Fashion Briefing: Kendrick Lamar and the return of JNCO Jeans - Glossy

This week, we take a look at Kendrick Lamar’s viral wide-leg jeans and how a recently relaunched JNCO, a brand synonymous with the style, is re-imagining itself for a new customer.

The Super Bowl wasn’t a very dramatic game. The Philadelphia Eagles got a commanding lead early and held it all the way to the final whistle. But the halftime show was a different story.

Kendrick Lamar’s record-shattering performance — already the most viewed half-time show in history — was notable for a number of reasons, including its political undertones and the teasing of Lamar’s award-winning Drake diss “Not Like Us.” But Lamar’s jeans also set off headlines. He wore flared, wide-leg jeans by Celine, a style that was completely sold out on Celine’s online store by Wednesday.

The New York Times wrote that his jeans “stole the show.” Other publications instantly latched onto the jeans’ throwback style, comparing them to the kinds of denim that were prevalent in the late ’90s and early 2000s. Within days, Glossy had received at least five pitches from denim brands like Wrangler and Paige highlighting the brands’ wide-leg offerings, with most specifically calling out Lamar’s influence on the trend.

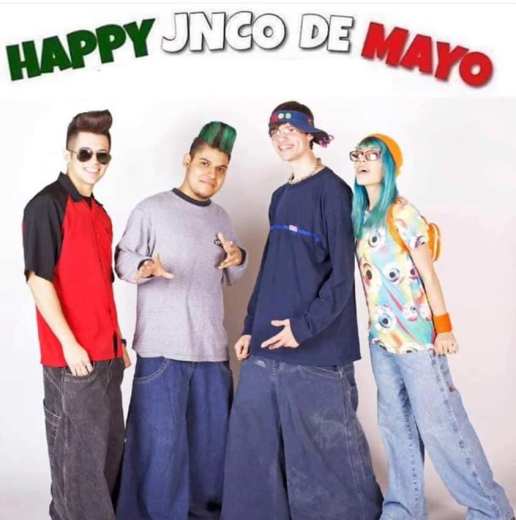

But perhaps no brand is better positioned to take advantage of the return of baggy, wide-leg jeans than JNCO. The brand, started by French-Moroccan brothers Jacques and Milo Revah in 1985, was known for the extreme bagginess of its jeans. The style was prevalent through the ’90s, and the absurd size of some of the brand’s most extreme products was the subject of frequent memes in the years since it fell out of favor. By 1999, changing trends led to JNCO’s revenue falling by half.

The Revah brothers sold the license to the brand to a Chinese company in 2014 and stepped back from the business. But in 2019, Milo Revah, alongside his daughter Camilla, bought the license back. And over the last five years, they have set about reinvigorating the brand. Kendrick Lamar’s performance, along with a general move away from skinny jeans and toward wider, baggier silhouettes, has been a boon for the company, Camilla Revah said.

“We relaunched in 2019, but then Covid hit, so we stopped production,” she said. “So it’s really been the last two or three years that we’ve seen a huge resurgence. We’ve been growing so quickly, working with our original designers and our original factories and relaunching many of our original styles. These are classic styles.”

Revah said she and her father surveyed secondhand marketplaces like eBay where classic vintage JNCO models were selling for thousands of dollars. That helped guide which products would be revived firstincluding collections like JNCO 5-0, themed around law enforcement and crime. The jeans sell for anywhere from $180-$360While back in the day JNCO was widely distributed in mass retailers like Macy’s, it’s now sold almost entirely direct-to-consumer online. In the first two years of JNCO’s relaunch, it quadrupled its revenue each year. Last year, it doubled revenue, and this year, it’s projected to double again.

While baggier silhouettes have been common in womenswear for years now, menswear is slow to catch up. But in the last six months, searches for bootcut jeans rose on Mr Porter by 346%. Other analyses have shown looser styles growing in popularity among men. While JNCO has traditionally targeted men specifically, Revah said the new iteration of the brand is intentionally gender-neutral, as can be seen on its Instagram page.

The designer Nguyen Tran, founder and CEO of the ready-to-wear brand Le Reussi, said the rise of the wide-leg look is owed, in part, to a continued preoccupation among consumers with comfort.

“Wide-leg pants initially gained traction as the perfect bridge between comfort and style, and denim naturally followed suit,” she said. “The dominance of skinny jeans has given way to looser, more breathable silhouettes that offer both nostalgia and practicality. The return of big, boxy jeans isn’t just a fleeting trend, it reflects a lasting shift in consumer mindset.”

Camilla Revah said the next step after reestablishing the brand’s product and revenue is to go harder on marketing. The branding of the product, even down to the logo, hasn’t changed much since the ’90s, but Revah hopes JNCO can ride the wave of Y2K nostalgia that’s prevalent in high fashion right now.

“We’re now gearing up to focus on marketing, in-person events and pop-ups, and really getting involved with the fashion scene in-person, not just online,” she said. “We think it will be a great year for us. We have a great product, and we’re ready to show the world.”

The percentage of orders on Bezel, a popular secondhand luxury watch marketplace, that are for watches by brands other than the most popular ones, including Rolex or Audemars Piguet, according to data provided to Glossy from the platform. Smaller, independent brands like Richard Mille have increased their cachet among high-end watch collectors, while big brands like Rolex have seen their secondhand prices dip in recent quarters.