowing strategy, opting for increased domestic borrowing while reducing reliance on external lenders. This decision, according to Treasury Cabinet Secretary John Mbadi, aims to mitigate risks associated with currency volatility and the rising costs of external debt servicing. As of December 2024, Kenya's public debt stood at Sh10.93 trillion, with a near-equal split between domestic (Sh5.868 trillion) and external (Sh5.057 trillion) sources. The new strategy targets a 75% domestic and 25% foreign borrowing ratio.

Mbadi highlighted the impact of currency fluctuations, citing the shilling's drop to Sh160 against the US dollar two years prior, which significantly increased the cost of servicing external debt. The shilling's recent strengthening to around Sh130 to the dollar has since reduced external debt by a trillion, from Sh6.089 in December 2023 to Sh5.057 trillion last December.

The shift is also influenced by changing global dynamics, with major economies like the US re-evaluating their support models for countries like Kenya. Mbadi noted that dwindling external funding necessitates a focus on strengthening domestic markets. He mentioned the potential impact of US policy changes on support from Europe as well. While the Treasury is exploring increased tax revenues, it remains cautious about raising taxes for Kenyans. Borrowing will continue to bridge budget deficits, but with a preference for domestic sources.

One factor influencing the decision is the reduction in available credit from international bodies such as the International Monetary Fund (IMF). The IMF will not disburse a Sh110 billion ($850 million) funding tranche, part of the Extended Fund Facility (EFF) and Extended Credit Facility (ECF), due to Kenya's failure to meet certain conditions. These conditions included restructuring Kenya Airways, reducing subsidies on goods like fuel, and increasing tax revenues. Mbadi clarified that the Treasury and IMF mutually agreed to abandon the final review and pursue a new program due to time constraints.

Concerns exist that increased government borrowing from local banks could squeeze out credit for households and businesses, as banks may prefer the stability of lending to the government through Treasury Bills and Bonds.

In related news, a recent PwC 2024 CEO Survey for Kenya indicates that inflation is the primary concern for Kenyan chief executives this year, despite recent softening to 3.5% in February. The survey also reveals that 60% of Kenyan CEOs are optimistic about the global economy's future, while 48% are cautiously confident about the local economy.

The Central Bank of Kenya (CBK) projects a 5.7% growth in Kenya, but this projection may be affected by the high cost of doing business, subdued consumer demand, and increasing geopolitical conflict. While global inflation is expected to decline to 4.2% in 2025, 35% of Kenyan CEOs remain highly exposed to inflation over the next 12 months, compared to 27% of global CEOs. Other threats identified by Kenyan CEOs include macro-economic volatility (28%) and cyber threats (25%), with climate change being the least concern (10%).

PwC's Peter Ngahu noted Kenya's leadership in digital maturity within East Africa and emphasized the importance of innovation and adaptation to evolving market conditions. The survey also documents strong confidence (65%) among Kenyan CEOs about the economic viability of their businesses over the next decade if they maintain their current course.