Crypto Giants Bleed Red While Universities Stack Sats and PowerSchool Leaks 62M

Bitcoin remains bullish despite a 3% weekly drop, driven by three key factors. First, market fear, as indicated by the Fear and Greed Index shifting to ‘fear,’ suggests a potential buying opportunity. Second, BTC holds the critical $92,800 support level, with strong buying pressure from investors on HTX and BitMEX. Lastly, February has historically been a strong month for Bitcoin, especially after halving years, with past gains reaching up to 62%.

SUMMARY

VITALIK

Vitalik Buterin thanks everyone for buying his bags as Ethereum drops 22%, despite recent network improvements. The gas limit increase from 30M to 36M has boosted transaction capacity by 20% and is expected to reduce fees by 10-30%, but investors remain unconvinced. High fees prior to the update and a shift to faster, cheaper blockchains like Solana have driven traders away. Ethereum’s dominance now hinges on proving that recent upgrades translate into real demand and usability. Institutional demand through BlackRock’s spot ETF and growing support from the Trump family’s World Liberty Financial project provide strong backing. Longer-term, Ethereum’s technicals show upside potential, with an ascending triangle pattern signaling a possible breakout. I remain bullish on ETH.

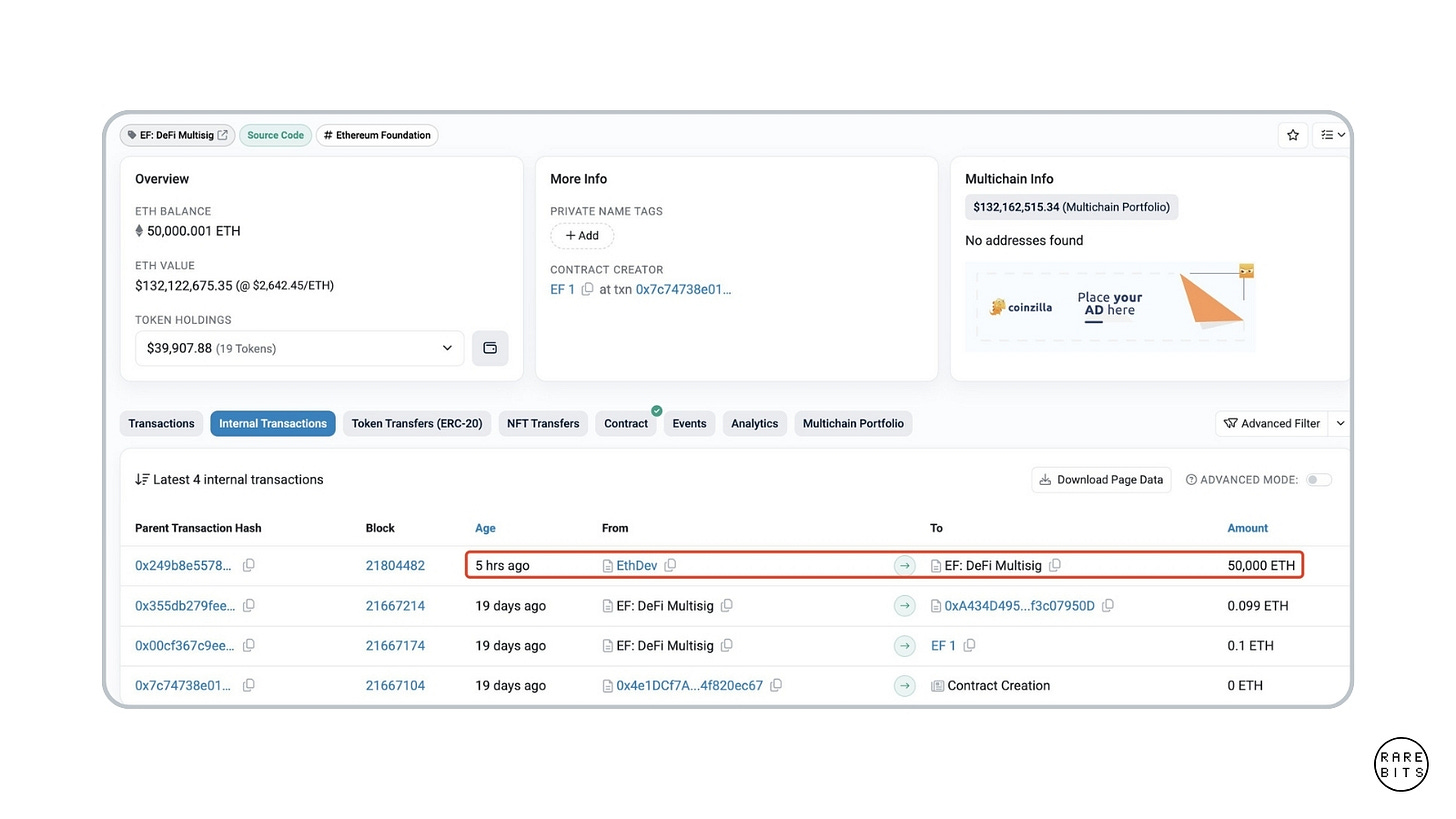

FOUNDATION

The Ethereum Foundation has moved $131 million to a multi-signature wallet for DeFi participation, signaling a push to generate income through decentralized finance. This follows last month’s allocation of 50,000 ETH—nearly 20% of its holdings—toward DeFi expansion. Amid past criticism for neglecting DeFi, Vitalik Buterin defended the foundation’s stance, emphasizing sustainability.

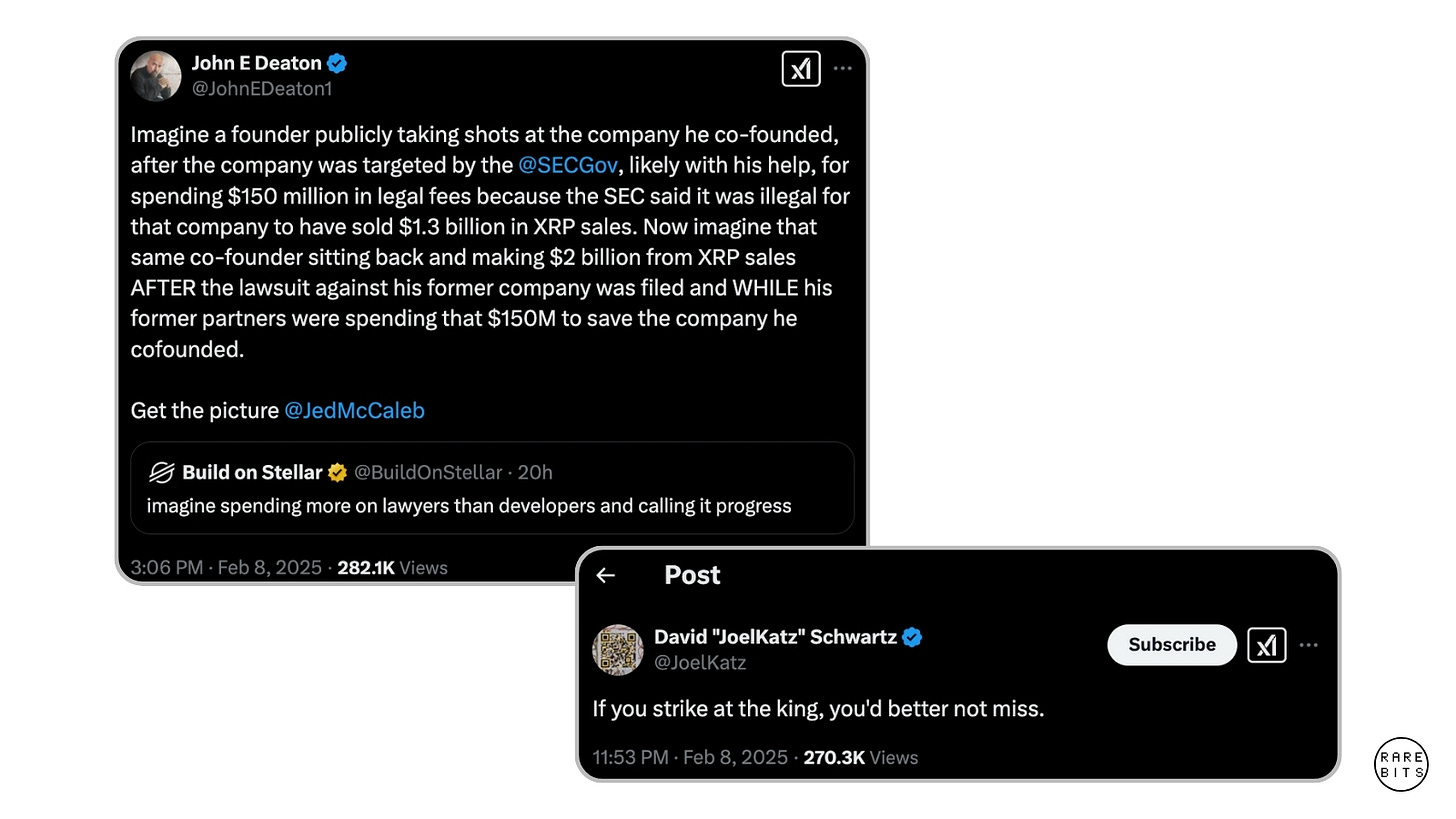

DEATON

The XRP community fires back at Jed McCaleb after a "Build on Stellar" post took a jab at Ripple amid its SEC battle. Lawyer John Deaton slammed McCaleb for profiting $2B from XRP sales while Ripple fought legal battles. Ripple CTO David Schwartz responded with, "If you go after the king, you might as well not miss," rallying XRP supporters. The long-standing feud between Stellar and Ripple reignites, with many questioning McCaleb’s intent—was it just a comment or a calculated move?

BREAKOUT

Solana I know you can do it. Literally primed for a rally after a 25% drop, with $25 million in SOL moving off exchanges, signaling accumulation. Currently trading near $197, SOL shows bullish momentum, with traders betting $90 million on long positions at $188.80. A breakout above $200 could push SOL toward $230.

ACCUMULATION

The $BERA dip is on my radar, as major altcoins like Berachain, BNB, and Pepe show potential for a comeback. Following a massive market crash, many altcoins saw sharp drops, creating opportunities for investors to buy in. Berachain’s price has fallen from its all-time high but shows signs of accumulation, with a potential rise toward $10 if it breaks $6.6. Binance Coin has rebounded strongly, aiming for $620, with a potential push to $640-$660 if momentum holds. Pepe is building support and could break above $0.00001, potentially reaching $0.000015 next week.

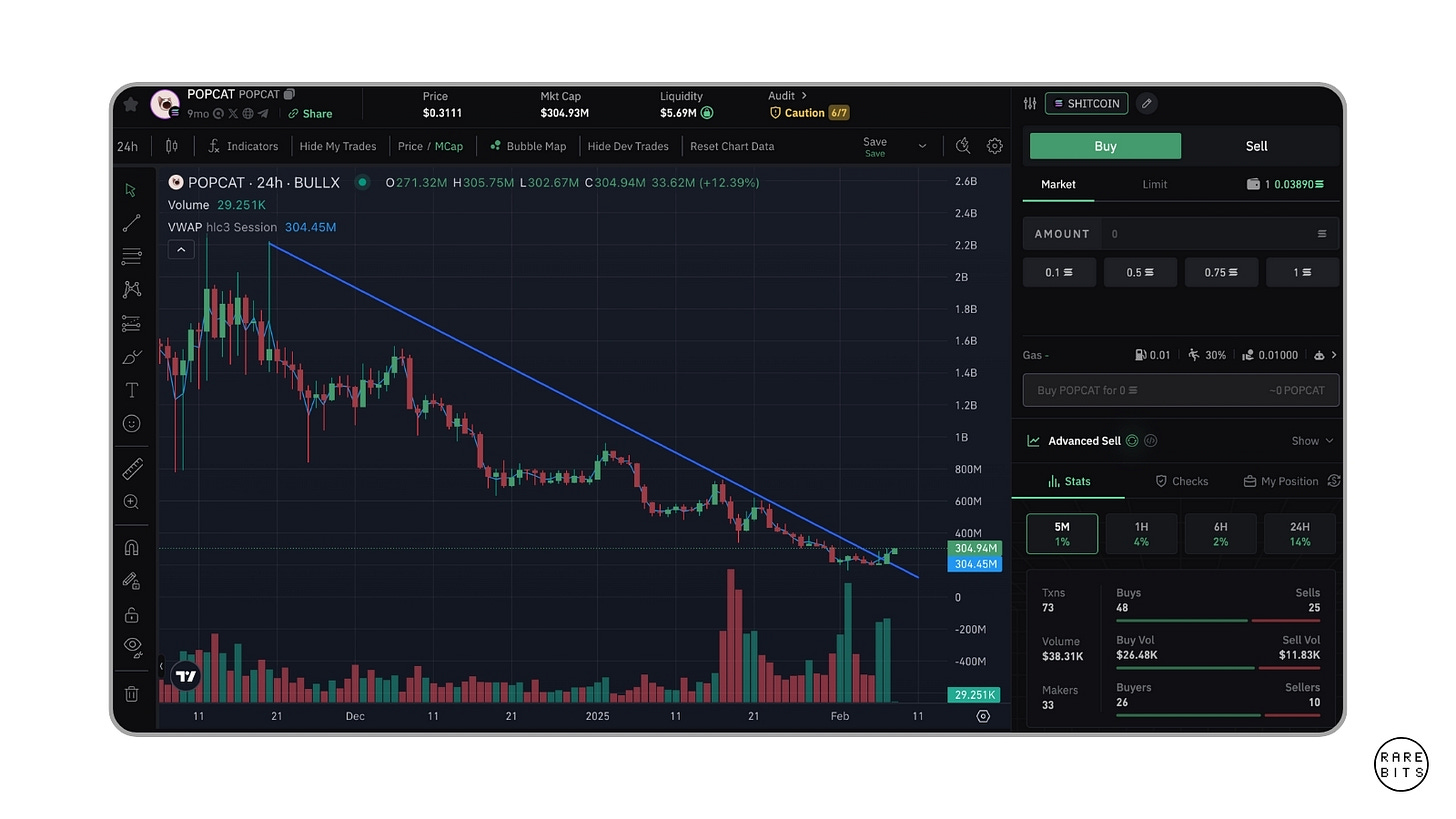

POPCAT

POPCAT surged by over 40% in the past 24 hours, reaching a price of $0.305. This rally has sparked notable interest from traders and investors, with a 38% increase in trading volume. POPCAT has formed a bullish long-falling wedge pattern and, if it breaks above $0.40, could see a further 80% rise, potentially reaching $0.70 or beyond. Despite some whale sell-offs causing inflows of $2.15 million onto exchanges, the market has shown resilience, indicating that the price surge may be sustainable.

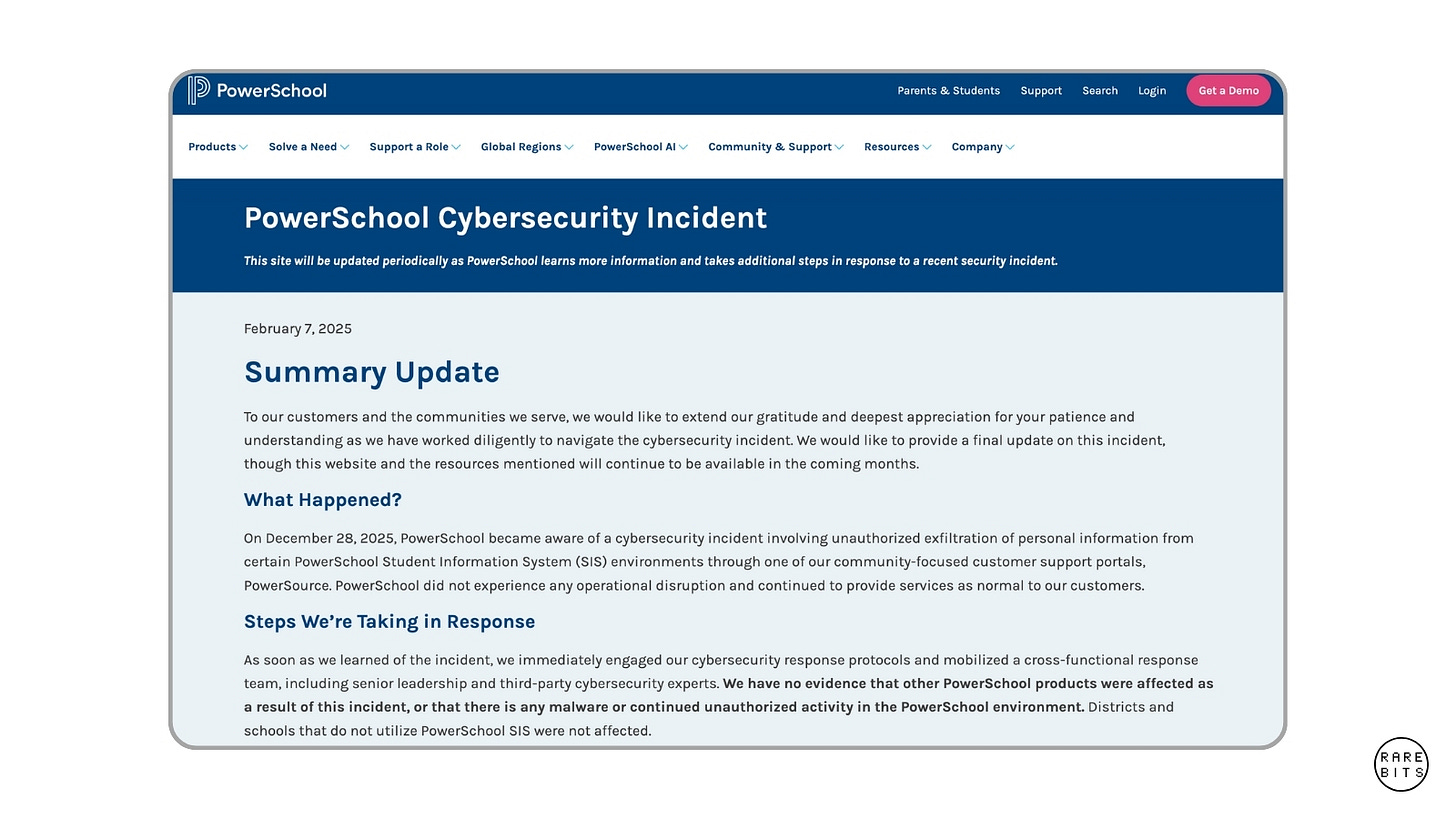

POWERSCHOOL

A massive data breach has exposed the personal information of tens of millions of US schoolchildren, marking one of the largest hacks of student data in history. The breach occurred in PowerSchool, which operates a widely-used Student Information System, after a vulnerability in its customer support portal. Hackers accessed sensitive data, including names, contact details, Social Security numbers, and medical information, though financial data was not compromised. The breach is believed to affect around 62 million students. PowerSchool is offering two years of free identity protection services to those impacted.

SIX

David Sacks, the White House's Crypto Czar, believes clear regulatory guidelines for digital assets could be established within six months. He emphasizes the importance of defining market structure, which includes categorizing digital assets such as cryptocurrencies, securities, commodities, and NFTs. Sacks notes that with Republican control of the House, there is a stronger chance of passing firm crypto regulations that can provide clarity for founders and ensure compliance. On a lighter note, I love how CNN chose to report on "BIG BALLS"—this kind of reporting is a crypto degen's dream come true!

MIRROR

I love Dave and often bring his stats into my reporting. I differ on his recent take, though—we can't look back to see forward this time. Dave the Wave, known for predicting the May 2021 Bitcoin crash, forecasts a significant pullback for Bitcoin in the coming weeks. He expects BTC to mirror last year's pattern, potentially dropping to around $81,000 by March. Despite this, Dave thex Wave anticipates a major rally later in the year, predicting Bitcoin could reach as high as $260,000 based on his logarithmic growth curve and MACD indicators.

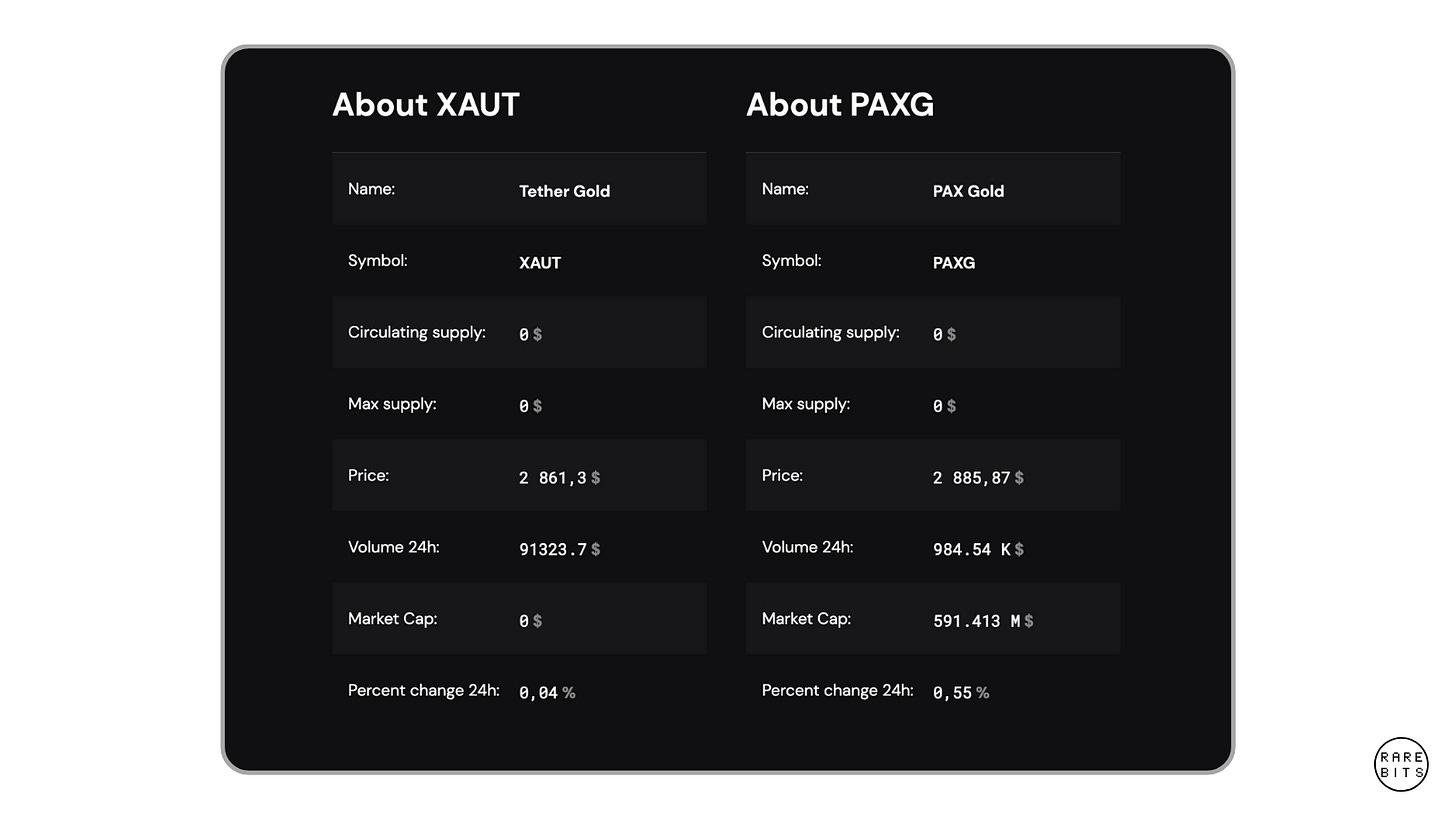

GOLD

Is gold the shiny key needed to get normies to ape into real-world assets (RWAs)? Major financial institutions like Citi and UBS are boosting their gold price forecasts amid trade war fears and central bank accumulation. This has led to gold-backed cryptocurrencies like PAXG and XAUT outperforming the broader crypto market. As geopolitical tensions and economic uncertainties persist, gold's appeal as a store of value and hedge against risk strengthens. Citi raised its short-term gold price target to $3,000 per ounce, while UBS also upped its 12-month forecast to $3,000. These moves point to a continued bullish trend for both gold and gold-backed tokens.

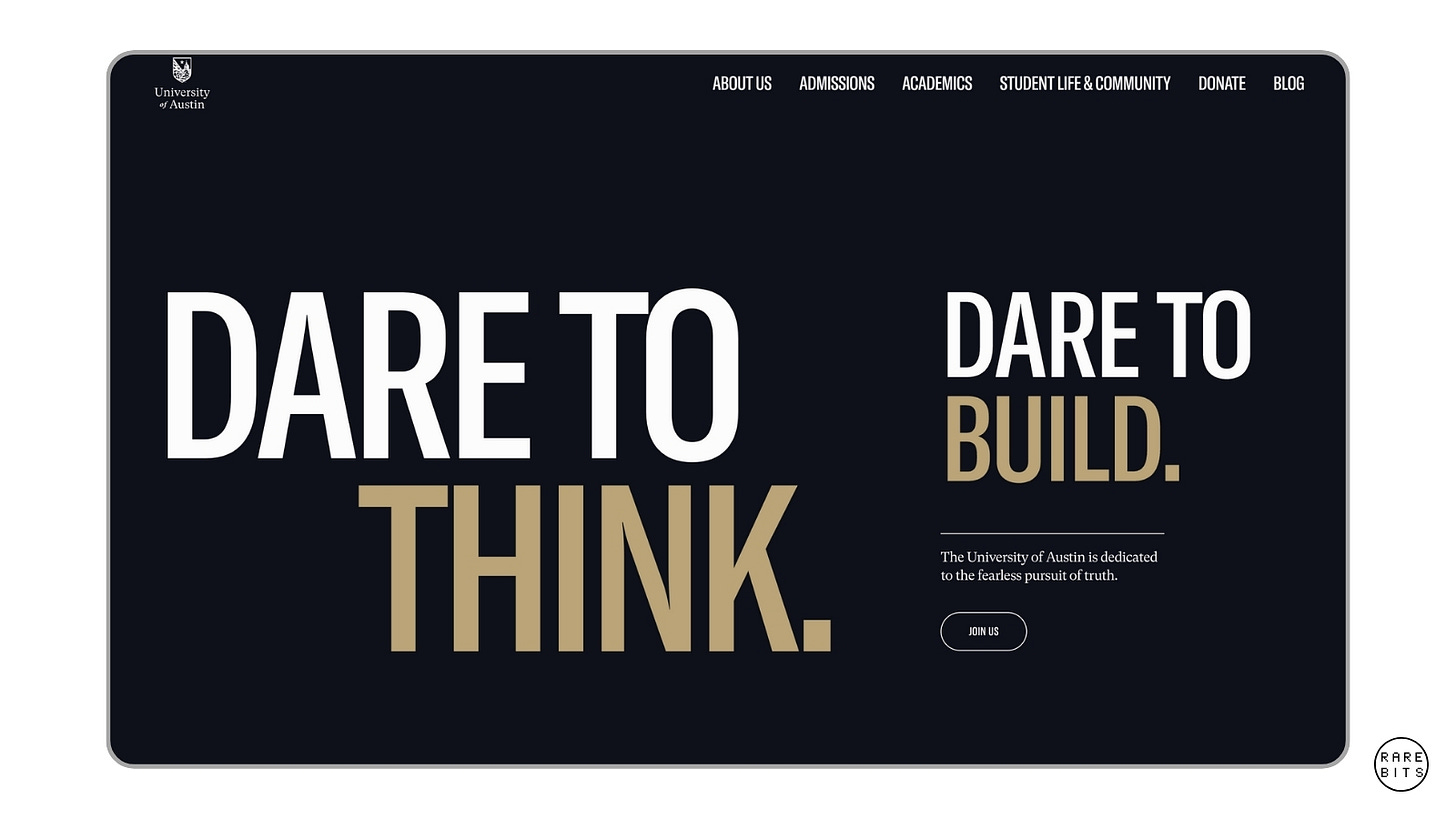

RESERVE

The chads at AU are fkn smart! The University of Austin is launching a $5M Bitcoin fund as part of its $200M endowment, with a five-year holding strategy. This move reflects growing institutional interest in Bitcoin, following Emory University's $15M Bitcoin ETF investment. The University of Austin's strategy is to invest in Bitcoin long-term, similar to stocks or real estate. This trend of multi-year Bitcoin holding strategies is gaining traction among institutions, and cryptocurrency is also increasingly appealing to younger generations for retirement savings, signaling a shift toward decentralized finance.

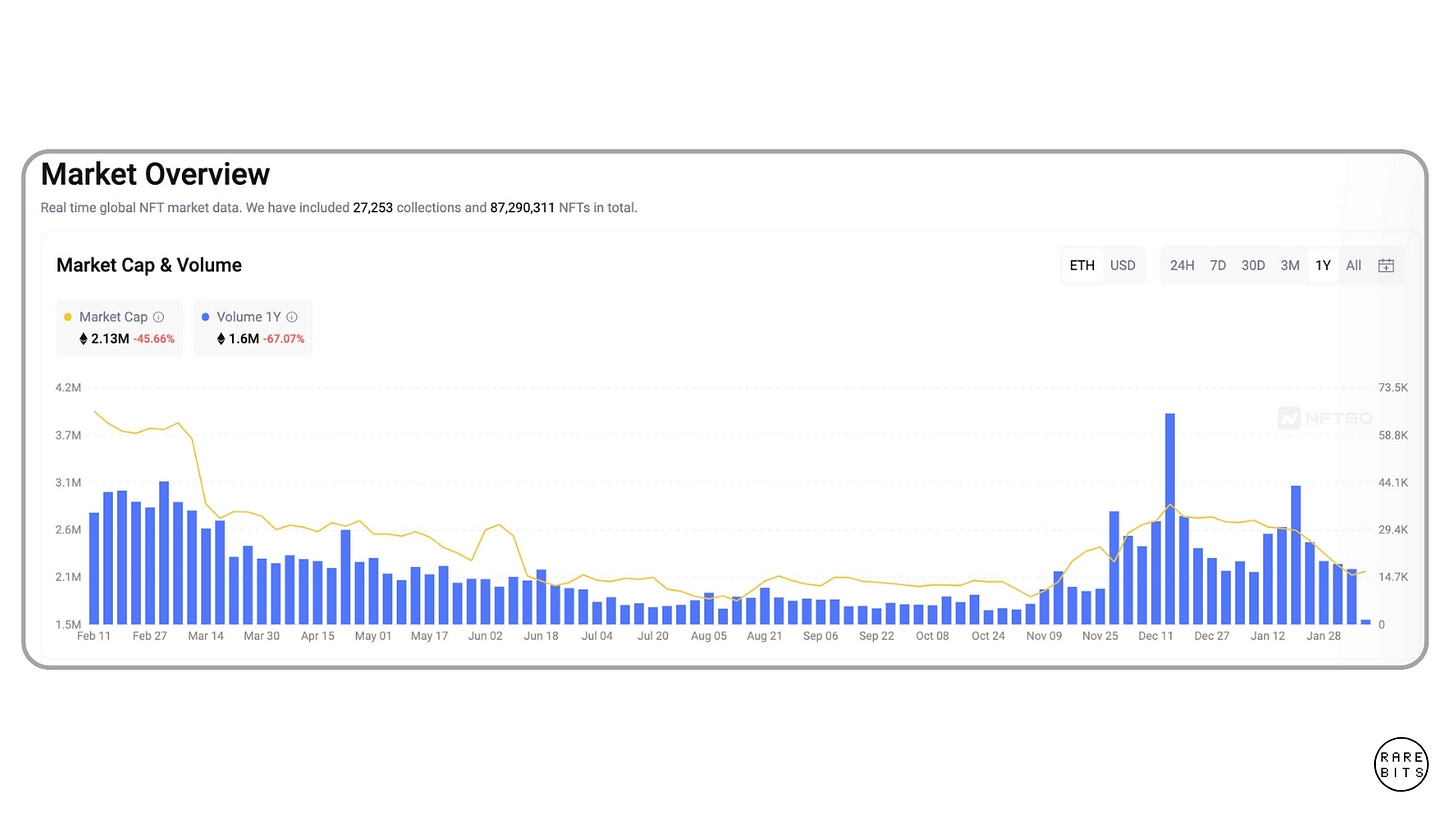

NFT

NFT sales dropped 33% to $119.5 million, mirroring the broader crypto market pullback. Ethereum led with $62.6 million in sales, despite a 38% decline, while Mythos Chain and Solana followed in second and third, signaling gaming as a strong contender for onboarding. Pudgy Penguins maintained the top spot, driven by the ethos that "the meme will rule the world"—control the meme, control the narrative, win the hearts of the young, and have them as lifelong customers. Pudgy sales fell 37.55% to $9.1 million, following a token launch, which also saw a decline as holders quickly sold their allocations. Other collections like CryptoPunks and Azuki saw significant drops as well. High-profile sales included CryptoPunks #8868, which sold for $558,008.

I still believe in NFTs. The market took a sizable hit in June 2024, along with the broader market, but has since flattened out. Crypto hype gave us a holiday bump, fueled by presidential buzz that sparked a mini rally. Looking at the overall NFT market cap, I think we're in a good spot. If we can integrate cool tech into NFTs—whether existing or new—we could have something special. These NFTs are wallets; think of all the things you can do with a wallet filled with cash. (For those who don't know, that's slang for money.)

As markets demonstrate their characteristic volatility, we're witnessing a fascinating contrast between short-term price action and long-term institutional adoption. While retail traders focus on daily swings, universities are quietly accumulating Bitcoin, traditional finance is embracing gold-backed cryptocurrencies, and major players like the Ethereum Foundation are deeply integrating with DeFi. Despite current market turbulence, the foundations of the crypto ecosystem continue to strengthen through technological advancement and institutional acceptance. Stay interesting, my friends.

THIS WEEK WILL BE HUGE