Crypto exchange Coinbase debuted on this year’s TIME 100 Most Influential Companies list as a "disruptor" after the company made waves as leading policy advocate, instrumental in Trump’s reelection.

The news helped push Coinbase’s stock from roughly $303 per share to a local high of $382 per share. TIME wrote:

“The company, which in May became the first crypto stock to be added to the bellwether S&P 500 index, is a key driver of the industry’s policy efforts in Washington D.C. If industry-friendly bills are passed, Coinbase stands to become an even bigger hub for US crypto activity.”

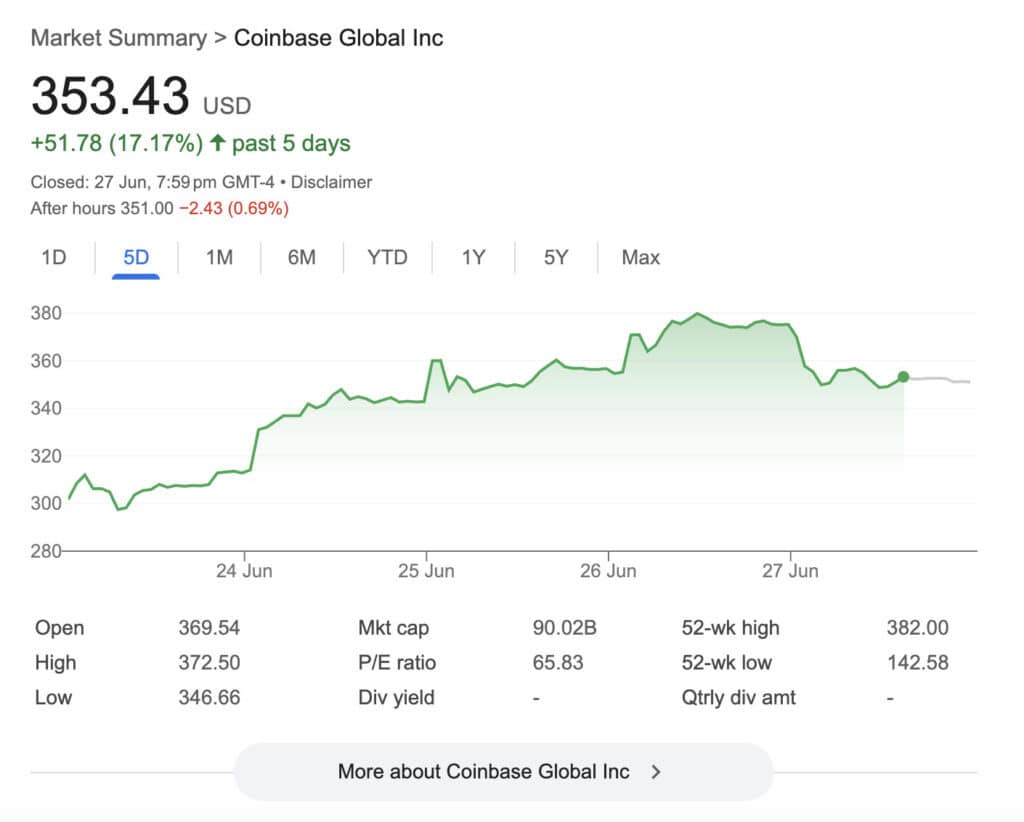

Coinbase is up 17.17% over the last past 5 days, source: Google

Last week the stock hit a fresh 52-week high after Bernstein analysts issued a bullish upgrade, calling the exchange the “Amazon of crypto financial services.” Shares climbed over 3% on the day, nearing Coinbase’s all-time high of $357.39, last reached in November 2021.

Bernstein analyst Gautam Chhugani raised the firm’s price target on Coinbase to $510, up from $310, and reiterated an Outperform rating. In a note to clients, Chhugani emphasized Coinbase’s dominant position across the crypto ecosystem: “COIN is the most misunderstood company in our crypto coverage universe,” he wrote. “It’s evolved beyond a trading platform and now offers a broad suite of financial infrastructure.”

Coinbase now operates the largest stablecoin business among exchanges, serves as custodian for most U.S. spot Bitcoin ETFs, and is the only crypto firm in the S&P 500 index. It has also diversified into areas such as institutional custody, blockchain infrastructure (Base), and prime brokerage services, bolstering its reputation as crypto’s closest analog to Amazon.

The stock’s recent surge has been fueled in part by legislative tailwinds. Coinbase has jumped more than 40% since mid-June, when the Senate passed the GENIUS Act, a pivotal bill aimed at establishing federal oversight for stablecoins. The regulatory clarity has been widely seen as a bullish catalyst for U.S.-based crypto platforms.

Coinbase co-founder and CEO Brian Armstrong highlighted the company’s growing institutional footprint in a post on X, noting that the platform now powers crypto integration for nearly 200 financial institutions, including banks, brokerages, and fintech firms.

Coinbase isn’t just riding domestic momentum. On June 20, the company announced that it had secured a key MiCA license in Luxembourg, allowing it to legally offer digital asset services across the European Union under the bloc’s new regulatory regime. It will also establish its EU headquarters in Luxembourg — a major move that further positions Coinbase as a global crypto leader.

Meanwhile, in the U.S., Coinbase is reportedly in talks with the SEC to gain approval for tokenized equity trading — a move that would put the company in direct competition with Robinhood and other fintech brokers.

The crypto industry’s shifting political landscape also played a role in boosting investor sentiment. At Coinbase’s State of Crypto Summit earlier this month, U.S. President Donald Trump delivered a video address pledging to implement “clear and simple market frameworks” to ensure America leads in Bitcoin and blockchain innovation.

Trump talked up his Crypto accomplishments via a pre-recorded message

Coinbase’s positioning as a central player in U.S. crypto policy was further recognized this year by TIME Magazine, which named it one of 2025’s 100 Most Influential Companies, citing its efforts to shape regulation in Washington.

Coinbase’s rally has come alongside gains in other crypto-adjacent stocks, with institutional adoption of Bitcoin and increased stablecoin regulation driving renewed interest. Analysts like Sean Farrell of Fundstrat say the trade still has legs: “There’s still additional upside to Coinbase here, despite the pretty vicious rally we’ve seen.”

With its deepening product suite, global expansion, and strategic regulatory wins, Coinbase is more than just a bellwether for the crypto industry — it’s fast becoming the financial operating system for the decentralized world.

Many investors are now asking if it is a good time to buy Bitcoin, to buy crypto, or indeed, to buy crypto related stocks. All sectors appear well positioned to enjoy gains in the short to medium term.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.

Brave New Coin reaches 500,000+ engaged crypto enthusiasts a month through our website, podcast, newsletters, and YouTube. Get your brand in front of key decision-makers and early adopters.