Daily Crypto Signals: Bitcoin Rebounds to $106K, XRP Eyes $8-$12 Target as Japan Proposes Crypto ETF Framework

Quick overview

Bitcoin BTC/USD has recovered to $105,000 driven by short liquidations and sustained US investor interest, while XRP XRP/USD analysts predict a potential surge to $8-$12 following completion of its corrective structure. Meanwhile, Japan’s Financial Services Agency has proposed reclassifying cryptocurrencies as financial products, potentially paving the way for crypto ETFs and a flat 20% tax rate.

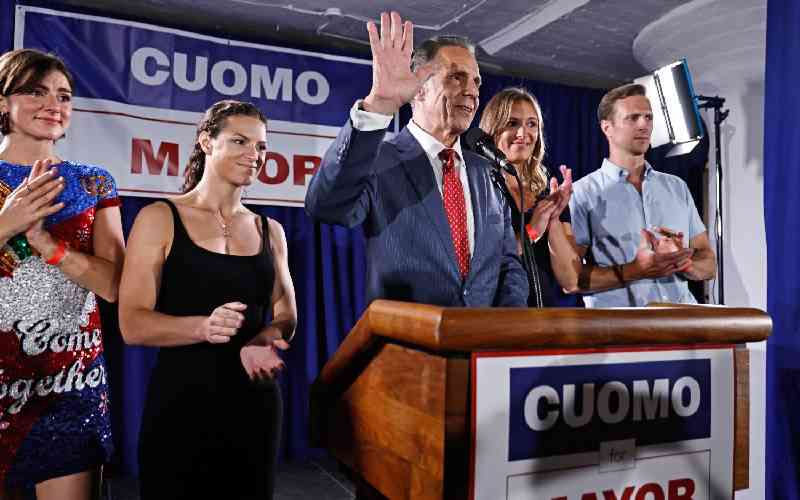

This week saw big changes in the cryptocurrency business, both in terms of rules and technology. Japan is now a possible crypto-friendly place because of proposed revisions to its rules. Eric Adams, the mayor of New York City, said that former Governor Andrew Cuomo’s way of regulating cryptocurrencies “destroyed” the state’s crypto economy while he was in office from 2011 to 2021. Adams, who has built a name for himself as a supporter of cryptocurrencies and notably took his first three mayoral salaries in Bitcoin and Ethereum, said this at the Permissionless conference.

Japan’s Financial Services Agency put out a big plan to change the way cryptocurrencies are classified under the Financial Instruments and Exchange Act, which is the same law that governs regular stocks. This change in the rules might lower crypto taxes from the current progressive rates of up to 55% to a flat 20% rate, which is the same as the rate for stocks. Japan says that as of January 2025, there are more than 12 million active domestic crypto accounts, and that the platforms possess more than 5 trillion yen ($34 billion) in crypto. It’s interesting to note that more people in Japan hold cryptocurrencies than participate in some traditional financial products, such corporate bonds and foreign currency. This is especially true for tech-savvy retail investors.

The regulatory momentum shows that more institutions are getting involved around the world. For example, more than 1,200 financial institutions, including US pension funds and Goldman Sachs, currently own US-listed spot Bitcoin ETFs. As worldwide investments in crypto continue to grow, Japanese policymakers want to help similar developments happen in Japan.

BTC/USD

Bitcoin showed strength by bouncing back to $105,000 on Monday after hitting a low of $98,300 on Sunday, a significant 6.7% increase. This jump in price, on the other hand, was mostly caused by short covering, not new bullish positions. This is shown by the fact that open interest fell by 10% at the same time. On June 23, short liquidations totaled $130 million, which forced bearish traders to buy back BTC and caused the rapid rally.

The Coinbase Bitcoin Premium Index hit its second-highest level in 2025, which shows that US investors are still interested in buying Bitcoin. This premium has stayed positive for much of June, which is in line with the typically positive flows of spot ETFs. A recent analysis found a 0.27 coefficient that linked ETF inflows from the previous day to price rises the next day. This suggests that institutional investors are still optimistic about the market.

On the other hand, Binance data shows that retail behavior is very different, with the percentage of retail inflows reaching two-year highs. Exchange inflows rose the most in the 0-1 BTC band, which suggests that retail traders are either taking profits or actively trading instead than building up their holdings over time. Maartunn, a onchain expert, said that these inflows show “proactive behavior rather than passive accumulation.” This is because deposits to Binance usually show trading plans rather than holding plans.

For Bitcoin to keep going up, it is important that buying volume stays high and open interest goes up. If the price successfully retests the $108,500 resistance level with significant momentum, it might mean that the rally will continue. On the other hand, if the price doesn’t stay at these levels and open interest stays low, it could mean that the price could drop even further to $102,000.

ETH/USD

Ethereum ETH/USD is on the rise, moving approaching the $2,500 mark with strong technical and fundamental support. Recently, the cryptocurrency tested and held a key support area of $2,100 to $2,200 for several months. This showed that buyers were quite interested at these levels. The three-day chart ended over $2,400 with a dragonfly doji pattern. This is a positive reversal signal that shows that sellers pushed early but buyers took back control.

The liquidation heatmap shows that prices are moving quickly as ETH looks for areas with a lot of liquidity over $2,500, where market makers could look for stop-loss orders and start short squeezes. The recent volume engagement is the biggest it has been since July-August 2022, which means that both retail and institutional investors are once again interested in Ethereum.

Swissblock study says that Ethereum might have a “catch-up” period because more than 90% of Bitcoin’s supply is currently making money, whereas ETH is only making money for less than 80% of its supply. This relationship has traditionally indicated chances for capital rotation, as evidenced in past bull cycles in 2017 and 2021. The ETH/BTC ratio is getting close to its lowest point in years, which could mean that it is undervalued.

Institutional interest seems to be moving in Ethereum’s favor. In June, the amount of money coming into the spot ETH ETF rose by 68% to $950 million, while the amount of money coming into the Bitcoin ETF fell by 49.5% to $2.64 billion. This 118% change in relative inflows indicates that institutional capital is moving more quickly toward Ethereum. Also, more than 61,000 ETH were taken out of Binance on Monday. This shows that traders are shifting their assets off of exchanges and into long-term holding methods instead of short-term speculating.

XRP/USD

According to well-known expert CryptoInsightUK, XRP is very close to finishing a corrective structure that started in early April. The expert said that XRP is “really flipping close” to finishing this corrective phase, which could lead to a big bullish rise. If the market stays poor, technical analysis suggests that liquidity shelves are at $1.89 and deeper blocks go down to $1.73. These levels could be objectives for the price to go down.

The analyst thinks that XRP might go through a “drastic” expansionary phase, with an initial target of $8 and a possible over-extension to $11-$12 levels. If you start with $1.85, this forecast suggests that you might make about 475% more. This optimistic view is based on XRP’s status as a large-cap, high-beta cryptocurrency that might see a lot of money pour in once Bitcoin’s price settles down and altcoin season starts.

The emergence of bullish divergence patterns is one of the most important technical indicators. In these patterns, the price makes lower lows while the 4-hour RSI makes higher lows. This scenario looks a lot like the one that came before XRP’s 140% rise in April. The analyst says there is “real accumulation rather than derivative games” since spot demand is gathering on price falls and funding rates are slowly rising as traders position long.

The main reason XRP might go up is because of Bitcoin’s dominance patterns, which are currently in what researchers call the “reversal box.” A last push to domination highs might start the long-awaited altseason. Major altcoins like XRP are in a good position to benefit from the capital flows that come from both institutional and retail investors who want to diversify beyond Bitcoin.

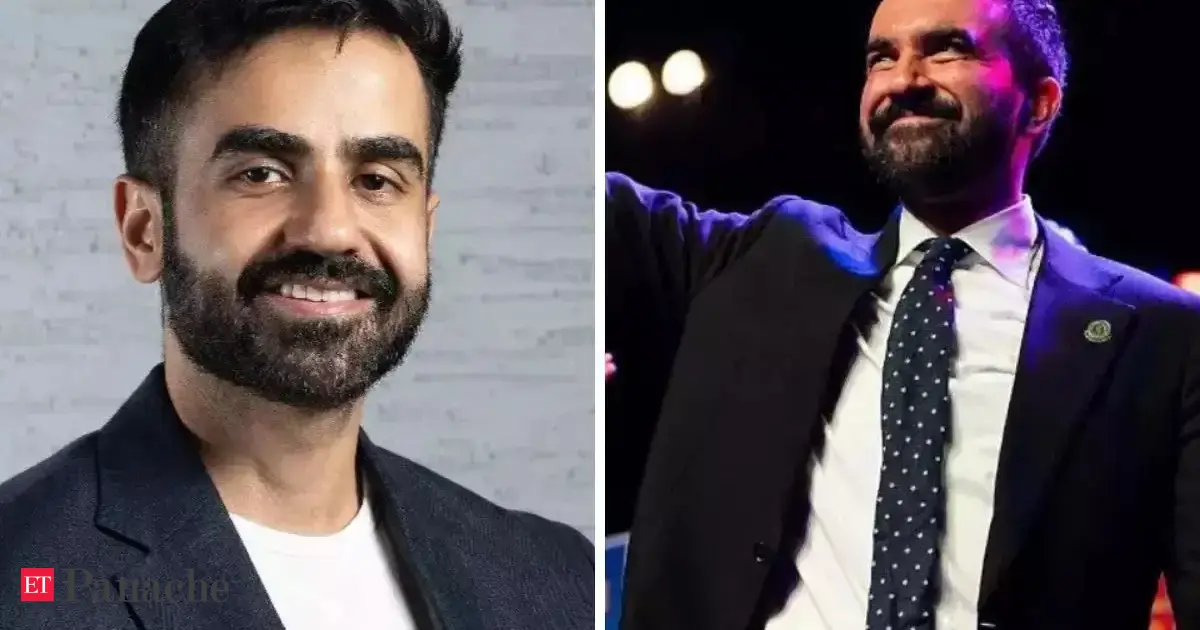

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics. His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker. His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.