BoG raises GH¢4.41 billion in its 56-Day bill auction

Bank of Ghana's new headquarters

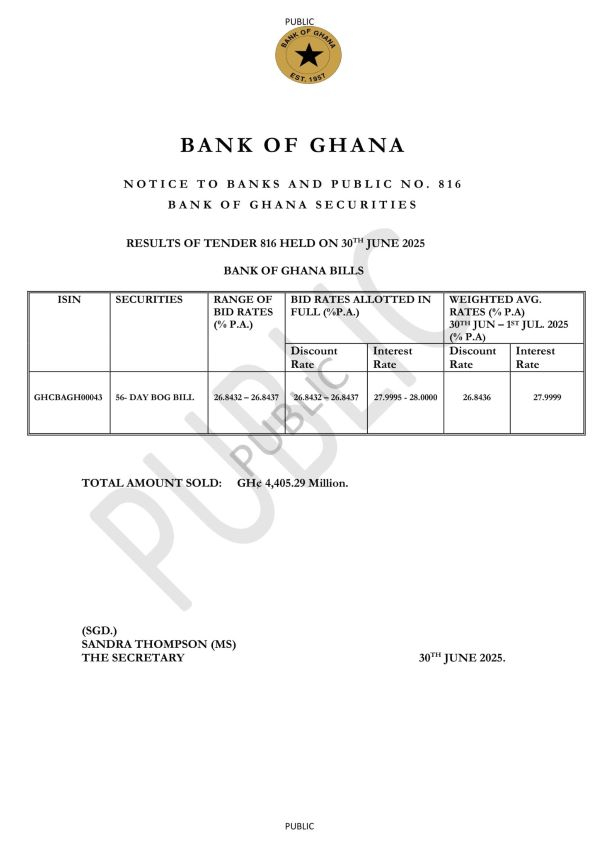

The Bank of Ghana (BoG) has successfully raised GH¢4.41 billion in its latest short-term debt auction, according to results from Tender 816 held on Monday, June 30, 2025.

The 56-day BoG bill was auctioned at a marginally narrow range of bid and allotment discount rates, coming in between 26.84% and 26.84% per annum.

These were fully allotted, with the weighted average discount rate settling at 26.84%.

In effective interest rate terms, the yield on the instrument translated to between 27.99% and 28%, with the weighted average interest rate settling at 27.99%.

This latest issuance follows a series of similarly high-yielding short-term bills in recent months.

Analysts view the central bank’s aggressive yield curve as a signal of its unwavering commitment to macroeconomic stability, particularly in the face of lingering inflation risks and exchange rate volatility.

As inflationary pressures persist and global financing conditions remain uncertain, market participants are closely monitoring the central bank’s next policy moves and future debt issuance strategies.

SP/SA

How social engineering hacks your mind and your bank account